Posted on 01/25/2016 11:42:16 AM PST by thackney

Global energy demand will increase 25% between 2014 and 2040, driven by population growth and economic expansion, according to ExxonMobil Corp.'s 2016 Outlook for Energy. Most of this growth will occur in nations outside the Organization for Economic Cooperation and Development.

At the same time, the carbon intensity of the global economy will decline by half because of energy efficiency gains and increased use of renewable energy sources and lower carbon fuels, such as natural gas.

In 2040, oil will provide one third of the world's energy, remaining the No. 1 source of fuel, and natural gas will move into second place. Natural gas is expected to meet about 40% of the growth in global energy needs and demand for the fuel will increase by 50%. In 2040, oil and natural gas are expected to make up nearly 60% of global supplies.

Nuclear and renewable energy sources--including bioenergy, hydro, geothermal, wind, and solar--are also likely to account for nearly 40% of the growth in global energy demand by 2040. By then, they are expected to make up nearly 25% of supplies of which nuclear alone represents about one-third.

The outlook projects that global energy-related carbon dioxide emissions will peak around 2030 and then start to decline. Emissions in OECD nations are projected to fall by about 20% from 2014 to 2040.

Other key findings of the report include:

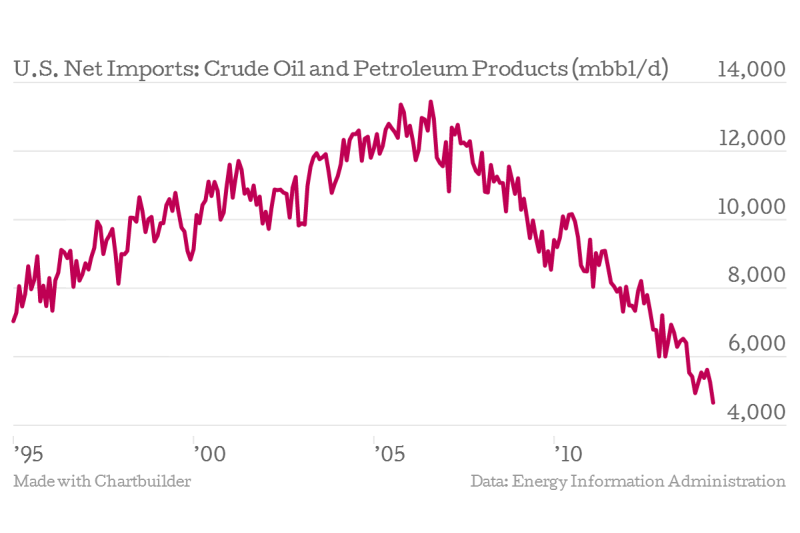

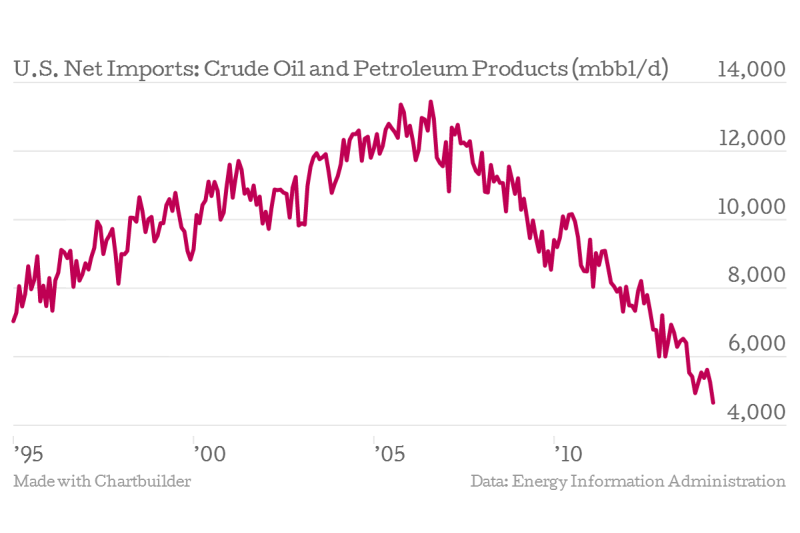

* North America, which for decades had been an oil importer, is on track to become a net exporter around 2020.

* India will surpass China as the world's most populous nation, with 1.6 billion people. The two countries are expected to account for almost half of the growth in global energy demand.

* Global demand for electricity is expected to increase by 65%, and 85% of the increase is in non-OECD nations.

* The share of the world's electricity generated by coal is expected to fall to about 30% in 2040 from 40% in 2014.

* Global energy demand from transportation is projected to rise by about 30%, and practically all the growth will be in non-OECD countries.

* Sales of hybrid vehicles are expected to jump from 2% of new-car sales in 2014 to more than 40% by 2040, when one in four cars in the world will be a hybrid. Average fuel economy will rise to 45 mpg from 25 mpg.

* Already the world's largest oil-importing region, Asia Pacific's net imports are projected to rise by more than 50% by 2040 as domestic production remains steady and demand increases.

Pffft... Exxon playing environmental footsie with those who would kill everyone of them if the lefties could get away with it. Look at Venezuela for a modern example.

Pathetic.

I would not bet against Exxon.

This may be possible but I rather doubt it on the current course. I hardly see how NA can recover from this bust and create enough new production in only FOUR years to be a net exporter. In fact, I WOULD take that bet against Exxon.

* North America, which for decades had been an oil importer, is on track to become a net exporter around 2020.

Fair enough but I still have a hard time seeing the gap filled in four years from now. I wrote what follows before qualifying the discussion to NORTH AMERICA so ignore that argument but I’m not going to throw it away. On the terms stated, North America, NA is nearing 1 mmbo/d away from being a net exporter.

It might be possible but by the end of this year the industry will be in shambles. I figure we will soon have nearly another mmbo/d in shale declines to make up by the end of the year. Our crude imports are up 700 mbo/d over the same time last year. Is this all refining value add that is being turned around as product export? Canada has tar sand projects in the mill that will have to start production unless they can’t even cover cash cost. The capex is sunk and gone no matter what.

I don’t know if rebuilding is always easier than building. It took from about ‘04 to build 3.8 mmbo/d of new shale oil in fits and starts. If it had not been for Macondo shale would have been off to a slower start. The Gulf shut down was not felt because all that capacity went to shale. The shut down began on April 20, 2010. I guess we or someone will see if we live long enough.

If only, crap in one hand and wish in the other and see which one fills up first.

Good discussion, thanks.

FUD.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.