Posted on 06/15/2021 5:52:05 PM PDT by blam

…time to ignore Dr.Copper once again!?

Copper prices plunged on Tuesday to their lowest levels in seven weeks over concerns about Federal Reserve’s monetary tightening and a pull-back in Chinese demand.

From aluminum to copper to lead to nickel to tin to zinc, the entire base metal complex is down anywhere from 2-4%.

Focusing on copper, future prices on the London Metal Exchange are down 4% to their lowest levels in seven weeks. Three-month LME copper futures were trading around $6,563 per ton, down 11% in 25 trading sessions since topping at $10,747 in early May.

Copper prices soared to a record in early May ($10,747 per ton) as stimuli, low-interest rates, and an economic recovery fueled a rally in base metals, along with most commodities. “Prices have since stumbled on concerns the Fed will pull back support, while China is looking to tap state reserves to accelerate its campaign to rein in surging raw material costs,” said Bloomberg.

“Market participants are worried that the U.S. Federal Reserve will signal this week that it intends to tighten its ultra-loose monetary policy,” Daniel Briesemann, an analyst at Commerzbank AG, said in a note. “In addition, the high metals prices appear to be slowing demand in China.”

China’s state planner has also been curbing speculation in commodity markets as domestic producer inflation soars to a 12-year high.

“The government knows that low material price and high manufactured good price are favorable to the Chinese economy,” said a China-based metals trader told Reuters.

According to Bloomberg, the Yangshan copper premium, a gauge of China’s demand for imports, continues to tumble to levels not seen since 2017. This could indicate that ample supply is flooding markets.

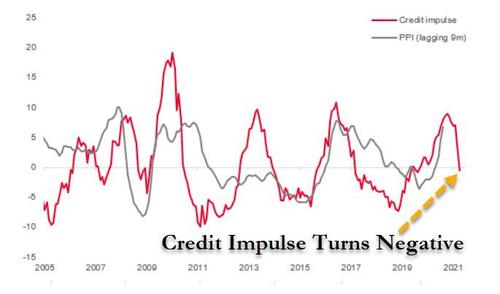

Readers may recall none of this should be surprising considering our ample coverage on China’s credit impulse (the 2nd derivative of the credit stock) turned negative in May. From peak to negative, it only took seven months this time, compared with 9-10 months in the past.

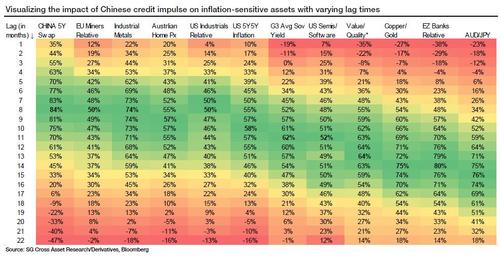

The slowdown in China’s credit has first reached assets driven primarily by the Chinese economy (Chinese bond yields and industrial metals). Next to be impacted are inflation breakevens and sovereign yields in Western economies. The peak correlation for other growth-sensitive assets such as eurozone banks and AUD/JPY arrives with bigger lag of around 4-5 quarters. This result, while logical, is quite significant, as it gives us a playbook for the ebb and flow in Chinese credit impulse.

The bottom line is China’s credit impulse has been in contraction for about a month which has coincided with the latest slump in base metal prices

What Is Doctor Copper?

The term Doctor Copper is market lingo for this base metal that is reputed to have a "Ph.D. in economics" because of its ability to predict turning points in the global economy. Because of copper's widespread applications in most sectors of the economy — from homes and factories to electronics and power generation and transmission — demand for copper is often viewed as a reliable leading indicator of economic health. This demand is reflected in the market price of copper.

Maybe the chinese don’t need anymore “ghost cities”?

Awesome I can buy Romex without needing to get a mortgage!

Well, for once, I didnt buy something I really thought was going to do well but it didnt.

:-)

Wheat, corn, soybeans, hogs, cattle, lumber all plunging as well, in typical ‘sell the news’ fashion after massive inflation media coverage.

You’d think that copper and wood prices would move in unison.

FCX has gone from $6 to $46 in a little over a year. With the push for electric vehicles worldwide, I’ll just keep holding, thank you. #nottooworried

Lumber Prices Are Falling Fast, Turning Hoarders Into Sellers

Inflation, deflation or speculation. My guess is big guys buy Up futures, fed talks the inflation talk then retail investors get fleeced. SOP. Need a bigger yacht, house plane bonus ....

Need better souls.

“Wheat, corn, soybeans”

Are total weather markets right now

Good article, thanks! The last sentence is the “money line”.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.