Posted on 05/01/2017 8:10:05 AM PDT by SeekAndFind

I feel like I am beating a dead horse on tax cuts, but facts are extremely important if we want to get the economy growing.

I get extremely aggravated when I read material like the following paragraph by Paul Waldmen in the Washington Post, because it is so demonstrably false.

Of course the notion that tax cuts don’t pay for themselves is repeated so often that either the media has no idea that it is false or they don’t care. My guess is they don’t care because they have had almost 14 years to research the Bush tax cuts and instead of the Democrats and the media telling the truth, they just repeat bald faced lies.

“Sixteen years ago, President George W. Bush made exactly the same arguments you’re making, in defense of a similar tax cut. The results were abysmal: a huge deficit; poor growth in GDP, jobs and incomes; and eventually a financial cataclysm. What did Bush do wrong?”

Something you rarely see in the diatribes about how disastrous Bush tax cuts were for the government and the economy are actual numbers. If they used actual numbers the public would get to see the lies. It is a shame that Republican politicians don’t show the actual numbers to the public.

The media and Democrats just repeat over and over again that tax cuts cause deficits and don't help the economy, hoping that the public becomes indoctrinated. It is exactly the way they handle climate change. Facts haven't mattered for a long time.

This website, http://www.usgovernmentrevenue.com/, shows federal revenue and expense numbers for all years in recent history. It also shows debt and deficit numbers. Anyone can download the information. The media must not be interested in the facts. Here are a few numbers and facts:

(Excerpt) Read more at americanthinker.com ...

What this author says is true, but more and more, I am of the opinion that we need taxes that equal spending. That will force people to make spending choices. If you run up a deficit for future generations to pay, it creates a “something for nothing” mentality. The same holds true if you cut taxes on the middle class and not the wealthy. Republicans scored a lot of political points taking the poor and middle class off the tax rolls. And in retrospect, that was a disaster that created the “47%” who vote for more and more benefits knowing they won’t pay for them. I want a rational tax system where everyone pays and it equals spending. I’d strongly prefer that to come from large spending cuts and rationalization of entitlements. But if that isn’t going to happen, then I’m for a fairly large lower and middle class tax increase to pay for it.

RE: I am of the opinion that we need taxes that equal spending.

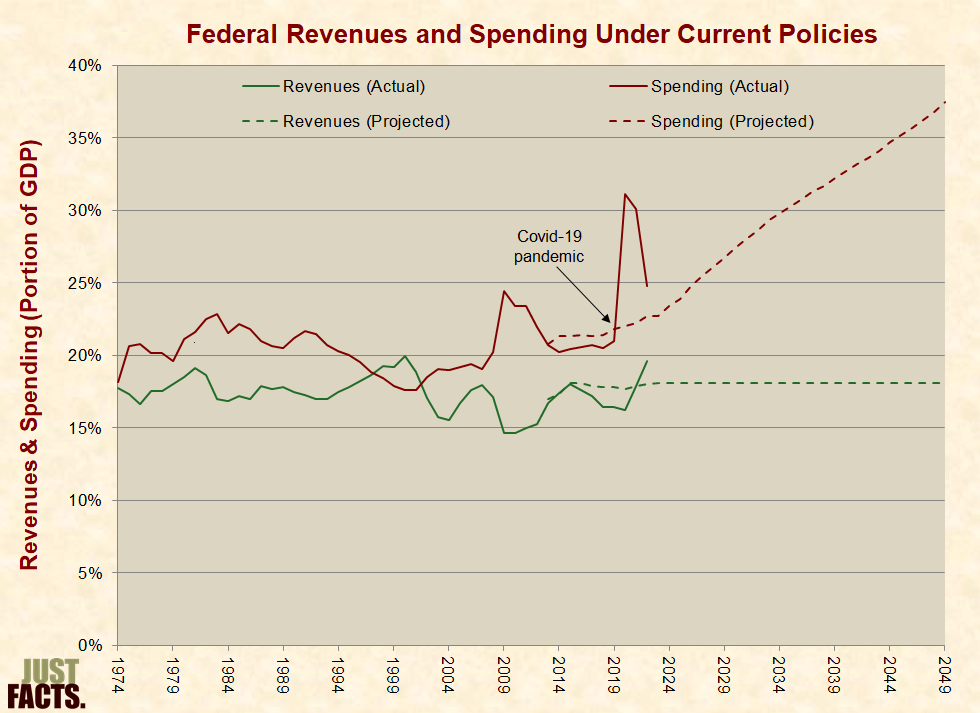

The graphs of posts 3 and 4 tells us everything.

Even as government revenue increased, SPENDING INCREASED EVEN MORE !!

This has been true for the JFK and Reagan tax cuts.

JFK cut taxes and LBJ used the increased revenue for his Great Society.

Reagan cut taxes and the Democrat controlled Congress ( ignoring their promise to Reagan ) INCREASED OUTLAYS even more than revenue !!

The moment money flows into the treasury, you can bet your bottom dollar that the folks in Washington will be salivating with glee.

Bookmark

“then I’m for a fairly large lower and middle class tax increase to pay for it.”

So am I but what has happened is that becomes the third rail of prior tax cuts as it seems those who pay no income tax feel that anyone paying tax is not paying enough!

But as things are now all I have to do is take what the media says and assume the opposite is true. It works across the board.

The entitlement programs are the biggest drivers of our debt. They need to be reformed, which will require a reduction in benefits or an increase in taxes, or some combination of both.

For every dollar in tax cuts, there needs to be a $1.50 spending cut. That’s the o0nly way we’ll get it under control in eight years or so.

Your premise is good but better to have spending that doesn’t exceed taxes and is based on actual Constitutional “allowances” vs. all the waste. I did a paper 25 or so years ago where I concluded that we could cut taxes by over 60% and still have a surplus if we stuck to Constitutionally legal spending instead of being a “do-all-for everyone” Nanny State.

Clearly you are the enemy of sanity. Tax cuts stimulates the economy which helps the individual citizen remain self sufficient and increases tax revenues. Why can’t you get that? Are just stupid? You want to punish citizens because the government spend to much? Who the hell are you?

The Media breathlessly reported Record Federal Tax Revenues over and over again during the last couple of Years of the Obama Administration.

The Bush Tax Cuts spurred Record Federal Tax Revenues in a shorter period of time but you never heard a peep about it.

I remember after 9/11 hearing that it would take us ten years to recover from the Financial Impact of that event.

It took less than three years for the turnaround, spurred by those same Bush era Tax Rate Cuts.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.