Posted on 05/02/2021 7:52:43 PM PDT by SeekAndFind

David Parker is the CEO of Covenant Logistics and he was blunt with analysts who follow the company on its earnings call Tuesday.

“How do we get enough drivers?” he said in response to a question from Stephens analyst Jack Atkins. “I don’t know.”

Parker then gave an overview of the situation facing Covenant, and by extension other companies, in trying to recruit drivers. One problem: With rates so high, companies are encountering the fact that a driver doesn’t need to work a full schedule to pull in a decent salary.

“We’re finding out that just to get a driver, let’s say the numbers are $85,000 (per year),” Parker said, according to a transcript of the earnings call supplied by SeekingAlpha. “But a lot of these drivers are happy at $70,000. Now they’re not coming to work for me, unless it’s in the ($80,000s), because they’re happy making $70,000.”

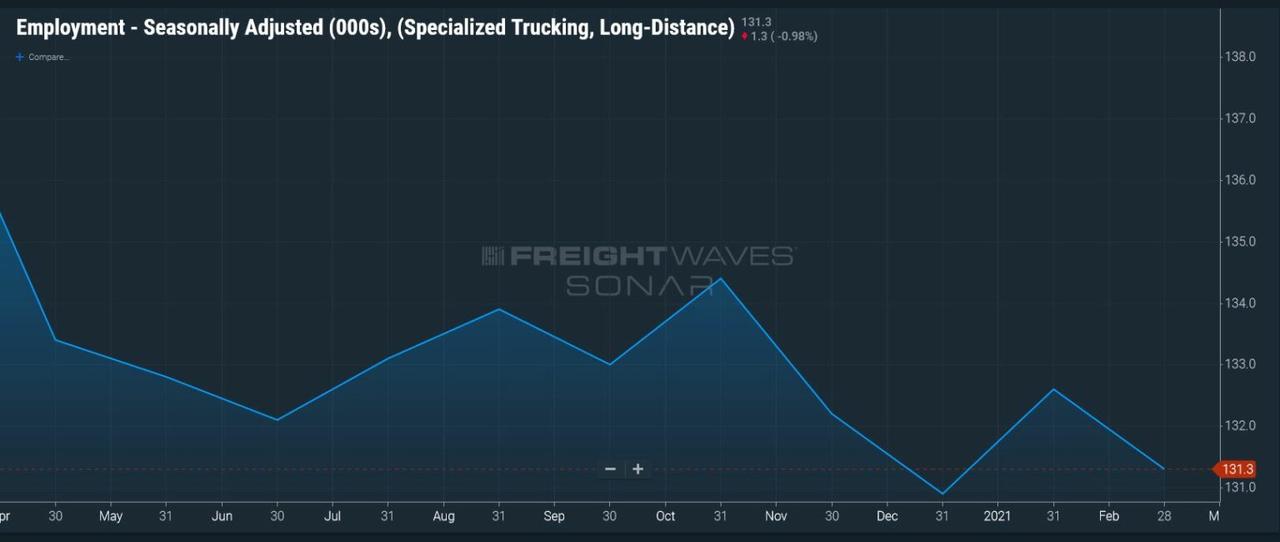

Seasonally adjusted long distance truck drivers. Source: BLS To learn more about FreightWaves SONAR, please go here.

What’s happening, he said, is that drivers are looking at the fact that they can make $70,000 “and stay home a little more.”

The result is a tightening of capacity. Parker said utilization in the first quarter at Covenant was three or four percentage points less than it would have as a result of that development. “It’s an interesting dynamic that none of us have calculated,” he said.

To put the numbers in perspective, Todd Amen, the president of ATBS, which prepares taxes for mostly independent owner-operators, said in a recent interview with the FreightWaves Drilling Deep podcast that the average tax return his company prepared for drivers’ 2020 pay was $67,500. He also said his company prepared numerous 2020 returns with pay in excess of $100,000.

Parker was firm that this was not a situation likely to change soon. “There’s nothing out there that tells me that drivers are going to readily be available over the medium [term in] one to two years,” he said. “And that’s where I’m at.”

Paul Bunn, the company’s COO and senior executive vice president, echoed what other executives have said recently: Additional stimulus benefits are making the situation tighter. He said that while offering some hope that as the benefits roll off, “that might help a bit.”

But what the government giveth the government can sometimes taketh away. Bunn expressed another familiar sentiment in the industry today, that an infrastructure bill adding to demand for workers would create more difficulty to put drivers behind the wheel. Construction, Bunn said, is “a monster competitor of our industry” and if the bill is approved, “that’s going to be a big pull.”

Labor is going to be a “capacity constraint” through the economy, Bunn said, while conceding that trucking is not unique in that. And because of that labor squeeze, capacity in many fields is going to be limited. “The OEMs, the manufacturers are limited capacity,” Bunn said. “They’re not ramping up in a major, major way because of labor, because of commodity pricing, because of the costs.”

All that means is that capacity growth is going to be “reasonable,” Bunn said. “It’s not going to be crazy, people growing fleets [by] significant amounts.”

“It’s all you can do just to hold serve,” he added.

While the driver situation is tough, it didn’t notably hurt the first-quarter performance of Covenant. To open the call, Joey Hogan, Covenant’s co-president, highlighted some of the company’s first-quarter numbers: a 6% growth in operating revenue on a strategic reduction in the number of company tractors and the best first-quarter net income figure in its history.

Beyond the market for drivers, Parker said the freight market is “hot” and likely to stay that way.

“We are at 7%, 8% GDP growth, that goes to 5%, well, probably, or it could stay 7% or 8%,” he said. “But it’s still going to be numbers that you and I have never sensed or felt from a freight standpoint. And so I don’t see that letting up, I see that a solid couple of years of being in that kind of environment.”

Given that, Parker and other Covenant managers used the occasion of the earnings call to drive home with more detail a point the company made in its earnings statement a day earlier: It intends to get higher rates out of some of its Dedicated customers. While the company’s Expedited division saw its operating ratio improve to 91% from 102.3% a year earlier, the Dedicated division saw its OR remain above 100%.

The Dedicated division, Bunn said, has two types of customers. One is a group with high returns, “and we want more of those,” he said. “We’re going to go to the customers [where] we have that and say, ‘Can we have more of your business?’”

The other are customers that Bunn referred to as “commoditized.” Those customers are going to need to “value” the Dedicated service provides “or we’re going to give those trucks to somebody who’s in the first bucket.”

Trucks won’t just get “yanked” out, Bunn said. But “we’re not going to run Dedicated with a 98, 99 or 100 OR,” he added.

But even though Covenant, like other carriers, has leverage in negotiations given the tight market for capacity, it does need to be handled with a certain degree of aplomb, Hogan said. Hogan was talking about the company’s Expedited division when he said that in price negotiations, a company needs to be “respectful” as prices get up to “that line where they say, ‘Well, I’m going to grow my own [transportation].’”

Another possibility: rail. “When does the price push them to the rail?” he asked.

However, the Expedited division is “in a good spot for at least a couple of years,” Hogan said. That’s aided by the fact that inventories are “stupid low” across the supply chain, he added.

I’d do it for the chicks.

The groupies mean everything.

At 70k a year, they will be replaced by autonomous trucks.

No sick days, no health insurance, no vacation, no bad trucker habits.

Make a Coors run.

There are too many variables on the road. That will only result in terrible accidents.

Read the article and take it at face value.

What do you think the solution is, if the problem IS just as he describes it?

You suggest AI as a solution, but it won't be.

Don't look for AI Trucking in the next 5 years.

IF I can get a quote for long distance deliveries the rates are now close to $3.00 a mile vs last year and before I was getting $1.35 to $1.50 a mile. Now quotes are only good for a couple days. It’s impossible to give my customers a solid freight cost, I have to leave it open ended until the day of pickup. It’s horrible.

Too many hot shot drivers, many from Russia hauling 5th wheel trailers off the back of an F-350-550.

I did it for 1.5 years. The most over-regulated, lowest paying, and dangerous industry. I was in the minority that actually loved his wife.

And Covenant sucks. They only offer teams, so you split your pay.

I guess that’s true. Myself, I’ve never been able to function well without sleep.

Work local P&D for an LTL carrier. You'll get more exercise than you bargained for. And be home every night.

Yep

What you are describing are "turnaround" runs, also know as "meets", and all the big carriers use them. I did it for a while for Estes. It's good money, but you work at night.

The cellphone has made driving of any vehicle much more dangerous than in the past. I have ‘retired’ after almost 20 yrs of rowing gears (van, reefer, flat, oversize, construction, hopper, etc. Got out clean, no wrecks, one speeding ticket (2005), no CSA points on my record. I truly appreciate the courteous drivers that I would encounter each, but their numbers are dropping every day. A month away and I don’t miss the big city logjams. The open road, especially between ol’ Muddy and the Rockies I will miss.

I’m a retired long haul trucker. I got in back when it was a fun lifestyle. The government has removed all pleasure from the job. Now they monitor every breath a driver takes. There is no longer any freedom of the road in trucking.

I think the trucking industry will end up composed of big carriers operating as you describe. Otherwise they will continue to have problems getting drivers.

Independents will be hauling the odd ball stuff that does not fit into big corporate systems.

For instance, hauling gas line pipe or water pipe out to the side of the road or to some construction site.

To put it more clearly, I predict the decline, maybe even the disappearance of small trucking companies and the industry being dominated by the super bigs.

Well, just check my screen name 😁👍. Been doing this for about 25 years, same company for 22. I’m home every night so it’s more like a regular job than most of the truckers out here. Nothing like it was when I started and CERTAINLY nothing like it was in the 50’s - 70’s. Been making damn decent pay for quite awhile so I’m in no hurry to find anything else.

The part about putting the trucks into tight spaces is for real - you’d be amazed at some of the hellholes I’ve had to get my truck into. As far as issues with family life, for the ones that are gone 3 weeks or more at a time it probably is. It was for me my first year in the job, glad I was in the right place at the right time for the job I have now.

I’m not saying AI will completely replace trucking, but if it can allow a trucker to work just another longer because of the basic work that it takes over, that’s thousands of truck that will not be needed across the industry.

It’s somewhat still an artificial problem that caused by driving profitability for the independent into the ground. When all things are considered, a professional trucker does not make much above minimum wage.

A person that is willing to work two minimum wage jobs can earn $70,000/year if he works the same amount of hours as a trucker.

Long haul drivers, living in a truck, no life, no family, zip?

They should be paying these guys 100k a year minimum.

What is this thing you call “sleep” of which you speak.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.