Posted on 03/11/2022 8:55:37 AM PST by SeekAndFind

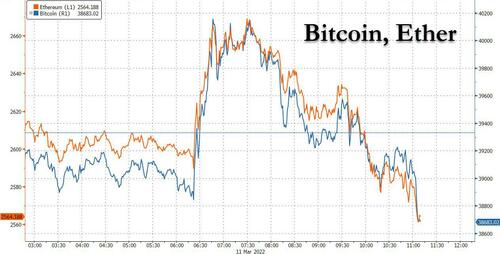

After briefly rising above $40,000 this morning following the earlier (and now forgotten) report of some soothing words from Putin over the Ukraine conflict, Bitcoin and the broader crypto sector has slumped to session lows...

... following a Reuters report that crypto firms in the United Arab Emirates (UAE) are being flooded with requests to "liquidate billions of dollars of virtual currency" as Russians seek a safe haven for their fortunes.

According to the report - which cites company executives and financial sources - some Russians are using cryptocurrency to "invest in real estate" in the UAE, while others want to use firms there to turn their virtual money into hard currency and stash it elsewhere. One crypto firm has received lots of queries in the past 10 days from Swiss brokers asking to liquidate billions of dollars of bitcoin because their clients are afraid Switzerland will freeze their assets, adding that none of the requests had been for less than $2 billion.

If accurate, that would naturally indicate that the recent Citi report suggesting that Russian crypto purchases had been de minimis was dead wrong, and instead Russians have been busy scooping up cryptos, just not in Rubles but in other currencies, which is why Citi never captured the transactions.

“We’ve had like five or six in the past two weeks. None of them have come off yet – they’ve sort of fallen over at the last minute, which is not rare – but we’ve never had this much interest,” an executive said, adding that his firm normally receives an inquiry for a large transaction once a month.

“We have one guy – I don’t know who he is, but he came through a broker – and they’re like, ‘we want to sell 125,000 bitcoin’. And I’m like, ‘what? That’s $6 billion guys’. And they’re like, ‘yeah, we’re going to send it to a company in Australia’,” the executive said.

Dubai, the Gulf’s financial and business center and a growing crypto hub, has long been a magnet for the world’s ultra-rich and the UAE’s refusal to take sides between Western allies and Moscow has signaled to Russians that their money is safe there.

One real estate broker, whose company has partnered with a cryptocurrency service to help people buy property, said: “We’ve been seeing a lot of Russians and even Belarusians coming to Dubai and bringing whatever they can bring, even in crypto.”

Meanwhile, finding themselves non-grata across most of Europe, a financial source in the UAE told Reuters that Russians are now buying property in Dubai, using crypto as a way of getting their money out of other jurisdictions and into the Gulf state.

Which is also strange considering that cryptocurrency exchanges have said that they are blocking the accounts of Russians sanctioned by the West over Moscow’s invasion of Ukraine. Major exchanges such as Coinbase and Binance say they are taking steps to ensure that crypto is not used as a vehicle to evade sanctions, and that they collaborate with law enforcement on the issue.

Still, European countries such as Germany and Estonia have this week called for tighter oversight to snuff out any loopholes that could allow sanctions busting. Three Western diplomats said they were increasingly alarmed by the number of Russians who in recent weeks were seeking a refuge in the UAE for their fortunes, including in property, and were wary that some could be acting on behalf of those under sanctions.

Two of the diplomats said they were skeptical that the UAE would crack down on Russian wealth in the Gulf state, which they said was predominantly held in Dubai, citing the country’s neutral stance in the conflict. A third said they hoped the UAE, which is also a gold trading hub, understood the implications for its reputation and would take action.

To be sure, the UAE's role in facilitating global money laundering is nothing new, and a decade ago, Dubai emerged as a key pillar for Iran's evasion of western sanctions when the state would allow Iran to trade gold with Turkey, while evading monetary sanctions (see "Turkish gold trade booms to Iran, via Dubai").

Not surprisingly, the UAE was put on a “grey list” this month for increased monitoring by financial crime and money laundering watchdog the Financial Action Task Force (FATF). The FATF cited risks in certain industries, including real estate agents and precious metals dealers. Dubai adopted a virtual assets law this week and established a regulator. The UAE’s regulator said it was close to issuing regulations and has consulted on money laundering risks in the sector.

The UAE’s Foreign Ministry told Reuters it had no further comment beyond previous statements that the government has a “strong commitment” to working with FATF on areas for improvement in its anti-money laundering and counter-terrorism financing regime.

Countering the argument that bitcoin is the preferred currency of money launderers, Reuters cited experts who said the relative transparency of cryptocurrency transactions, which are recorded on the blockchain ledger that underpins bitcoin and other tokens, makes large-scale sanctions evasion difficult. Furthermore, the U.S. Treasury said on Monday that sanctions-busting using crypto was “not necessarily practicable,” and called for vigilance from companies in the industry.

Two sources familiar with the matter said UAE companies had reputational concerns about doing business with Russians, but felt the state’s abstention at the U.N. Security Council, when Russia vetoed a resolution condemning its invasion of Ukraine, was a signal they should not impose restrictions on Russians.

The UAE, which has deepened ties with Russia over the years, has not matched sanctions imposed by Western nations and its central bank has not issued any guidance regarding the measures. Dubai has long been popular with Russians, who were among the top visitors and purchasers of real estate even before the war and ensuing sanctions threw the Russian economy into turmoil.

Apurv Trivedi of Healy Consultants, which advises on setting up businesses, including crypto companies, said they had definitely been getting more interest from Russian clients.

“They’re basically trying to protect themselves against the inflationary pressures that are happening against the Russian currency. So crypto has been a very good exit for them to manage the risks that they’re facing,” Trivedi said. “It’s a good liquidity provider for them.”

Healy’s Sami Fadlallah said a lot of the money coming from Russia has been moving into Dubai’s real estate, citing both industry talk and their company’s experience.

“People parking their money in dozens of apartments in the Marina, Downtown,” Fadlallah said. “We’ve seen a lot of Russians hedging their bets against the devaluation of the rouble by moving a lot of assets into crypto. And the UAE is relatively loose in terms of its regulation and authorities over transferring crypto here.”

While all of the above may be accurate and is certainly a bearish indicator for crypto prices, at least in the short term, one should probably consider what will happen to crypto prices when China inevitably strikes Taiwan, and all those Chinese deposits comprising the bulk of Chinese bank assets, which at last check were $54 trillion, or more than double those of the US...

... rush to find a safe, offshore haven.

Real estate in UAE? It would be their just desert. If they’re willing Dubai, the emirates will be willing to sell.

“And I seem to find the happiness I seek,

When we’re out together dancing sheik to sheik...”

A 6 month chart of bitcoin looks like the glidepath of an airliner going 35 thousand feet to landing.

Did anyone see the bump that started a couple weeks ago when the invasion started? Does anyone see the drop recently?

If you were a Russian Oligarch or Bitcoin multimillionaire...don’t you think they would be slightly ahead of the Western News?

Once again, the news is a day late and a dollar short. The only people getting caught in this downdraft are the kids who are trying to day trade instead of going to their Micro-economics class.

Paper profits are never profits until you cash them in for real assets.

There is a lesson here for everyone.

Thats not what this was about.

This was some group of “millionares” seeing the writing on the wall. They bought crypto on the black market in Russia, or and then transfered it to an exchange who doesn’t care where the money comes from.

My guess, and this is only a guess, is that the price of the crypto sold was not equal to the amount these Russians received. Remember the movie Casablanca? Everything costs more in Casablanca because everyone charged a corruption premium.

What you are seeing is the case study for the crypto use that is peer to peer and, pretty much, free from government intervention.

There are ALWAYS people in the world who will help you liquidate their assets. And those dollars are probably enjoying the Caribbean sun by now.

Do you look at the Dow or the S&P over six months?

Not saying a lot of people don’t...but if you bought crypto in 2013 (where a lot of folks around here bought it) the trade is still the best trade of their lives—even 50% off the recent high.

"Looking good, Louis!"

Just to put it in perspective.

There are four things I measure every day in my financial spreadsheet:

Compound Annual Rate for Bitcoin, Gold, Silver, and SP500

I measure from May 2013. These are as of this morning.

S&P 500 CAGR is 10.90%

Silver CAGR is 4.0517

Gold CAGR is 4.013%

Bitcoin CAGR is 93.1%

If you are looking at a 10 year time frame, it is important to keep things in perspective. Bitcoin is wildly sporadic and is not for the feint of heart or those with a short time frame.

But it doesn’t take many years at 93% compound annual growth to turn a throw away “speculation” into a live changing amount of money.

Your mileage is going to vary. But after more than ten years of reading about this stuff—and 9 years of owning (almost) you get used to the wild swings. And you take some off the top and spread it around fairly regularly.

And you pay your taxes and keep immaculate records because the IRS is ALL over that.

And if you bought Apple in 1984... who cares? It only matters where will it go from here, PERIOD. Should I have bought Sears stock a few years ago, just because it performed well for the first 100 years? Or Xerox?

EXACTLY.

And its under the name of a company, owned by a lawyer from Panama.

Essentially....its gone.

There is a reason this is plastered everywhere in the trading and investment world:

Past Performance Is No Guarantee of Future Results

Really? So the Apple shares that I bought when they were $20 should be sold because they are down recently.

I am not sue I follow your logic.

Of course, you seem to be too busy making excuses why you didn’t research in it ten years…and you warn off anyone looking to do so today.

Sounds like sour grapes to me.

When your time frame is measured in days, it’s no wonder think this way.

If you don’t understand “the logic” that the trading/investing performance from in the past may not be meaningful to what is happening now or in the future, this is not an area you should be involved in. Read this and ponder it’s meaning:

Past Performance Is No Guarantee of Future Results

How many times are you going to write that?

You must think I have crypto as “the basis” of my portfolio. That’s silly.

My point is that you look at the past six months, but ignore the context of the larger picture. You ignore the adoption cycle. You ignore the institution adoption. You ignore the investment in the infrastructure.

Nope, you look at six months price movement and you make a declaration.

Do you look at earnings history? Revenue growth? Expansion history? Dividend growth when looking at investments? All of these things related to traditional investments require a look at a 1-3-5 year window.

Am I saying the CAGR is going to stay at 93%? Your argument suggests that. And that means you are simply arguing to argue. And that’s a waste of time.

It’s extremely foolish of you to be a know-it-all on what I think and how I invest, simply because I said look at the the 6 month chart.

But you make all sorts of assumptions about MY investing based on almost nothing.

I simply said you need to look at context. Your post indicated at the last six months was all the context you needed.

You do this often on lots of threads. And then you turn it into some kind of personal attack. Why don’t you spend as much time learning what you are debating about. Your arguments are juvenile, and your “debating” skills are infantile.

You are a Joe retail trader that is all full of yourself.

“Your post indicated at the last six months was all the context you needed.”

That was a lame assumption you made. There was nothing in my post where I implied that. I call you out on stupid and then you get your feelings hurt.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.