Skip to comments.

Paper Gold Price Manipulation—Rigged to Fail

Gold Switzerland ^

| 7/11/2022

| Matthew Piepenburg

Posted on 07/12/2022 6:06:39 AM PDT by PK1991

"The current and open fraud regarding the paper gold price in the COMEX market is now as plain to see as the open desperation in the global financial system, which is unraveling in real-time all around us.

As risk assets tumble foreseeably into bear territory before a headwind of deliberately rising rates, precious metals have seen headline-making falls as well **** But let’s get to the real heart of the matter, namely: Legalized paper gold price manipulation (i.e., fraud) in the COMEX market, a topic we’ve addressed more than once, here and here.

As we’ve openly argued for years, nothing embarrasses an otherwise discredited fiat currency like a rising gold price.

As I’ve described it, rising gold prices are a middle finger to debased currencies whose declining purchasing power are the DIRECT result of the failed and drunken monetary policies (i.e., mouse-click trillions) of a central bank near you.

Or as Ronan Manly more distinctly observed: “Gold to central bankers is like sun to vampires.”

And that, folks, is precisely why the big banks (under the direction of the BIS) are deliberately (and if law school serves me correctly) as well as fraudulently manipulating the paper gold price."

TOPICS: Business/Economy; Foreign Affairs; Government; News/Current Events

KEYWORDS: comex; gold; manipulation; price

Note he doesn't talk about who is buying the paper, only the banks selling it. There are two sides of this trade. Why would any institution buy this paper if it's "manipulated" unless the Fed or treasury is the other side of the trade (that would be manipulation).

The gold bugs have been saying this forever, and they always say the jig is up, but it continues for years. Are we nearing the end? If you do buy, buy real not paper!

1

posted on

07/12/2022 6:06:39 AM PDT

by

PK1991

To: PK1991

I assume paper gold is like those stock options that don’t have enough shares to be redeemed?

To: scrabblehack

Economy up? Economy down? Sun rising in the East? Buy Gold!

3

posted on

07/12/2022 6:14:58 AM PDT

by

glorgau

To: PK1991

Whatever became of that outrageous sized gold find in Uganda?

4

posted on

07/12/2022 6:18:37 AM PDT

by

KC Burke

(If all the world is a stage, I would like to request my lighting be adjusted.)

To: PK1991

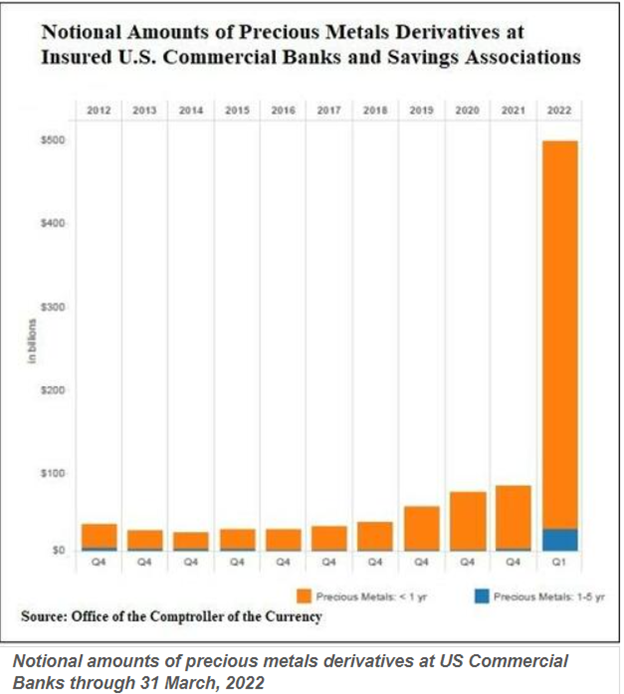

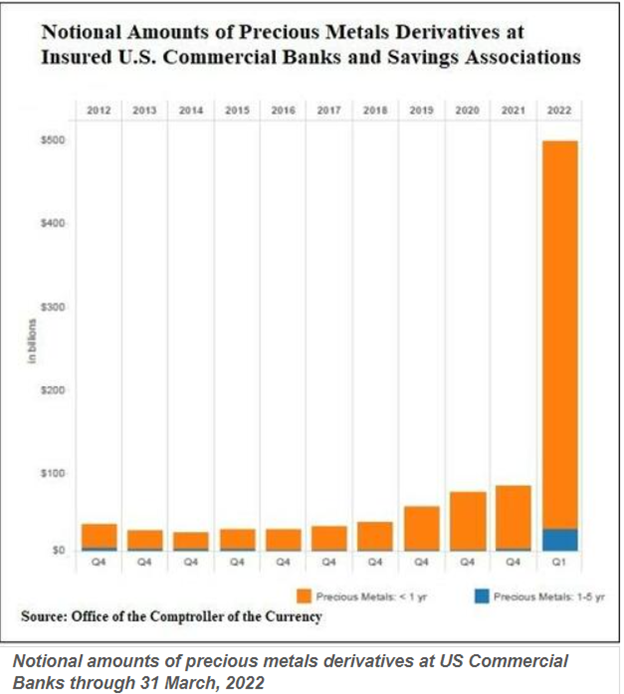

Do you think that mined physical gold has suddenly increased following this graph?

No. It's "paper gold" ie fake gold, a game played at top banks.

It's just as easy to fabricate "paper gold" derivatives and trade them back and forth as it is for the federal reserve to create thin-air money.

The only real gold is physical gold, IN YOUR POSSESSION.

["Physical gold" supposedly kept in your name in some other location is NOT physical gold, it's a scam for suckers. If you don't have the physical, you have nothing.]

5

posted on

07/12/2022 6:31:19 AM PDT

by

Travis McGee

(EnemiesForeignAndDomestic.com)

To: PK1991

Trading gold as a serious investment in financial markets requires “paper” gold instruments such as gold certificates and stock in companies such as GLD. When it becomes impossible to redeem those certificates for physical gold, then it will be clear the market is rigged. Thus far anyone who wants possession of physical gold at the current price can have it. Yet it is somewhat confusing why the price of gold has been weak during this decline in most markets. Could be some gold bugs are buying commodities such as wheat, rice, natural gas, LNG , coal and oil. Or there is simply much less real surplus wealth to store as gold.

It should be noted that during the Depression , the real price of gold declined. There was little real surplus wealth being accumulated to store as gold. IMHO the decline in the price of gold over the past three months suggests that the world economy is significantly contracting.

6

posted on

07/12/2022 6:39:23 AM PDT

by

allendale

To: PK1991

the banks buy & sell to each other....

7

posted on

07/12/2022 6:40:18 AM PDT

by

wny

To: PK1991

One of the main reasons the price of gold dropped is because I bought some.

8

posted on

07/12/2022 6:59:45 AM PDT

by

ComputerGuy

(Heavily-medicated for your protection)

To: PK1991

I am not sure what paper gold is.

I also do not understand why the author claims manipulation.

Gold is currently trading at $1725, which is just 11% below its forty year high, which it reached during the Covid pandemic.

To: glorgau

I have never heard an advertisement saying it is a great time to sell gold. Gold is down, silver is down, inflation is up. I have some coin stacks but regret ever buying them. Even with averaging for years it has been a losing hedge.

10

posted on

07/12/2022 7:23:19 AM PDT

by

Organic Panic

(Democrats. Memories as short as Joe Biden's eyes)

To: Organic Panic

Most of the commercials on TV say that gold is a perfect hedge against inflation. WHY? Inflation is at a 40 year high and gold cannot break the $2000/ounce barrier and sustain it for any length of time. Either the commercials are lying to us, or there is something rotten in Denmark. Someone is manipulating the price of gold (and silver). I did not buy my small investment in gold to speculate on the price. I bought mine to hopefully have something of value to barter with when the world monetary system collapses.

11

posted on

07/12/2022 7:48:53 AM PDT

by

Saltmeat

(69)

To: PK1991

Feather river will deliver

To: scrabblehack

I understand how they can suppress paper gold prices, but why is it that physical gold is not through the roof?

It’s easy to see what physical gold is selling for: just check recently completed eBay sales. The physical gold and silver does command a premium over the spot price, but it’s only about 5%.

The only explanation I can think of to explain why physical precious metals is not skyrocketing as a result of dire inflation fears it is that our central bank is stupidly selling off our gold reserves to China, Russia, etc. at steep discounts in order to prop up the US$.

If that’s what is happening, that’s not price manipulation - that’s treason.

To: Saltmeat

Gold is used as a hedge against concerns of future inflation, when there is actual inflation gold under performs as holding it does not generate revenue.

14

posted on

07/12/2022 7:32:09 PM PDT

by

Brellium

(The environment is of upmost importance, without trees where will we hang Moscovites?)

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson