Sound good to me.

From AEI today:

Gold bugs shouldn’t read this

James Pethokoukis | April 15, 2013, 11:33 am

MKM’s Mike Darda makes a number of great points here:

1. With gold tumbling more than 25% from its 2011 high (into official bear market territory), the strategy of buying gold (instead of equities) since the initiation of QE has failed.

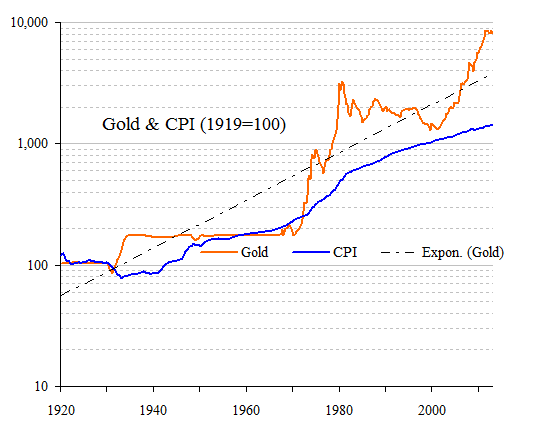

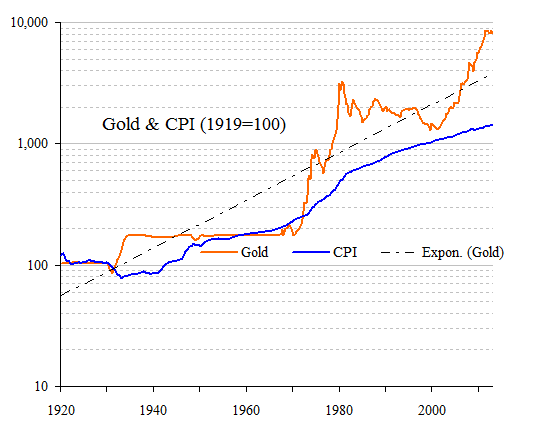

2. As we have pointed out in the past, if gold had simply followed the CPI over the last 100 years, the gold price would be just below $500/o z., meaning even after this pullback, the yellow metal could still be seriously extended.

3. In any event, gold and industrial commodity prices have de-linked from U.S. NGDP, inflation and inflation expectations over the last 12 years, meaning the most recent fall (and the previous run-up) likely do not have material implications for the U.S. business cycle.

4. Historically, industrial commodity prices have tended to fall at about a 1.7% per annum pace in real terms. Thus, the neo-Malthusian argument for a commodity price super cycle based on a population explosion and ever-increasing scarcity never made much sense to us. In the more intermediate term, however, the China leading indicators we track suggest slight downward bias for industrial commodity prices, an outlook we would continue to characterize as neutral.

Sound good to me.