Fed Prez, Richard Fisher's speech in L.A. July 16, 2014:

http://www.dallasfed.org/news/speeches/fisher/2014/fs140716.cfmI spoke of this early in January, referencing various indicia of the effects on financial markets of “the intoxicating brew we (at the Fed) have been pouring.” In another speech, in March, I said that “market distortions and acting on bad incentives are becoming more pervasive” and noted that “we must monitor these indicators very carefully so as to ensure that the ghost of ‘irrational exuberance’ does not haunt us again.” Then again in April, in a speech in Hong Kong, I listed the following as possible signs of exuberance getting wilder still:

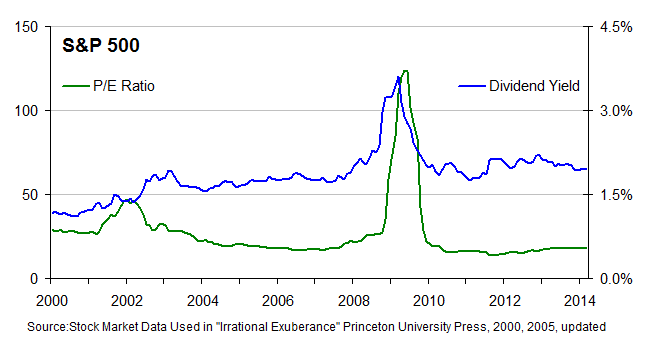

The price-to-earnings, or P/E, ratio for stocks was among the highest decile of reported values since 1881;

The market capitalization of U.S. stocks as a fraction of our economic output was at its highest since the record set in 2000;

Margin debt was setting historic highs;

Junk-bond yields were nearing record lows, and the spread between them and investment-grade yields, which were also near record low nominal levels, were ultra-narrow;

Covenant-lite lending was enjoying a dramatic renaissance;

The price of collectibles, always a sign of too much money chasing too few good investments, was arching skyward.

I concluded then that “the former funds manager in me sees these as yellow lights. The central banker in me is reminded of the mandate to safeguard financial stability.”

From

the speech:

- The price-to-earnings, or P/E, ratio for stocks was among the highest decile of reported values since 1881;

- The market capitalization of U.S. stocks as a fraction of our economic output was at its highest since the record set in 2000;

Here are the PE ratios (along w/ dividend yields) for the S&P 500 from Princeton---

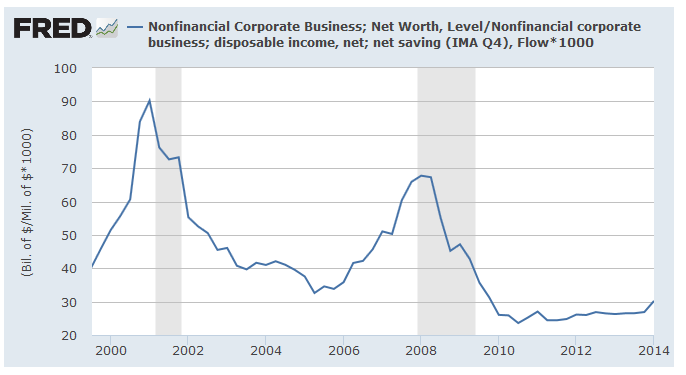

---and here's the total U.S. market cap divided by total US corp profits:

IMHO the numbers just don't support Fisher's claims. FWIW, the phrase "irrational exuberance" is how Sir Alan described stocks in the mid-'90's. When the dot-com bubble finally did come up a half decade later, his big worry by then was (I swear I'm not making this up) Y2K!!