Posted on 09/01/2022 12:45:53 PM PDT by RomanSoldier19

Jeremy Grantham is among Wall Street’s most respected investors.

The cofounder of Boston asset manager GMO is well known for having predicted Japan’s asset price bubble in the 1980s, the dot-com bubble of the late ’90s, and even the U.S. housing blowup that came before the 2008 financial crisis.

Now the 83-year-old Wall Street veteran is arguing that despite the stock market’s struggles this year, the economy’s real downturn has yet to come. Grantham has been warning of a brewing “superbubble,” and he says it’s yet to pop.

In a Wednesday research note, the investor noted that stocks remain “very expensive” and high inflation like the economy is experiencing now has historically led their valuations to contract. He also claimed that global economic “fundamentals” have begun to “deteriorate enormously” in recent months, pointing to COVID-19 lockdowns in China, the energy crisis in Europe, global food insecurity, Federal Reserve interest rate hikes, and slowing government spending worldwide.

“The current superbubble features an unprecedentedly dangerous mix of cross-asset overvaluation (with bonds, housing, and stocks all critically overpriced and now rapidly losing momentum), commodity shock, and Fed hawkishness,” Grantham wrote. “Each cycle is different and unique—but every historical parallel suggests that the worst is yet to come.

(Excerpt) Read more at finance.yahoo.com ...

A recession/depression caused by green lunacy, money printing, over taxation and over regulation is a sure cure for inflation and over priced stocks and real estate.

Wonderful…

As is true of most middle class Americans I see the equity that I have...or *think* I have...in my home as being a substantial portion of my “net worth”. So thanks to The Big Guy and his “most comprehensive voter fraud operation in history” my net worth will be taking a nosedive...at the same time that my grocery bills (and other bills) are up 30%.

It could be worse, you could be a renter like me.

We have a giant zit in the White House which needs to pop.

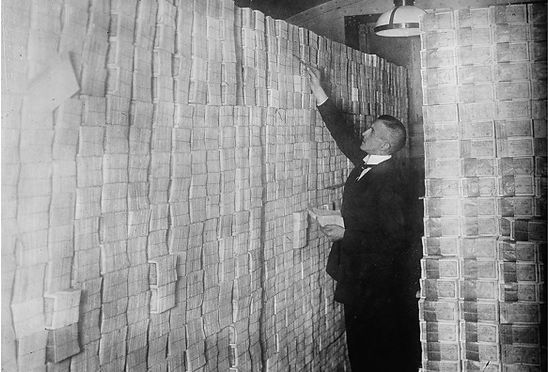

It’s a super bubble of worthless cash.

You think 9.2% inflation was bad? That was nothing.

Does a best bubble spotter have more experience than a expert bubble spotter? Asking for a friend.

In gold we trust.

That said I don't follow others,,,,,,,,,,

"It’s a super bubble of worthless cash."

.

A Berlin banker counts stacks of bundled marks. (1923).

[Photograph.]. Rare Historical Photos.

https://rarehistoricalphotos.com/banknotes-german-hyperinflation-1923/

Misery index = (Inflation + Unemployment rate)

= (9.2 + 12)= 21.2

My guess for unemployment rate.

You had to be a moron to miss the impending 2008 housing-related crash. For at least 12 months prior I was constantly trying to figure out how to profit when it finally all fell apart.

I never figured that one out. And I doubt I will figure this one out either.

Exotic financial instruments are not my thing, but there seem to be new ones at the heart of each new market collapse.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.