Skip to comments.

A Capitalist Revolt In Socialist France

Business Insider ^

| 10/04/2012

| Wolf Richter, Testosterone Pit

Posted on 10/04/2012 7:26:57 AM PDT by SeekAndFind

The French government is trying to reign in its deficit by jacking up taxes, including the capital gains tax, which it wants to bring to the same level as the tax on income earned by the sweat of your brow—an old philosophical pillar of the French left.

But an explosive essay published last Friday hit a nerve with entrepreneurs, venture capital investors, artisans, and mom-and-pop business owners.

And their anger, which spread across the social media, the papers, and finally TV news, turned into an open revolt.

The trigger was an editorial in La Tribune by John-David Chamboredon, Executive President of ISAI, an internet startup fund. After the Finance Law 2013 was proposed during the presidential elections, he wrote, “la France du business stopped breathing.” Investments and hiring were put on hold.

The cause: the capital-gains tax provisions. An entrepreneur, for example, who risked his savings, spent 10 years growing his business, created perhaps hundreds of jobs, survived all the challenges, and then wanted to cash out, would have to pay two layers of taxes on the capital gains, totaling, according to his calculations, 60.5%. And so would investors.

It would kill entrepreneurship. Funding for startups would dry up. And growth in the private sector would wither. “If the fiscal maelstrom is confirmed, the sequence of events is quite clear,” he wrote. “Instead of hiring people and developing the business, owners threatened by this confiscation would spend the rest of 2012 imagining ways to escape it.”

(Excerpt) Read more at businessinsider.com ...

TOPICS: Business/Economy; Culture/Society; Foreign Affairs; News/Current Events

KEYWORDS: capitlaism; europeanunion; france; socialism

Navigation: use the links below to view more comments.

first 1-20, 21-31 next last

To: SeekAndFind

I’ve never understood very well why capital gains should be treated differently myself, not that I’m in favor on income taxes generally.

2

posted on

10/04/2012 7:29:41 AM PDT

by

DonaldC

(A nation cannot stand in the absence of religious principle.)

To: SeekAndFind

The rest of Euope is wooing all of these disgruntled businesses. France will dry up overnight.

3

posted on

10/04/2012 7:33:42 AM PDT

by

stephenjohnbanker

(God, family, country, mom, apple pie, the girl next door and a Ford F250 to pull my boat.)

To: SeekAndFind

I think businesses in France should simply go on strike. Shut their doors for a few days.

4

posted on

10/04/2012 7:35:14 AM PDT

by

GeronL

(http://asspos.blogspot.com)

To: DonaldC

LOL. Read the article. You might learn something.

5

posted on

10/04/2012 7:35:34 AM PDT

by

kabar

To: SeekAndFind

If you follow what's been going on in France in terms of its fiscal policies and compare it to what Obozo wants to do in this country, the parallels are obvious. Yet, for reasons I cannot fathom, voters in this country behave like lock-step lemming bound and determined to fall over the Socialist cliff. Raising taxes on the group who drive the economic engine is simply stupid. Obozo has the same plan...tax the rich, give to the poor. I don't know about you, but I've yet to have one job provided by a poor person. Can't Obozo see that a rising tide lifts all boats? Guess not...

6

posted on

10/04/2012 7:39:25 AM PDT

by

econjack

(Some people are as dumb as soup.)

To: DonaldC

I’ve never understood very well why capital gains should be treated differently myself, not that I’m in favor on income taxes generally.Inflation. If an asset "appreciates" due mostly to inflation of the currency, capital gains taxes are taxing you on the devaluation of your currency, which is also a tax. Hello, double taxation.

To: GeronL

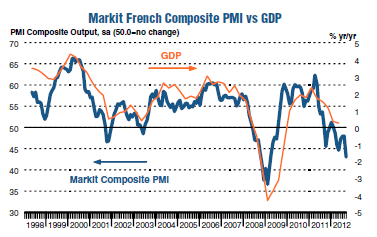

The French economy has started to implode. Service sector business activity is dropping at fastest rate since October 2011.

More importantly, the

Markit Composite PMI sports the steepest rate of contraction since March 2009 with job losses accelerating at the fastest pace in 33 months and output plunging at the fastest rate in 42 months.

Here's an excerpt from their recent report....

Service sector activity declined in response to a further fall in new business during September. The rate of contraction in new work accelerated to the fastest in five months, with anecdotal evidence pointing to lacklustre demand conditions and clients delaying decisions on projects. Combined with a steeper decline in new orders in the manufacturing sector, overall new business across the French private sector fell at the steepest rate for 41 months.

Reduced workloads prompted French service providers to make further cutbacks to employment during September. The rate of job shedding accelerated to the sharpest for 33 months, with panellists indicating that staffing levels were lowered in response to declining activity and as part of cost-cutting efforts. Composite data signalled the sharpest reduction in employment since December 2009.

If that does not accurately describe implosion, what does? Looking for who or what to blame? Look no further than inane work rules and regulations made worse by the socialist government of president François Hollande.

8

posted on

10/04/2012 7:50:25 AM PDT

by

SeekAndFind

(bOTRT)

To: Disambiguator; DonaldC

There’s also the element of risk.

Income, generally speaking, is pretty risk free - you agree to do x amount of work for an employer, he agrees to pay you y amount of $$ in return. Absent extenuating circumstances, that arrangment will last indefinitely.

Capital gains are the results of investment. While it is possible to gain much, it is also possible to lose the entire investment. Even an investment that doesn’t appreciate or depreciate is essentially a loss when you consider the opportunity costs (could just put it in a savings account, for example).

If taxing capital gains occured at the same rate as income, there would be no incentive to invest because of the risk of losing the investment with no upside when the investment pays off.

9

posted on

10/04/2012 7:59:59 AM PDT

by

chrisser

(Starve the Monkeys!)

To: econjack

“Can't Obozo see that a rising tide lifts all boats?”

No, neither Hollande or Obama can see this because socialists/Marxists are all about equality of outcome. Their world is a zero sum game where if one prospers, it is at the expense of another. Their idea of fairness is to spread misery equally among the masses while the elites like them live high at everyone’s expense. They are the Pig in Orwell's “Animal Farm”.

To: SeekAndFind

France’s earlier work rules were already an insane burden on employers. Expect exorbitant exit taxes on one way flight departures any day now.

The plunge in service sector jobs is kind of ambiguous. Does this mean surly waiters will be let go or retained to maintain glorious tradition?

11

posted on

10/04/2012 8:09:26 AM PDT

by

Covenantor

("Men are ruled...by liars who refuse them news, and by fools who cannot govern." Chesterton)

To: econjack

“Can’t Obozo see that a rising tide lifts all boats?”

It isn’t ignorance, it is malevolence. Obama does not want to raise the poor up, he wants to tear the rich down. Some people have a hatred of success, perhaps because they know they are incapable of attaining it themselves. It is envy and resentment due to their own ineptitude.

12

posted on

10/04/2012 8:10:57 AM PDT

by

TexasRepublic

(Socialism is the gospel of envy and the religion of thieves)

To: DonaldC

Capital gains are earned by risking your capital. Capital can be lost, too. There is no guarantee of a profit.

Payroll income has no risk of loss.

Hollande is crazy. Any French business not tied to the French economy will leave. Those that remain will whither away.

13

posted on

10/04/2012 8:31:43 AM PDT

by

Mister Da

(The mark of a wise man is not what he knows, but what he knows he doesn't know!)

To: DonaldC

income taxes are immoral.

14

posted on

10/04/2012 8:44:43 AM PDT

by

bravo whiskey

(if the little things really annoy you, maybe it's because the big things are going well.)

To: SeekAndFind

The French government is trying to reign rein in its deficit by jacking up taxes [...]reign:

1. Exercise of sovereign power, as by a monarch.

2. The period during which a monarch rules.

3. Dominance or widespread influence: the reign of reason.

intr.v.

reigned, reign·ing, reigns

1. To exercise sovereign power.

2. To hold the title of monarch, but with limited authority.

3. To be predominant or prevalent: "Panic reigned as the fire spread."

rein:

1. A long narrow leather strap attached to each end of the bit of a bridle and used by a rider or driver to control a horse or other animal. Often used in the plural.

2. A means of restraint, check, or guidance.

3. A means or an instrument by which power is exercised. Often used in the plural: the reins of government.

v. reined, rein·ing, reins

v.tr.

1. To check or hold back by or as if by the use of reins. Often with in, back, or up.

2. To restrain or control.

v.intr.

To control a horse, for example, with reins.

Regards,

15

posted on

10/04/2012 8:46:15 AM PDT

by

alexander_busek

(Extraordinary claims require extraordinary evidence.)

To: DonaldC

I’ve never understood very well why capital gains should be treated differently myself, not that I’m in favor on income taxes generally.

I feel the same way about Property Taxes. If the Government MUST have taxes to run on then it should be consumption taxes alone.

To: Cincinna; AdmSmith; AnonymousConservative; Berosus; bigheadfred; Bockscar; ColdOne; ...

17

posted on

10/05/2012 7:32:06 PM PDT

by

SunkenCiv

(https://secure.freerepublic.com/donate/)

To: SeekAndFind; afraidfortherepublic; mojo114; seenenuf; LucyT; Think free or die; DollyCali; ...

H/T SeekandFind for the Post; Sunken Civ for the Ping

This will pose an even more serious problem for French society in the future, as well as the economy.

These “pigeons” as they are called, the fledgeling intrepreneurs, artists, inventors and creators have been the creative “juice” in French culture an economy for quite awhile

While we often like to joke about the French, they have been incredibly creative in technology, fashion, tourism, museums, aviation, and cultural life. These pigeons want to work, create, innovate, and start up businesses. If the socialist government creates an inhospitable atmosphere, they will go elsewhere.

They are young, talented, and not stupid enough to allow 65% of their efforts to be confiscated.

*** FRENCH POLITICS AND CULTURE PING LIST ***

*** FREEPMAIL ME IF YOU WANT TO JOIN ***

18

posted on

10/06/2012 12:31:42 AM PDT

by

Cincinna

( *** NOBAMA 2012 ***)

To: DonaldC

So people can sit on their assets and collect income while doing not a lick of work. It’s little different from welfare, IMO, and is part of the reason for the anger of the OWS folks.

19

posted on

10/06/2012 12:54:21 AM PDT

by

Lexinom

To: SeekAndFind

The French government is trying to reign in its deficit by jacking up taxes, including the capital gains tax, which it wants to bring to the same level as the tax on income earned by the sweat of your brow—an old philosophical pillar of the French left. I actually agree with this. Money earned from real work should be taxed at a lower rate than income not tied to the sweat of the brow. Let's encourage innovation, not golfing.

20

posted on

10/06/2012 12:57:02 AM PDT

by

Lexinom

Navigation: use the links below to view more comments.

first 1-20, 21-31 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson