Skip to comments.

Chart That Could Decide the 2016 Election And it doesn’t look great for Democrats.

New Republic ^

| November 18, 2015

| David Dayen

Posted on 11/19/2015 4:32:25 AM PST by expat_panama

click here to read article

Navigation: use the links below to view more comments.

first previous 1-20, 21-35 last

To: expat_panama

Chart could decide election.Don't fool yourself. Numbers were very similar in '12 to what we were looking at in 1980 with Carter.

The difference, is that you have a much larger voting populous who are in love with their entitlements. Add another faction of left wing idiots, and the dims have a near lock on the POTUS office.

21

posted on

11/19/2015 8:11:45 AM PST

by

catfish1957

(I display the Confederate Battle Flag with pride in honor of my brave ancestors who fought w/ valor)

To: citizen

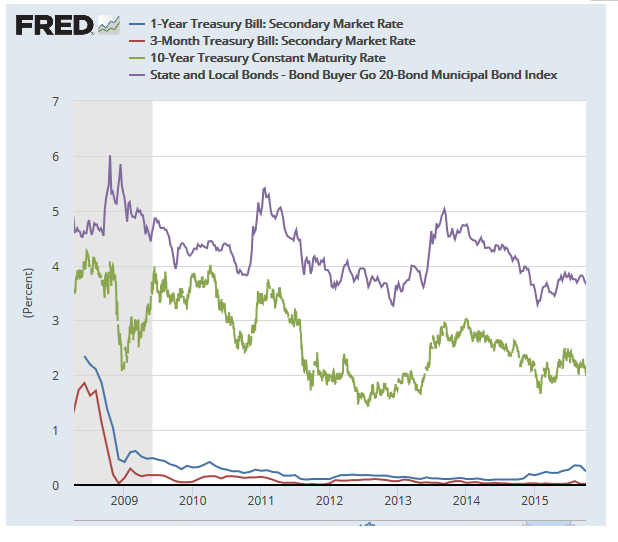

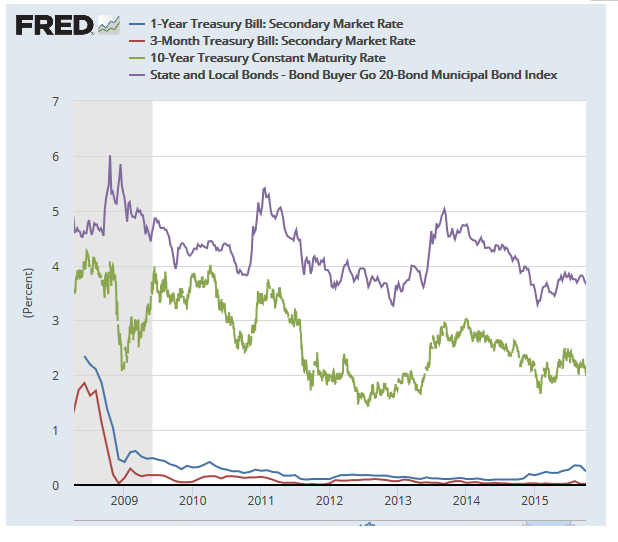

Yields Signal Possible Fed ‘Policy ErrorSomehow Zero hedge is not as easy for me to follow as it is for everyone else. He supports his idea with this plot but he doesn't say where it came from nor just what it's showing, but here are the Tbill rates as determined by the free market:

What we got is that for years now overwhelming supply and demand factors have been forcing rates lower across the board. Anything else is static that we can write off to anything we feel like.

mho...

To: Toddsterpatriot

We’re earning a decent return in our retirement accounts and we aren’t going to draw on them for 4 or 5 more years, but for those who really need everything to be in cash, ZIRP doesn’t help.

23

posted on

11/19/2015 9:51:32 AM PST

by

randita

To: Political Junkie Too

As Dennis Miller used to say, If Obama keeps this up the unemployment rate will be zero-—no one will have a job and no one will be looking!

To: expat_panama

My back of the envelope calc is that government at all levels is about a 40% cost to economy. So you have to earn $1.67 to just get a dollar that then gets taxed at the federal, state and local level.

That’s an enormous economic drag and most of it is unnecessary. If we returned to a pre-Nixon regulatory environment the economy would boom. Just returning to the bad old days of Billy (the accused rapist) Clinton’s regime and we’d be up in the 3-4% real growth range.

It’s as if the President and his staff hated the country and wanted to create misery for us and the world.

25

posted on

11/19/2015 10:59:32 AM PST

by

1010RD

(First, Do No Harm)

To: randita

ZIRP always kills an economy. That’s its history. Think what it does to business investment. We know that it is not the market rate (think supply and demand curves for money). So how do you invest long term knowing that rates aren’t real?

For instance, the rule of thumb in RE is for every 1% uptick in interest rates you have to lower the RE price 10-12% to keep the same payment. Do the calcs yourself to prove it.

So you buy a house for $250K at 4%. Unless inflation kicks in or massive income growth across all incomes, then when you go to sell it and rates are 5% you’ll have to lower the price 10%. You’re literally making yourself poorer.

Chinese and ME money poured into the coastal cities and into Chicago. That’s the bump you’re seeing in RE. Don’t be fooled. That money is a savings account against home country political risk.

Let the market rule and you don’t have this kind of corruption. Actually, free markets kill corruption.

26

posted on

11/19/2015 11:04:57 AM PST

by

1010RD

(First, Do No Harm)

To: randita

for those who really need everything to be in cash, ZIRP doesn’t help.It's not supposed to. Except for the overnight bank rates (to regulate the value of the dollar per Art. I Sect. 8) virtually all other interst rates are set by the free market, and those rates are set for supply and demand; "those who really need" have to check in w/ the county welfare dept.

To: randita

but for those who really need everything to be in cashNowadays, who needs everything in cash?

28

posted on

11/19/2015 12:30:55 PM PST

by

Toddsterpatriot

("Telling the government to lower trade barriers to zero...is government interference" central_va)

To: henkster

There have been a number of months in the last few years where positive economic growth was based entirely on growth of inventories.

The truth is, though, that the US economy is resiliant enough that it takes a really big shock that produces a cascading/ripple effect (massive panic) create obvious problems.

So what we’re seeing here is a slow and creeping burn. Which can be drug out for a long long while. The way this ends will not be with a bang, but a whimper ...

To: Toddsterpatriot

People, who for one reason or another, do not have access to credit or do not want to use credit, but have or anticipate having substantial expenses.

30

posted on

11/19/2015 1:06:49 PM PST

by

randita

To: randita

You can open an Ameritrade account to access higher rate securities, without a credit card.

31

posted on

11/19/2015 1:30:30 PM PST

by

Toddsterpatriot

("Telling the government to lower trade barriers to zero...is government interference" central_va)

To: expat_panama

Somehow Zero hedge is not as easy for me to follow as it is for everyone else.I stopped trying to decipher their gibberish a while ago. Now I just poke fun at their idiocy.

32

posted on

11/19/2015 2:16:17 PM PST

by

Toddsterpatriot

("Telling the government to lower trade barriers to zero...is government interference" central_va)

To: Toddsterpatriot

That approach sure is tempting, but I put in the effort not to smirk just for the sake of not making too many more enemies on the FR than I already have.

To: expat_panama

just for the sake of not making too many more enemies on the FR than I already have.You're a harmless little fuzzball, how could you have any enemies on FR?

34

posted on

11/20/2015 10:40:16 AM PST

by

Toddsterpatriot

("Telling the government to lower trade barriers to zero...is government interference" central_va)

To: Toddsterpatriot

...how could you have any enemies on FR?

Navigation: use the links below to view more comments.

first previous 1-20, 21-35 last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson