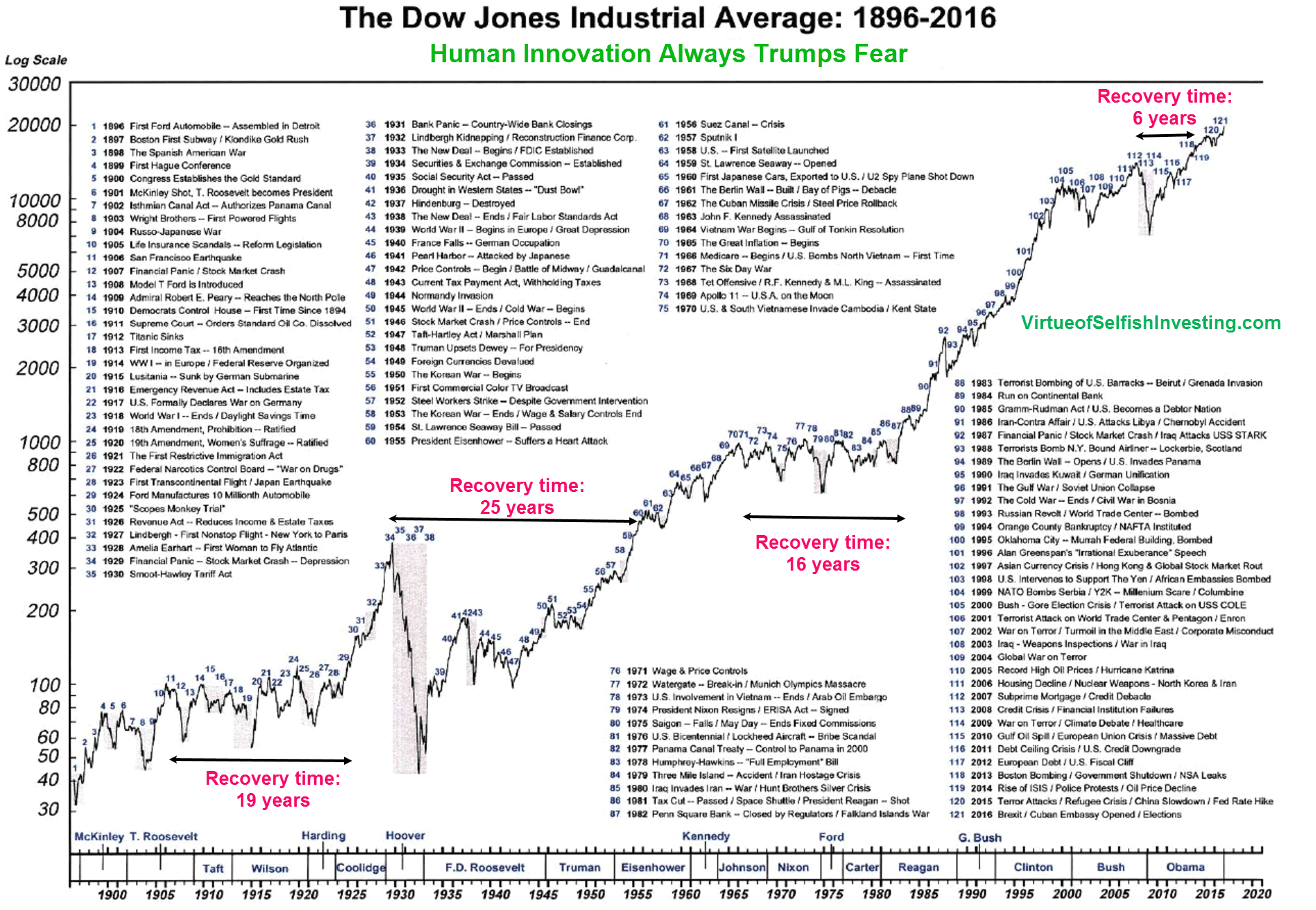

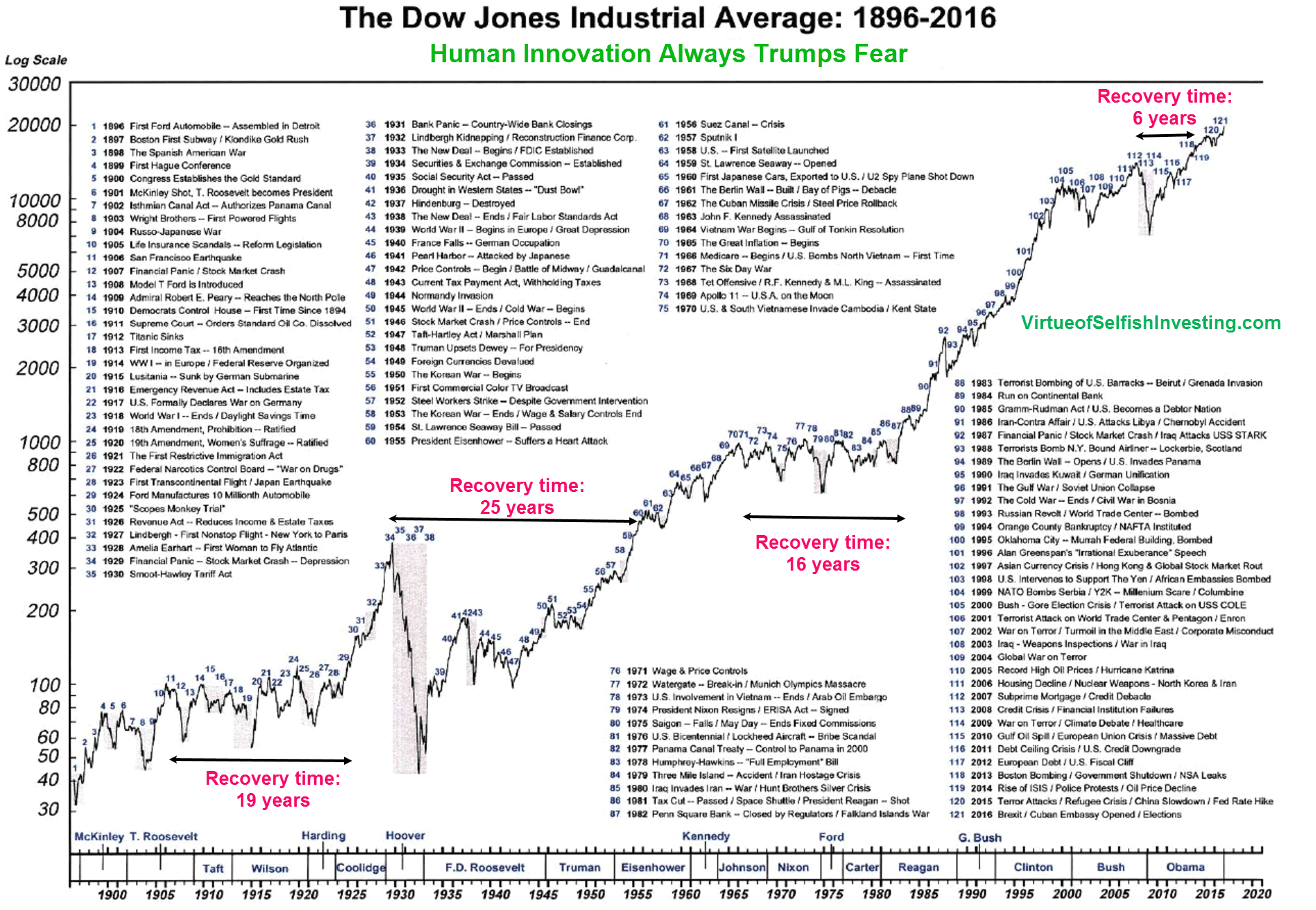

Here's the Dow Jones Industrial Average from the beginning in 1896 to 2016:

Classic hyperbolic blowoff chart.

Click here for 20 year DOW chart.

Like a huge wave about to crash on the shore.

I’m certainly only a beginner, but isn’t this what happens before a massive crash?

DOW, S&P, and NASDAQ at all time highs?

I’m still confused over housing prices.

Yes, we are due some kind of significant correction. Please tell me when this will happen.

It merely documents the rise of the FAANG-Fed-Deep State governmental system. This is the new Constitution.

Hope everyone enjoyed their profits.

At this point there is nowhere else for people to put their retirement money.

As one who has definitely benefited from this 20-year run - at least with my retirement portfolio - I'd be a fool to predict where it goes from here. Anybody would for that matter.

But look around you. This long tech boom is not without substance. All of us are walking around with powerful devices (smartphones) with more computing power in our pockets than the entire NASA space program in the 1960s. The routine things we do with smartphones today was the stuff of science fiction just a few decades ago:

With the push of a button, I can tell you the airplane flying 33,000 feet over my head is an Airbus A330 enroute to Houston from Paris. With another push of a button, I can move $200 from my checking to my saving account. Now with a few swipes and pushes, I can order my coffee at Dunkin Donuts and pay for it. All I have to do is show up in a few minutes to pick it up.

I can instantly access pretty much every song or piece of music ever recorded. I can stream any one of billions of videos, old TV shows, movies, documentaries, etc.

Most of us can work from home effortlessly due to technology.

It did kind of sneak up on most of us but we are living in a science fiction world and the pace of technological change continues to increase rapidly.

For better or worse, our world today will seem primitive compared to the technologies that will be prevalent in just another 20 years.

When Doge Coin or NFTs are treated and traded as something real, there’s definitely something screwy going on in the market.

Here's the Dow Jones Industrial Average from the beginning in 1896 to 2016:

Nasdaq is reflecting the tech bubble.

Dow (and other indexes) are rigged by shuffling stocks in and out so that losers (and their losses) disappear and up-and-comers (and their gains) appear in their place. For example, a stumbling GE was booted and replaced by a new “industrial” company, the drugstore chain Walgreens Boots. Not exactly my idea of a manufacturing giant, but the stock riggers were desperate, it appears.

All you need to know about America, 2021.

Control the message(even if it's a lie)control the world.

It’s doubled since last March lows.

Faced with financial crises, policy makers in central banks and government no longer make the mistake of the Fed in 1929 1930. They no longer constrict credit. Instead they flood the market, and the world, with cash, and not all of this cash ends up being invested productively. People don’t know what to do with all the money, but they see asset prices rising and they jump into the market.

What will happen? At some point the prices will rationalize. When will that happen? I have no idea. We might double again first.

I will say that INVESTING at this time, meaning, obtaining productive capital is not an unwise thing to do. The problem is that investing may not have anything to do with buying NASDAQ stocks. It may be closer to the Republicans’ 800 billion infrastructure bill.

Find a good stock. If it goes up sell it. If it doesn’t go up don’t buy it.

This progress of the NADDAQ is an artifact of two things.

(1) NADAQ is heavily weighted with technology companies and

(2) so much economic growth the last twenty years has been either directly related to the technology industries or indirectly related via their contributions to other industries;

but that is other industries not as heavily represented in the NASDAQ, yet some of which have performed well.

But here is the broader S&P done by the same charting outfit, and it looks similar to the NASDAQ.

So the real story is not a NASDAQ story, it is a 20 year stock market story.

We have something of not total but obvious disconnect between “the stock market” and the U.S. domestic economy.

That is due to;

(a) a more globally integrated business environment (the number and size of U.S. listed companies whose business is global and not merely U.S. domestic, with some that have more business outside the U.S. than in the U.S.)

(b) globally represented companies in the stock market indexes,

(c) and how companies can be doing well globally regardless of how that does or does not relate to the U.S. domestic economy,

but (d) their total global performance will be reflected in the stock markets.

I think what we’re seeing here is an effect of the general rule: The stock market is a good predictor of how much money will be changing hands in a year or two.

When the market sees inflation increasing, the market goes up, anticipating higher prices for the goods that will be flowing. When the market sees inflation subsiding, the market goes down, anticipating lower prices (than it was previously expecting).

In everything except inflation, the market goes up on positive economic news (something that will increase the flow of commerce), and down on negative news. In inflation, the market goes down on good news (inflation subsiding), and up on bad news (inflation on the way).

My unducated guess is that the market sees an inflation tidal wave, and is going up in anticipation of higher asset prices. If the market is correct, there will be a correction, not in terms of stock prices going down, to indicate lower value, but in terms of the value of dollar going down, so the stocks will have lower values, even at the same prices. I do not expect stock prices to drop, I expect the prices of other things to catch up with them.