Skip to comments.

Why Are Democrats So Worried About A Fed Rate Hike?

Investors Business Daily ^

| 12/02/2015

| Editorial

Posted on 12/03/2015 4:16:20 AM PST by expat_panama

click here to read article

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-62 next last

To: CPT Clay

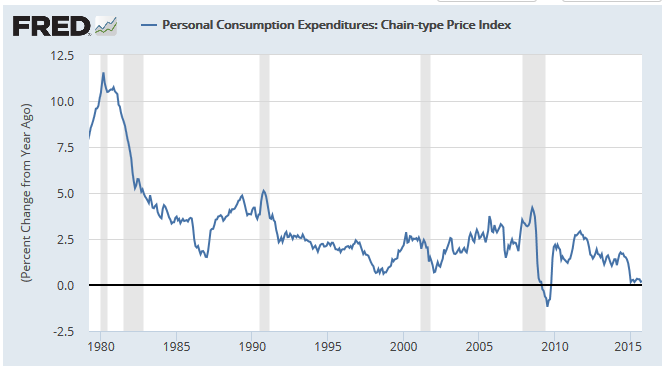

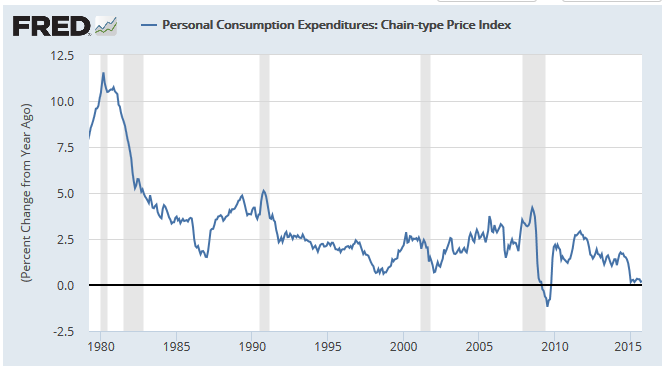

.25 per cent is not going to crash anything.One option had been a miniscule token hike --maybe 0.00025%? The thinking now is that we really no longer have to worry if a hike would crash anything because the economy already is crashing. Once again that doesn't matter either becuase the Fed works w/ inflation and they can and will tank the economy if inflation's a problem. It isn't; most serious metrics (meaning we'll ignore the FR whining arm-wavers) are seeing price indexes wandering back down like it was 2008 all over again.

Let's not think the Fed can't lower the overnight bank rate below zero --if they really want they can go and pay banks to borrow. The reason they don't (as far as I can see) is that this is no longer a technical problem but rather a political one and a negative move would be too much of a political blast for an election year.

To: expat_panama

For what it’s worth, I received this information this morning. I can’t vouch for the accuracy, but when IBD says we’re headed south, I’ll listen.

#1 On Tuesday, the price of oil closed below 40 dollars a barrel. Back in 2008, the price of oil crashed below 40 dollars a barrel just before the stock market collapsed, and now it has happened again.

#2 The price of copper has plunged all the way down to $2.04. The last time it was this low was just before the stock market crash of 2008.

#3 The Business Roundtable’s forecast for business investment in 2016 has dropped to the lowest level that we have seen since the last recession.

#4 Corporate debt defaults have risen to the highest level that we have seen since the last recession. This is a huge problem because corporate debt in the U.S. has approximately doubled since just before the last financial crisis.

#5 The Bloomberg U.S. economic surprise index is more negative right now than it was at any point during the last recession.

#6 Credit card data that was just released shows that holiday sales have gone negative for the first time since the last recession.

#7 As I mentioned yesterday, U.S. manufacturing is contracting at the fastest pace that we have seen since the last recession.

#8 The velocity of money in the United States has dropped to the lowest level ever recorded. Not even during the depths of the last recession was it ever this low.

#9 In 2008, commodity prices crashed just before the stock market did, and late last month the Bloomberg Commodity Index hit a 16 year low.

#10 In the past, stocks have tended to crash about 12-18 months after a peak in corporate profit margins. At this point, we are 15 months after the most recent peak.

#11 If you look back at 2008, you will see that junk bonds crashed horribly. Why this is important is because junk bonds started crashing before stocks did, and right now they have dropped to the lowest point that they have been since the last financial crisis.

42

posted on

12/03/2015 7:05:14 AM PST

by

Mase

(Save me from the people who would save me from myself!)

To: cymbeline

Which debt? Our ‘known’ $19T+ or the ‘red-headed-step-child’ $100T+ of unfunded liabilities?

Which point would be the ‘point of no return’? Edging over the 50% mark that don’t pay income taxes (if any taxes)? Having the highest corporate tax rate on the planet (while expecting biz to stay to bend over/take-it)? Printing more fiat $$, to prop up Wall/K-St?

Sorry, my FRiend, the U.S. of Fascist America will end like all Socialist systems: BADLY.

Luckily, only the little people will suffer /s

43

posted on

12/03/2015 7:08:38 AM PST

by

i_robot73

("A man chooses. A slave obeys." - Andrew Ryan)

To: citizen

Isn't the Fed's balance sheet on top of the authorized national debt? No, it is included the total national debt. I misspoke on the amount held by the Fed. It is around $2.5 trillion.

Congress did not allocate money for the QEs or any other Fed program, correct? Or do I have that all balled up...

They don't have to allocate any money for QE's. The Fed prints the money and buys T-bills, which are debt instruments. They are no different than the T-bills bought by the Chinese, Japanese, etc.

How the Fed Works

44

posted on

12/03/2015 7:25:12 AM PST

by

kabar

To: expat_panama

I don’t see a hike happening. If one does, we have to service more interest on the debt which ultimately means programs will need to be cut as budgets will have to shrink and you can be damn sure it won’ be entitlement programs.

I haven’t read enough to understand the ramifications of NIRP, but the folks at zerohedge seem fairly certain it is in our future.

45

posted on

12/03/2015 7:32:14 AM PST

by

Ghost of SVR4

(So many are so hopelessly dependent on the government that they will fight to protect it.)

To: Mase

Whoa, thanks for the headsup. One thing that caught my eye-- "..velocity of money in the United States has dropped to the lowest level ever recorded." They may be talking about

the Fed's number set w/ data going back to 1960, but

this other set patched together vel. back to 1900 and we're now beginning to look more like 1929...

To: expat_panama

Thanks for the links! I've been trying to validate this information because some of these comparisons seem fallacious. Unfortunately I haven't gotten very far this morning.

I think the impact of many imminent energy-sector bankruptcies is being underestimated. Unless oil rises in 2016, I believe we will see this sector drag entire market down. Heck, even now the economic data stinks.

But I've been sitting on the sidelines for a long time now watching the market go up without me. So what the hell do I know.

47

posted on

12/03/2015 8:00:54 AM PST

by

Mase

(Save me from the people who would save me from myself!)

To: expat_panama

Don’t worry. If any naked pictures of Yellen and Rosie O’Donnell exist, the Clintons surely have them.

To: Fai Mao

If the recession becomes obvious the democrats will lose all hope of winning a national election for years You mean yesterday's Islamic terrorist attack that killed 14 people and wounded 17 others who were attacked because they're Christian and were attending a Christmas Party in a California Mandated GUN FREE ZONE didn't already do that?

Wow, this country is f**ked.

49

posted on

12/03/2015 8:42:07 AM PST

by

usconservative

(When The Ballot Box No Longer Counts, The Ammunition Box Does. (What's In Your Ammo Box?))

To: expat_panama

Do you SERIOUSLY think there's no inflation?

Bought food lately? Up to the last year one could say that about fuel also, but these low prices aren't going to last forever.

Seniors are getting financially KILLED by 8+ years of 0% interest rates. Combined with 0% COLA's for Social Security this country's Senior Citizens are falling into poverty level at an alarming rate.

50

posted on

12/03/2015 8:50:31 AM PST

by

usconservative

(When The Ballot Box No Longer Counts, The Ammunition Box Does. (What's In Your Ammo Box?))

To: Lurkina.n.Learnin

They’re not the only ones that need a vow of silence. Someone needs to duct tape Obama’s stupid pie hole shut too.

51

posted on

12/03/2015 8:51:37 AM PST

by

usconservative

(When The Ballot Box No Longer Counts, The Ammunition Box Does. (What's In Your Ammo Box?))

To: usconservative

52

posted on

12/03/2015 8:53:15 AM PST

by

usconservative

(When The Ballot Box No Longer Counts, The Ammunition Box Does. (What's In Your Ammo Box?))

To: usconservative

53

posted on

12/03/2015 8:54:44 AM PST

by

usconservative

(When The Ballot Box No Longer Counts, The Ammunition Box Does. (What's In Your Ammo Box?))

To: Tax-chick

Saving $10-$20 bucks per fill-up once or twice a month is NOT going to save this economy and it's certainly not going to save this Christmas shopping season.

Everything I've seen/read has been that black Friday was a bust, online sales are better than last year but brick and mortar sales are in the crapper. People are also saving more, spending less.

Doesn't bode well, does it? You're correct that the real unemployment rate is still dangerously high, and it's generally agreed that the REAL unemployment rate is still over 10% while the workforce participation rate is at 40+ year lows.

This "economy" (or lack thereof) has been an 8 year long powder-keg ready to blow, and NOT in a good way.

54

posted on

12/03/2015 9:08:58 AM PST

by

usconservative

(When The Ballot Box No Longer Counts, The Ammunition Box Does. (What's In Your Ammo Box?))

To: usconservative

...Fed hike was needed to stop inflation as measured by the PCE. It's not there...you SERIOUSLY think there's no inflation?

That's what I like about hanging around the FR, everyone cares about what I think. The Fed sure doesn't tho, so even while you care so much about my thoughts when it comes to inflation the Fed only watches the PCE. This is the PCE:

It says no inflation.

To: SoothingDave

Belief in a savior

I don't think of him as a "savior". I think Trump's background makes him more capable to handle an economic disaster which is coming.

56

posted on

12/03/2015 9:20:14 AM PST

by

painter

( Isaiah: �Woe to those who call evil good and good evil,")

To: expat_panama

Right, that's because the two most historically inflationary components have been REMOVED: those being FOOD and FUEL.

Factor in WAGE DEFLATION and I guarandamntee you there's inflation, and it's PAINFUL inflation.

57

posted on

12/03/2015 9:22:56 AM PST

by

usconservative

(When The Ballot Box No Longer Counts, The Ammunition Box Does. (What's In Your Ammo Box?))

To: Mase

In 2008, commodity prices crashed just before the stock market did, and late last month the Bloomberg Commodity Index hit a 16 year low.

I talked to a friend yesterday and he was telling me scrap metal prices have crashed from $250 a ton at it's peak to less than $50 a ton.

58

posted on

12/03/2015 9:25:19 AM PST

by

painter

( Isaiah: �Woe to those who call evil good and good evil,")

To: usconservative

The price of gas affects the price of consumer products, as well as the individual transportation costs of consumers.

Other than that, I entirely agree with you.

59

posted on

12/03/2015 9:52:51 AM PST

by

Tax-chick

(Fool me once, shame on you. Fool me twice, shame on me.)

To: usconservative

Do you SERIOUSLY think there's no inflation? We're in a period of deflation. Its one reason why commodity prices are getting crushed. Seniors relying on earnings from interest for their retirement are almost always going to have problems.

60

posted on

12/03/2015 10:00:28 AM PST

by

Mase

(Save me from the people who would save me from myself!)

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-62 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson