Posted on 04/25/2022 5:54:33 AM PDT by blam

Last week’s violent stock selloff has resumed as a new week begins, with Asian and European markets tumbling, and US futures trading at session lows, but nowhere is the panic selling worse than in China, where the stocks, commodities and the yuan all tumbled.

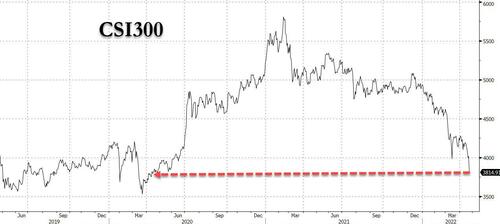

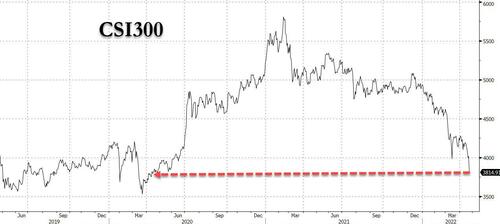

The CSI 300 equity benchmark slumped 4.9%, its biggest drop since Feb 2020, to the lowest level since May 2020 and wiping out gains from a March pledge by officials to support the economy as fears that the Covid breakout in Shanghai is spreading to Beijing, sparking new concerns about China’ economic and earnings growth outlook.

The Shanghai closed more than 5.1% lower, and the CSI 300 Index is set for for its sixth session of declines in seven, on track to extend this year’s drop to 22%. Some indexes carrying Chinese stocks are ranking among the world’s worst-performing equity gauges for 2022.

It was just as ugly across all regional markets:

•*CHINA’S SHANGHAI COMPOSITE INDEX CLOSES DOWN 5.132% TO 2928.51

•*CHINA’S CHINEXT INDEX FALLS 5% TO 2,181.44

•*CHINA’S CSI 300 INDEX FALLS 4.9%, MOST SINCE FEBURARY 2020

•*HONG KONG’S HANG SENG INDEX FALLS 4% TO 19,809.83

•*HANG SENG TECH INDEX FALLS 5% TO 3,800.80

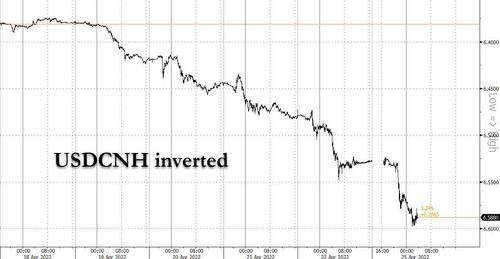

It wasn’t just stocks: extending on last week’s plunge, the yuan fell to its weakest in a year on concerns about rising capital outflows and oil sank below $100 on worries over Chinese demand.

Besides a mass liquidation of risk assets, fears of a new covid breakout in the country’ capital sparked a bout of panic buying of goods as Beijing residents — fearful of being caught unprepared in the event of a citywide shutdown– rushed to stockpile supplies after the government announced mass testing plans and put some areas under lockdown.

China’s capital Beijing has begun mass testing and shutting down residential and business districts amid a new virus outbreak of 40 cases since Friday. Residents were staying in and stocking up on food in case they are confined to their homes. https://t.co/LzaygbAvEE

— The Associated Press (@AP) April 25, 2022

As noted earlier, the city of more than 20 million people and the country’s political center has sealed off dozens of residential compounds and told inhabitants of the eastern district of Chaoyang to be tested three times this week after dozens of infections were found over the weekend. Officials have warned of more cases in coming days, with Beijing city government spokesman Xu Hejian saying late on Friday that the current outbreak is “complex and stealthy” while vowing to take further measures to prevent its spread.

Meanwhile, a Covid flareup that shut down much of Shanghai appeared to worsen over the weekend with Bloomberg reporting that the financial capital reported a record 51 Covid fatalities for Sunday, bringing the total number of Covid deaths to 138 during the current outbreak, according to the city’s health commission. Shanghai also reported 19,455 local Covid-19 cases.

The twin outbreaks in two of China’s most significant cities has become an unprecedented test for President Xi Jinping, who is likely to seek a third five-year term during a Communist Party congress later this year.

“There are concerns about the Covid situation in Beijing evolving into what happened in Shanghai with some prolonged lockdowns that bites the economy,” said Kevin Li, portfolio manager at GF Asset Management (Hong Kong) Ltd.

China has repeatedly defended its Covid Zero policy, saying the policy saves lives and keeps the economy going, even as the strategy is doing just the opposite, increasingly darkens the country’s growth outlook and threatens to disrupt global supply chains. Some have even speculated that China’ surge in civid cases is intentional and meant to purposefully destabilize US supply chains in retaliation for US sanctions against Beijing’ close ally. Moscow.

The news of the fresh covid scare in China spread around global markets with stocks and equity futures under pressure and havens like the dollar and Treasuries gaining. Traders balked at the potential impact of coronavirus restrictions on growth in the world’s second-largest economy, which was already showing signs of slowing down thanks to a property crisis and increased regulation. The growth fears come amid China’s widening policy divergence with the U.S., which has led to foreign outflows and weighed on the yuan. Investor nerves were already frayed after last week’ market plunge sparked by fears of a more aggressive tightening from the Fed and European Central Bank late last week.

The Covid situation is putting the country into “the darkest moment in economic terms for the last couple of decades,” said Junheng Li, JL Warren Capital founder and CEO, told Bloomberg TV in an interview adding that it’s a “confidence crisis” given Shanghai, the most affluent city in China, has a “consensus disappointment and resentfulness” toward the Covid policy.

“People really don’t know what’s a clear path to get China out of this Covid situation” and it’s “unlikely that China will be opened up in a sustainable way” in the foreseeable future, Li said warning that coupled with the war in Ukraine and the Federal Reserve raising rates, Chinese stocks will see a couple of “potentially very volatile months” ahead. “It’s very hard to make long calls with a situation where the future is so uncertain”

The renewed selling also comes as investors have grown weary about a lack of follow-through on policy promises last month to shore up growth and stabilize markets. Markets shrugged off Friday’s latest policy vow from the People’s Bank of China to ensure stability, which repeated commentary seen in the past month.

Meanwhile, analysts have started downgrading economic growth forecasts for this year below the government’s 5.5% target given the extent of the lockdowns, after a number of manufacturers and car makers highlighted supply chain disruptions.

The selling led to a fresh tumble in local bonds – in the corporate debt market, Chinese dollar junk bonds fell as much as 2 cents on the dollar Monday, led by developers.

The selling frenzy also swept through commodities markets, with the nation heading for the largest oil demand shock since the early days of the pandemic. Meanwhile, iron ore tumbled almost 12% in Singapore before paring around half of the drop.

“The sharp price fall is mainly due to the burgeoning Covid impact,” said Chen Wen Guang, research director at Lange Steel Information Research Center, an industry group in Beijing. With “lots of areas affected, people are beginning to worry about demand.”

Here’s what some other strategists and fund managers are saying:

GF Asset Management (Kevin Li)

•“There are concerns about the Covid situation in Beijing evolving into what happened in Shanghai with some prolonged lockdowns that bites the economy”

•“On the other hand, the unchanged one-year and five-year LPR rates have also hurt sentiment”

Bank of Singapore (Eli Lee)

•“The latest disappointing set of stimulus measures from China have led us to downgrade our 2022 GDP growth forecast from 5.5% to 4.8%”

•“As the PBOC grows wary of the inflation and currency risks related to the divergence in monetary policy versus the Fed, Chinese policy makers will find it difficult to achieve their trinity of goals: 5.5% GDP growth in 2022, zero Covid cases and limiting the leverage in the economy”

•“While this weakens the thesis for our overweight position in Chinese equities at the margin, we see our long-term thesis to be broadly intact given overly depressed valuations and a still constructive long term outlook”

Straits Investment Management (Manish Bhargava) •“Fears of an extended lockdown in Shanghai (and possibly other major cities) could dent the country’s economic prospects”

•“While it is hard to tell how bad the selling could get, today’s market reactions suggest that Covid fears have not been fully priced in”

IG Asia (Jun Rong Yeap)

•The intensifying virus risks suggest “economic conditions will continue to remain impaired with its zero-Covid stance. Overall, the sell-off may have been further exacerbated by the dent in global risk sentiments, with the lack of positive catalyst for market participants to take on added risks for now”

Bloomberg Intelligence (Marvin Chen)

•Today’s fall has come on back of “continued lockdowns and lack of easing, and this following on the global selloff on Friday as well with S&P 500 down almost 3%”

•“China may need to renew policy vows made in March to stimulate withering markets, but this time such pledges might not be as effective with the Fed expected to deliver a super-sized rate hike in early May”

Does that mean we go south too?

A fake flu brings down the red dragon?

Its nothing to do with ‘covid’

Xi Jinping is putting China through his own “Cultural Revolution.”

U.S. markets are crashing as well. Trump was right about Brandan crashing our 401k’s.

I’m sure there will be propagation of effects.

Between this, Russia v Ukraine, inflation, real estate bubbles, and supply issues…

This is 2020 all over again. They never mention the variant, they’re using propaganda to scare the crap out of idiots around the world and they will try to lock us down in a few months. Weird, right before the mid terms…

I think by August the idiots here will be pushing lockdowns, masks, more vaccines, etc, etc, etc.

I think we are already going south, regardless of what happens in China, the financial meltdown in China certainly will have some impact, you don’t have the #1 and #2 economies in the world in trouble and not affect the rest of the world.

China is strangling itself over Covid, shutting ports and factories that supply a lot of things for the Western World.

The USA is being run by a dementia ridden senile old man with a party that has gone off the deep end.

Throw in a war in Europe with potential to spread and you have the major ingredients for a real disaster.

To effect another lockdown in time for midterms, there must be a kinetic attack to compel Martial Law or another Wuhan plandemicized Fauci period.

Looks as if Swamp is testing both options.

And just who the hell is ‘Nation and State’?

The Communist Party still controls the central bank. Immense amounts of capital have been squandered financing urban buildings and huge investments in the military. There has been no economic return. Urban real estate is grossly overvalued and is the basis of many loans. Often that money has been squandered as well. If China has a poor harvest, the economy very well can crater even without COVID.

BTW. Tesla has made huge investments in China to manufacture, sell and export vehicles. Thus far there have been no real profits and virtually all its proprietary trade secrets, patents and techniques are in Chinese hands. Musk is smart to diversify his holdings into Twitter and other assets.

We (Americans and the rest of the world) have been lied to for decades (by the globalist). China’s economy was an illusion supported by loans (from western banks and governments).

I have described China in the past as a giant ponzi scheme. Members of the Communist party getting rich.

As long as there was a flow of money into China (like all Ponzi schemes) they appeared to have a stable economy.

It is ironic that the virus they created and released on the world is what is bringing China down.

I think it’s going to be far worse economically, but negligible Covid deaths.

That said, Baby Boomers are getting old, and the US’s yearly deaths should increase without respect to Covid.(in the coming decade)

Interesting when they grew exactly 8% every year…

The dominos are falling. This may or may not move the timetable for invasion of Taiwan, but for sure, this earthquake is going to make the entire world reverberate like a huge bell. Aftershocks will continue on and on to make the entire financial system collapse, and the “Great Reset” will be probably one of the first fatalities. Even George Soros may not be able to show any gain from this.

Today is a double hammerfist blow for the brainless Pooties. First the Russian central bank head testifies how devastating the sanctions have been. And now their great saviour China and the yuan is crashing.

Hmmm ... Chinese stocks are cheap eh? This is a chance to make a few bucks.

They invented it.

Now, enjoy !

Hmmm ... Chinese stocks are cheap eh? This is a chance to make a few bucks.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.