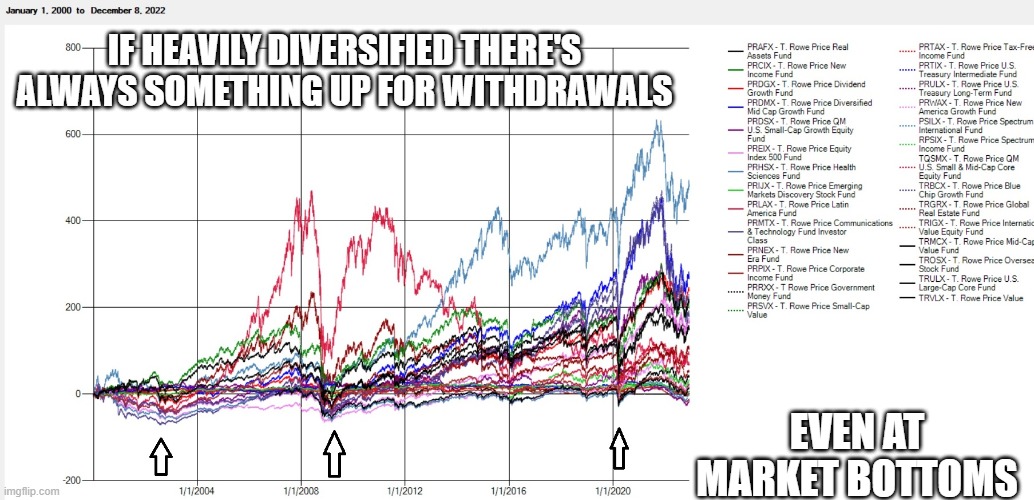

I put arrows at the time points of market bottoms for Fall 2002, March 2009, and March 2020 (forgive me Marty for the arrows not being drawn to scale LOL). Even at those times, something in the portfolio is up for you to live off of.

So let's look at the three market bottoms and pretend we were retired and looking for a place in our mutual funds to do our withdrawals from.

Fall 2002:

PRSVX (small-cap value) was up 21% from the start of 2000.

PRULX (long-term treasury) up 20%.

PRTIX (intermediate treasury) up 17%.

TRMCX (mid-cap value) up 13%.

PRTAX (municipal tax free bonds) up 9%

PRCIX (intermediate bonds) up 7%

So yeah, your overall balance is low, but there are many options to live off of (you're selling high by withdrawing from them).

March 2009:

PRLAX (Latin-American fund) up 113% since you retired in early 2000.

PRNEX (natural resources/energy) up 33%

PRULX up 29%

PRTIX up 23%

PRHSX (health sciences) up 20%

PRSVX up 14%

PRCIX up 5%

TRMCX up 2%

March 2020:

PRHSX up 341%

TRBCX (blue-chip) up 200%

PRMTX (communications and tech) up 191%

PRDMX (mid-cap growth) up 188%

PRDSX (small-cap growth) up 118% TRULX (large-cap core) up 115%

So if you can stomach your overall portfolio balance being low during market downturns, a very diversified portfolio can be 70% to 80% in equities and give you enough cushion to live on by always having some of your mutual funds be in the positive for you to withdraw from.