Skip to comments.

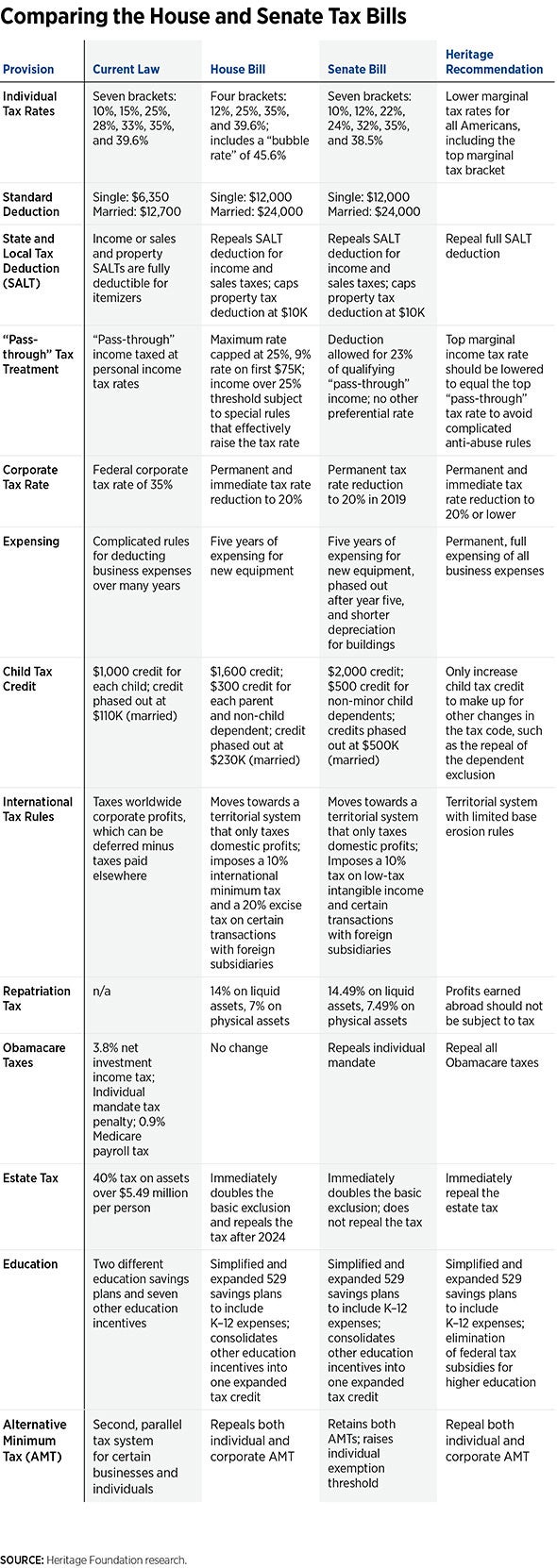

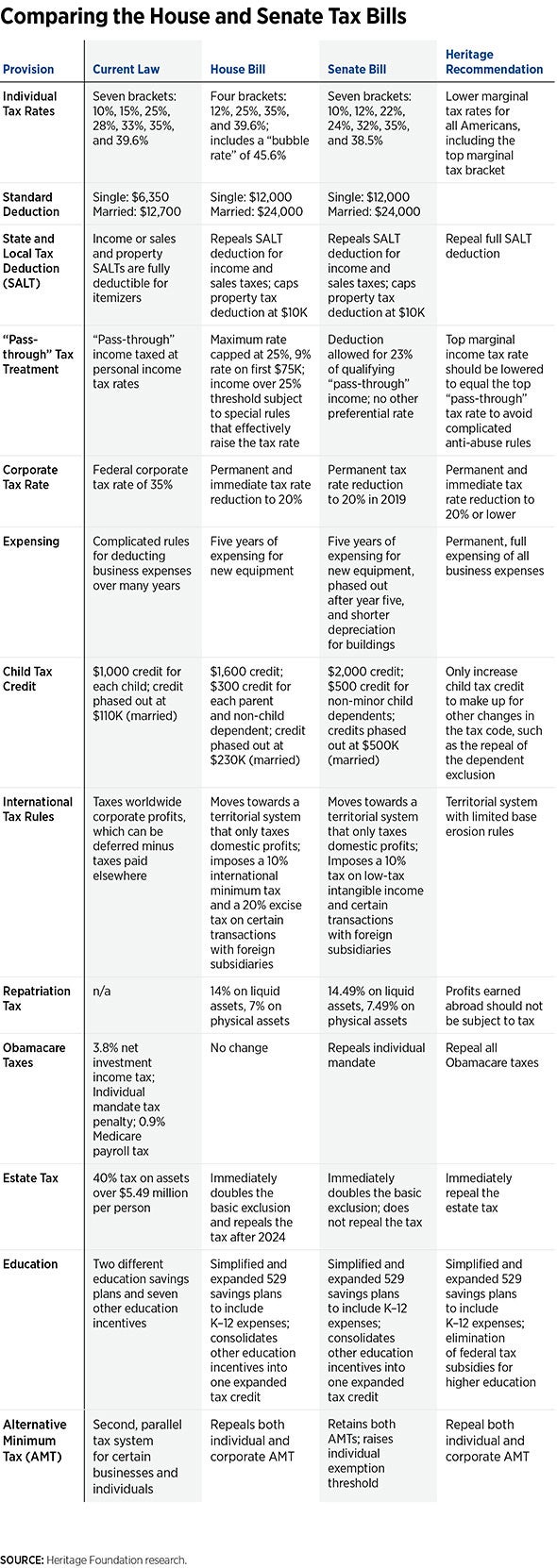

In 1 Chart, the Differences Between the House and Senate Tax Reform Bills

The Daily Signal ^

| 12/3/17

| Adam Michel

Posted on 12/03/2017 12:20:16 AM PST by x1stcav

The House and Senate have now each passed different versions of Tax Cuts and Jobs Act.

Both bills are big improvement to America’s out-of-date tax code and could boost the economy by almost 3 percent, leading to more jobs and higher wages for working Americans.

Both bills cut taxes for individuals and businesses, largely repeal the state and local tax deduction, and allow businesses to invest more in the American economy through temporary expensing.

The bills now head to a conference committee where a unified bill will be crafted. Here are some of the major differences you need to know about:

(Excerpt) Read more at dailysignal.com ...

TOPICS: Business/Economy; Government; News/Current Events; Politics/Elections

KEYWORDS: 115th; conference; house; reform; senate; tax; taxes; trumptaxcuts; trumptaxplan; trumptaxplangraphic

A pretty good, easy to compare, summary.

(Still a bunch of BS)

1

posted on

12/03/2017 12:20:16 AM PST

by

x1stcav

To: x1stcav

Bkmrk thanks for the info

2

posted on

12/03/2017 12:37:24 AM PST

by

BurrOh

(All animals are equal, but some animals are more equal than others. ~Orwell)

To: BurrOh

I read Collins got SALT added to the Senate bill.

She proves she is a Democrat

Can someone verify if SALT was dropped from the Senate bill, because they got Collins vote.

To: Zenjitsuman

Collins added language to match the House - property taxes deductions allowed. Both bills match, so that will stay in final bill.

4

posted on

12/03/2017 2:19:16 AM PST

by

MMaschin

(The difference between strategy and tactics!)

To: MMaschin

5

posted on

12/03/2017 3:24:51 AM PST

by

texas booster

(Join FreeRepublic's Folding@Home team (Team # 36120) Cure Alzheimer's!)

To: x1stcav

I can’t understand why we just simply go to a flat tax. Nothing could be fairer.

6

posted on

12/03/2017 3:42:04 AM PST

by

HarleyD

("There are very few shades of grey."-Dr. Eckleburg)

To: Zenjitsuman

Can someone verify if SALT was dropped from the Senate bill, because they got Collins vote. $10K in property tax only was added to the Senate bill. This is the same amount of a deduction that was put into the House bill.

But, both bills still kill all state and local tax deductions - so that deduction will be gone, forever.

Even with the property tax deduction, it won't be enough without state and local to prompt many to itemize. I read an estimate that they believe that instead of 1/3rd of American itemizing, that number will dwindle to around 6%.

7

posted on

12/03/2017 4:07:43 AM PST

by

SkyPilot

("I am the way and the truth and the life. No one comes to the Father except through me." John 14:6)

To: HarleyD

I can’t understand why we just simply go to a flat tax. Nothing could be fairer. A flat tax would be fairer.

But K Street lobbyists are not paid millions of dollars to make things "fair" - but to take care of who pays them.

Lobbyists wrote these bills.

8

posted on

12/03/2017 4:09:23 AM PST

by

SkyPilot

("I am the way and the truth and the life. No one comes to the Father except through me." John 14:6)

To: HarleyD

We know the answer, don’t we?

(Can’t get to the feed trough on a level field)

9

posted on

12/03/2017 4:21:05 AM PST

by

x1stcav

(We have the guns. Do we have the will?)

To: Zenjitsuman

Have you ever used SALT deductions? If so, did you complain about them at the time?

10

posted on

12/03/2017 4:34:03 AM PST

by

raybbr

(That progressive bumper sticker on your car might just as well say, "Yes, I'm THAT stupid!")

To: x1stcav

There was a real estate decline around 1993 because Congress changed certain real estate expensing rules. I expect if this tax bill passes that we’ll see a possibly sharp decline in real estate as people realize housing costs more. This will be most painful in high tax states like New Jersey. Expect the States most affected to sue Congress.

To: x1stcav

The most important event is the ongoing process where by protected assets in an IRA have increased in value 20% in the last year.

The result is there will be a large gain but no increase in the $0 taxes paid

12

posted on

12/03/2017 5:23:00 AM PST

by

Thibodeaux

(whites seem to actually be supreme)

To: x1stcav

The House bill raises us from a 33% to 35% tax bracket and I lose a bunch of deductions..massive tax increase for us. Funny, I don’t feel rich. Senate bill I go from 33% to 24%. I’m rooting for the Senate bill, which is closer to across the board cuts.

13

posted on

12/03/2017 5:28:26 AM PST

by

big'ol_freeper

(Trump risked his wealth for our country. Clinton risked our country for her wealth)

To: big'ol_freeper

What are the actual income thresholds for each proposed bracket? Hard to evaluate without it.

14

posted on

12/03/2017 8:35:45 AM PST

by

Codeflier

(Thank you for speaking truth to power President Trump)

To: HarleyD

I can’t understand why we just simply go to a flat tax. Nothing could be fairer.

Which is why they won't do it. As much as I dislike him, Romney put the spotlight on the 47% who pay no income taxes for a brief moment.

Imagine the screaming if they were suddenly forced to send money into Washington DC!

15

posted on

12/03/2017 8:51:57 AM PST

by

LostInBayport

(When there are more people riding in the cart than there are pulling it, the cart stops moving...)

To: Codeflier

16

posted on

12/03/2017 10:42:00 AM PST

by

big'ol_freeper

(Trump risked his wealth for our country. Clinton risked our country for her wealth)

To: x1stcav; HarleyD; SkyPilot

Congress can’t pass out favors or mete out punishment with a flat tax. Besides, reductions in rates are never permanent, but deductions that are lost are gone forever. It’s a giant, perpetual scam and we are the suckers.

17

posted on

12/03/2017 6:37:00 PM PST

by

Pining_4_TX

(For they sow the wind, and they shall reap the whirlwind. ~ Hosea 8:7)

To: big'ol_freeper

To: big'ol_freeper

Oh wise one! I was making the point that the chart should included the f*#king thresholds or it is not very valuable.

19

posted on

12/04/2017 7:59:36 AM PST

by

Codeflier

(Thank you for speaking truth to power President Trump)

To: Codeflier

You can find them by going to

https://econdata.shinyapps.io/taxcuts/, select the tax plan (Current 2018, House 2018, or Senate 2018) that you want for both Tax Plans, and click on the "Comparison of Plans" tab. If you select two different plans, it will merge the brackets together so that you can compare the plans. Also, you can compare other provisions of the plans.

20

posted on

12/04/2017 11:37:26 PM PST

by

remember

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson