Good question :-) This could be a “good news is bad news” day. Hilsenrath’s comments on the taper likely the key driver. (http://blogs.wsj.com/economics/2014/03/07/hilsenrath-analysis-fed-likely-to-continue-taper-consider-changing-to-forward-guidance/)

Charles Schwab’s take:

Early Employment Enthusiasm Fades

After getting an initial boost from a stronger-than-expected U.S. February nonfarm payroll report, domestic stocks are mixed in late-morning action as the data may be furthering expectations that the Federal Reserve will continue to withdraw its stimulus measures. Meanwhile, Treasuries are seeing solid pressure on the employment report, which is more than offsetting an unexpected widening of the trade deficit. The U.S. dollar is modestly higher and crude oil prices are gaining ground, while gold is trading to the downside. In equity news, Safeway agreed to be acquired by a unit of Cerberus Capital Management for about $9.0 billion, while Foot Locker topped the Street’s profit expectations. Overseas, Asian stocks finished mixed in cautious trading ahead of the U.S. jobs report, while European equities have moved back below the unchanged mark after a brief boost from the employment data on the other side of the pond.

Zero Hedge’s take:

Having heard the great and good declare this morning’s “beat” on the headline NFP data as indicative of 1) the recovery is awesome; 2) the reason why stocks have been rallying; and 3) the recovery is awesome... it appears between a rising unemployment rate, tumbling average hourly earnings, and Gazprom’s threat in Europe, stocks are taking this “good news” as “bad news.” Confirmed by Hilsenrath that the taper is on - which is what bonds, gold, and the dollar appeared to be saying - the S&P 500 having spiked 10 points is now 13 points off its highs and in the red for the day...

Payroll employment is getting very close to the pre-recession peak.

Of course this doesn't include population growth and new entrants into the workforce (the workforce has continued to grow), but reaching new highs in employment will be a significant milestone in the recovery.

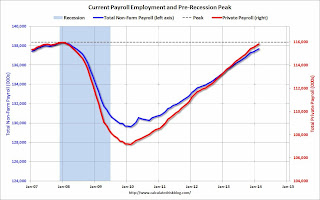

The graph below shows both total non-farm payroll (blue, left axis) and private payroll (red, right axis) since January 2007. Both total non-farm and private payroll employment peaked in January 2008.

The dashed line is the pre-recession peak.

The pre-recession peak for total non-farm payroll employment was 138.365 million. Currently there are 137.699 million total non-farm payroll jobs, or 666 thousand fewer than the pre-recession peak.

At the recent annual pace (about 2.2 million jobs added per year), total non-farm payroll will be at a new high in June 2014.

The pre-recession peak for private payroll employment was 115.977 million. Currently there are 115.848 million total non-farm payroll jobs, or 129 thousand fewer than the pre-recession peak. It seems likely private sector employment that will be at a new high in March.

Read more at http://www.calculatedriskblog.com/2014/03/when-will-payroll-employment-exceed-pre.html#syPMCo7EpBR2qO2D.99

Some interesting data:

Federal government reached their lowest level since the mid-1960's

Meanwhile State and Local Employees appears to have bottomed: