Skip to comments.

Corzine to pay $5M penalty to resolve MF Global case

AP via Philly.com ^

| 01/04/2017

| MARCY GORDON

Posted on 01/05/2017 11:32:57 AM PST by Kid Shelleen

Jon Corzine, the former New Jersey governor who led the collapsed brokerage MF Global, has been ordered to pay a $5 million penalty for his role in the firm's alleged illegal use of almost $1 billion in customer funds. A federal court in Manhattan on Thursday granted the order against Corzine to the U.S. Commodity Futures Trading Commission, which brought civil charges against him in 2013. Following the stunning collapse of the big Wall Street firm in late 2011, the CFTC alleged that MF Global misused customer funds in a vain attempt to remain solvent.

(Excerpt) Read more at philly.com ...

TOPICS: Business/Economy; Crime/Corruption; News/Current Events; US: New Jersey

KEYWORDS: corzine; goldmansachs; joncorzine; mfglobal

Navigation: use the links below to view more comments.

first 1-20, 21-26 next last

To: Kid Shelleen

2

posted on

01/05/2017 11:33:36 AM PST

by

Brilliant

To: Brilliant

Last number I saw was $1.5 bil. But who’s counting. Sweetheart deal. That’s one heck of a euphemism for it. Corzine should be doing hard time.

3

posted on

01/05/2017 11:36:09 AM PST

by

mewzilla

(I'll vote for the first guy who promises to mail in his SOTU addresses.)

To: Kid Shelleen

Steal billions and repay millions. It’s good to be a Democrat.

4

posted on

01/05/2017 11:36:25 AM PST

by

Dr.Deth

To: Kid Shelleen

5

posted on

01/05/2017 11:36:29 AM PST

by

ColdOne

(( I miss my poochie... Tasha 2000~3/14/11~ Trump should get a Russian Wolfhound for first pet in WH.)

To: Kid Shelleen

Corzine belongs in jail, but he is a Democrat.

Clinton’s Bag Man belongs in jail, too, but he is Governor of my state.

6

posted on

01/05/2017 11:42:07 AM PST

by

Lurkinanloomin

(Natural Born Citizen Means Born Here Of Citizen Parents)

To: Kid Shelleen

7

posted on

01/05/2017 11:43:19 AM PST

by

CaptainK

(...please make it stop. Shake a can of pennies at it.)

To: All

Dec 05, 2011---Fox News Report:

Bill Clinton Reaped Big Bucks from Corzine Firm Before Collapse A former MF Global employee accused former president Bill Clinton of collecting $50,000 per month through his Teneo advisory firm in the months before the brokerage careened towards its Halloween filing for Chapter 11 bankruptcy, reports Human Events.

Teneo was hired by MF Global’s former CEO Jon S. Corzine to improve his image and to enhance his connections with Clinton’s political family, said the employee, who asked that his name be withheld because he feared retribution, according to Hum/Events.

The Teneo contract with MF Global lasted at least five months, the source said. “The board cancelled it after Corzine resigned.”

The source, who is no longer associated with MF Global, said Teneo is a dual-track company with one side devoted to merchant and investment banking and the other side set up to provide image and strategy consulting services. Clinton is the chairman of the company’s advisory board, reports Hum/Events.

SOURCE http://nation.foxnews.com/mf-global/2011/12/05/report-bill-clinton-reaped-big-bucks-corzine-firm-collapse#ixzz1fhH3pHHH

8

posted on

01/05/2017 11:45:05 AM PST

by

Liz

(The Clintons' embracing humanitarian relief is like the Sopranos' embracing waste mgmt.)

To: All

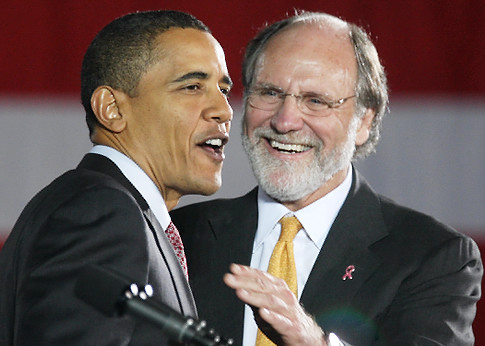

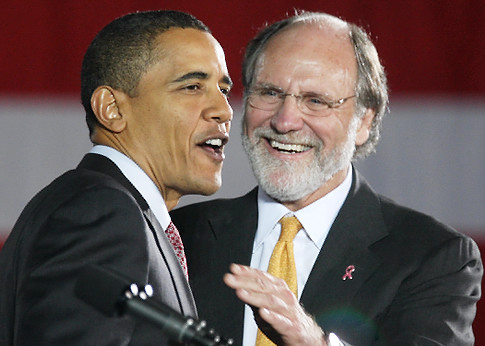

Then-US Sen Hillary made a special effort to make friends w/ Wall Street.

Then-US Sens Clinton and Corzine.

Corzine was fresh out of Goldman Sachs executive suite. Corzine came from Wall Street to Capitol Hill. Then back to Wall Street to head a company that hired Bill Clinton @ $50,000 per month, AND also misplaced $1.3 Billion investor dollars.

===============================================

Goldman Sachs top echelon are nuts for Hillary. The G/S biggies "invested" in Hillary's SIL's hedge fund. SIL's cockamamie investing turned the fund into an economic disaster according to the WSJ. It's been shuttered due to the huge losses in Greek debt investments.

================================================

THE CLINTON CORZINE CONNECTION: The NY Post reported Dec 2011 that Teneo was advising MF Global, the doomed international brokerage firm headed by former New Jersey Gov. Jon Corzine (and ex-US Senator). The firm paid Teneo an eye-popping $125,000 a month as it was imploding and losing millions for its investors. Bill Clinton was also pocketing at MF Global--- an astounding $50,000 per month.

EXHIBIT ONE Corzine was fresh out of Goldman Sachs executive suite, buying his NJ Senate seat office for $65 million; then buying the NJ governorship. Out of office, he ran a hedge fund where $1.5 B went missing....its advisor Teneo was connected to both Bill Clinton and then-Secy of State Hillary's top aide Huma Abedin.

EXHIBIT TWO When Chelsea Clinton's husband started a hedge fund, he gained access to investors who had ties to the Clintons and to Goldman Sachs. Back in 2011, Mezvinsky, now 37, and two former Goldman Sachs'ers — Bennett Grau and Mark Mallon — began raising money for Mezvinsky's Eaglevale Partners LP hedge fund.

Some of Mezvinsky's "investors" included Goldman Sachs CEO Lloyd Blankfein. Blankfein, a slavish Democrat supporter, said he had "always been a fan of Hillary Clinton."

The WSJ reported extensively on the hedge fund's underperformance since its inception and Mezvinsky's mediocre investing and strategizing.

==========================================

THIS JUST IN---Bloomberg is reporting G/S's CEO Lloyd Blankfien is a newly-minted billionaire---and also has his own Foundation.

Mmmmmmmm....the sound of wire-transfers is almost palpable.

The IRS says the biggest tax evasion fraud is one Foundation writing a check to another Foundation. The check receiver takes a cut, then wire-transfers the bulk to an offshore bank for the check-writer's use later ----- the way these "humanitarians" skim off-tax free dollars for themselves.

9

posted on

01/05/2017 11:51:15 AM PST

by

Liz

(The Clintons' embracing humanitarian relief is like the Sopranos' embracing waste mgmt.)

To: Brilliant

Jon Corzine (former Goldman Sachs CEO) oversaw $1.6 billion in customer accounts disappeared at MF Global and, essentially walks free with a $5 million fine.

A hog farmer can track a hog from his farm to somebody’s table.

Yet somehow, Jon Corzine loses $1.6 billion in customers accounts and only pays pocket change, as a punishment.

Walk into a bank with a gun and steal $2,000 and you’ll get 20 years in prison.

Walk into a Wall Street trading house in a $2,000.00 suit, steal $1.6 billion, go to Congress and say “I don’t know”, pay $5 million in pocket change and, now, go home for dinner that night.

To: All

Then Secy Hillary Sent Classified State Dept Email

To Chelsea To Help Son-In-Law's Greek InvestmentsTwitter ^ | November 5, 2016 | Mike Cernovich / FR Posted by Bon mots

Then-Scy Hillary sent classified State Dept email to her daughter Chelsea about the Greece debt crisis (in which Chelsea's husband was deeply invested). Chelsea's husband runs a hedge fund trading Greek bonds.

=================================================

Insider trading!--- Wikileaks lists 550 conflicts of interest of the Clinton Foundation. Prominent name is billionaire Marc Lasry

<><>Chelsea Clinton's first job was w/ Lasry's hedge fund.

<><> Lasry got Chelsea's hubby's hedge fund off the ground.

<><> Lasry's son, Alexander, worked for Obama's Senior Adviser Valerie Jarrett.

<><> Lasry's daughter, Samantha, was a staffer for Congressman Rahm Emanuel.

(NOTE: Emanuel later became a top Clinton aide AND a Goldman Sachs lobbyist at the same time. Emanuel became Obama's COS AND ran the Dept of Treasury at the same time......now he's Chicago mayor.)

=====================================

NY TIMES 2015 report----"For the Clintons a hedge fund in the family."

EXCERPT When Chelsea's hubby, and his partners began raising money in 2011 for a new hedge fund firm, Eaglevale Partners, a number of investors in the firm were longtime supporters of the Clintons, according to interviews and financial documents reviewed by The New York Times. Tens of millions of dollars raised by Eaglevale can be attributed to investors with some relationship or link to the Clintons.

The investors include hedge fund managers like Marc Lasry and James Leitner; an overseas money management firm connected to the Rothschild family; and people from Goldman Sachs, including the chief executive, Lloyd C. Blankfein. Some of the investors in Eaglevale have contributed campaign money to the former president and Mrs. Clinton. Some have also contributed to the family’s foundation.

Identifying who put money into Eaglevale, a roughly $400 million fund that has had underwhelming returns for much of its brief history, is difficult because hedge funds do not publicly disclose their investors.

Still, the overlap between at least some of Eaglevale’s investors and backers of the Clintons illustrates how politics and finance can intersect and shows the fine line the Clinton family must navigate as their charitable and business endeavors come under scrutiny in an election cycle.

SNIP

Mr. Lasry, a co-founder of the big hedge fund Avenue Capital and a longtime friend and financial backer of both the former president and Mrs. Clinton, said he invested $1 million in Eaglevale. In an interview in his Park Avenue office, adorned with many photos of him with the former president, he said that he recommended that his relative by marriage, Craig Effron, another hedge fund manager, also invest in the fund. “I gave them money because I thought they would make me money,” said Mr. Lasry, whose $13 billion firm was one of the first places Chelsea worked after graduating from Stanford.

A number of other investors reached by The Times declined to be interviewed.

Rest here: http://www.nytimes.com/2015/03/23/business/dealbook/for-clintons-a-hedge-fund-in-the-family.html?_r=0

more

11

posted on

01/05/2017 11:57:19 AM PST

by

Liz

(The Clintons' embracing humanitarian relief is like the Sopranos' embracing waste mgmt.)

To: ColdOne

How MF Global’s ‘missing’ $1.5 billion was lost — and found

I recall that the missing funds were later found, though Corzine claimed bewilderment over the loss and recovery.

I’ve always suspected the money was fronted to the ‘12 campaign and later stealthily restored. He worked as a bundler for both ‘08 and ‘12 campaigns. The last minute timing of this settlement seems consistent with this.

So, 5 mil is small potatoes, but I guess is as well as could be done to someone with so many friends.

12

posted on

01/05/2017 11:57:33 AM PST

by

tsomer

To: All

more

Then-Secy Hillary kept a sharp eye on valuable US intelligence assessing the chances of a bailout of the Greek central bank b/c her SIL's hedge fund was heavily invested in Greece, and financed by Goldman Sachs.

Most egregiously, Hillary sucked-up to Mideast oil billionaires for her SIL...as the bodies of four Americans lay brutally murdered in Benghazi.

============================================

(Excerpt) Read more at judicialwatch.org ... On September 15, in a telephone call with then-Egyptian Foreign Minister Mohamed Amr, Secy Clinton emphatically portrayed the “stupid, very offensive film” as the root cause of the Benghazi violence.

Clinton told Amr, “I have repeatedly, as has the President and other officials in our government, deplored not only the content of this stupid, very offensive film… But we have to exercise more self-discipline… otherwise we’ll be in a vicious downward circle against everyone who has ever felt offended, particularly on the internet….”

After referring to Benghazi, Secy Clinton’s telephone call with then-Egyptian Foreign Minister Mohamed Amr also contained a curious reference to what the former secretary referred to as a “very successful investment visit led by my deputy Tom Nides, and on the very day they left, this series of incidents began to unfold.”

According to the Washington Post, Nides, who was deputy secretary for management and resources at the State Department, was at the same time responsible for “communications with donors” to the Clinton Foundation.

Nides was also involved in the earlier scandal involving Clinton’s efforts to provide special access to State Department officials for hedge fund clients of her son-in-law, Marc Mezvinsky ....who was financed by Goldman Sachs.

13

posted on

01/05/2017 11:58:13 AM PST

by

Liz

(The Clintons' embracing humanitarian relief is like the Sopranos' embracing waste mgmt.)

To: tsomer

14

posted on

01/05/2017 12:00:22 PM PST

by

tsomer

To: Kid Shelleen

That’s .5%, the poor guy.

15

posted on

01/05/2017 12:02:09 PM PST

by

Kickass Conservative

( Democracy, two Wolves and one Sheep deciding what's for Dinner.)

To: CaptainK

The zeros are easily dropped to make a point on just how much “chump change” it is.

1,300,000,000 equals 1.3 billion drop 6 zeros

5,000,000 equals 5 million drop 6 zeros

It is as if Corzine stole/misplaced $1,300 and was fined $5. He should be Bernie Madoff’s cell mate with the same sentence, 150 years.

THIS PENALTY DOES NOT “RESOLVE” THE CASE.

16

posted on

01/05/2017 12:57:43 PM PST

by

BatGuano

(You don't think I'd go into combat with loose change in my pocket, do ya?)

To: Kid Shelleen

To: Brilliant

Chicken feed for a guy like Corzine. A mere traffic ticket.

18

posted on

01/05/2017 1:46:43 PM PST

by

Tallguy

To: Kid Shelleen

It's GOOD to be the minion of the Dem King!

19

posted on

01/05/2017 1:47:13 PM PST

by

catnipman

(Cat Nipman: Vote Republican in 2012 and only be called racist one more time!)

To: Kid Shelleen

How much did Corzine pocket out of this $1B scam?

20

posted on

01/05/2017 1:54:13 PM PST

by

PLMerite

(Lord, let me die fighting lions. Amen.)

Navigation: use the links below to view more comments.

first 1-20, 21-26 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson