To: expat_panama

The “experts” are saying the oil bump is the classic “dead cat bounce.”

Who knows?

But I still have some dry powder in case another buying opportunity presents itself.

25 posted on

02/04/2015 4:09:44 AM PST by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: abb

“experts” are saying the oil bump is the classic “dead cat bounce.”

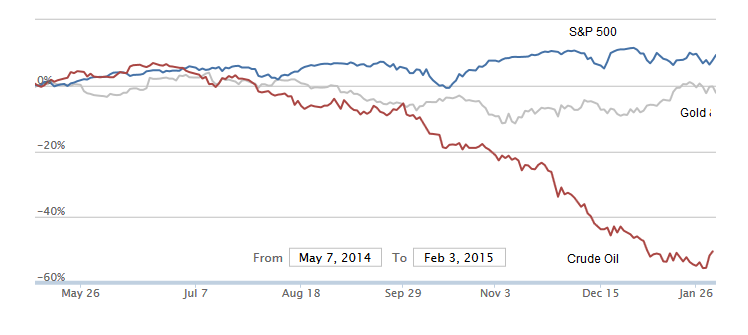

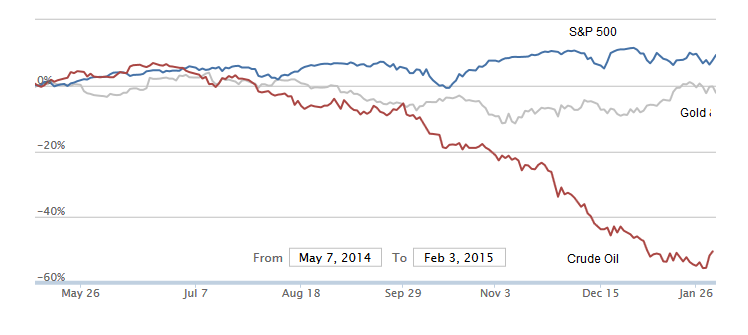

That's what it looks like for price, but a 'DCB' usually shows less volume on the upside than it did before and since I only got price here I can't say. Regardless, while a DCB usually points the way down I've seen more than a few times it led into a bigtime rally...

To: abb; Wyatt's Torch

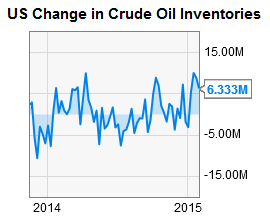

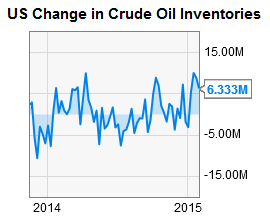

Yesterday we got the

Crude Inventories report for Jan. and it showed another big increase. Problem is that trends in prices and inventories can mean anything we want for the next year or two because the industry takes so long to react --we can't just drill a new well overnight any more than we can quickly get a new job closer to home to use less gas.

So like the first half of 2014 inventories went up and down while the price of oil just went up, and then inventories went up down and up in the other half of 2014 while the price plunged. What I'm getting is that meaningful price trends in oil take decades to set in, and month/year timeframes are just noise static.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson