Posted on 05/06/2013 4:29:48 AM PDT by dennisw

Daily investment & finance thread (5-6-13 edition) ---- Freepers lets make some cash

Trying to focus on the markets for today and each day and the economic news

This is where you can impart some investment wisdom to your fellow freepers.

You can complain about the big one that got away.

How Obama is out to wreck American capitalism.

If you see another FR economic thread you like and want to link to it here, please do

Post your favorite economic site links. Your favorite economic blogs and precious metals blogs and sites

Apmex.com is a solid place with good reputation to buy precious metals and has great presence on ebay for easy quick impulse buys such as a gift for a college boy's graduation. College Girls too! Even high school.

Kitco is the best site for gold and silver charts and other precious metals information

Ping list -- on or off let me know here or via freep-mail. If I missed you then Freep-mail me

I might ping you to other interesting economic threads a few times a week. One per day maybe

Sites that posters have recommended ------

hot stuff here Rush Limbaugh quotes them sometimes

http://www.zerohedge.com

Precious Metals

http://www.tfmetalsreport.com

http://www.Apmex.com

The Markets....

http://seekingalpha.com/

http://www.dailystocks.com/

http://www.gainerstoday.com/

http://www.gainerstoday.com/

http://www.realclearmarkets.com/

http://247wallst.com/

http://www.decisionmoose.com/

http://www.market-ticker.org/

Dividends...

http://dividendsvalue.com/

http://www.dividends4life.com/

http://www.dividendyieldhunter.com/

http://www.dividendstocksonline.com/

http://www.dividenddetective.com/

http://dividendstocks4income.com/

http://www.dividendgrowthinvestor.com/

“Drip-ing”...

http://dripinvesting.org/tools/tools.asp

CPA’s....

http://www.aicpa.org

Gold, Out of the Box Thinking etc...

http://www.davejanda.com/

https://www.everbank.com/

http://dailypfennig.com/

http://theeconomiccollapseblog.com/

http://globaleconomicanalysis.blogspot.com/

http://www.marketoracle.co.uk/

Oil and Gas Industry

http://fuelfix.com/

http://www.theoildrum.com/

http://www.petroleumnews.com/cgi-bin/start.cgi/homeauto.html

Treasury Basics..

http://www.treasurydirect.gov/BC/SBCPrice

ping

Thanks very useful>>>> http://www.barchart.com/commodityfutures/Metals?disp_hm=true

Live chart seems to me

Ahead of the Bell: Dow futures are trading down 2 points and S&P futures are trading down 2 points. Sluggish growth in China and weak private sector activity from the euro zone are forcing investors to take a pause after the major indices hit all-time highs in the previous trading session. China’s service sector shows decline, following disappointing manufacturing data last week. A survey showed euro zone private sector activity fell again in April, signaling that the 17-member bloc is falling deeper into a recession. Germany, which is the region’s strongest member, is suffering contraction in business activity which has plagued other member states like Italy, Spain and France.

• On the economic calendar today, no reports are due. The dollar is up against the euro and down against the British pound and Japanese yen. Gold is trading at $1,475. Crude oil is currently trading at $96 a barrel.

• Last week, stocks rose sharply as the bulls came roaring back to the equity markets buoyed by better than expected jobs data and central bank action. With no other better alternative to put their money, investors are starting to jump back into the equity market. The blue chip index crossed the 15K mark for first time and the broader S&P 500 index broke through the 1600 resistance level. For the week, the Dow climbed 1.8% and the S&P 500 rose 2%. The economic data for the week was better than expected led by the April employment reports which was better than forecasted, while the unemployment rate ticked down slightly to 7.5% from 7.6%. However, the February and March employment reports were revised upwards, showing significantly much more jobs were created during those months. The weekly jobless claims data fell to a five year low as fewer Americans filed for unemployment benefits. The S&P Case Shiller index showed, home prices rose in February and consumer confidence climbed in April. The Federal Reserve concluded its two-day meeting and said it could expand its bond purchasing program if required. The ECB cut its benchmark interest rates for the first time in 10 months amid dismal economic data from the euro zone. Frist quarter earnings season is on the final leg; thus far about 403 or about 81% of the S&P 500 companies have reported first quarter results and 47% have beaten estimates on revenues, while about 73% have beaten estimates on earnings.

• The week ahead; with limited economic data, the tail end of first quarter earnings season, and the momentum from the previous week with backing from global central banks, stocks are expected to continue the rally. This week, the economic calendar is light with a few notable reports on tap, such as consumer sentiment, wholesale inventories, and weekly jobless claims. The claims data in particular will be in focus, as recent trends have shown the number of Americans filing for unemployment benefits has been declining. Earnings season is in the home stretch; some companies reporting earnings this week include Disney, Tyson Foods, Dean Foods, Electronics Arts, Whole Foods, and Priceline. According to Thompson Reuters, corporate earnings have improved from earlier expectations, with forecasted earnings growth now at 5.2%, up from 1.5% at the beginning of earnings season.

• On CNBC today, investor Warren Buffett, talked about how business is doing, the board, succession planning, and investments. Buffett said the insurance business is doing very well, Geico insurance is having a phenomenal year, and he hopes it continues. He still thinks the airline business is a challenge and at the end of the day an airline seat is a commodity, although consolidation is helping the industry somewhat. According to Buffett, Berkshire has been adding a terrific group of younger directors. He looks for directors who understand the company’s businesses and management. On succession planning, Buffett hinted that on Berkshire’s board, there are three potential candidates who could replace him. He likes to invest in stocks rather than bonds, although someday bonds will yield more than they do now, but he is not sure when. Right now bonds are not a great investment. He is confident in his investments in IBM and Coca-Cola.

• Iron Man 3 was the top movie at the box office this past weekend.

• Orb won the 139th running of the Kentucky Derby on Saturday, the first leg of the Triple Crown.

• Happy Monday and have a wonderful week!

Friday’s Close

DJIA up 142.38 pts/+0.96%/ 14,973.96

S&P up 16.83 pts/+1.05%/ 1,614.42

Nasdaq up 38.01 pts/+1.14%/ 3,378.63

Monday’s Futures

Dow Futures down 2.27 pts/-0.02%

S&P Futures down 2.50 pts/-0.05%

Nasdaq Futures up 2.25 pts/+0.09%

Overseas Markets

FTSE +0.94%

CAC 40 -0.38%

NIKKEI 225 -0.76%

HANG SENG +0.99%

Overseas: World stock markets are mixed today. European and Asian markets are mixed on disappointing economic data from China and Germany.

Economic Reports: None for today, later in the week Consumer Credit, MBA Purchase Applications, Chain Store Sales, Jobless Claims, Wholesale Trade, Fed Balance Sheet, and Treasury Budget

Top Headlines:

• Reports indicate private equity groups, including Bain Capital and Golden Gate Capital Corp. are nearing a deal to acquire BMC Software Inc. (BMC) for about $6.55 billion or $46 per share.

• Bloomberg reports TPG Capital and Warburg Pincus LLC are exploring a possible sale or public offering of Neiman Marcus Group Inc. Private equity bought the retailer in 2005 for $5.1 billion.

• Intel Corporation (INTC) is offering to buy Finland’s Stonesoft Oyj for $389 million or $5.90 in cash to expand the product offering of its McAfee security-software business.

• Institutional Shareholder Services is urging shareholders to vote in favor of a proposal to split the roles of chairman and CEO of JPMorgan Chase (JPM). ISS also proposed to oust three directors following a $6.2 billion trading loss.

Commodities/Currency:

Gold: up $11.70 to $1,475.50

Oil: up 0.64 to $96.25

EUR/USD 1.3099 -0.0018

USD/JPY 99.2350 +0.0700

GBP/USD 1.5560 +0.0001

Volatility Index (VIX): As of the close of business Friday, May 3, the VIX is down 0.74 at 12.85

Companies Reporting Quarterly Earnings:

E.W. Scripps reports Q1 EPS (5c), vs. Est (7c) and Q1 revenue $198.7M, vs. Est $203.15M.

Tyson Foods reports Q2 adjusted EPS 36c, vs. Est 45c and Q2 revenue $8.42B, vs. Est $8.58B.

Resolute Energy reports Q1 EPS (5c), vs. Est 1c and Q1 revenue $78.9M, vs. Est $77.08M

Today’s Opening and Closing Bells:

Office of the Comptroller of the Currency, US Department of the Treasury celebrating 150th Anniversary of Founding will ring the opening bell.

Global Payments Celebrates 12th Anniversary of Listing on the New York Stock Exchange Chairman and CEO Paul R. Garcia will ring the closing bell.

yeah, I’d forgotten that the barchart folks cover lots of good stuff, stocks, commodities, currencies, etc.

Nice good write up and summary. Pretty much the picture in a 2 minute read.

I failed to include the header on this one but this is the NYSE morning update that they send out every morning to listed companies.

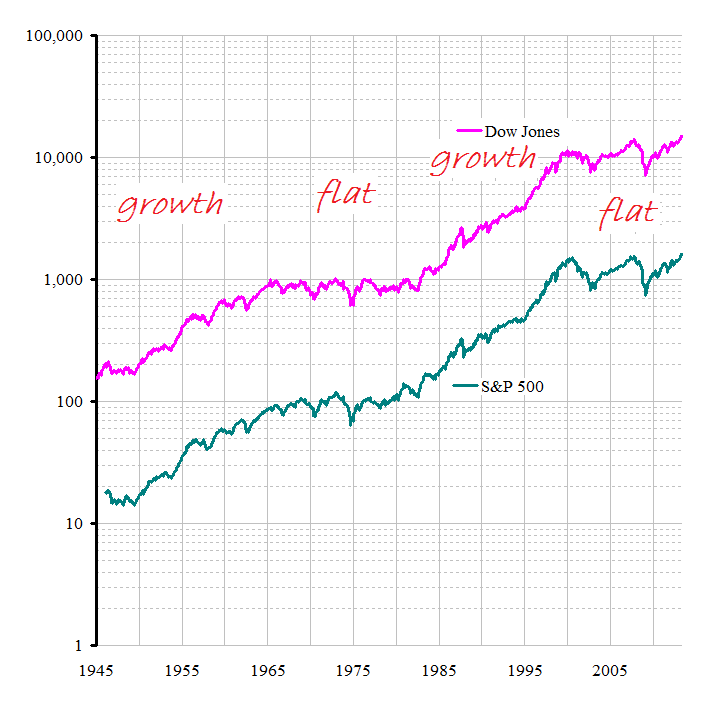

There's a good debate topic. In the real world prices fluctuate and while there are fools that always predict rising prices there are even more doom'n'gloom idiots forever crying that the sky is crashing. This is what's been going on for hundreds of years:

and here's what we're dealing with now:

Reality is that today stock prices may go up or they may go down, and usually doom'n'gloomers are wrong.

Looking at the charts you posted I am reminded that I've been much more successful in making money during Democratic presidential administrations. That gives me some consolation when I'm feeling uncharitable towards President Obama.

The optimism that's afoot lately in equity markets causes me worry. I wonder whether I'm among the sheep being led to slaughter.

I hear that a lot (especially from the no-nothing press) but that sure hasn't been my experience. Especially comparing the Reagan era w/ the Carter malaise. Remember stocks are a leading indicator and how the crash began w/ Obama's ascendancy.

You must be mistaking the Clinton years for the Gingrich years. Another one coming up is the Dem CRA years for the Bush years. When Clinton capitulated to Gingrich and the Republican Revolution, the economy exploded and you couldn't lose money. Remember "The era of big government is over" and the Contract with America?

Another aberration in people's psyche is The CRA caused crash during the Bush Administration. It was a Dem idea that Bush even tried to bring to Congress' attention, but he was even called a racist for bringing it up. Later McCain held hearings for the same thing. A president that held unemployment to under 5% for the majority of his 8 years ended up with a crash for the last couple of months due to a Dem idea.

Today, my investing mind tells me ObamaCare will kill jobs yet the numbers show otherwise. Oil should be cheap, yet it rises, Gold should be on it's way to $5k an ounce, yet it falls. I continue to lose money on many of my attempts to invest due to these misconceptions of what's going on. I'm sure there are many here that invest in metals believing they must be right someday, but gold falls teaching them the market can remain irrational longer than they can remain solvent. How is it logical that losing more full time jobs and people giving up looking for a job is bullish, but 165k is great when 250k under Bush was anemic?

I just have trouble learning to speak "Dem investing". If you just buy and hold, I guess Dem presidents work, but trying to "market time" is very tough in an upside down world. How long have people been buying gold and shorting bonds waiting for the Fed money printing to take hold. I guess it will finally "work" during the next Rep administration. Whoever he/she is will have to unravel the inevitable gold rise and skyrocketing interest rates. I will be broke by then.

The reward of suffering is experience-— Harry S. Truman

Brings to mind the business venture where someone with a little money got together with someone with a little experience, and before you know it one guy ended up with a lot of money and the other had a lot of experiance.

Now when it comes to investing trading profits, I wish for someone a bit to the right of Calvin Coolidge.

In good times I lay in the sun and nap. During periods of stress, such as the first two years of the current administration, I trade to alleviate anxiety and to take advantage of roiling markets.

I suspect we're more in agreement than not. I have no ability to market time and don't try. What I trade or invest in is independent of who's in the White House, hemlines, football conferences, etc.

I only know how to do two things: I can make money over a period of years with a pretty passive buy and hold strategy that only changes to address imbalances in my portfolios. Second, I sometimes go into day trader mode when I see what looks like low hanging fruit.

All freepers should do great in the markets and never lose anything on their long term investments. Let the liberals lose in the markets

BTW I heard that Truman quote on Limbaugh today.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.