Skip to comments.

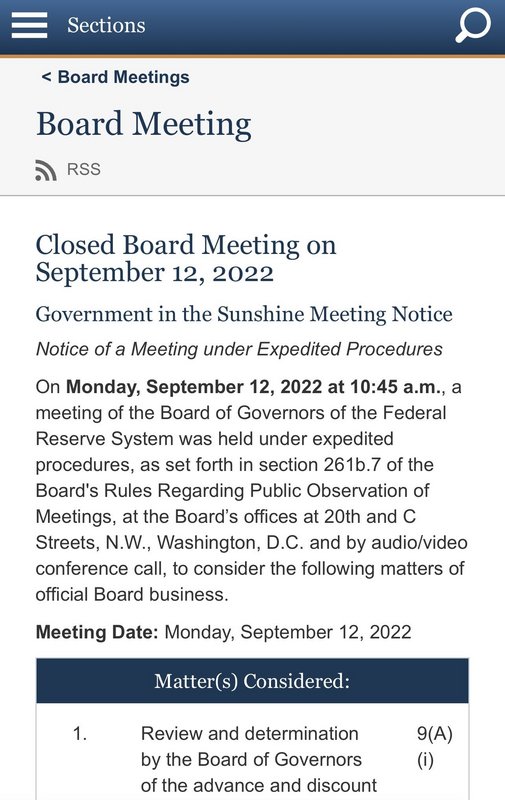

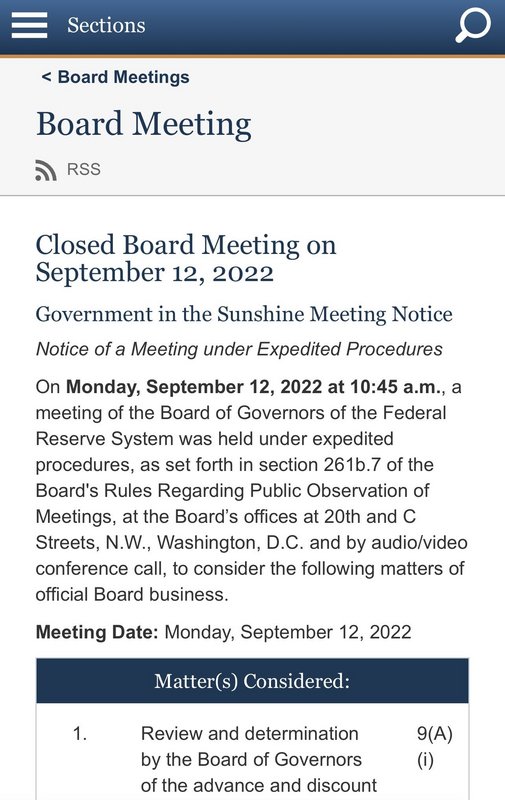

FED Advanced Notice of a Meeting under Expedited Procedures

Federal Reserve ^

| 0/29/2022

| Federal Reserve

Posted on 10/02/2022 6:26:12 AM PDT by PK1991

click here to read article

Navigation: use the links below to view more comments.

first 1-20, 21-33 next last

I tried to post a video that explanation the implications of the emergency meeting to discuss the discount rate but it was pulled. So I just posted the government meeting notice for your knowledge and consideration.

1

posted on

10/02/2022 6:26:12 AM PDT

by

PK1991

To: PK1991

They will soon pivot and follow the Bank of England to lower rates.

2

posted on

10/02/2022 6:32:23 AM PDT

by

Georgia Girl 2

(The only purpose of a pistol is to fight your way back to the rifle you should never have dropped)

To: PK1991

there are rumors flying around about Credit Suisse ... maybe related?

3

posted on

10/02/2022 6:32:59 AM PDT

by

bankwalker

(Repeal the 19th ...)

To: PK1991

Thanks for posting.

Put your head between your knees and brace, brace, brace.

4

posted on

10/02/2022 6:34:03 AM PDT

by

paulcissa

(Politicians want you unarmed so they can control you.)

To: bankwalker

I saw that also. Credit Suisse is the next Lehman.

5

posted on

10/02/2022 6:37:47 AM PDT

by

PK1991

( )

To: PK1991

Could be couple of things:

1) notice to go live with digital currency

2) interest rate adjustment because of economic problems

To: PK1991

The election is coming soon and the stock market Fall is killing Democrats. They’re going to try to do something that will save them and that’s most likely an interest rate drop.

7

posted on

10/02/2022 6:48:55 AM PDT

by

tiki

(Electiongate)

To: bankwalker

Yeah, credit swisse is junk

8

posted on

10/02/2022 6:49:25 AM PDT

by

struggle

To: PK1991

The 3rd quarter just ended and it is now abundantly clear that we are in a recession.

Biden has single-handedly destroyed everything that Trump built in just two years. And it’s getting worse.

Impeachment is the only recourse now to save our country.

9

posted on

10/02/2022 6:51:53 AM PDT

by

Apparatchik

(If you find yourself in a confusing situation, simply laugh knowingly and walk away - Jim Ignatowski)

To: Apparatchik

10

posted on

10/02/2022 6:54:37 AM PDT

by

EEGator

To: paulcissa

Stand by for heavy rolls.

11

posted on

10/02/2022 7:02:02 AM PDT

by

cuz1961

(USCGR Veteran )

To: Pete Dovgan

The Fed could also increase the purchase of treasuries and/or MBS.

I think this is more likely than a rate adjustment since the treasury and MBS markets are starting to break, and a rate adjustment would be a knock to the Fed’s credibility.

12

posted on

10/02/2022 7:02:48 AM PDT

by

cockroach_magoo

(“Sure we’ll have Fascism here, but it will come as an anti-Fascism movement.” - Huey Long)

To: Georgia Girl 2

I did a quick search here... Didn’t find anything about England Fed lowering rates... Saw they started buying some bonds cause pension funds fund are getting margin called. Got a link to rate cut?

To: cuz1961

Why am I getting this classic flashback from Star Trek.

Scotty!!!

More Power !!#

\

I’m giving it all she’s got captain !!

14

posted on

10/02/2022 7:04:44 AM PDT

by

cuz1961

(USCGR Veteran )

To: bankwalker

15

posted on

10/02/2022 7:11:53 AM PDT

by

Cincinnatus.45-70

(What do DemocRats enjoy more than a truckload of dead babies? Unloading them with a pitchfork!)

To: PK1991

So, Brandon...my neighbor is trying to take over one of my five acres. How’s about ya send me a quick million or so...a girl’s gotta eat, ya ol’ freekin’ fool!

16

posted on

10/02/2022 7:16:14 AM PDT

by

blu

(Bagster's ping on the side oh, and FJB!)

To: Pocketdoor

Yes, they are moving to QE. Printing $5 billion per month up to $65 billion. The rates will drop. Watch for the Fed to move to QE also. There is no way they can keep raising rates without bringing the whole system down.

Without a major cash infusion the big 5-6 US banks are going bye bye. They hold the silver shorts and billions in derivatives. Its a house of cards.

17

posted on

10/02/2022 7:16:54 AM PDT

by

Georgia Girl 2

(The only purpose of a pistol is to fight your way back to the rifle you should never have dropped)

To: Cincinnatus.45-70

It seems to me as a worst-case scenario, the Chinese sale of dollar-denominated assets, especially government bonds, will drive up the price of those bonds and conceivably lead to a sovereign debt crisis in America if coupled with similar actions by the Japanese,Brits and other nations whose currencies are under pressure.

18

posted on

10/02/2022 7:18:47 AM PDT

by

nathanbedford

(Attack, repeat, attack! - Bull Halsey)

To: PK1991

These meetings under expedited procedures are pretty standard. The UK will have a Lehman moment very soon. The bond vigilantes are not happy at all.

19

posted on

10/02/2022 7:25:39 AM PDT

by

Theoria

To: tiki

“ The election is coming soon and the stock market Fall is killing Democrats. They’re going to try to do something that will save them and that’s most likely an interest rate drop.”

The announcement of a successful soft landing and suspension of any further increases would do the same.

20

posted on

10/02/2022 7:29:06 AM PDT

by

jdsteel

(PA voters: it’s Oz or Fetterman. Deal with it and vote accordingly.)

Navigation: use the links below to view more comments.

first 1-20, 21-33 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson