My point is, and was, that alcohol IS a drug. You can't deny that.

As for alcohol, it has been widely acceptable to American society as part of the cultural inheritance.

Much has transpired in the history of the United States....

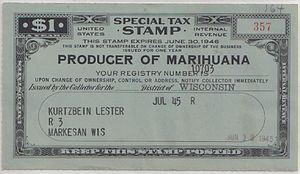

The Marijuana Tax Act of 1937 made possession or transfer of cannabis illegal throughout the United States under federal law, excluding medical and industrial uses, in which an expensive excise tax was required. Annual fees for the tax were $24 ($337 adjusted for inflation) for importers, manufacturers, and cultivators of cannabis, $1 annually ($14 adjusted for inflation) for medical and research purposes, and $3 annually ($42 adjusted for inflation) for industrial uses. Detailed cannabis sale logs were required to keep record of cannabis sales. Selling cannabis to any person who has previously paid the tax is $1 per ounce or fraction thereof; however, it is $100 ($1,406 adjusted for inflation) per ounce or fraction thereof to sell any person who has not registered and paid the special tax.[29]

The American Medical Association (AMA) opposed the act because the tax was imposed on physicians prescribing cannabis, retail pharmacists selling cannabis, and medical cannabis cultivation and manufacturing; instead of enacting the Marijuana Tax Act the AMA proposed cannabis be added to the Harrison Narcotics Tax Act.[30] After the Philippines fell to Japanese forces in 1942, the Department of Agriculture and the U.S. Army urged farmers to grow hemp fiber and tax stamps for cultivation were issued to farmers. Without any change in the Marijuana Tax Act, over 400,000 acres of hemp were cultivated between 1942 and 1945. The last commercial hemp fields were planted in Wisconsin in 1957.[31] New York Mayor Fiorello LaGuardia, who was a strong opponent of the 1937 Marijuana Tax Act, started the LaGuardia Commission that in 1944 contradicted the earlier reports of addiction, madness, and overt sexuality.[32] In its 1969 Leary v. United States decision the Supreme Court held the Marijuana Tax Act to be unconstitutional, since it violated the Fifth Amendment privilege against self-incrimination.[33] In response, Congress repealed the Marijuana Tax Act and passed the Controlled Substances Act as Title II of the Comprehensive Drug Abuse Prevention and Control Act of 1970, which repealed the Marijuana Tax Act.[34]