Skip to comments.

Canada's Subprime Lenders Collapse; Has The Bubble Popped?

Seeking Alpha ^

| 05/01/2017

| Ian Bezek

Posted on 05/01/2017 8:29:47 AM PDT by SeekAndFind

Summary

Home Capital plunged as much as 60% last week.

Equitable Group fell around 40% in sympathy.

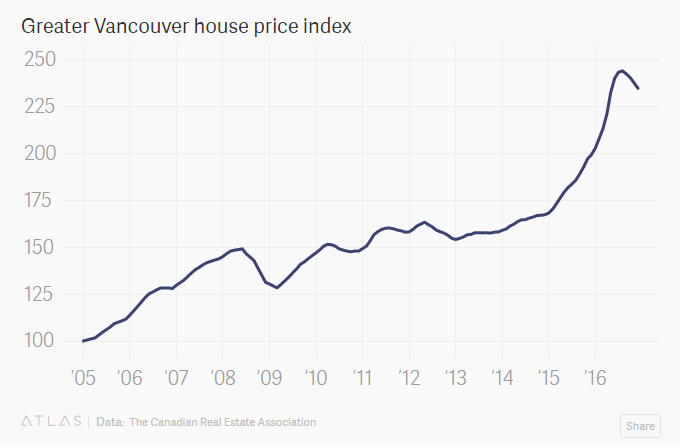

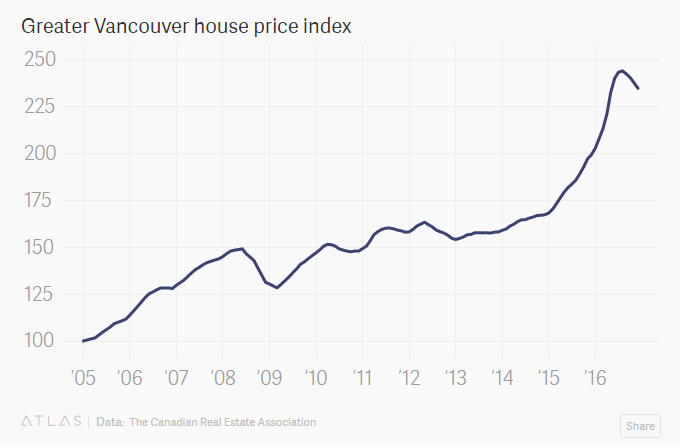

Home prices appear to have topped in Vancouver.

Has the long-running Canadian housing bubble finally started to pop?

What happens with the big five banks?

It's long been argued that Canada's housing market is immune to normal financial rules, such as debt/income ratios. Given that Canada is a relatively small country, and there had been (at least in theory) a ton of foreign capital wanting to invest, there was supposedly near-infinite demand for Canadian housing in its big cities.

This foreign money theory has come under scrutiny. 2016 revealed that in some cases there were fewer foreign buyers of Canadian housing than expected, and the domestic speculative streak runs stronger than had been realized. Besides, the Chinese government is taking further efforts to slow capital outflows. We've already seen significant signs of strain in various overseas markets where Chinese money laundering provided the marginal bid for the asset.

Regardless of the source, speculation rapidly reversed in 2016 within Vancouver. The market went from boom to bust inside of a year following passage of a foreign buyers tax. Sales are down as much as 40% year/over/year, and prices are now moving lower as well.

Now Ontario is following in Vancouver's footsteps, rolling out a similar tax on foreigners. On top of that, newly-proposed rent control policies would potentially make a large portion of newly-constructed Toronto condos perpetually cash flow negative after paying interest. That would be a major problem going forward. The greater Toronto area's housing market is still booming for the moment, but if Vancouver serves as a guide, this market could quickly retreat.

Elsewhere in Canada, Alberta remains in a deep funk, with prices down huge along with oil. The rest of the nation's housing market is generally pretty reserved, with other areas such as Ottawa and the Atlantic provinces flattish. Throw in rising interest rates which will slow down the market nationally, and it's easy to see the case for a top in Canadian housing prices right now, with only Toronto still moving higher.

Home Capital (Toronto:HCG) (OTC:HMCBF) is the poster child for Canada's housing market. The stock has been heavily shorted for many years, as housing market skeptics viewed it as the easiest target. It took awhile, but that belief has now paid off in spades:

Home Capital has been under fire for making questionable loans, with particular shortcomings in documentation for mortgage underwriting. The company also failed to disclose relevant information to shareholders, drawing a sharp inquiry from the Ontario Securities Commission.

The piling up of concerns led to a run on the bank, with firms pulling money out of Home Capital rapidly - at a clip of as much as C$290 million a day. Also, many intermediaries have stopped offering Home Capital time deposits, making it difficult for the firm to replace its disappearing capital. As an emergency measure, the company accepted a usuriously expensive line of credit. Investors did the math and realized a bank whose cost of capital is in the double-digits and which writes mortgages in the single digits has a busted business model.

Wider Fallout?

I wrote just one week ago about a potential short to play off Home Capital's troubles:

Equitable Group (Toronto:EQB) (OTC:EQGPF) looks like an attractive short. It's Home Capital's closest peer. Unlike Home Capital, however, Equitable stock hasn't lost more than half its value over the past year. In fact, the stock was still riding high right up until the Ontario decision to attack the housing bubble recently [...]

Sure, the stock hasn't performed great since 2014, but it hasn't started to collapse yet either. [...] Even a moderate 15% downturn in prices probably wipes out the Canadian subprime lending industry outright.

Alas, Equitable stock blew up this week. Give me a point for timeliness, but from today's much lower starting point this is much less attractive of a short.

With the exception of Alberta, home prices aren't really down far enough to cause major loan losses just yet. Vancouver's recent troubles and the latest crackdown on the housing bubble in Toronto is likely to cause issues in a few quarters. But for now, the threat of a short squeeze and the possibility of a couple more quarters of great earnings make this a tough short now that it's 50% off its 52-week high.

With the exception of Alberta, home prices aren't really down far enough to cause major loan losses just yet. Vancouver's recent troubles and the latest crackdown on the housing bubble in Toronto is likely to cause issues in a few quarters. But for now, the threat of a short squeeze and the possibility of a couple more quarters of great earnings make this a tough short now that it's 50% off its 52-week high.

Genworth MI Canada (OTC:GMICF) is another option that should get battered as subprime slides. However, with a greater than 5% dividend, shorting that one could be a bit uncomfortable while waiting for the fireworks.

The Big Five

It's been widely assumed that the big five Canadian banks will be immune to a downturn in Canadian housing. Not that many people seem to have done much work on how exactly things would play out, at least if my conversations with Canadian investors and a perusal of recent Seeking Alpha articles on the big five banks are any guide.

An analysis from Moody's last year suggested that a 25% downturn in housing would cost the Canadian financial system C$18 billion, with the big banks eating most of that. That level of loss would be a major blow for earnings for a few years, but not come close to threatening any of the big banks' viability.

Moody's did raise one troubling concern, however. That is that the Canadian government might make the banks suffer losses on some insured mortgages with poor underwriting – Moody's provided an analogy to the US financial crisis where banks had to repurchase bad loans from Fannie Mae if they had been made without sufficient documentation. Moody's wrote:

We do not believe Canada is immune to such risk: in a stressed mortgage environment, mortgage insurers may increase claims rejection for purposes to preserve capital, and the political environment could prompt a shift of the risk-sharing burden to the banks and away from taxpayers.

It's also worth considering the other costs to the system. A crash in housing prices would likely add strain to other forms of debt service. Yes, a Canadian mortgage gone bad isn't as terrible for a bank as a US mortgage, since homeowners are generally personally responsible for mortgage debt (though the majority of US states are also recourse, contrary to popular conception).

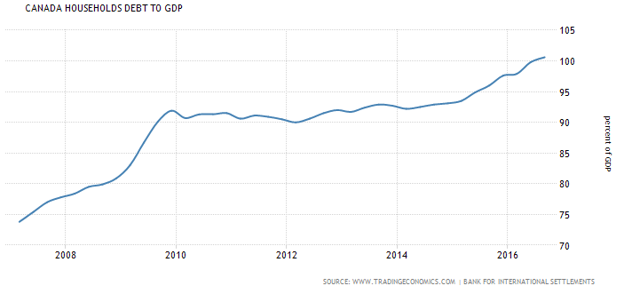

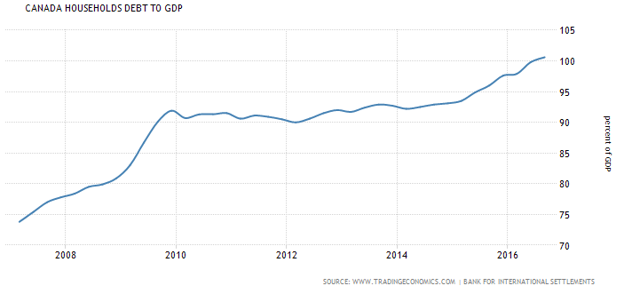

However, if someone making $75,000 a year bought a $750,000 house and it drops to, let's say, $500k in value, the bank would have to spend many years before getting its money back, even with recourse. You're also likely to see more consumer credit go bad in an environment where a large portion of the country is underwater on its home equity. Canadian household debt to GDP has exploded in recent years and has now topped 100%; it leads the way in this figure among G7 countries.

Assuming the subprime lenders such as Equitable and Home Capital are wiped out, it's likely those failures would cause hits for the bigger banks one way or another – in the same manner that the likes of Countrywide and IndyMac collapsing caused collateral damage in 2008.

It seems naive to me to assume that the Canadian banks would get through a housing collapse unscathed. Yes, I grant the system is far more stable than America's, and mortgage insurance makes it likely that taxpayers directly foot the bill (rather than indirectly via bailouts as we did in the US). However, I wouldn't be at all surprised if Canadian banks tumble 30% or more as investors go from complacent to nervous and react by aggressively unloading banking shares.

I have only a token position in CIBC (CM) now, and I certainly wouldn't think of adding here. The Canadian banks look cheap even here, but there's a lot of event risk. If you do want a position, I'd wait until Toronto housing prices get toward -10% year/over/year comps, and you'll probably get a fat pitch to buy the banks then. The big banks started to slide last week, with CM stock in particular seeing some selling, but this is still just an appetizer to what you'll get once Toronto housing prices head into reverse:

CM Price data by YCharts

CM Price data by YCharts

Zooming out even farther, there's little reason to expect Canada's housing troubles to spread beyond that country's borders. I know there's a grand theory that all the world's various housing bubbles (including the likes of Australia and New Zealand) will blow up at once. Supposedly, rising interest rates are going to cause a global liquidity squeeze and cause marginal buyers in all these overheated small markets to disappear at once.

In a world where the US dollar and interest rates keep spiking higher, I guess this sort of thing could play out. However, real estate tends to be at most a national market, if not even more local than that. (I will grant that much of the EU experienced a bubble prior to the financial crisis, but that's the exception, not the rule). Bubbles such as the Canadian one can and will pop due to local developments, such as taxes on foreigners and newly-imposed empty house fines, rather than international macroeconomics. If anything, Canada rejecting Asian money should support house prices in Australia – that Chinese money still has to go somewhere for safe-keeping after all.

Timing: It's Finally Canada's Moment

Shorting the Canadian housing market has been a popular trade since at least 2011. Prices were already fairly high in 2008, and then Canada missed out on the 2008-09 festivities that hit the US and much of Europe. As such, price/income ratios have hit absurd levels, and construction of new properties, particularly in Toronto, far outpaces any plausible uptake rate. Yes, inventory is constrained now, but it won't be forever.

As always, though, the question is when to short. Bears have an airtight case; the market is overvalued and will go down. But if you shorted in 2011, you've probably already gotten stopped out or gone out of business (if you were a fund manager) because the market remained resilient at least six years after the trade became popular. (The same logic holds for perpetually shorting overpriced US stocks from 2013 on)

This is why I personally wait for signs that the market has cracked before getting into a short position myself. Vancouver has clearly topped and now appears to be in steady decline. And Ontario has just now enacted similar (perhaps even more harsh in fact) laws to rein in its market. Toronto could well follow Vancouver.

When a storm comes, the weakest player dies first. That's Home Capital, and it's seemingly well on its way to joining the subprime graveyard. However, like in 2008, there was great money to be made shorting the stronger subprime lenders since the whole industry was destined to go bust. Equitable got punished last week, but it's still worth looking at on any sort of big short squeeze.

For the bigger banks, keep some powder fresh for future buys, because there's a decent chance that we'll see a big dip in their shares over the next couple of quarters.

I'd been watching Canadian developments with rising interest over the past few months. The combination of Ontario's harsh new laws and Home Capital's sudden collapse raises the possibility that the bubble is finally popping.

A million dollar house in Toronto.

TOPICS: Business/Economy; Canada; Foreign Affairs

KEYWORDS: bubble; canada; realestate; subprime

To: SeekAndFind

So you’re saying that the Chinkathon in Canada is over?

2

posted on

05/01/2017 8:38:40 AM PDT

by

vette6387

To: SeekAndFind

> It’s long been argued that Canada’s housing market is immune to normal financial rules,

It’s the new, new, new economy. The experts can’t possibly be wrong again, can they?

3

posted on

05/01/2017 8:50:37 AM PDT

by

ArcadeQuarters

("Immigration Reform" is ballot stuffing)

To: SeekAndFind

Oh noes!

Anyway, who qualified for the loan on that “million dollar house”?

4

posted on

05/01/2017 8:54:07 AM PDT

by

Fido969

(IN!)

To: SeekAndFind

All the original/real Canadians will blame it on the "Trump Refugees" from America. lol

5

posted on

05/01/2017 9:23:06 AM PDT

by

SandRat

(Duty, Honor, Country.)

To: SeekAndFind

Great opportunity for a new class of mortgagees to save the day and keep up with Canada’s demographic trends. Sharia lender. He Mahommet, no haram interest. (Tee hee).

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson