To: Brown Deer

> ...flawed and carefully cherry-picked?

>

> From your link, it shows a tax cut all the way across...

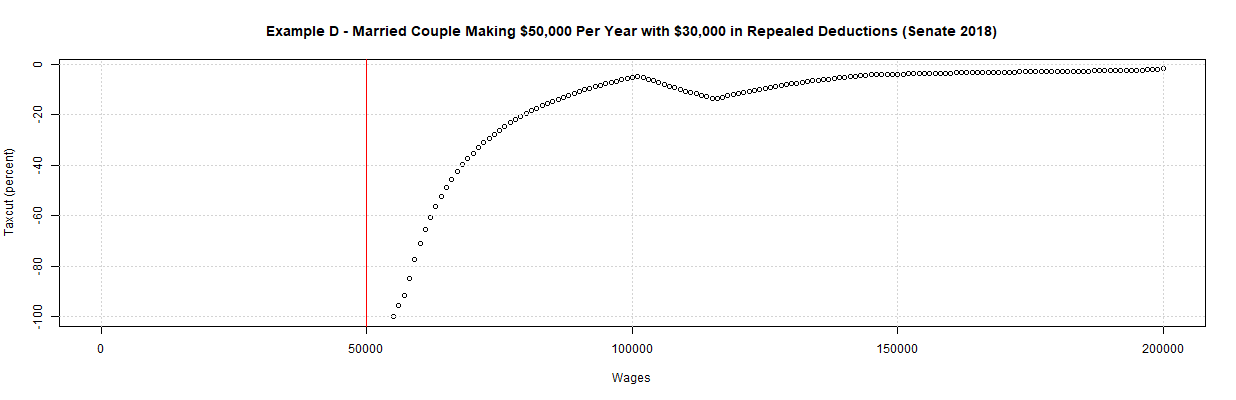

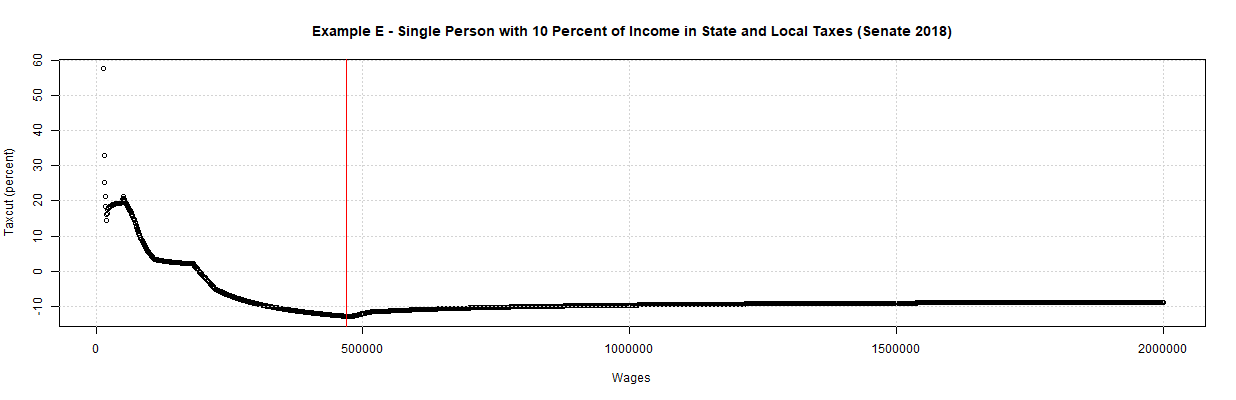

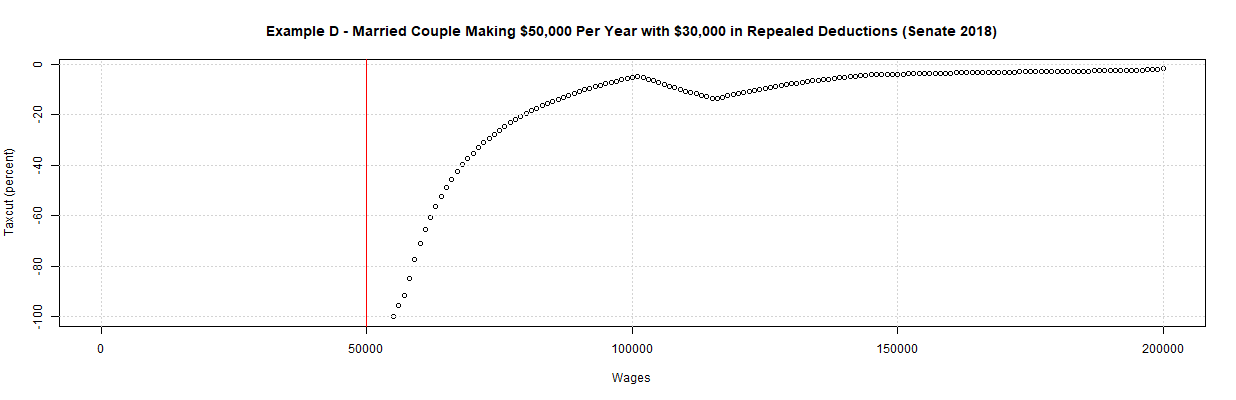

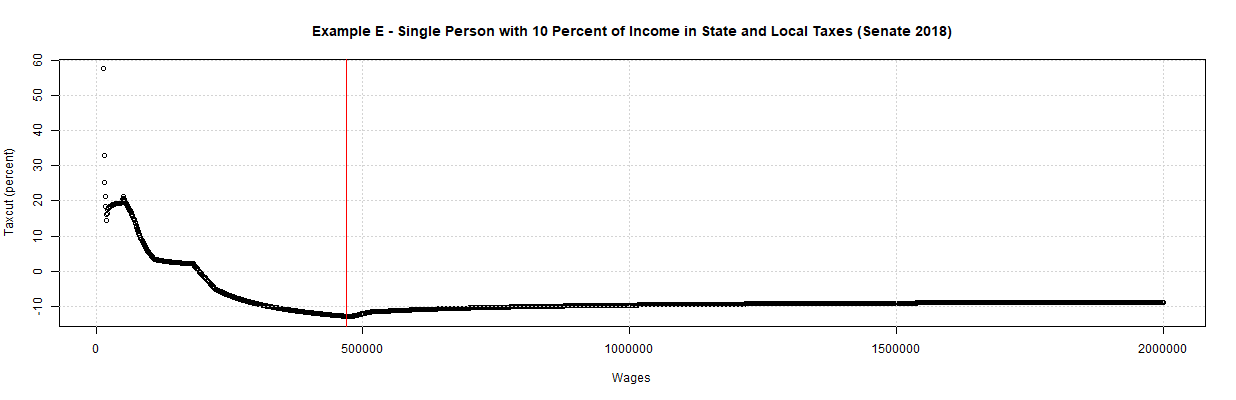

The two examples I cite are cherry-picked in that they carefully include taxpayers with eligible children and who use the standard deduction to take advantage of the fact that both of those have doubled (or nearly so). Following are a couple of plots from http://usbudget.blogspot.com/2017/11/who-will-see-their-taxes-go-up-under.html which include taxpayers who itemize and do not have eligible children:

The first plot shows higher taxes, especially for lower incomes, and the second plot shows higher taxes for higher incomes. In addition, there is the problem that the tax cut bill will increase the debt. That will make cuts to programs like Medicaid more likely and/or will leave that much more debt for our children. Tax cuts cannot be treated as being manna from heaven. The costs need to be considered as well.

73 posted on

11/26/2017 4:01:04 PM PST by

remember

To: remember

So now you are cherry picking? That is not the original link the you posted!

The first plot shows higher taxes, especially for lower incomes...

Over $50,000/per year is considered a lower income? Just exactly how many people in this country making $50,000 per year have been getting away with itemized deductions of over $30,000 per year on their income tax?

Talk about cherry picking!

The first example, from the Finance Committee was "A family of four with income of around $73,000 (median family income)" - a typical American family with two children with a middle claass family income. Nothing whatsoever, "cherry picked".

74 posted on

11/27/2017 8:16:13 AM PST by

Brown Deer

(America First!)

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson