Posted on 12/19/2022 11:40:50 AM PST by catnipman

even though the Mazars report ... suggested Binance's situation was solid, it also showed bitcoin liabilities were $245 million bigger than assets, the WSJ reported. Nearly half of the company's $75 billion reserves are in its own stablecoin BUSD and its native token binance coin (BNB) ...

On Friday, the accounting firm suspended its proof-of-reserves work with Binance and other crypto clients "due to concerns regarding the way these reports are understood by the public,

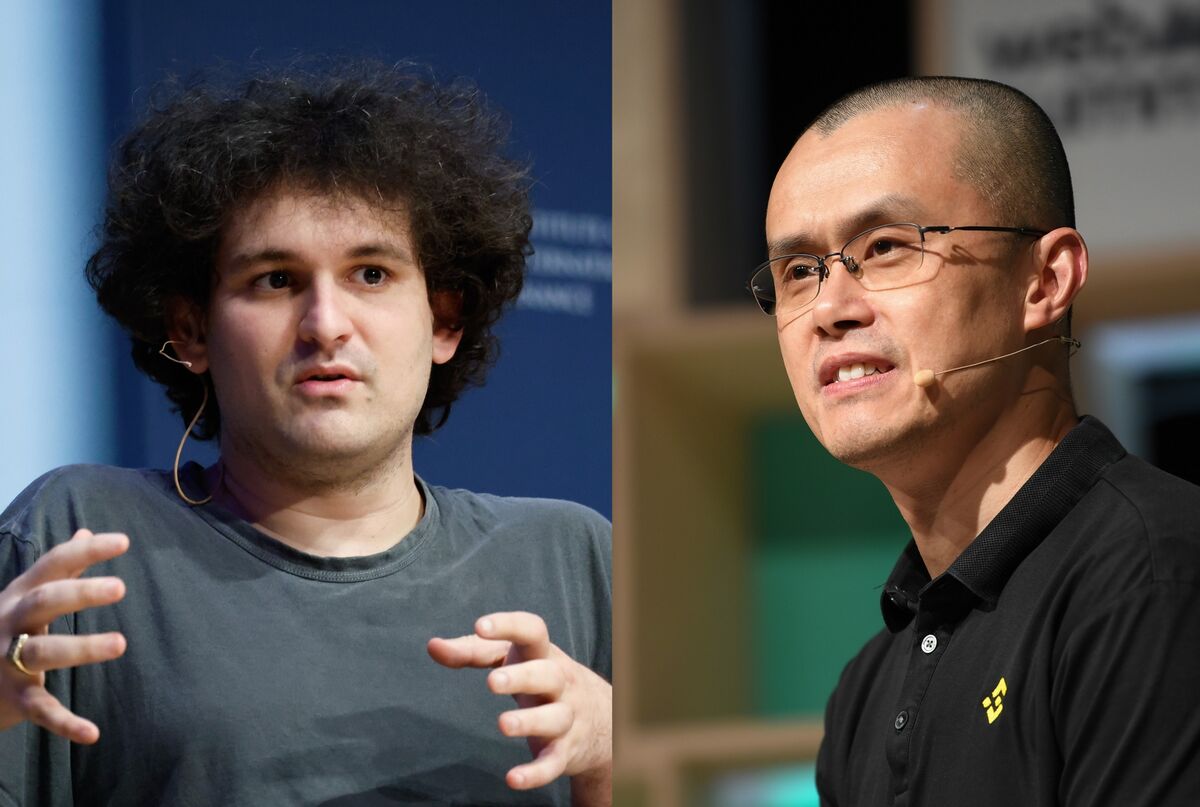

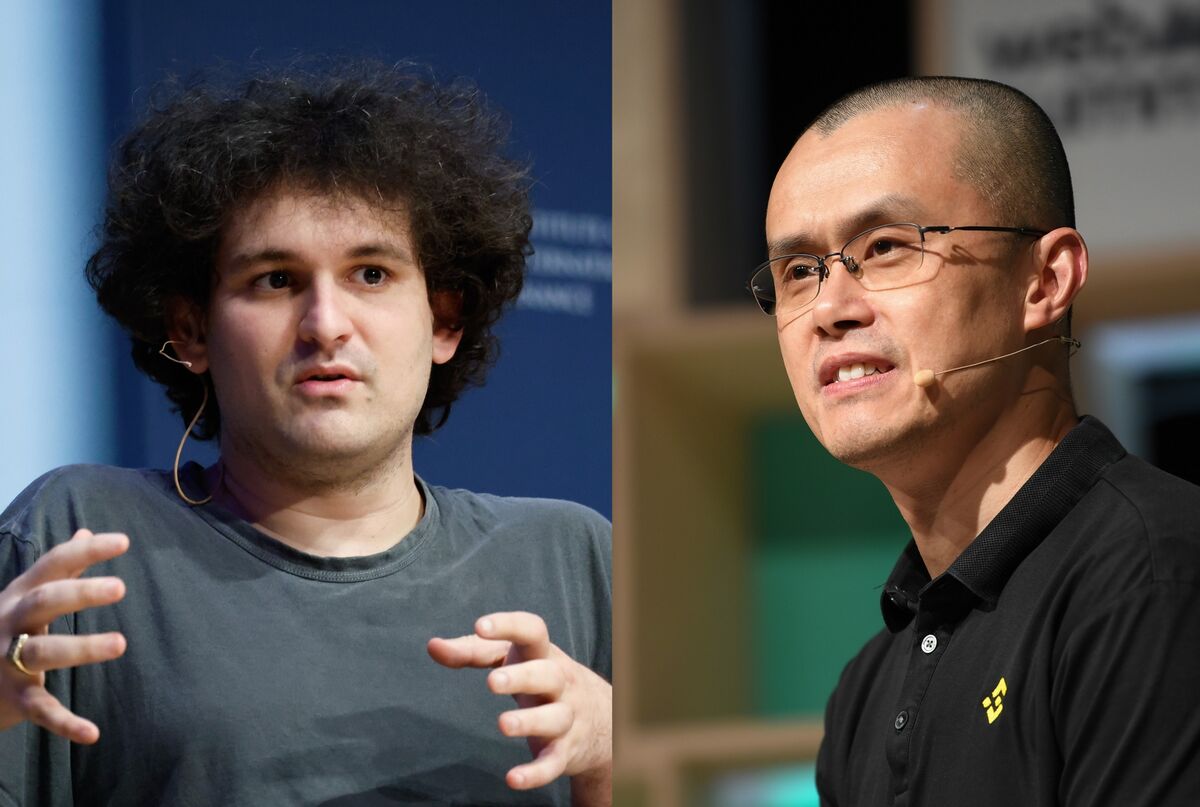

Investors are worried that cracks are starting to appear at Binance after the shocking collapse of FTX.

The crypto exchange giant faces questions about its reserves, and it is under investigation by the DOJ.

As the crypto market lose confidence in the exchange, its CEO warned staff of "bumpy" times ahead.

Customers drained billions of dollars from Binance's crypto platform last week

(Excerpt) Read more at finance.yahoo.com ...

Since Binance is the biggest and last exchange standing, it's collapse would (thankfully) signal the end of the biggest Ponzi scheme in history ...

Anyone who has given binance the custody of their virtual "assets" and doesn't withdraw them immediately is a fool ...

Is the bloom off the tulip?

Obviously in the hair futures market, one is going long, the other short.

Gee what could go wrong, a dude named CZ controls the entire company, there’s no board, there’s no audits, there’s no oversight, there’s no daylighted balance sheet, nothing! probably your money is not there either.

“Anyone who has given binance the custody of their virtual “assets” and doesn’t withdraw them immediately is a fool ...”

***************************************

I think its already too late for that, Binance has already suspended withdrawals. They will be the next exchange to go belly up in the coming days.

God damn if the 118th handled this correctly they could have unlimited punch down. But without Rush as the speartip, it's just as likely to go away.

Binance is a huge outfit, much bigger liabilities than FTX.

This is going to rock financial markets all over the world and could easily cause cascading failures in other financial institutions—fasten your seat belts everybody.

Binance is a huge outfit, much bigger liabilities than FTX.

This is going to rock financial markets all over the world and could easily cause cascading failures in other financial institutions—fasten your seat belts everybody.

Hardly.

Only one thing I need to know: It's a "crypto exchange".

Are any of these vapor assets being used as collateral for stock investments. If so, there is going to be some domino affects.

Zero Hedge has some great articles on Binance here:

https://www.zerohedge.com/search-content?qTitle=binance

This baby is going down...hard.....

The problem is that Binance liabilities are fungible—that means that they might owe someone a dollar who borrowed that dollar to buy stock.

That is why financial institution collapses are like viruses in the financial system.

There are no real firewalls preventing them from having an indirect impact on any type of asset class.

The “experts” hope nobody notices.

Which accounting firm????

I thought the plethora of cryptocurrency was confusing, now there are different types of coins under the same issuing organization. I have no idea what the difference is between BUSD and BMB.

You have to be an idiot to ever cash out your crypto to leave money “in an exchange.”

Doing so leaves you perfectly at their mercy.

And they have none.

It is a classic shell game street con—and there is nothing under either shell!

I should mention I arbitrage stablecoins on other exchanges so I'm sensitive to inflows/outflows, volatility and stuff exactly like this. And what I saw on Binance during this event was like a barely-perceptible tremor compared to a major earthquake (of which crypto has had plenty historically). And that's too bad, because I make the most of it when volatility hits and the stablecoin market charts start looking like a seismograph.

I wound up selling my tether for $1.001 on Binance - it's not exactly a sign of market stress when you can get more than par value for their digital token than the actual thing it symbolizes is worth.

“Gee what could go wrong, a dude named CZ controls the entire company, there’s no board, there’s no audits, there’s no oversight, there’s no daylighted balance sheet, nothing! probably your money is not there either.”

has NO “proper headquarters” but “is looking for one” (according to “CZ”)

AND banned in the U.S., China, Japan, UK, Italy, Thailand, Netherlands ...

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.