I have felt that demographics of the boomer retirements, low birth numbers of millennials and bad conditions for gen X in their prime years have put us on the track for deflation. The succeeding generations don’t want or can’t afford the homes of the boomers, boomers will spend less and have less to spend in retirement etc.

It all adds up to a falling market. Deflation.

Consider this please:

A fellow came by the office today. I’ll tell you what he is selling but also tell you some things he believes are headed our way. One of you may know him. In ‘13 he did a pretty fair job of predicting the end of the oil boom based on charting the trends. He is a technical / chart trader in just about anything that is traded. Not a big fan on analysis of fundamentals since the events usually have passed by the time the analysis has been done. He has been trading for about 40 years.

Here are some facts and what he thinks:

Fact, 75 million baby boomers are leaving the consumption market and their spending patterns are not replacing those of Gen X and the Millennials

Fact, Japan is deep in a demographic hole with an aged population and Europe is following in close step to Japan and the U.S.

Fact, not enough workers to support debt promises to retirees

Fact, too many lucrative pensions have been given to public employees who retire far too early for us to afford to pay them. Again, not enough workers to support these pensions.

Fact, we are not creating enough well paying jobs because we are not making enough value added products.

Observation, There are long and short term patterns in everything. E.g. a trend of boom and bust is suggested starting with 1902 when new technologies came on the scene creating a major shift in the economy. They were the car, the airplane, communications etc. The boom lasted until 1928. The bust lasted until 1942 or so with the onset of the World War. The good times lasted until about 1968 when Vietnam became so costly and the markets stalled. That bust lasted until some sea change came along, the computer technology boom in about 1982. The dot com bust came and went, then 9/11 then the Great Recession in 2008. The pattern conveniently suggests 26 years of growth and 14 years of bust.

Observation, per the Fourth Turning, we are in the fourth period of an 80 year cycle. The fourth period, for the last 500 years studied, commences with an economic down turn followed by a global war. The last 20 year period of the 80 year cycle is called the Crisis.

Conditions suggest we are firmly in the grip of the Crisis phase of the 80 year cycle.

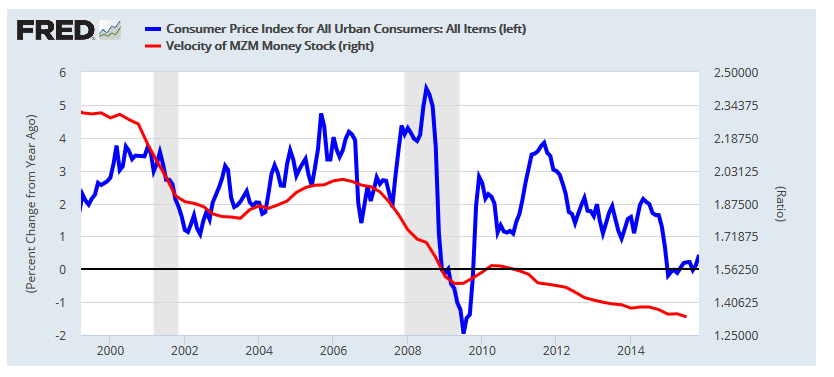

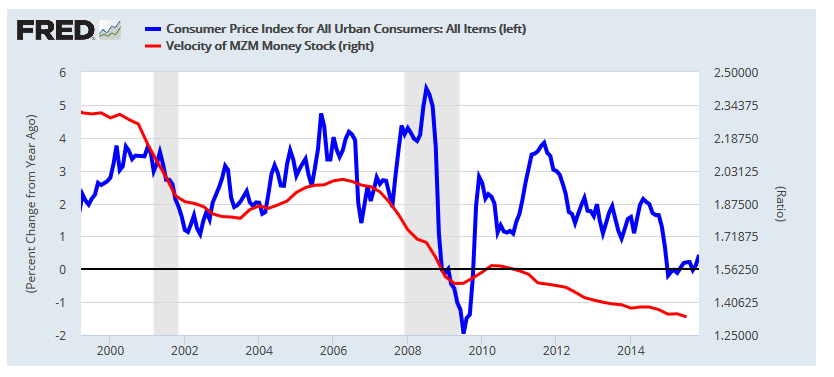

He suggests that the market has been propped up by 4 trillion of QE and that it is a house of cards owing to the facts and observations noted and that the trend is for deflation as people consume less. The FED seems hell bent for leather to declare victory and raise interest rates. I’d say this will not go well and QE will resume very quickly in the election year but probably not quickly enough. The economy does not turn that fast but the market does turn very fast to the downside and it probably will.

He suggests that the debt is, as most of us probably concur, unsustainable. A default must take place because it can’t be paid back.

Politicians will do all they can to sustain their power including even more aggressive confiscation to prop up their power as the crisis deepens and grows old.

He forecasts gold to less than 400 as it is not the haven some have suggested since it is a hedge against inflation, not deflation

He forecasts the Euro to go up to about $1.15 to the euro and then collapse to about $0.88 as it becomes apparent that the game of QE there is not working.

He expects the EU to eventually fail within only a “few” years.

He forecasts oil must fall to the previous troughs low before it can begin recovery. The charts suggest low 30s notwithstanding some geopolitical outbreak.

He forecasts an even worse fall in housing than we have seen as there are too few buyers for downsizing and dying boomers homes.

He makes two suggestions: Cash and learning how to make money in a declining market by shorting the market.

If you have a paid for house keep it but if it is not paid for realize it may go upside down again.

Now for the punch line of what he does. A disclaimer. He is an unregistered trader, meaning he is a boutique trader only able to manage the money of a limited number of persons. He trades and markets himself as an investment coach teaching people how to read charts and thereby achieve his fantastic, so he shows, results.

What he does, does not make the facts untrue though he is very motivated for you to buy his service, the observations invalid or the forecasts necessarily tainted. Obviously though one wonders why, if he is such a successful trader would he bother with selling his services as an investment coach at $2,700 for a three month engagement? Certainly not altruism.

Notwithstanding this disclaimer I don’t count this evaluation as wrong nor what appears to me as the risky proposition to deal with it.