Skip to comments.

Daily investment & finance thread (TUESDAY 5-4-13 edition)

5-4-13

Posted on 06/03/2013 6:50:26 PM PDT by dennisw

Edited on 06/04/2013 10:48:51 AM PDT by Admin Moderator.

[history]

Daily investment & finance thread (TUESDAY 5-4-13 edition) ----

Trying to focus on the markets for today and each day and the economic news

This is where you can exchange some investment opinions and advice

If you see another FR economic thread you like and want to link to it here, please do

Post your favorite economic site links. Your favorite economic blogs and precious metals blogs and sites

Ping list -- on or off let me know here or via freep-mail. If I missed you then Freep-mail me

I might ping you to other interesting economic threads a few times a week. One per day maybe

Sites that posters have recommended ------

hot stuff here Rush Limbaugh quotes them sometimes

http://www.zerohedge.com

Precious Metals

http://www.tfmetalsreport.com

http://www.Apmex.com

The Markets....

http://seekingalpha.com/

http://www.dailystocks.com/

http://www.gainerstoday.com/

http://www.gainerstoday.com/

http://www.realclearmarkets.com/

http://247wallst.com/

http://www.decisionmoose.com/

http://www.market-ticker.org/

Dividends...

http://dividendsvalue.com/

http://www.dividends4life.com/

http://www.dividendyieldhunter.com/

http://www.dividendstocksonline.com/

http://www.dividenddetective.com/

http://dividendstocks4income.com/

http://www.dividendgrowthinvestor.com/

“Drip-ing”...

http://dripinvesting.org/tools/tools.asp

CPA’s....

http://www.aicpa.org

Gold, Out of the Box Thinking etc...

http://www.davejanda.com/

https://www.everbank.com/

http://dailypfennig.com/

http://theeconomiccollapseblog.com/

http://globaleconomicanalysis.blogspot.com/

http://www.marketoracle.co.uk/

Oil and Gas Industry

http://fuelfix.com/

http://www.theoildrum.com/

http://www.petroleumnews.com/cgi-bin/start.cgi/homeauto.html

Treasury Basics..

http://www.treasurydirect.gov/BC/SBCPrice

TOPICS: Business/Economy

KEYWORDS: dfi

1

posted on

06/03/2013 6:50:26 PM PDT

by

dennisw

To: chuckles; Diana in Wisconsin; Boogieman; BipolarBob; yldstrk; nodakkid; Aquamarine; BenLurkin; ...

2

posted on

06/03/2013 6:51:24 PM PDT

by

dennisw

(too much of a good thing is a bad thing - Joe Pine)

To: dennisw

When I post articles my only real alternative is to use the News/Activism link. Is it poosible when I get to that page, we add a “Business/Economy” selection?

3

posted on

06/03/2013 7:00:42 PM PDT

by

TexGrill

(Don't mess with Texas)

To: dennisw

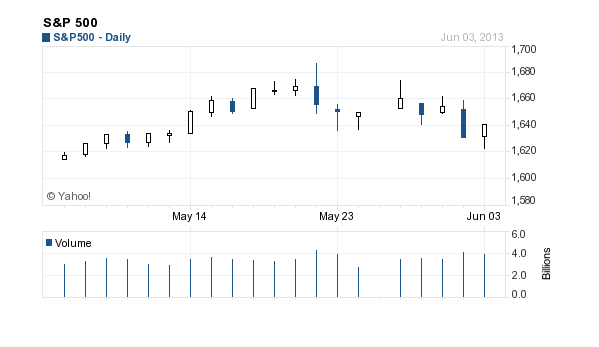

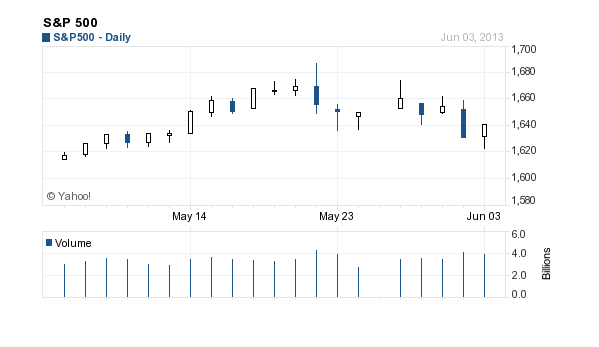

In my unsupported, shallow, and ignorant opinion....the market has seen its’ high for the year.

4

posted on

06/03/2013 7:28:31 PM PDT

by

Attention Surplus Disorder

(This stuff we're going through now, this is nothing compared to the middle ages.)

To: dennisw

5

posted on

06/03/2013 7:51:25 PM PDT

by

A.A. Cunningham

(Barry Soetoro can't pass E-verify)

To: Attention Surplus Disorder

In my unsupported, shallow, and ignorant opinion....the market has seen its’ high for the year.The opinion's ok, but if you think it needs more support, depth, and info then how about this:

--institutions have begun a heavy sell off,

--IBD switched views from 'confirmed rally' to 'market under pressure',

--the current aging rally is marked with new highs with lower volume while price dips show volume surges.

Now you can say your opinion is supported in depth and informed, although we still don't know for sure what's happening next...

To: expat_panama

“we still don’t know for sure”

No, of course we never do. To be sure; though....

There is STILL no place else to go than stocks...and the direction of rates, esp the TNX, make munis look bad, make junk debt look bad (see: IQI, HYG)

And so...will they make 4% yielding stocks also look bad..?

Corpses who claimed “it can’t go any higher” abound.

It looked this way at the onset of all prior correction in this rally, and most of them were a piddly 2-3%..you were VERY well paid for sitting with a little tummy problem.

OTOH, fundys do not look that great, drop in lumber prices, no real improvement in housing, etc.

Question is, do we get that “coyote over the cliff” moment when we look down and see nothing but air while dancing out on an imaginary platform of deteriorating macro?

This is a data-heavy week. But, I’ll stick w/my stmt without trying to beat anyone over the head with it.

7

posted on

06/04/2013 6:15:50 AM PDT

by

Attention Surplus Disorder

(This stuff we're going through now, this is nothing compared to the middle ages.)

To: expat_panama

” —institutions have begun a heavy sell off,”

Who were the buyers? Heavy sell offs require buyers.

8

posted on

06/04/2013 10:19:12 AM PDT

by

Lurkina.n.Learnin

(President Obma; The Slumlord of the Rentseekers)

To: Lurkina.n.Learnin

Who were the buyers? Heavy sell offs require buyers.Excellent point --I have to laugh when I hear people talk about stuff like "too much selling & not enough buying" as if there could be one without the other. What we got is that prices have been falling w/ increased volume---

---and since most stocks are owned by institutions (even though most trades are executed by individuals) it usually means big institutional investors have decided to sell holdings to individuals or smaller firms. That's hard to do, it takes a long series of sales to finish off a big position so it means the drop we got has more to come later.

To: expat_panama

That makes sense. I always scratch my head when they talk about “everybody “ is running for the door. Everybody isn’t possible.

10

posted on

06/04/2013 11:52:37 AM PDT

by

Lurkina.n.Learnin

(President Obma; The Slumlord of the Rentseekers)

To: Lurkina.n.Learnin

It points out another myth we hear a lot about how the little guy doesn’t stand a chance against the big guy. Hogwash.

When a stock sours the little guy dumps in the blink of an eye while the dinosaur has to work on it for days. Used to be that the big time trader had an economy of scale, he could hire a staff of researchers or pay for an expensive telecom line. We’re now in the info age where that advantage is now open to all.

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson