Posted on 01/05/2014 6:35:47 AM PST by Kaslin

America desperately needs genuine entitlement reform to avoid a Greek-style fiscal future.

The biggest problems are the health entitlements such as Medicare, Medicaid, and Obamacare, but Social Security also has a huge long-run fiscal shortfall.

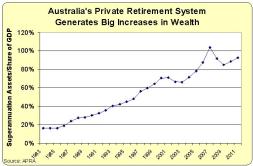

That’s why I’m a big fan of the very successful reforms in places such as Chile and Australia, where personal accounts are producing big benefits for workers.  These systems also boost national economies since they generate higher savings rather than added unfunded liabilities.

These systems also boost national economies since they generate higher savings rather than added unfunded liabilities.

And I’m very happy that we now have more than 30 nations with personal accounts, even tiny little jurisdictions such as the Faroe Islands.

But many statists object to reform, presumably because they don’t want workers to become capitalists. They apparently prefer to make people dependent on government.

Not all leftists take that narrow and cramped approach, however. Some academics at Boston College, for instance, produced some research showing some big benefits from Australia’s private Social Security system.

And new we have some remarkable admissions about how minorities are net losers from Social Security in a study from the left-leaning Urban Institute.

We use historical and projected data from 1970 to 2040 to measure the ratio of old age, survivors, and disability insurance (OASDI) benefits received to taxes paid by members of each race or ethnicity each year. This measure captures the transfers that occur in a given year from current workers to current beneficiaries of each group. We then examine benefit-tax ratios for each race or ethnicity into the future to determine how these redistributions will play out in the coming years. Our conclusion: When considered across many decades—historically, currently, and in the near future—Social Security redistributes from Hispanics, blacks, and other people of color to whites.

Why does the program have this perverse form of redistribution?

On average, blacks are more likely to be low income and short lived and are less likely to marry than whites. …Given this, one would expect forced annuitization and auxiliary benefits related to marriage and divorce to redistribute from blacks to whites.

And that’s exactly what the research found.

…whites have clearly received a disproportionate share of benefits relative to the taxes that they pay in at a point in time. Their benefit-to-tax ratio has been higher than that of blacks, Hispanics, and other ethnic groups for as long as the system has existed, while projections continue that trend at least for decades to come.

Here’s a chart from the study showing how different races have fared in terms of taxes paid and benefits received.

In other words, if folks on the left really cared about minorities, they would be among the biggest advocates of genuine reform.

By the way, it’s also worth noting that Social Security is a bad deal for everyone. The Urban Institute study simply investigates who loses the most.

And the system is getting worse for every new generation.

Recent studies have also documented how different generations are treated within Social Security, with succeeding generations achieving successively lower “returns” on their contributions.

This helps explain why the evidence shows personal retirement accounts are superior – even for folks who would have retired at the peak of the recent financial crisis.

Here’s my video on why we should replace the bankrupt tax-and-transfer Social Security system with personal retirement accounts.

P.S. You can enjoy some Social Security cartoons here, here, and here. And we also have a Social Security joke, though it’s not overly funny when you realize it’s a depiction of reality.

P.P.S. Thanks to Social Security, I made a $16 trillion mistake in a TV debate. Fortunately, it didn’t really change the outcome since I was understating the fiscal shortfall of the current system.

As if an automatic communist governance was not tyranical, gay and inherently unilateralist racist and prosecutorial...

People never learn.welcome to militarization of society and police. You all are now incorporated, gay mariage contract style.

The Social Security system can not sustain the corrupt political system that uses it for a slush fund. Put back the $13.4T and it will survive greatly.

Good. They helped put this bastard in office, just like the juveniles who swallowed his bull crap.

Medicare, Medicaid, Welfare, Social Security, and Obamacare all need to be abolished.

The SS joke about the dead donkey reminds me of a firm I know that does not bill by the hour but takes a substantial retainer and considers it a flat fee. They do very little work. Occasionally a client will complain and then they refund the retainer. They claim to make a lot of money,

the bastard is in office because too many republicans simply refused to vote!

That was because the GOP elite gave us a candidate 70% of us didnt even want, let alone 100% of our opponents

“Frontrunner” Mitt was hailed as the leader from day 1 and they just systematically destroyed anyone else who wON primaries against him.

If you recall, he LOST every primary in the beginning. AND if you consider he never got over 30% he LOST every primary.

70% of the GOP voters wanted someone else- but it was divided among too many. The GOP should vote and vote again until someone achieves 50%

The answer to solving the problems could not be more simple.

First TERM LIMITS.

Next-Mandatory health savings accounts starting when first employment begins

Finally-Private SS accounts in the name of the citizen with all SS contributions going in the account. Since it is owned by the individual he passes it along to his family and the government gets squat.

What is lacking is not the solution to these problems but finding politicians with the stones to do anything other than figure ways to get themselves re elected. Term limits will solve that problem and free them up to MAYBE do the right thing.

“Medicare, Medicaid, Welfare, Social Security, and Obamacare all need to be abolished.”

I turn 63 this year, and I have no problem with Medicaid, Welfare, and even Medicare being abolished (though I have paid into these programs pretty much my entire working life: I was 16 when such taxes started being taken out of my paycheck).

However, I am adamantly opposed to getting stiffed on Social Security. Hell, I’d be happy to just get back, in cash, the full amount I have paid into the f***ing system since I was 16 (which is well into the six figures), and I won’t even demand any interest. I mean, I’d be willing to forego what amounts to a lifetime annuity, which — if I live long enough — would pay out more than I put in. Is that okay with you?

Great, you didn’t like the candidate so you in effect took your ball and went home....right?

So how are you feeling about the winner of the election? Tell us all how you think we are better off with the disaster in the WH than we would have been with Romney, as imperfect as he is to all of us here?

If you put into SS “well into 6 figures” and expect to get it back, think again. If you collect at age 65 about $25,000 annually and live to be about 83 you will get back $425,000 which is not imo “well into 6 figures.

I do agree private accounts are the way to go.

Why is it that women and minorities are always incapable of taking care of themselves?

That too!!!

As far as women, let’s not forget that the norm for centuries was for women to stay home and raise the children and take care of the home. Men were the bread-winners. This was the norm until 60’s....then women started to work outside the home..resulting in two income families..

Then we have Men, who left their wives, who had no “skills”....leaving them to find babysitters to care of their children so they could go and get a job to provide for themselves. Fast forward, you have millions of single women with children from men who don’t pay child support or the women refuse to name the father of their children so they can collect Medicaid. If you name the father, Medicaid attempts to collect from the Fathers...

It is now the cool norm to be single and pregnant...

The Feministas are now rapant in our country....replacing the white working male who now is a metrosexual who stays at home with the kids....

I am thinking of retiring this year, I turn 55 and an access my 403b without penalty because of IRS rule that in the year you turn 55 or after and are eligible to retire from your employer you won’t be penalized for early withdrawal.

I would take a lump sum benefit. I am terrified the government will seize 401k’s, 403b’s, etc and replace it with a monthly benefit (which Dems have discussed)...

Any one else do this? pro’s, con’s?

Where did you get the $13.4 T from?

Even if the SSTF contained cash instead of $2.4 trillion in interest bearing, non-market T-bills, SS would still go broke. It is not sustainable from an actuarial standpoint. You must either cut benefits or increase taxes or some combination thereof to keep it going.

SS is a pay as you go system. Today's workers pay for today's retirees. SS has been running in the red since 2010.

Source: CBO “Combined OASDI Trust Funds; January 2011 Baseline” 26 Jan 2011.

Note: See “Primary Surplus” line (which is negative, indicating a deficit)

A radio talk show on KOA I think said it. JFK was the first to break the piggy bank and remove monies and leave an IOU. When all the IOUs are added up it comes to $13.4T.

you are correct! which brings us to how do we stop that from happening again ...the press dictating who we should vote for

You made my point. Just give me back what I put into it and I’ll call it even.

I, too, think private accounts are the way to. But don’t stiff those of us who have paid into SS our entire working lives, and just when we get to see some of it, take it away from us. Hence, my proposition to just give me back what I paid into it, and not stiff me, and I’ll call it even.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.