Skip to comments.

Golfer Phil Mickelson May Call It Quits Due To Climbing Tax Rates

Forbes ^

| 1/21/2013

| Tony Nitti, Contributor

Posted on 01/21/2013 5:12:50 AM PST by tellw

Word is, Phil Mickelson is mad as hell about rising tax rates, and he’s not going to take it anymore. What follows is a brief portion of an interview Mickelson gave earlier today after carding a final-round 66 at the Palmer Course at PGA West in La Quinta – which I assure you, is not associated with the La Quinta next door to your local Denny’s – in which the golfer hinted that he is considering drastic career changes because of a combined tax rate nearing “62, 63 percent:”

(Excerpt) Read more at forbes.com ...

TOPICS: Extended News; News/Current Events; US: California; US: Florida; US: Hawaii; US: Nevada

KEYWORDS: bho44; mickelson; millionaires; taxandspend

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-52 next last

1

posted on

01/21/2013 5:12:57 AM PST

by

tellw

To: tellw

Q. When you’re asked about Stricker’s semi-retirement, with the political situation the last couple months, blah, blah, blah, what did you mean by that? Do you find it an unsettling time in a way?

PHIL MICKELSON: Well, it’s been an interesting offseason. And I’m going to have to make some drastic changes. I’m not going to jump the gun and do it right away, but I will be making some drastic changes.

Q. Meaning leaving from California?

PHIL MICKELSON: I’m not sure.

Q. Moving to Canada?

PHIL MICKELSON: I’m not sure what exactly, you know, I’m going to do yet. I’ll probably talk about it more in depth next week. I’m not going to jump the gun, but there are going to be some. There are going to be some drastic changes for me because I happen to be in that zone that has been targeted both federally and by the state and, you know, it doesn’t work for me right now. So I’m going to have to make some changes.

To be honest, it’s hard to blame Mickelson – who has compiled a net worth approaching $180 million by repeatedly striking a tiny white ball until it falls into a hole — for putting all options on the table, which according to some, include the possibility of prematurely shutting down his career to avoid his rising tax burden. Let’s take a look at what Mickelson is up against in 2013:

For starters, courtesy of President Obama’s re-election and the subsequent fiscal cliff negotiations, Mickelson will experience an increase in his top tax rate on ordinary income from 35% to 39.6%, and an increase in his top rate on long-term capital gains and qualified dividends from 15% to 20%. Clearly, when faced with tax hikes of that magnitude, it stops making economic sense for Mickelson to continue to swing a metal stick up to 70 times a day in exchange for the $48 million he earns on an annual basis.

But it gets worse. Thanks to the expiration of the temporary 2% reduction in the payroll tax rate on the first $113,700 of self-employment income, Mickelson will have to fork over an extra $2,274 in tax during 2013, an additional burden that makes it hard to justify briskly walking as many as five miles per day, four days a week. In long pants, nonetheless.

And then there’s the impact of Obamacare. When you consider that from now on, Mickelson will be liable for an additional 0.9% tax on his self-employment income and 3.8% tax on his net investment income after each exceeds $250,000, what’s left over from the multi-million dollar endorsement deal requiring him to sport a Rolex watch while playing private courses in exotic locales hardly seems worth it.

If you think perhaps Mickelson is being a bit of a baby for threating to end a career that’s earned him a spot on this list of 10 wealthiest athletes on the planet because of some tax increases, understand that he’s getting hit on the state level, too. In November, California passed Proposition 30, which increases the top income tax rate on resident millionaires to 13.3%, a drain on Mickelson’s take-home pay that may force him to sell his 9,500 square foot mansion and flee his home state in search of more friendly pastures.

Should Mickelson follow through on his promises, he is fortunate that there is no shortage of countries across the globe that offers an opportunity for a man to earn exorbitant riches by playing a game. But I, for one, would encourage Mickelson to stay the course, continue to fight the good fight, and hire a savvy tax advisor. He shouldn’t have to look too far; after all, one of the sponsors that paid Phil an estimated $44 million in 2012 was KPMG.

2

posted on

01/21/2013 5:14:20 AM PST

by

tellw

To: tellw

One thing about Canada - there is no inheritance tax.

3

posted on

01/21/2013 5:18:33 AM PST

by

expat1000

To: tellw

Just how snarky can a “writer” get.......good God.

4

posted on

01/21/2013 5:18:53 AM PST

by

RightOnline

(I am Andrew Breitbart!)

To: tellw

I always wondered about PM living in California. Most pro golfers live in Florida, for obvious reasons.

To: RightOnline

Yeah, mocking someone who earns a living “ hitting a little white ball”, when the writer earns a living putting electrons out into the cloud. At least the athlete has talent....

6

posted on

01/21/2013 5:28:26 AM PST

by

Kozak

(The Republic is dead. I do not owe what we have any loyalty, wealth or sympathy.)

To: tellw

“Mickelson will have to fork over an extra $2,274 in tax during 2013, an additional burden that makes it hard to justify briskly walking as many as five miles per day, four days a week. In long pants, nonetheless.”

...this guy is a MAJOR LEAGUE RICHARD NOGGIN!!

7

posted on

01/21/2013 5:28:33 AM PST

by

albie

To: tellw

And one day, when the inevitable happens and Phil dies, the government will try to take 40% of whatever he’s saved during his lifetime. So why should a dude with rheumatoid arthritis married to a wife who had cancer keep spending 8 months per year away from home when he’s already amassed a significant fortune?

To: tellw

9

posted on

01/21/2013 5:28:57 AM PST

by

skinkinthegrass

(who'll take tomorrow,spend it all today;who can take your income,tax it all away..0'Bozo man can :-)

To: tellw

Interesting post/thread. HOORAY Phil for even speaking out (about socialism)!

Socialism Is Legal Plunder - Bastiat

http://www.usdebtclock.org

DEPOPULATE socialists from the body politic.

Double eagle BUMP/BANG!

10

posted on

01/21/2013 5:28:57 AM PST

by

PGalt

To: RightOnline

Just how snarky can a “writer” get.......good God. In Forbes, no less. Envy is cool.

I hope the golfer quits, or moves. It might wake up some sports zombies.

To: tellw

“To be honest its hard to blame Mickelson...” Um, no. I don’t blame him at all. He is trying to protect WHAT HE EARNED.

12

posted on

01/21/2013 5:32:28 AM PST

by

ThunderSleeps

(Stop obama now! Stop the hussein - insane agenda!)

To: tellw

who has compiled a net worth approaching $180 million More likely is the fact that he has accumulated more money than he could ever spend so why would you continue to play.

By the way, most people work all their lives to be able to retire and play golf in their golden years. What does a professional golfer do when he retires?

13

posted on

01/21/2013 5:33:26 AM PST

by

oldbrowser

(They are marxists, don't call them democrats)

To: tellw

As they say, people vote with their feet.

Next thing we know, Bronco will release an Exec. Order which freezes the bank accounts and confiscates the property of all millionaires who have the chutzpah to relinquish their citizenships in favor of becoming citizens of a country whose laws reflect that what you earn is yours, and not the gubmint’s.

14

posted on

01/21/2013 5:39:12 AM PST

by

randita

To: tellw

That writer wouldn’t have dared to write the same article on Tiger Woods making his move to FL.

15

posted on

01/21/2013 5:40:56 AM PST

by

G Larry

(Which of Obama's policies do you think I'd support if he were white?)

To: RightOnline

What the snarky writer doesn’t get and Mickelson does is that this is only the start. Taxes are going much, much higher on the wealthy and there will be more taxes on the middle class as well.

There have to be, to keep the scam going.

16

posted on

01/21/2013 5:42:19 AM PST

by

randita

To: tellw

He is making 48 million a year? So he is gifting over $30,000,000.00 a year.....that’s a lot of obama phones.

17

posted on

01/21/2013 5:43:02 AM PST

by

Toespi

To: tellw

Mickelson going Galt?

I don’t watch golf (my Dad always controlled the TV growing up, so I learned something about it) but Phil Mickelson has always been a class act in the game and outside of the game. I hope folks take notice.

18

posted on

01/21/2013 5:44:47 AM PST

by

SueRae

(It isn't over. In God We Trust.)

To: oldbrowser

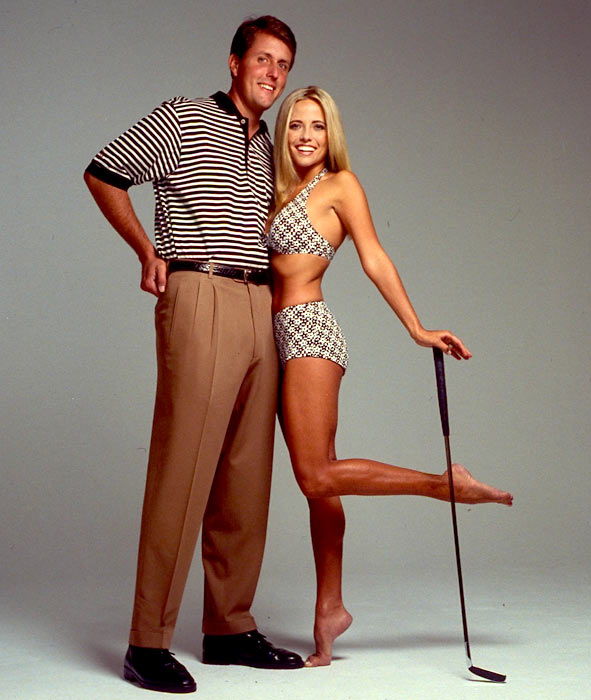

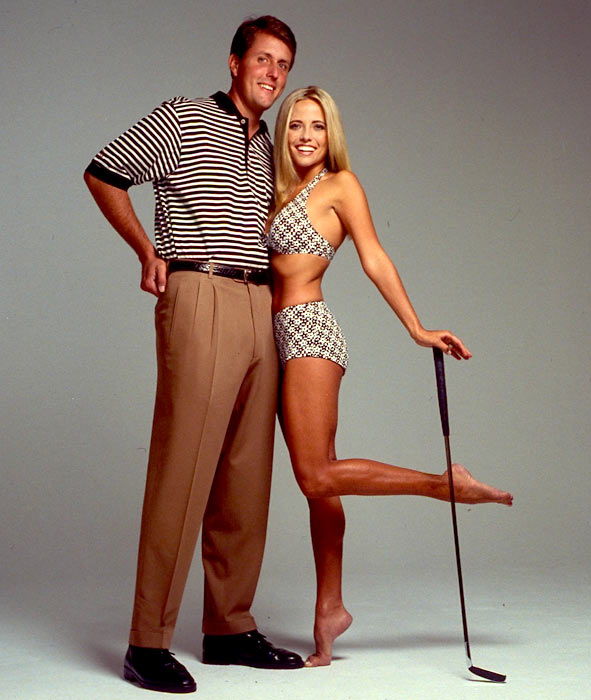

More likely is the fact that he has accumulated more money than he could ever spend so why would you continue to play. Makes sense. He's 42, has young children, and a hot wife.

So he cuts way back on his work, spends a lot more time with the kids and the wife, and enjoys life and spending his money. What's so bad about that? I wish I'd had the opportunity to do that at his age.

19

posted on

01/21/2013 5:45:45 AM PST

by

PapaBear3625

(You don't notice it's a police state until the police come for you.)

To: tellw

Somebody should ask “writer” Tony Nitti what his handicap is.

Sounds to me like a snarky little man who is jealous of someone else’s success. In short, a liberal.

20

posted on

01/21/2013 5:45:54 AM PST

by

Colonel_Flagg

("Don't be afraid to see what you see." -- Ronald Reagan)

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-52 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson