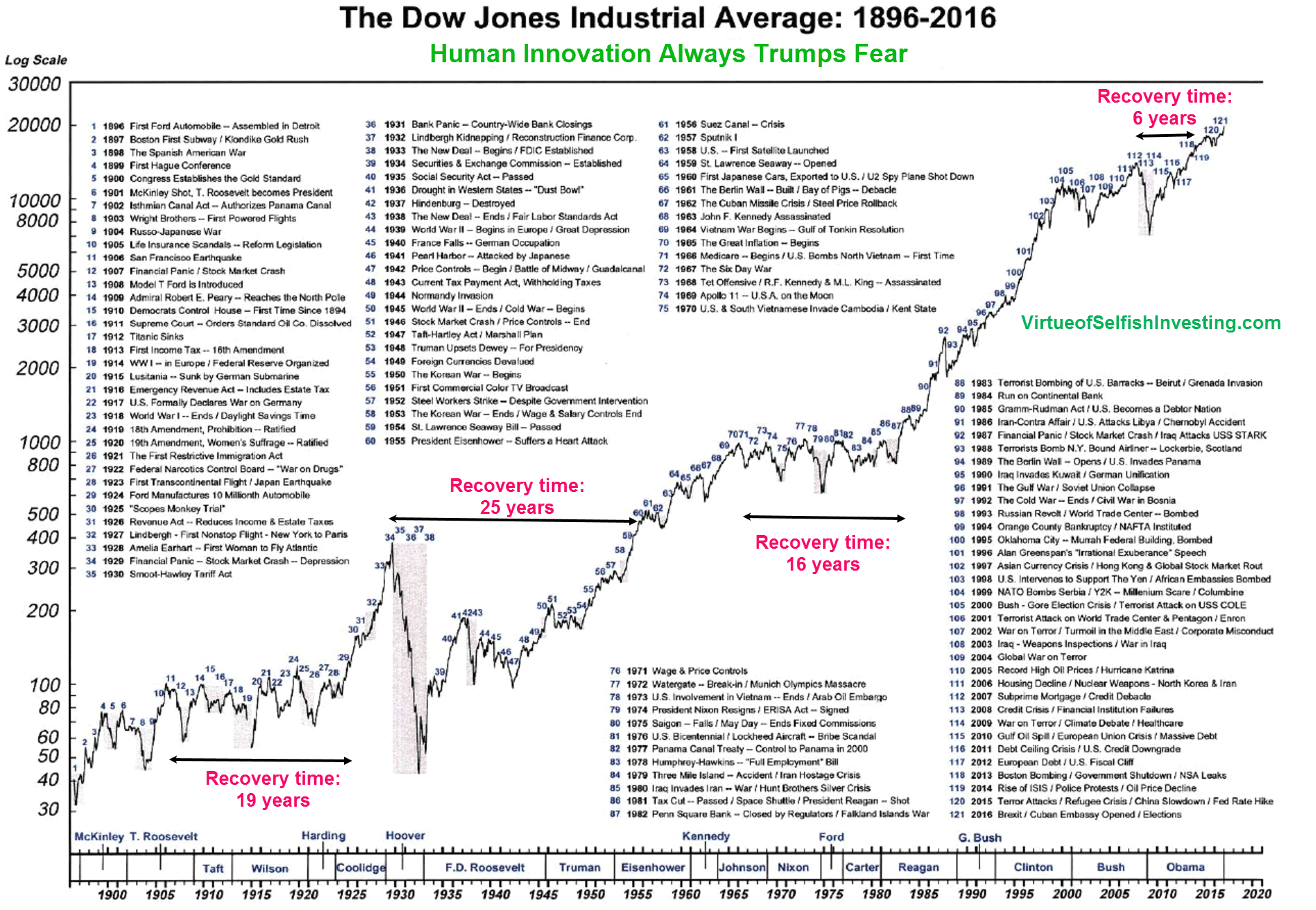

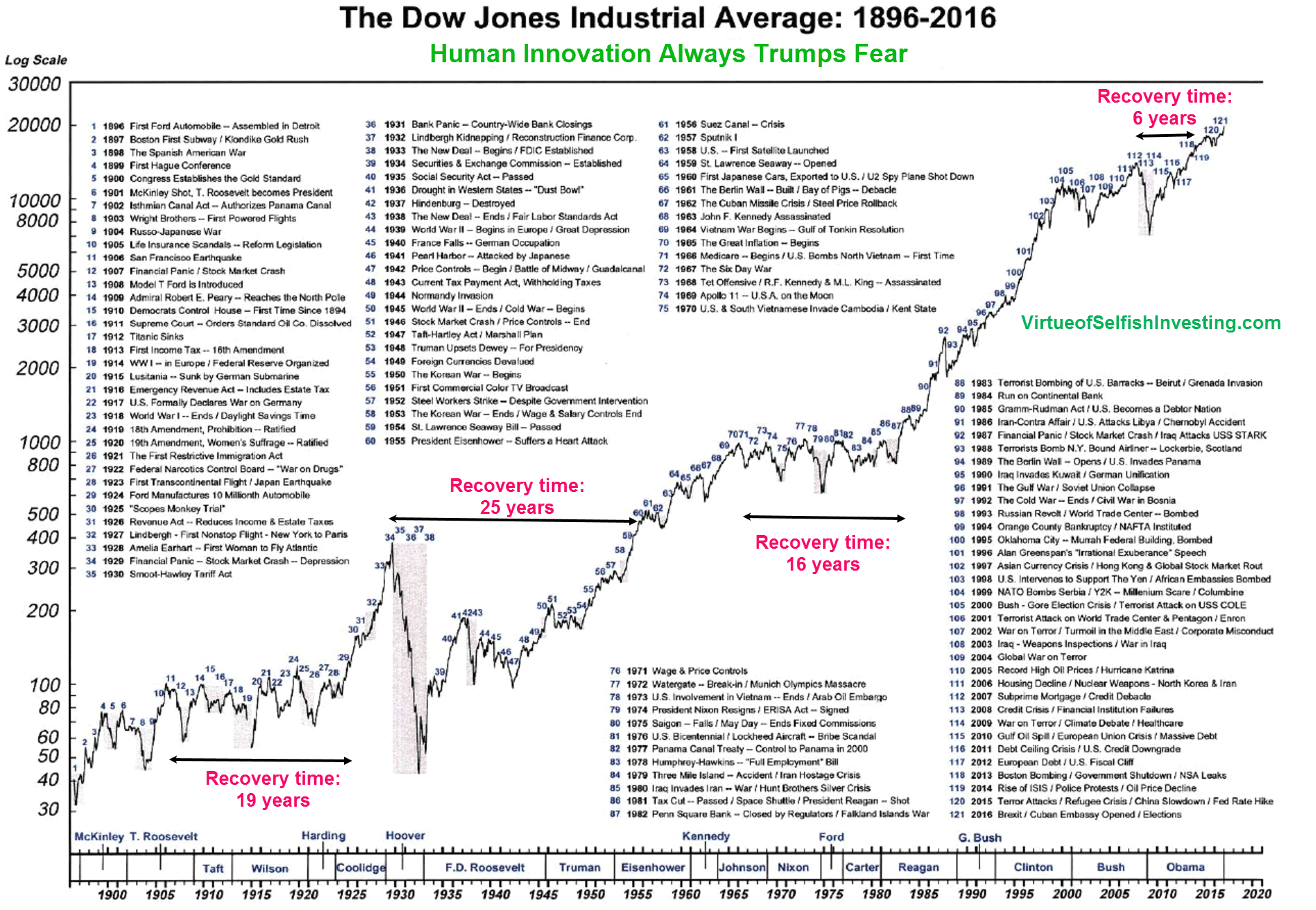

Here's the Dow Jones Industrial Average from the beginning in 1896 to 2016:

Posted on 04/17/2021 4:36:37 AM PDT by MeneMeneTekelUpharsin

I understand the printing of money aspect, but so many businesses have closed. So many people became unemployed, and no longer counted as such. So many are underemployed. Wages/compensation haven’t gone up much at all around me.

I get your point about the music is still playing.

I don’t think it will be good when it stops...

Both are completely insane.

Real Estate is insane right now.

Yes, a lot of small business have been squashed but large corps are thriving - amazon has added 500k jobs in the last year, for example. And guess what the stock market is - large businesses. And the government has made sure even those who lost their jobs have had more money than even while working (most folks) between huge UE checks AND 3 rounds of stimulus checks worth over $10k for a family of 4. No one works to work! My company has 650 locations nationwide and hiring new employees is the hardest its ever been even with starting wages close to $15 now vs $10 5-6 years ago.

Residential real estate is at least. Retail and commercial not nearly as hot. I just sold one of my last few rentals Thursday for a nice profit but won’t sell the rest of them till next year - unfortunately or fortunately, my w2 income is going to be 2-3x normal this year too so my marginal tax with state and medicare surcharge is 43% so going to hold off on the others b/c of depreciation recapture.

I get that you’re correct.

I think I was, unfortunately, going by feeling rather than thought.

With lockdowns, businesses destroyed, and riots all over the place, I let that effect my thinking.

The housing rise is a combination of factors that all are affecting the market at the same time.

First, historically low interest rates that are starting to slowly go up.

Second, 25-35 years olds were content to rent ever since the great recession.

To go along with that the people who declared bankruptcy I the great recession can now buy a home again.

Third, foreigners especially Asians are buying here in the USA.

It is a safe place to buy as compared to where they live.

Fourth, Covid has caused a mass exodus from the big cities. These people are moving to the suburbs or another state.

Fifth, BLM riots increased the exodus from the cities where riots were allowed to happen. Again, some are moving to the suburbs. Others are moving to the country, not necessarily in the state where they are employed.

Six, many people who do their job over a computer can now work from home.

That home is now anywhere you have 4K internet. Even if that is a 42’ sailboat in the Virgin Islands or a house in MT, ME, or whatever.

Seven, you are only seeing the increase in demand areas.

If you are a landlord in NYC, San Fran or Chicago you are nervous.

This goes for commercial office space in every city.

Even where I am in southern NH there are empty office space, buildings everywhere.

Some of these will be converted to condos

Bondzilla could end the party at some point (or force the Fed Reserve to just resort to outright printing to levels never seen even last year) but hasn’t yet happened. My personal net worth right now is roughly 40% real estate (including primary home and a handful of rentals), 40% stocks (25% international stocks), 10% bonds, 7% cash and 3% precious metals. For folks who don’t want to own real estate, I’d suggest 65% stocks (split between ETFs of S&P 500, Nasdaq, International, midcap and small cap), 15% bonds, 15% cash, 5% alternative investments (and use the cash on large pullbacks).

When soros and crew decide that it is in their interests to blow it all up {probably right after Trump wins the 2024 election}.

The soros crew will short the hell out of the market, and the media pimps will start the doom and gloom stories, the market will go down and the stories will feed on themselves.

If the market is still stable in early 2024 and Trump is running, {he will win again, but who's doing the counting} dump your stock in the summer.

The inflection point was about 2013 when the current shenanigans started.

If only we knew who was directing policy then...

Here's the Dow Jones Industrial Average from the beginning in 1896 to 2016:

Nasdaq is reflecting the tech bubble.

Dow (and other indexes) are rigged by shuffling stocks in and out so that losers (and their losses) disappear and up-and-comers (and their gains) appear in their place. For example, a stumbling GE was booted and replaced by a new “industrial” company, the drugstore chain Walgreens Boots. Not exactly my idea of a manufacturing giant, but the stock riggers were desperate, it appears.

“The link shows the last 6 months.”

There is a menu above the chart where you can adjust the time range. When the posters paste the link, it does not preserve the time range they were viewing.

Thanks.

Yes, post 32 is right that indexes can be artificially high due to replacement.

And yes, there are some concerning things that have gone on in our economy.

On the other hand, the graph is not as concerning as at first appears. Historically, stocks do gain close to double digits each year (on the average), and that should create the classic compound interest curve, which tends toward parabolic rather than diagonal. That’s why on the bottom of that chart there is the “logarithmic” scale. Click that button and your blood pressure might ease a bit.

All you need to know about America, 2021.

Control the message(even if it's a lie)control the world.

It’s doubled since last March lows.

Faced with financial crises, policy makers in central banks and government no longer make the mistake of the Fed in 1929 1930. They no longer constrict credit. Instead they flood the market, and the world, with cash, and not all of this cash ends up being invested productively. People don’t know what to do with all the money, but they see asset prices rising and they jump into the market.

What will happen? At some point the prices will rationalize. When will that happen? I have no idea. We might double again first.

I will say that INVESTING at this time, meaning, obtaining productive capital is not an unwise thing to do. The problem is that investing may not have anything to do with buying NASDAQ stocks. It may be closer to the Republicans’ 800 billion infrastructure bill.

Find a good stock. If it goes up sell it. If it doesn’t go up don’t buy it.

This progress of the NADDAQ is an artifact of two things.

(1) NADAQ is heavily weighted with technology companies and

(2) so much economic growth the last twenty years has been either directly related to the technology industries or indirectly related via their contributions to other industries;

but that is other industries not as heavily represented in the NASDAQ, yet some of which have performed well.

But here is the broader S&P done by the same charting outfit, and it looks similar to the NASDAQ.

So the real story is not a NASDAQ story, it is a 20 year stock market story.

We have something of not total but obvious disconnect between “the stock market” and the U.S. domestic economy.

That is due to;

(a) a more globally integrated business environment (the number and size of U.S. listed companies whose business is global and not merely U.S. domestic, with some that have more business outside the U.S. than in the U.S.)

(b) globally represented companies in the stock market indexes,

(c) and how companies can be doing well globally regardless of how that does or does not relate to the U.S. domestic economy,

but (d) their total global performance will be reflected in the stock markets.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.