Posted on 10/30/2013 8:04:51 AM PDT by thackney

In the early days of the Eagle Ford Shale, one of Petrohawk’s wells in McMullen County came in big.

It was the fall of 2009 and about a year after the company had announced its first successful well in neighboring La Salle County, setting off a mineral-leasing frenzy that swept across South Texas like a vast dust devil.

Petrohawk’s McMullen County well had initial production of 1.39 million cubic feet of gas per month.

By October 2010, the Petrohawk well was making 24 million cubic feet of gas per month.

This year, the same well is making around 8.9 million cubic feet of gas, according to the Texas Railroad Commission.

Companies have since switched to hunting crude oil, but the huge drop off in Eagle Ford well production hasn’t changed.

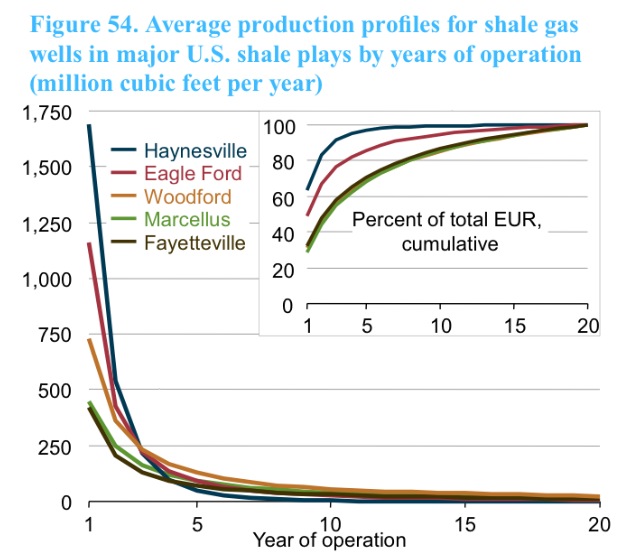

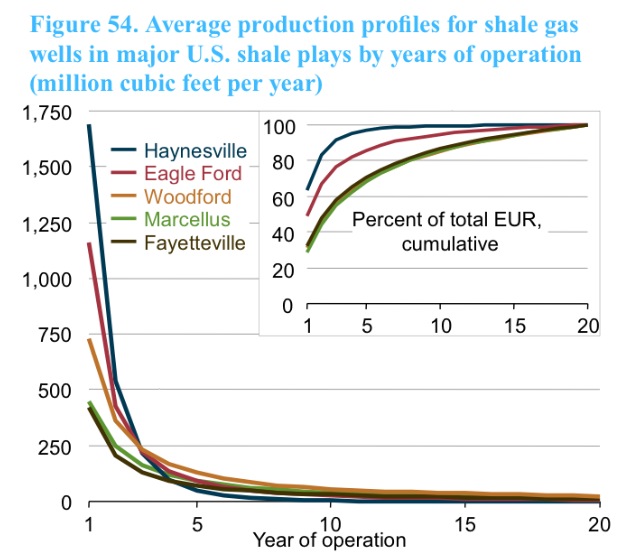

Eagle Ford wells come in producing large amounts of oil or gas, but drop like a roller coaster after a year — a more than 60 percent dip that experts say is inherent to shale production.

That sharp decline is one of the reasons — along with high profits — that tens of thousands of wells are predicted for South Texas: Companies must keep drilling to keep replacing their production.

It’s called the Red Queen, named after the character in Lewis Carroll’s “Through the Looking-Glass” who tells Alice she must run, “Faster! Faster!”

“Now, here, you see, it takes all the running you can do, to keep in the same place,” the Red Queen says. “If you want to get somewhere else, you must run at least twice as fast as that!”

Fred Wang, research scientist with the Bureau of Economic Geology at the University of Texas at Austin, said a 60- to 80 percent decline curve is simply characteristic of shale, a tight rock that requires hydraulic fracturing to produce oil and gas. Fracturing pumps a mix of water and chemicals at high pressure to break the rock. Then sand is added to the fluid in increasing amounts to hold open the rock fissures, letting oil and gas flow up the well to the surface.

“These decline curves are normal. You can’t do anything about it,” Wang said. “You have to drill. There’s no other choice. You’ve got to keep drilling.”

Decline rates vary based on the quality of the rock, the effectiveness of the frac and the production rate, Wang said. Most companies now “choke down” a well, reducing the initial flow rate. It may help improve ultimate recovery from the well, and also makes it easier for companies to deal with transportation issues such as pipelines that aren’t yet connected.

“In the beginning of a shale development, company operators like to use large choke size. You can report really large production. It’s good for the stock; it’s not good for ultimate recovery,” Wang said. “These days, people try to choke down the size a little bit.”

Companies have to find the balance between making money upfront or over time.

Phani Gadde, a U.S. shale analyst with Wood Mackenzie in Houston, said most Eagle Ford wells drop off between 70 and 80 percent in the first year. And while there’s well-by-well variation in South Texas and within every shale field, no place is immune to a steep decline curve.

“Typically, beyond the second year, they really start to flatten out,” Gadde said. “The idea is these wells will live on for at least two to three decades.”

Gadde said the theory is that choking a well could improve long-term recovery between 10 and 15 percent over a 30-year period. “If you let a well flow at its full potential, the high pressure drops can damage the well itself,” he said.

Operators that want immediate cash flow don’t choke their wells and are the ones that report the biggest initial rates of production, often reporting wells that come in at thousands of barrels per day. Others, such as BHP Billiton or ConocoPhillips, “won’t make the headlines” because they’re concerned with long-term production, Gadde said. They choke their wells.

Some see the decline rates as a fatal flaw of shale fields.

A February report from the Post-Carbon Institute said the Eagle Ford and North Dakota’s Bakken Shale would be part of a 10-year shale bubble.

“The U.S. cannot drill and frack its way to ‘energy independence.’ At best, shale gas, tight oil, tar sands, and other unconventional resources provide a temporary reprieve from having to deal with the real problems: fossil fuels are finite, and production of new fossil fuel resources tends to be increasingly expensive and environmentally damaging,” the report said.

It estimated that more than 6,000 U.S. wells would be needed each year to offset declines, at an annual cost of $35 billion, including more than 1,500 wells in the Eagle Ford and Bakken.

Gadde said he sees the decline curves as a fact of production that companies are dealing with by getting more cost efficient and faster.

“It’s a different resource than what we’re used to,” Gadde said. “It’s a different paradigm. We have to drill more wells than we were used to drilling in the past.”

More than 11,100 wells have been permitted in the Eagle Ford since 2008, but the research firm DrillingInfo estimates there are around 85,000 more wells left to drill in the field.

The Red Queen isn’t unique to shale. All oil and gas wells, including conventional ones that don’t require fracturing, decline over time.

Allen Gilmer, chairman and CEO of DrillingInfo, said that companies have to improve their production with more efficient operations or by adding crews and equipment.

“Unconventionals a have higher initial declines but much longer tails,” Gilmer said. “And there are tens to hundreds of thousands of these.”

Eagle Ford drillers have started 3,266 new wells so far this year, according to the latest Baker Hughes Well Count.

“These wells can produce 30 to 40 years,” Wang said. “They taper for a long, long time.”

I was SURE this article would have been about Michelle Obama or HRC.

Really?

I thought the major source is plate tectonics. Of course the sustainable rate could be lower than the current take rate, but who really has an accurate handle on it?.

All oil and gas commercial production is in sedimentary basins. They are sourced to ancient ocean, lake and river bottoms where organics like algae and plankton were trapped in sediment away from a source of oxygen to complete decomposition. Heat becomes an issue and fields are describe in terms of "thermally mature". More heat and time takes the breakdown further creating more smaller hydrocarbon molecules like propane, ethane & methane. Less thermally mature fields have more heavies like bitumen.

Places in the world with essentially no sedimentary basin but with lots of mantle activity pushing up from underneath have little to no oil gas fields fields, like Hawaii.

I once did the math here on Free Republic. If the current consumption rate of oil was the production rate of crude oil for 400 million years, it would cover the earth 6 miles thick.

It was the fall of 2009 and about a year after the company had announced its first successful well in neighboring La Salle County, setting off a mineral-leasing frenzy that swept across South Texas like a vast dust devil.

Petrohawk’s McMullen County well had initial production of 1.39 million cubic feet of gas per month.

By October 2010, the Petrohawk well was making 24 million cubic feet of gas per month.

This year, the same well is making around 8.9 million cubic feet of gas, according to the Texas Railroad Commission.

‘’’’’’’’’’’’’’’’’’’’’’’’

ah now here is an apples to apples comparison for the “beast” of the niabrara of western colorado drilled by WPX. Here’s what they say about their beast natural gas well:

WPX drilled a well in the Niobrara shale that produces so much natural gas it is being called the ‘beast.’ The well in western Colorado produced an initial high of 16 MMcf/d and averaged an incredible 12 MMcf/d over the first 30 days. In total, the beast generated 1.4 Bcf in the first 180 days. After eight months, it was still generating an amazing 4.4 MMcf/d. The discovery was so massive that the CEO made claims that the potential existed to more than double their current 18 Tcfe of 3P reserves. The company has over 4.6 Tcfe of proved reserves on 1.6 million acres.

http://www.fool.com/investing/general/2013/10/18/the-stock-to-gain-from-the-niobrara-beast.aspx

,,,,,,,,,,,,,

It appears the beast has very high production rates —at least by eagle ford standards.

I don’t know what industry standards are

Comparing the highest producing individual well of a field, to the average of another, is not an apples-to-apples comparison.

That has to do with the fact that sedimentary rock is porous and it accumulates there from below. It isn’t that it is necessarily created there.

And of course, hydrocarbon oceans are found on other planets that had no records of Dinosaurs and forests.

Hydrogen and carbon are 2 of the top 4 elements found in the universe. They readily combine. And we are told to believe that on earth they cannot possibly come from down deep. Finding gas and oil in sedimentary formations, and saying it must form there naturally, is like seeing people getting off airliners and deciding that airliners create people.

The fact that a hot deep earth theory would still predict that we would find the oil and gas where we do, negates the Hawaii point.

can you show an apples to apples comparison?

I do not know a way to search for the best wells of individuals fields, for the first months of their production.

Nor do I believe that an individual well is indicative of an entire field.

And when an individual company assigns emotional names to a well for their press release, I view it as an unusual result compared to their other wells, with an attempt to bump up the stock price.

If I owned such a well, in a relatively new field with little build-out of facilities, I would be keeping my mouth shut while I bought up every available lease before the word got out.

One well does not make a field.

Hawaii is a red herring. Hawaii is the tallest mountain on earth. It’s a 33,000 foot volcano of which about 13,000 stands above the water. It would be bizzare for oil and gas to have ever accumulated there from activites below the plates. Nobody would be surprised to not find oil and gas fields in the top 30% of Mount Everest.

btw I saw your post on drilling in the gulf of mexico. It looked like the fields there would be adding another 200k-300k barrels@ day of oil production in each year of 2014-2015.

does that sound about right to you.

I’m thinking that the Nibrara and the Woodford cana shales might together add another 100k@day of oil production in each of the years 2014-2015.

Does that sound about right to you?

The Niobrara: Who,

What and Where

http://www.sipeshouston.org/presentations/niobrarawilliams.pdf

Why is it always found in places that accumulate sediment from above and often away from the edges of the tectonic plates?

Nobody would be surprised to not find oil and gas fields in the top 30% of Mount Everest.

If that is not a sedimentary basin from prehistoric times, I would agree.

EIA expects U.S. crude oil production to rise from an average of 6.5 million bbl/d in 2012 to 7.5 million bbl/d in 2013 and 8.5 million bbl/d in 2014. The continued focus on drilling in tight oil plays in the onshore Williston, Western Gulf, and Permian basins is expected to account for the bulk of forecast production growth over the next two years. Offshore production from the Gulf of Mexico is forecast to average 1.3 million bbl/d in 2013 and 1.4 million bbl/d in 2014.

http://www.eia.gov/forecasts/steo/report/us_oil.cfm

What’s got people thinking about possible non biological sources of carbon energies is that there are methane and ethane clouds on places like Titan—one of jupiter’s moons.

The atmosphere of Titan is largely composed of nitrogen; minor components lead to the formation of methane and ethane clouds and nitrogen-rich organic smog. The climate—including wind and rain—creates surface features similar to those of Earth, such as dunes, rivers, lakes and seas (probably of liquid methane and ethane), and deltas, and is dominated by seasonal weather patterns as on Earth. With its liquids (both surface and subsurface) and robust nitrogen atmosphere, Titan’s methane cycle is viewed as an analogy to Earth’s water cycle, although at a much lower temperature.http://en.wikipedia.org/wiki/Titan_%28moon%29

...............

As well, there are artificial ways these days to make gasoline from CO2 — without using algae or bacteria,

................

I have no strong opinion on this. For now I tend to believe that oil in the ground came from dead plants and animals of earlier epochs. but evidence suggests there’s more than one way to skin a cat and more than one way to make gasoline. whether that’s in fact what happened is another matter.

mitigating the red queen effect is the accelerating speed & falling costs at which they can drill wells and the rising projected addressable oil inventories available in the oil fields. ... as well as the longer tails of the fracked wells.

Carbon and Hydrogen atoms in a non-oxygen atmosphere would eventual equalize at the lowest energy state. Without oxygen, that would be methane, ethane and the like depending on the ratio of atoms.

If a planet/moon has hydrogen and carbon and little to no oxygen, I would be surprised to find it wasn't methane and ethane.

If the Titan has iron, will you be surprised there is no rust, iron oxide?

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.