Calling all tin foil hat members that were warning that the US dollar would be removed as the international trading currency, which would in turn cause a massive unprecedented depression.

How's that working out for you?

1 posted on

11/14/2014 7:14:51 AM PST by

Minsc

Navigation: use the links below to view more comments.

first 1-20, 21-24 next last

To: Minsc

My only question is what stocks, instruments, etc. that Joanna is hawking right now and for whom.

2 posted on

11/14/2014 7:18:52 AM PST by

Gaffer

To: Minsc

I actually googled this “Midwestern girl on the east coast”. You seriously aren’t trying to hold her up as the be-all and end-all authoritative source on finance and world economy are you?

4 posted on

11/14/2014 7:21:18 AM PST by

Gaffer

To: Minsc

It may seem stronger relative to other currencies

But its absolute value, what goods it will actually buy in the marketplace, is less and less every day.

7 posted on

11/14/2014 7:22:54 AM PST by

Iron Munro

(DHS has the same headcount as the US Marine Corps with twice the budget)

To: Minsc

How's that working out for you?Time will tell. For now, this is just the dollar being slower in the race to the bottom than the euro or yen.

8 posted on

11/14/2014 7:24:00 AM PST by

Paine in the Neck

(Socialism consumes EVERYTHING)

To: Minsc

The decrease in oil prices and as a result our decrease in oil imports and increases in our oil exports is making our $ stronger each day. This week, I filled the gas tank on my pickup for $2.85 per gallon. A month ago it was $3.30/gallon, and we thought that was a good price. Every gas tank fill up by an American means more disposable means they get to keep more money in their pocket.

Lower fuel prices can mean lower food prices. We bought our monthly 4 pack of boneless rib eyes at $6.99/ pound this week versus $9.99 last month.

One of the best kept secrets with the crisis in Iraq/Syria/? and other oil producing countries, is how the price of gasoline and oil in America keeps coming down.

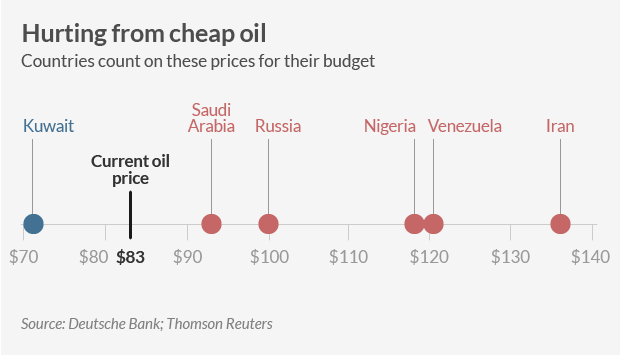

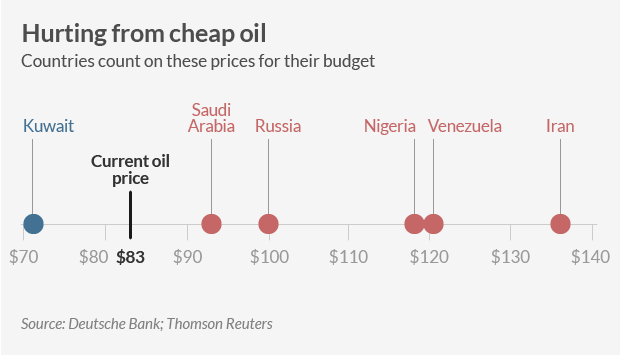

Increased U.S. production is helping to create an oil surplus on world markets, driving down prices despite a myriad of threats to oil supplies, and doing more to crush Russia’s economy than the sanctions imposed by the U.S. and European Union, said Chris Faulkner, chief executive of Breitling Energy.

http://www.washingtontimes.com/news/2014/sep/8/us-oil-surplus-eases-prices-in-global-crises/?page=all

This is also preventing the Opecker Princes from doubling their price on oil to again cause another major economic recession around the world.

The price of oil on the open market is kicking the Opecker Princes, Putin and the thugs in charge of Venezuela really hard below their economic belts.

11 posted on

11/14/2014 7:26:28 AM PST by

Grampa Dave

(The Democrats, who run America are too old, too rich, and too very/very white elitist losers!.)

To: Minsc

Seems to me I've heard a line like that before.

If you strike me down, I shall become more powerful than you could possibly imagine.

13 posted on

11/14/2014 7:27:44 AM PST by

Mastador1

(I'll take a bad dog over a good politician any day!)

To: Minsc

17 posted on

11/14/2014 7:30:20 AM PST by

wastedyears

(I may be stupid, but at least I'm not Darwin Awards stupid.)

To: Minsc

U.S. dollar will "get a lot stronger than anyone can imagine", Despite interference from the 0bama regime, the steady move toward energy independence and away from mideast oil, should be a big boost to the dollar and the economy.

18 posted on

11/14/2014 7:30:49 AM PST by

The Sons of Liberty

(OK. Now How many votes do we need to IMPEACH and REMOVE the bastard?)

To: Minsc

Most currencies are falling rocks. The dollar is just falling slower than the rest.

Or, is this another sign of deflation? There are many.......

19 posted on

11/14/2014 7:33:40 AM PST by

Arlis

To: Minsc

Saying the dollar is getting stronger because Europe is collapsing is like saying a man dying of brain cancer is getting better because everyone else in the room has ebola.

We are Trillions in debt to a Communist dictatorship and that debt is rapidly increasing. The dollar is stage four terminal.

22 posted on

11/14/2014 7:39:29 AM PST by

American in Israel

(A wise man's heart directs him to the right, but the foolish mans heart directs him toward the left.)

To: Minsc

The USD is just the best looking horse in the glue factory right now ... and It’ll look better and better as Europe and Japan fall down... but when they fall and we have no trading partners what will happen then?

To: Minsc

yep......almost all currencies are stable against other currencies ass the dollar rises.

For example the COP was 1785=$1 USD two yrs ago now the COP is 2160 to the USD. But has stayed stable with the EURO.

This doesnt mean all is rosey...we still have huge probs here in the former good ol USofA

25 posted on

11/14/2014 7:48:23 AM PST by

rrrod

(at home in Medellin Colombia)

To: Minsc

Anyone can writer for Yahoo, including you, your grandmother and your liberal neighbor’s illegal gardener.

Get started today and earn a fraction of a penny on every 100 views of your sensationalist garbage. The more outlandish and stupid your article,the more fractions of a penny you can earn.

Remember, you don’t need to know nothin’. Logic and grammar not needed. BS encouraged. Write now for Yahoo!!!

http://www.freedomwithwriting.com/freedom/uncategorized/5-ways-to-make-money-on-yahoo-voices/

To: Minsc

In extremis a unit of currency is worth what the military backing it can say it is worth.

28 posted on

11/14/2014 7:54:39 AM PST by

mrsmith

(Dumb sluts: Lifeblood of the Media, Backbone of the Democrat Party!)

To: Minsc

as long as they’re printing $80b/mon ... the dollar will continue to devalue.

since the dollar isn’t backed by anything, except the good faith of the US govt... an organization that is currently $18 trillion in debt with hundreds of trillions in unfunded liabilities... that ‘good faith’ is faltering

and now we’re seeing moves by various other countries / groups to coin its own money with different backing (gold in some cases).

this will continue to erode the standing of the US dollar unless the debt is dealt with.

29 posted on

11/14/2014 7:58:20 AM PST by

sten

(fighting tyranny never goes out of style)

To: Minsc

Canada and Russia have reached direct currency swap trade agreements with China. The EU is also making agreements with energy-producing countries, including Russia, for direct payment in euros. South America is extending its MERCOSUR agreements to include trade using regional currencies.

The dollar seems strong now, but other countries are slowly moving away from it. Combine that with huge US government and trade deficits, and it’s easy to foresee a weakening dollar.

33 posted on

11/14/2014 8:16:50 AM PST by

VanShuyten

("a shadow...draped nobly in the folds of a gorgeous eloquence.")

To: Minsc

Yeah, I never bought that demise of the dollar stuff.

No matter how badly we keep screwing-up the rest of the planet is far, far worse. So we keep getting an A minus on the curve.

To: Minsc

Seriously? The US dollar will start birthing Skittles any day now!

40 posted on

11/14/2014 8:47:31 AM PST by

GeronL

(Vote for Conservatives not for Republicans)

To: Minsc

The dollar is super strong!!!!!

Yet, groceries are more expensive than ever.

Hmmmm.

Maybe the dollar-hawks are wrong.

44 posted on

11/14/2014 9:21:42 AM PST by

Lazamataz

(Proudly Deciding Female Criminal Guilt By How Hot They Are Since 1999 !)

To: Minsc

Stick around:

Submitted by Charles Hugh-Smith of OfTwoMinds blog,

I have been suggesting for several years that the U.S. Dollar would confound those anticipating its demise by starting a long secular uptrend.

In early September I made the case for a rising U.S. dollar, based on the basic supply and demand for dollars stemming from four dynamics:

-Demand for dollars as reserves

-Other nations devaluing their own currencies to increase exports

-“Flight to safety” from periphery currencies to the reserve currencies

Reduced issuance of dollars due to declining U.S. fiscal deficits and the end of QE (quantitative easing)

http://www.zerohedge.com/news/2014-11-13/why-rising-us-dollar-could-destabilize-global-financial-system

47 posted on

11/14/2014 10:34:12 AM PST by

Para-Ord.45

(Americans, happy in tutelage by the reflection that they have chosen their own dictators.)

Navigation: use the links below to view more comments.

first 1-20, 21-24 next last

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson