The provision to have access to your financial information via Obamacare makes a lot more sense if the Feds are trying to monitor how much more they can squeeze you for...just enough so you can eat a meal a day, afford a car so you can work, and your Obamacare biill

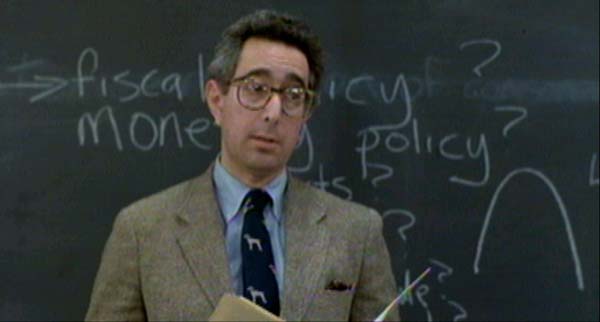

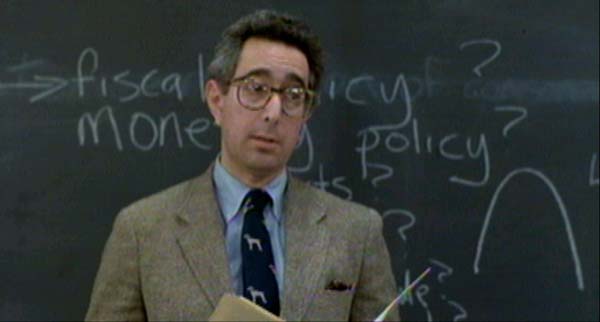

The important point to note about the Laffer Curve is that Conservatives must not fall for the trap it lays for them. We are tempted to want to tweak the tax rate so as to optimize government revenues.

Government exists not to be able to extract the maximum amount of money from its citizens but to achieve the maximum amount of liberty for them. This is the Liberty Curve, where zero government has no liberty due to anarchy and complete government intrusion has no liberty due to tyranny and coercion.

We must strive to use government for its intended purpose, to secure the blessings of liberty for all citizens.

Look up “Rahn Curve”

During the Depression, top tax rates were above 90%. So instead of building a factory and creating jobs, investors put their money into stamp collections, Swiss Bank accounts and other non-productive tax shelters.

Hence the worst year of the Depression was 1937.

We are being given the innovative policies of the 1930s — with similar results.

The Left has never cared about maximizing economic growth or even maximizing tax revenues. When will conservatives stop thinking that Leftists have good intentions but lack sufficient knowledge or good sense.

The Leftists are composed of 3 primary factions economically. There are the exempt super-rich (not the 1%, but the .001%) that are exempt from income taxes because they can shelter their income via off shore corporations, foundations, and various other complex tax shelter schemes not available to medium and small business owners. They also get the government contracts, and special immunity from legislation (0-care, carbon emissions). There is the parasitic government worker class (teachers, bureaucrats, municipal & state workers) that receive overly generous tax free benefits such as pensions & healthcare, and are relatively less affected by higher taxes paid by those making more than $200k. More government means more work & job security. Then there is the welfare class that receives food stamps, EITC, healthcare etc.

The Left needs to destroy their enemy, AKA the productive & innovative sector, to retain political power. Deprive small and medium business of income, and you can destroy their means to fund candidates. Put people out of work, or into part time employment, and you gain more welfare constituents, and those that depend on government programs.