What you should know about Social Security and Medicare

Posted on 06/24/2018 12:05:42 PM PDT by SeekAndFind

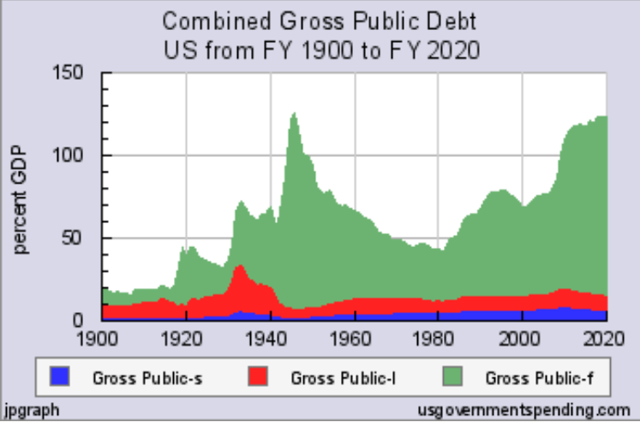

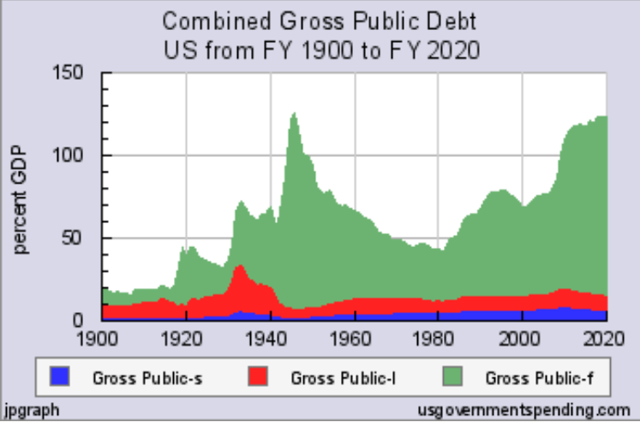

The 2018 "official" U.S. debt figure of $34 trillion is 120% of GDP and projected to double as a percent of GDP within the next 20 years. It's big.

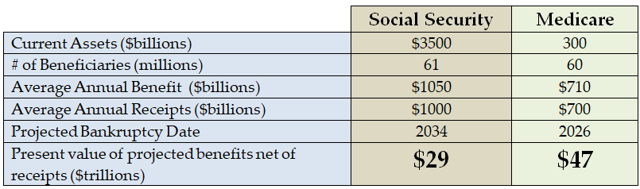

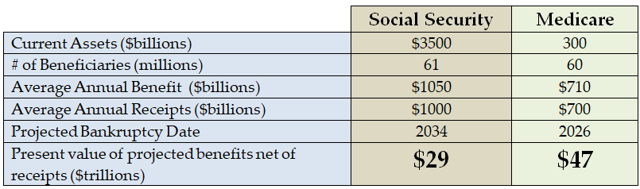

If we add "off-the-books" net obligations like Social Security and Medicare, our all-in debt, or so-called "fiscal gap", rises to $110 trillion, or 390% of GDP. It's scary.

Raising taxes and reducing benefits won't restore solvency. Something is going to break, and it won't be pretty.

We're broke and no one seems to care. We're all aware that this country owes a lot of money, but no one cares because we're leading pretty good lives here. We have yet to feel the consequences of being broke, but that won't last long. Some things are already breaking, and an ultimate breakdown is on the way. 2018 is the first year when tax receipts won't pay for Social Security and Medicare benefits. We are spending down the corpus, and will have spent all of the Social Security Trust by 2034, while Medicare monies will only last until 2026. This might sound like we have time, but we don't, especially since nothing is being done to head off these catastrophes. It's full speed ahead into the reckoning. Furthermore, some large pension funds are broke, and are likely to renege on their promised benefits. In the following, we share some details on this bankruptcy, and offer some actions that might help, although they are unlikely.

As shown in the following graph, the reported national debt of $34 trillion is currently 120% of GDP, a level only seen before in the wake of World War II.

(Excerpt) Read more at seekingalpha.com ...

Socialism Is Legal Plunder - “The Law” - Frederic Bastiat

We’ve been plundered by SOCIALISTS for their unsustainable SOCIALIST SCHEMES.

“Everything about socialism is sham and affectation.” - 23.11; Ch23 Evil; Economic Harmonies; Frederic Bastiat (1801-1850)

Our children and grandchildren are born into DEBT SLAVERY.

FUCONgre$$

News flash. Social Security and many of the other “off the books net obligations” are not “owed” in any typical financial or legal understanding of the terms. They are politically determined payouts that can be reduced or even ended at the will of the politicians or voters. The lefties are getting slick about running up obligations and then claiming their promises are a binding and obligation. Just see the posts on FR calling SS an intergenerational sacred obligation.

Then again even sovereign debt obligations may not be airtight.

See the words of Jefferson for a good explanation as to what obligations succeeding generations are under for repaying the debt of previous generations.

A 25% tariff would balance the budget year over year.

What we need is for men like Donald Trump to occupy the White House till the coming of the Lord.

Our children can simply refuse to pay. Are we prepared to accept that? They owe us nothing except to protect their heritage of freedom and pass it along to our grandchildren.

I’m not worried. Once we lasso that gold asteroid we will all be billionaires.

I don’t know where 34 trillion comes from. Even after considering the interagency debt it’s only approaching 21 trillion dollars. But he’s right about the percent so I’m sure there is an explanation. Maybe a typo.

How so? Is Congress going to quit spending ever more money? A tariff is a tax and we have proven in spades that no level of taxation will balance the budget. A tariff will simply enable further spending and borrowing unless we implement offsettIng personal income tax cuts.

Aren’t you a proponent of relying on a tariff instead of income taxes to fund the government? Or do you simply want the government to have more revenue?

How is that any different than raising taxes? Tariffs do nothing if no one buys the product. If they do buy the imported product, some part of that tariff will be passed onto the consumer in the form of higher prices. There is no need to raise taxes, as alternatives exist.

How ‘bout this instead: Have politicians reducing spending, especially on the “get-me-reelected” bullcrap like free cell phones for deadbeats. Idea #2, Warren Buffet’s idea: Any politicians who votes for a budget that produces a deficit cannot run for reelection. That would fix it overnight.

Correct.

In Fleming vs. Nestor the Supreme Court ruled:

“... that workers have no legally binding contractual rights to their Social Security benefits, and that those benefits can be cut or even eliminated at any time.

To engraft upon the Social Security system a concept of ‘accrued property rights’ would deprive it of the flexibility and boldness in adjustment to ever changing conditions which it demands.” The Court went on to say, “It is apparent that the non-contractual interest of an employee covered by the [Social Security] Act cannot be soundly analogized to that of the holder of an annuity, whose right to benefits is bottomed on his contractual premium payments.”

In an earlier case Helvering vs. Davis (1937) the Court ruled:

“...Social Security was not a contributory insurance program, saying, “The proceeds of both the employee and employer taxes are to be paid into the Treasury like any other internal revenue generally, and are not earmarked in any way.”

In other words, Social Security is not an insurance program at all. It is simply a payroll tax on one side and a welfare program on the other. Your Social Security benefits are always subject to the whim of 535 politicians in Washington. Congress has cut Social Security benefits in the past and is likely to do so in the future. In fact, given Social Security’s financial crisis, benefit cuts are almost inevitable.

Ping

Name a product that went up 25% and EVERYONE stopped buying it? Ever buy a McD hamburger? How much did they cost in 1995?

Prices will be higher, post tariff. Much higher at first them lower later on as domestic supplies kick in. The higher cost will be the difference in US labor/regs minus cheaper shipping costs. I'd estimate 5-7% higher in the end. But quality will go up too. Yes, the one time inflation is worth it to me and a lot of other patriots.

Politics and economics mesh, they are really the same thing. Whether pointy headed green eye shade arm banded ledger types like it or not, that is reality.

Yes, consumption taxes, especially the tariff, is the fairest most conservative tax of all. Tariffs are regressive ! Libertarians and Republicans should be in favor of them.

Therefore, I am in favor of the tariff. More please.

Of course. But spending is a different issue and has nothing to do with how much and how that revenue is generated. They are totally different topics. You are a confused person.

the politicians who cut benefits will be immediately voted out of office an replaced with Democrats who will simply print more money, no matter the consequence

Was sent this. Expect more taxes to pay for the debt.

Charlie Reese is a former columnist of the Orlando Sentinel Newspaper.

What you do with this article now that you have read it... is up to you.This might be funny if it weren’t so true.

Be sure to read all the way to the end:

Tax his land,Tax his bed,Tax the table,At which he’s fed.

Tax his tractor,Tax his mule,Teach him taxes are the rule.

Tax his work,Tax his pay,He works for peanuts anyway!

Tax his cow,Tax his goat,Tax his pants,Tax his coat.

Tax his ties,Tax his shirt,Tax his work,Tax his dirt.

Tax his tobacco,Tax his drink,Tax him if he tries to think.

Tax his cigars,Tax his beers,If he cries Tax his tears.

Tax his car,Tax his gas,Find other ways to tax his ass.

Tax all he has then let him know that you won’t be done till he has no dough.

When he screams and hollers;Then tax him some more,Tax him till he’s good and sore.

Then tax his coffin,Tax his grave,Tax the sod in which he’s laid...

Put these words upon his tomb,’Taxes drove me to my doom...’

When he’s gone,Do not relax,Its time to apply the inheritance tax.

~~Accounts Receivable Tax, Building Permit Tax, CDL license Tax,Cigarette Tax,Corporate Income Tax,Dog License Tax,Excise Taxes,Federal Income Tax,Federal Unemployment Tax (FUTA),Fishing License Tax,Food License Tax,Fuel Permit Tax,Gasoline Tax (currently 44.75 cents per gallon,)Gross Receipts Tax, Hunting License Tax, Inheritance Tax,Inventory Tax,IRS Interest Charges, IRS Penalties (tax on top of tax),Liquor Tax,Luxury Taxes,Marriage License Tax,Medicare Tax,Personal Property Tax,Property Tax,Real Estate Tax,Service Charge Tax,Social Security Tax,Road Usage Tax,Recreational Vehicle Tax,Sales Tax,School Tax,State Income Tax,State Unemployment Tax (SUTA),Telephone Federal Excise Tax,Telephone Federal Universal Service Fee Tax,Telephone Federal, State and Local Surcharge Taxes,Telephone Minimum Usage Surcharge Tax,Telephone Recurring and Nonrecurring Charges Tax,Telephone State and Local Tax,Telephone Usage Charge Tax,Utility Taxes,Vehicle License Registration Tax,Vehicle Sales Tax,Watercraft Registration Tax,Well Permit Tax,Workers Compensation Tax

STILL THINK THIS IS FUNNY?

Not one of these taxes existed 100 years ago, & our nation was the most prosperous in the world. We had absolutely no national debt, had the largest middle class in the world, and Mom stayed home to raise the kids.

What in the heck happened?

Can you spell ‘politicians?’

Link: http://theferalirishman.blogspot.com/2018/06/read-weep-print-and-keep.html

Our local newspaper had an article how Housing and Urban Development has agreed to subsidized rent for a gay pick-up bar in our town.

And we wonder why America is going bankrupt.

“A 25% tariff would balance the budget year over year.” You cannot follow your own remarks to their mathematical conclusion. Let me help you win the math. Revenue - Spending = $0 is a balanced budget. See when you say “balance” you have included both sides. Spending is not a separate issue.

But let’s agree I am confused. Now explain how additional revenue will balance the budget.

The federal budget deficit averaged around $600B over the last 20 years - give or take. It’s simple math. The USA imports around $2.4T annually and a 25% tariff would generate $600B. Which is equal to that average budget deficit.

Snore

Nobody cares

Where this will really hit first is States and cities. Which will go broke

You can’t pay folks not to work

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.