PRNEWSWIRE: 43 trillion dollars lawsuit!Spire-law ^ | 11/12/12 | Chrisnj / FR Posted by chrisnj

http://spire-law.com/in-the-news/ 43 trillion dollars lawsuit against gov officials and major banks

Major Banks, Governmental Officials and Their Comrade Capitalists Targets of Spire Law Group, LLP’s Racketeering and Money Laundering Lawsuit Seeking Return of $43 Trillion to the United States Treasury

NEW YORK, Oct. 25, 2012 /PRNewswire/ — Spire Law Group, LLP’s national home owners’ lawsuit, pending in the venue where the “Banksters” control their $43 trillion racketeering scheme (New York) – known as the largest money laundering and racketeering lawsuit in United States History and identifying $43 trillion of laundered money by the “Banksters” and their U.S. racketeering partners and joint venturers – now pinpoints the identities of the key racketeering partners of the “Banksters” located in the highest offices of government and acting for their own self-interests. \

In connection with the federal lawsuit now impending in the United States District…… (for more go to the link.) /

===========================================

FOURTEEN TRILLION DOLLARS Behind The Real Size of Obama's Wall Street Bailout; A guide to the abbreviations, acronyms, and obscure programs that make up the $14 trillion federal bailout.

SOURCE motherjones.com

Mon Dec. 21, 2009 12:23 PM PST

The price tag for the Wall Street bailout is often put at $700 billion—the size of the Troubled Assets Relief Program. But TARP is just the best known program in an array of more than 30 overseen by Treasury Department and Federal Reserve that have paid out or put aside money to bail out financial firms and inject money into the markets.

To get a sense of the size of the real $14 trillion bailout, see our chart at web site. Below, a guide to the pieces of the puzzle:

Treasury Department bailout programs

(Remember that Obama's Treasury Dept was controlled by his then-COS Rahm Emanuel---a savvy, connected G/S lobbyist in the WH)

Money Market Mutual Fund: In September 2008, the Treasury announced that it would insure the holdings of publicly offered money market mutual funds. According to the Special Inspector General for the Troubled Asset Relief Program (SIGTARP), these guarantees could have potentially cost the federal government more than $3 trillion [PDF].

Public-Private Investment Fund: This joint Treasury-Federal Reserve program bought toxic assets from banks and brokerages—as much as $5 billion of assets per firm. According to SIGTARP, the government's potential exposure from the PPIF is between $500 million and $1 trillion [PDF].

TARP: As part of the Troubled Asset Relief Program, the Treasury has made loans to or investments more than 750 banks and financial institutions. $650 billion has been paid out (not including HAMP; see below). As of December 21, 2009, $117.5 billion of that has been repaid.

Government-sponsored enterprise (GSE) stock purchase: The Treasury has bought $200 million in preferred stock from Fannie Mae and another $200 million from Freddie Mac [PDF] to show that they "will remain viable entities critical to the functioning of the housing and mortgage markets."

GSE mortgage-backed securities purchase: Under the Housing and Economic Recovery Act of 2008, the Treasury may buy mortgage-backed securities from Fannie Mae and Freddie Mac. According to SIGTARP, these purchases could cost as much as $314 billion ---SNIP---.

LONG READ---go to web site to read more and checkout the shocking financial charts.

SOURCE http://motherjones.com/politics/2009/12/behind-real-size-bailout

2008 Candidate Barack Obama told us on the campaign trail: " The problem is, that the way Bush has done it over the last eight years is to take out a credit card from the Bank of China in the name of our children, driving up our national debt from $5 trillion for the first 42 presidents, # 43 added $4 trillion by his lonesome so that now we have over $9 trillion of debt that we are going to have to pay back, $30,000 for every man woman and child. That’s irresponsible. It’s unpatriotic." REALITY CHECK Obama presided over the biggest political heist in US history. The Obamanations (insiders and politicians) sucked up trillions under the guise of inheriting the "Bush financial crisis."

THIS MADE ME LAUGH OUT LOUD Obama COS Rahm Emanuel "suddenly" discovered he wanted to be Chicago's mayor---the little turn went before the mics and announced his campaign "raised $10 million in just a few weeks." Rahm also controlled the US Treasury as COS.

======================================

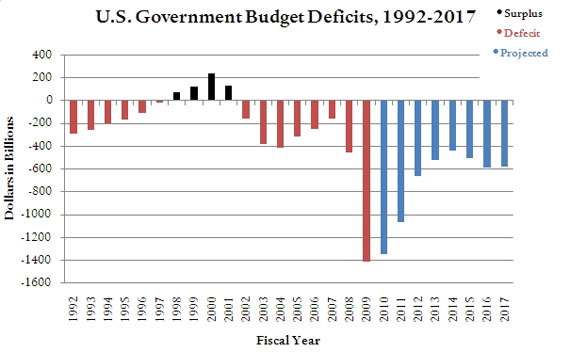

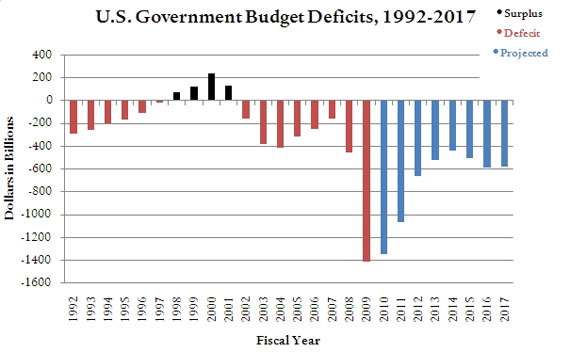

In a fair accounting, Pres Obama is responsible (along with the then-Dem Congress) for the $1.3 trillion in deficit spending in 2010 and the estimated $1.6 trillion in 2011. Obama should not get credit for the $149B in TARP (Troubled Asset Relief Program) repayments made in 2010 and 2011 to cover most of the $154B in bank loans that remained unpaid at the end of the 2009 fiscal year—--loans that count against Pres Bush’s 2009 deficit tally.

Treasury says all but $5B of the TARP bank l/oans have been repaid. The portion of repayments for loans issued in 2009 should be deducted from Bush’s deficit tally, not credited to Obama as deficit savings. There is some astounding number crunching here, and a chart of a modern day president’s “average annual deficit spending” ........a frightening conclusion of what happens if Obama has an 8- year term.