Exactly. Velocity continues to collapse:

Posted on 04/15/2013 6:41:57 AM PDT by Sub-Driver

thank yu.

That bubble is about to pop also.

I doubt it. Over many years a gold boom starts, the people rush in buying like mad based upon the usual gold bug statements, then the rug is pulled. I know absolutely nothing about commodity markets but I think based upon history gold will go down to about $500 to $700 per ounce. Where it will remain stable for several years.

I have heard what you say. Can you refer us to some reputable written sources? Thanks.

Just google for it. It is public knowledge.

You found a 10/22?

Been looking for one for 3 months now, but I can’t find ammo either so.......

Massive withdrawal of capital. The reason there is no inflation is that the Feds are barely improving liquidity. Obama’s actions are scaring the markets. The Fed’s ZIRP is punishing the prudent and the wise and rewarding the frivolous and foolish, along with the politically connected criminal.

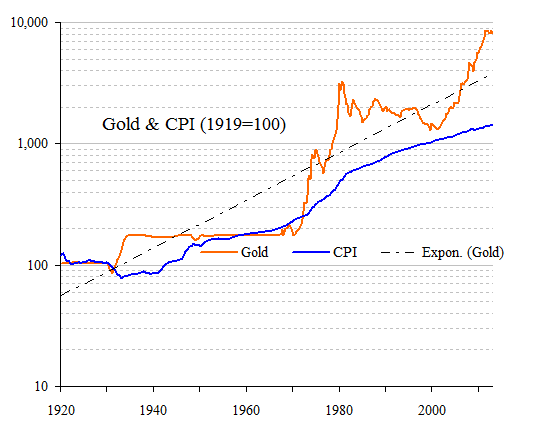

Doesn't show a connection between the two, but it does show why most people don't want a gold standard.

Perhaps he meant "exhauSt"? :-)

There's a lot of truth to that and vice versa.

Oil has historically sold for about 12 bbls/oz. of gold. We're returning to that figure. Investors looking for a quick return have driven gold higher than that average.

They're bailing now, as they should. Gold isn't an investment. It's a hedge against inflation. When it gets closer to $1000, I'm buying me some.

From AEI today:

Gold bugs shouldn’t read this

James Pethokoukis | April 15, 2013, 11:33 am

MKM’s Mike Darda makes a number of great points here:

1. With gold tumbling more than 25% from its 2011 high (into official bear market territory), the strategy of buying gold (instead of equities) since the initiation of QE has failed.

2. As we have pointed out in the past, if gold had simply followed the CPI over the last 100 years, the gold price would be just below $500/o z., meaning even after this pullback, the yellow metal could still be seriously extended.

3. In any event, gold and industrial commodity prices have de-linked from U.S. NGDP, inflation and inflation expectations over the last 12 years, meaning the most recent fall (and the previous run-up) likely do not have material implications for the U.S. business cycle.

4. Historically, industrial commodity prices have tended to fall at about a 1.7% per annum pace in real terms. Thus, the neo-Malthusian argument for a commodity price super cycle based on a population explosion and ever-increasing scarcity never made much sense to us. In the more intermediate term, however, the China leading indicators we track suggest slight downward bias for industrial commodity prices, an outlook we would continue to characterize as neutral.

Exactly. Velocity continues to collapse:

>> You found a 10/22?

Stumbled into the local Wally World one day looking for ammo, and they had one on the shelf. Just came in that morning. I felt like I had won the lottery.

I like it! It’s a lot of fun to pretend to shoot. :-)

Your lips to GOD’s ear...

lol

Sound good to me.

How does CPI (a very fungible figure) relate to gold prices?

Shouldn’t we be comparing gold vs. the buying power of the dollar? Gold looks pretty good on those graphs.

Gold looks good to you if that's what you care about I care about things I can reasonably expect to make a profit. So we know that gold's price rose. In fact, we even know today's gold future's prices are up and that means a lot of people expect to profit from an increased gold price today. We don't know what's happening next.

Torch's source stated the fact that gold's price was at the high end of a volatile range and many successful people in commerce (including myself) see that as a good time to sell.

Yes, that is the trillion dollar question.

I think we are in uncharted waters. There has never been a superpower hyperinflating before.

My theory: With unions dead(7% and falling) and so few people working(same size US workforce today as the US had in 1970?) there is nothing pushing prices up; remember “cost push inflation”? So the debt doesn’t matter, for now. If people get off their asses and go back to work then inflation will take off. Right now the slackers on public assistance are making just enough to get by and are happy with that, they are not really huge consumers.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.