Help End The Obama Era In 2012

Your Monthly and Quarterly Donations

Help Keep FR In the Battle!

Sponsoring FReepers are contributing

$10 Each time a New Monthly Donor signs up!

Get more bang for your FR buck!

Click Here To Sign Up Now!

Posted on 08/05/2012 10:18:27 AM PDT by Son House

Let us review the Obama administrations GDP projections:

- In August of 2009, the White House — after having a half year to view the economy and its $800 billion stimulus response — predicted that GDP would rise 4.3% in 2011, followed by 4.3% growth in 2012, 2013 and 2014.

- In its 2010 forecast, the White House said it was looking for 3.5% GDP growth in 2012, followed by 4.4% in 2013, 4.3% in 2014.

- In its 2011 forecast, the White House predicted 3.1% growth in 2011, 4.0% in 2012 and 4.5% in 2013, 4.2% in 2014.

- The 2012 forecast from the White House predicted 3.0% growth this year and next, and then back to 4.0% after that.

In reality, the economy grew 1.7% in 2011 and, based on the most recent reports, the CBO is now projecting only 2.4 percent growth this year, which is likely to be revised downward after second quarter numbers are released. Private economists, such as Michael Feroli with JP Morgan, are projecting 1.4 percent growth. Actual growth for the first quarter of the year was only 1.9 percent.

Not only has the White House been consistently wrong in their estimates, they have been off by as much as 50-percent. Based on this administrations history with projections, the incorrect economic forecast should come as no surprise. President Obama told Americans that the passage of the Recovery Act (which passed in 2009) would prevent unemployment from breaking 8-percent; however the reality is that unemployment peaked at 10.1 percent in October 2009 and has not been under 8-percent since the Recovery Act was passed.

(Excerpt) Read more at examiner.com ...

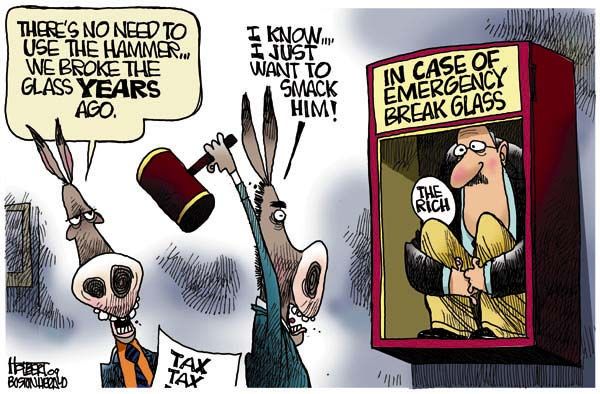

Long-run Macroeconomic Impact of Increasing Tax Rates on High-income Taxpayers in 2013

http://www.nfib.com/LinkClick.aspx?fileticket=OMV7uZczVaM%3D&tabid=1083

Executive Summary

...

This report finds that these higher marginal tax rates result in a smaller economy, fewer jobs, less investment, and lower wages. Specifically, this report finds that the higher tax rates will have significant adverse economic effects in the long-run: lowering output, employment, investment, the capital stock, and real after-tax wages when the resulting revenue is used to finance additional government spending.

Long-run macroeconomic impact of increasing tax rates on high-income taxpayers in 2013

Through lower after-tax rewards to work, the higher tax rates on wages reduce work effort and labor force participation. The higher tax rates on capital gains and dividend increase the cost of equity capital, which discourages savings and reduces investment. Capital investment falls, which reduces labor productivity and means lower output and living standards in the long-run.

Output in the long-run would fall by 1.3%, or $200 billion, in today’s economy.

Employment in the long-run would fall by 0.5% or, roughly 710,000 fewer jobs, in today’s economy.

Capital stock and investment in the long-run would fall by 1.4% and 2.4%, respectively.

Real after-tax wages would fall by 1.8%, reflecting a decline in workers living standards relative to what would have occurred otherwise.

These results suggest real long-run economic consequences for allowing the top two ordinary tax rates and investment tax rates to rise in 2013. This policy path can be expected to reduce long-run output, investment and net worth.

economic statistics

Pshaw! Ernst and Young? What the hell do they know?

Don’t worry. They can fudge the GDP by vastly underestimating the inflation rate, and they can fudge unemployment by decreasing the number of people in the workforce. The polls have been corrupted by overestimating Dem turnout. The next step is fixing the election results.

Thanks Son House.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.