Posted on 01/30/2012 1:15:35 PM PST by STARWISE

Activists are expressing serious concerns that Mitt Romney’s private equity firm Bain Capital owns one of America’s largest media conglomerates, Clear Channel Communications, Inc., which broadcasts numerous popular talk-show hosts with incalculable influence in the 2012 GOP primary.

Among the radio personalities syndicated by Clear Channel or aired on hundreds of stations it owns nationwide are Rush Limbaugh, Sean Hannity, Mark Levin, Glenn Beck, Michael Savage, and many others.

Because of the San Antonio-based media giant’s enormous influence — it is the largest owner of radio stations in the United States, and experts point out that it essentially owns what has come to be known as the conservative talk-radio industry — Romney critics, supporters of Ron Paul and Newt Gingrich, Tea Party groups, and elections commentators are all raising the alarm.

Some analysts are even calling for the firm to disclose the fact that Romney’s Bain Capital owns a station or syndicates a show whenever a media personality is reporting on the Republican presidential campaign.

Former Politico.com reporter Ben Smith, now the editor-in-chief of BuzzFeed, called out Rush Limbaugh on Thursday for defending Romney and Bain Capital without disclosing that his employer is owned by the candidate’s firm. “Talk radio king Rush Limbaugh has emerged as a key defender of Mitt Romney’s tenure at Bain Capital, where — his Republican and Democratic critics charge — layoffs at companies Bain owned should be blamed on Romney,” noted Smith. “But Limbaugh hasn’t mentioned his own tie to the venture capital firm: Bain owns Clear Channel Communications, whose subsidiary inked a $400 million, eight-year syndication deal with Limbaugh in 2008.”

It turns out the talk-radio titan had actually revealed the connection later on in the show, and Smith updated his article to include that fact when he was made aware of it by readers. But the explosive story attracted more media interest in the subject nonetheless.

Bain Capital joined with private-equity firm Thomas H. Lee Partners to buy Clear Channel in 2008, with the announcement made shortly before Romney’s 2008 run for the GOP nomination. The $25-billion deal included around 1,000 AM and FM stations, as well as dozens of televisions stations that were later sold off.

Clear Channel subsidiary Premiere Radio Networks — the largest radio syndication service in America with talk-show hosts including Rush Limbaugh, Glenn Beck, and Sean Hannity — was also part of the package. According to the company’s website, its radio programs reach nearly two-thirds of the American people each week through some 5,000 radio affiliations.

“Think about that the next time you're flipping channels on the radio and realize that Rush Limbaugh calls the candidates ‘Romney,’ ‘Non-Romney,’ and ‘Loony,’” noted Delaware elections examiner Angel Clark in a piece detailing the connections. “Why do these other candidates get called ‘Non-Romney’?”

Today, of course, Romney no longer leads the firm he co-founded, though Bain Capital and Bain & Co. are shoveling gargantuan sums of money into his campaign. But Romney still owns a huge stake in the company and profits handsomely from it, according to his financial disclosure report. And analysts say he undoubtedly still wields at least some degree of influence.

“If you have been wondering why so many conservative talk show hosts are being so incredibly kind to Mitt Romney, this just might be the answer,” explained a popular blogger commenting on the Bain Capital-Clear Channel connection, saying it was improper for one of the Republican front-runners to have such an overwhelming financial stake in talk radio. “In the media world, there is a clear understanding that you simply do not bite the hand that feeds you…. If you were making tens of millions of dollars a year, wouldn't you be very careful to avoid offending your boss?”

It remains unclear how much influence Bain Capital actually exerts over the day-to-day operations of its employees at Clear Channel. However, even the perception of a potential conflict of interest has led to severe and growing criticism of both the media behemoth and Romney.

Clear Channel and its subsidiaries have been criticized on several other fronts in recent times, too. Last year, for example, its Premiere Radio Networks syndication service was exposed using paid actors to call into talk shows and read scripts. Some cynics have even suggested that pro-Romney callers on conservative shows may have actually been well-paid propagandists reading from a prepared script.

What is clear is that very little serious scrutiny and criticism of Romney or Bain Capital has been broadcasted by Clear Channel radio stations and talk-show hosts in recent years. More than a few, however, have been very vocal in their support for Romney.

Excerpt:

GOP presidential hopeful Mitt Romney is under fire after news reports surfaced showing that his company, Bain Capital, benefited from multiple federal bailouts amounting to well over $50 million. The top-tier Republican candidate has flip-flopped on the issue of whether or not taxpayers should be forced to bail out private firms, but critics have seized on his controversial work at Bain to attack his candidacy from all angles.

The scandal over Romney’s federal bailouts first surged to prominence after a former strategist for the late Sen. Ted Kennedy publicly released an unaired campaign ad — made nearly a decade ago when Romney was running for the Massachusetts Senate seat — exposing a $10-million federal bailout of Bain & Co. while Romney was at the helm. The attack ad, citing a 1994 report in the Boston Globe, noted that Romney worked with the Federal Deposit Insurance Corp. (FDIC) to bamboozle the American people out of money under the guise of “debt forgiveness.”

“Mitt Romney says he saved Bain & Company, but he didn’t tell you that on the day he took over, he had his predecessor fire hundreds of employees, or that the way the company was rescued was with a federal bailout of $10 million,” notes the narrator in Sen. Kennedy’s unreleased ad as pictures of newspaper articles fill the screen. “He and others made $4 million in this deal which cost ordinary people $10 million.”

As if that was not bad enough for one of the GOP front-runners, Reuters recently reported that a steel company taken over by Bain Capital went bankrupt and received another big handout from the government. After the Missouri mill’s approximately 750 employees were fired, a federal insurance agency had to bail out its underfunded pension plan to the tune of almost $45 million. But Bain still made millions in profits on the deal.

“His supporters say the pension gap at the Kansas City mill was an unforeseen consequence of a falling stock market and adverse market conditions,” Reuters reported in the article entitled “Romney's steel skeleton in the Bain closet,” published on January 6. “But records show that the mill's Bain-backed management was confronted several times about the fund's shortfall, which, in the end, required an infusion of funds from the federal Pension Benefits Guarantee Corp.”

Romney opponents from across the political spectrum have seized on the revelations to paint one of the GOP’s leading presidential candidates as a flip-flopping, taxpayer-fleecing insider. “This is more evidence that the so-called ‘fronrunners’ from the establishment represent more of the status quo that American voters are tired of — people who benefit from government bailouts on the taxpayers’ dime and seek office to help their buddies do the same,” said Jesse Benton, chairman of Rep. Ron Paul’s surging top-tier campaign for the Republican nomination.

Some Romney defenders such as the editors of National Review had recently claimed — inaccurately — that he “never” sought a bailout. But media pundits quickly exposed the error and mocked the neoconservative publication, borrowing a word from the NRO article to label its coverup of Romney’s federal rescues “asinine.”

Other Romney apologists have attacked his critics for exposing Bain Capital’s record. But because the former Massachusetts Governor has made his work at the firm one of the central focuses of his campaign, analysts said closer scrutiny of Romney’s career there should have been expected.

And the criticism is growing quickly. "Put it all together and even Barack Obama is to Mitt’s right on bailouts," wrote conservative commentator John Hawkins in a piece calling Romney the “Bailout King” of American politics. "Is this what conservatives will have to defend in 2012 in the name of 'capitalism' because Mitt Romney’s the nominee?"

BTTT

And all the local radio stations that carry rush and hannity.Ever wonder why the local guy you have listened to in the morning ,whom you thought was conservative, will not bash romney?He just might be getting his paycheck indirectly from bain capitol.

I heard Rush make a reference to Bain Capital and Clear Channel, but, no way are any of the conservative talk show hosts in the tank for Romney. Consider the source.

Fox news seems to have some subtle marching orders as well....

JMHO....

I beg to differ with you on that.

. . Zing!

Interesting

Great find, STARWISE. Another drip in the (nearly full) bucket.

Rush shilling for Romney?? Seriously??

It’s unbelievable, isn’t it? Insanity.

The local station I listen too, WNIS, bashes everyone. Tony Macrini is a libertarian. He doesn’t even agree completely with Dr. Paul.

I don’t see Rush, Hannity nor Levin in the tank for Romney total BS.

Rush has been very fair ..and critical of Romney .. so I don’t hold him up as an example of this piece.

Rush Limbaugh: “Romney is not a conservative”

http://www.youtube.com/watch?v=W_YLARNrZGw&feature=player_embedded

Don’t Hold Your Breath for Romney to Attack Obama the Way He Attacked Newt

Same with Mark Levin ..

Mark Levin: ‘Character Matters and Romney’s Worries Me’

Mark’s entire Romney piece:

https://www.facebook.com/notes/mark-levin/character-matters-and-romneys-worries-me/10150499413515946

As for the other hosts, who knows ...

>> no way are any of the conservative talk show hosts in the tank for Romney <<

Your kidding, right? I can not believe you wrote it.

Connecting the dots ...

http://www.freerepublic.com/focus/f-news/2832273/posts

Bain Capital Owns Clear Channel (Limbaugh,Hannity, Beck, Savage, Etc.)

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

http://www.freerepublic.com/focus/news/2833425/posts?page=89#89

Romney Plans to Pursue Public Service - SLOC boss won’t return to business after Games; Romney Plans to Pursue Public Service

Salt Lake Tribune, The (UT) - Tuesday, August 21, 2001

Author: MIKE GORRELL, THE SALT LAKE TRIBUNE

EXCERPT

The transition was ensured when Romney informed the 26 managing directors of Bain Capital recently that he was “going limited.” That meant he no longer intended to resume his duties as managing partner and chief executive of the company, which started or took part in 140 corporate acquisitions since 1984 and has more than $12 billion in assets.

In doing so, he gave up control over all of Bain Capital’s voting stock, dividing the shares between the two dozen directors. The divestiture had no financial ramifications, Romney said, affecting only the management and control of the company.

//

http://www.freerepublic.com/focus/f-news/2835158/posts?page=15#15

Public service for Romney

Deseret News, The (Salt Lake City, UT) - Monday, August 20, 2001

Author: Lisa Riley Roche and Bob Bernick Jr., Deseret News staff writers

EXCERPT

Romney took a leave of absence in 1999 as chief executive officer of Bain Capital Inc. to take the helm at SLOC.

Bain is one of the nation’s biggest private equity firms with 26 partners.

Earlier this year, Huntsman Corp. announced a deal in which Bain invested more than $600 million in the Salt Lake City-based chemical company.

Under terms of the deal, Bain gained a minority equity stake in Huntsman Corp., which assured the deal had nothing to do with Romney .

//

Say what?!?

http://www.politico.com/news/stories/0112/71886.html

By KENNETH P. VOGEL | 1/24/12 11:56 AM EST Updated: 1/25/12 7:41 AM EST

Mitt Romney and his wife earned $13 million from Bain Capital investments in the past two years, according to tax information released by his presidential campaign Tuesday morning.

(snip)

“Remember that Gov. Romney resigned from Bain in February 1999 to take a full-time job running the Salt Lake [City Olympic] organizing committee,” (Brad Malt, the lawyer who administers the Romneys’ trusts) said. “Since that time, he has not had anything to do with Bain Capital or its investments. He has not participated in Bain Capital affairs.” The $13 million Romney received in 2010 and 2011 is from so-called carried interest that “does represent investments previously made by Gov. Romney in Bain Capital.”

(snip)

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

http://pfds.opensecrets.org/N00000286_2010_pres.pdf

Form 278

http://www.davemanuel.com/pols/mitt-romney/

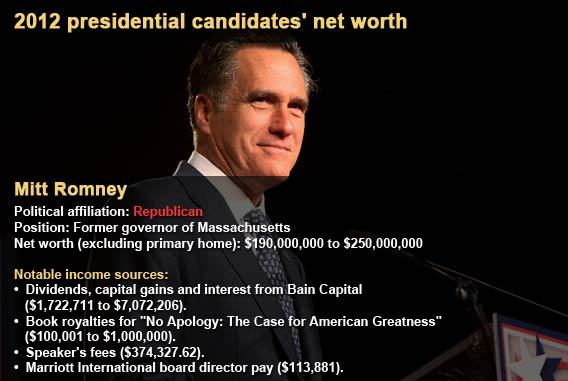

2012 Net Worth for Presidential Candidate Mitt Romney

Tweet

Average Net Worth: $171,748,066*

Minimum Net Worth: $80,873,131

Maximum Net Worth: $257,852,991

Average 2010 Income: $26,343,067**

Min. Gross Income: $9,592,421

Max. Gross Income: $43,093,712

Name: Mitt Romney

Last Filing: August 12th, 2011

Title: Presidential Candidate

Salary: $0

Party: Republican

Term Start: -

Term End: -

Assets

GS Financial Square Federal Fund - FST Shares $5,000,001 - $25,000,000

BCIP Trust Associates III $5,000,001 - $25,000,000

SPDR S&P 500 ETF Trust SPDR $1,000,001 - $5,000,000

Sankaty Credit Opportunities IV $1,000,001 - $5,000,000

IShares TR-IShares MSCI Eafe Index Fund ETF $1,000,001 - $5,000,000

GS Strategic Income Fund Class 1 $1,000,001 - $5,000,000

FHLB 3.625% 10/18/2013 AO SR LIEN $1,000,001 - $5,000,000

FHLB SER: 421 3.875000% 06/14/2013 JD $1,000,001 - $5,000,000

FHLB SER: 312 5.750000% 05/15/2012 MN $1,000,001 - $5,000,000

FHLB 5.5% 08/13/2014 FA $1,000,001 - $5,000,000

Sankaty Credit Opportunities III $1,000,001 - $5,000,000

Thornburg Investment Management $1,000,001 - $5,000,000

FHLB 1.0% 12/28/2011 JD $1,000,001 - $5,000,000

Select Commodities Strategies, LLC $1,000,001 - $5,000,000

FHLB 1.625% 03/20/2013 MS $1,000,001 - $5,000,000

FHLB 1.75% 08/22/2012 FA $1,000,001 - $5,000,000

Absolute Return Capital Partners $1,000,001 - $5,000,000

Brookside Capital Partners Fund $1,000,001 - $5,000,000

Prospect Harbor Credit Partners $1,000,001 - $5,000,000

Sankaty High Yield Asset Grantor Trust $1,000,001 - $5,000,000

FHLB 5.250000% 06/18/2014 JD $1,000,001 - $5,000,000

FHLB 3.625% 05/29/2013 MN $1,000,001 - $5,000,000

FFCB 4.875000% 12/16/2015 JD $1,000,001 - $5,000,000

FHLB 1.75% 08/22/2012 FA $1,000,001 - $5,000,000

FHLB 4.75% 12/16/2016 JD $1,000,001 - $5,000,000

BNP Paribas Lnkd to Basket of 6 Commod Fut 0% Coupon Due Nov 21, 2014 Structured Note $1,000,001 - $5,000,000

FHLB 3.625% 09/16/2011 MS $1,000,001 - $5,000,000

FHLB 4.625% 10/10/2012 AO $1,000,001 - $5,000,000

GS Private Client Portfolio $1,000,001 - $5,000,000

FHLB 1.0% 12/28/2011 JD $1,000,001 - $5,000,000

Eksportsfinans ASA Linked to Global Basket vs USD 0% Coupon Due May 2012 Structured Note Over $1,000,000*

Bain Capital Fund VIII Over $1,000,000*

BCIP Venture Associates Over $1,000,000*

FHLB 4.625% 10/10/2012 AO Over $1,000,000*

BCIP Associates IV Over $1,000,000*

BNP Paribas Lnkd to Basket of 6 Commod Fut 0% Coupon Due Nov 21, 2014 Structured Note Over $1,000,000*

FHLB 4.500000% 11/15/2012 Over $1,000,000*

FFCB 4.875000% 12/16/2015 JD Over $1,000,000*

BCIP Associates III Over $1,000,000*

GS 2002 Exchange Place Fund LP Over $1,000,000*

Goldman Sachs Hedge Fund Partners II, LLC Over $1,000,000*

BNP Paribas Lnkd to Eurostoxx 50 Div Pts 0% Coupon Due 12/29/2014 Over $1,000,000*

Brookside Capital Partners Fund II Over $1,000,000*

Brookside Capital Partners Fund Over $1,000,000*

Elliott Associates, LP Over $1,000,000*

D5 Family Bulldog Fund, LP Over $1,000,000*

Goldman Sachs Hedge Fund Partners, LLC Over $1,000,000*

Solamere Founders Fund 1-B, LP Over $1,000,000*

Goldman Sachs Trust GS Inflation Protected Securities Fund - Instl Shs Over $1,000,000*

Goldman Sachs Global Opportunities Fund, LLC Over $1,000,000*

BNP Paribas Lnk to Bric + IT vs JPY (FX) 0% Coupon Due 9/22/2011 Structured Note Over $1,000,000*

GS Financial Square Federal Fund - FST Shares Over $1,000,000*

SPDR S&P 500 ETF Trust SPDR Over $1,000,000*

Rabobank Nederland, Utrecht Lnkd to Ishares FTSE/China 0% Coupon Due 5/7/2012 Structured Note $500,001 - $1,000,000

The Goldman Sachs Group, Inc. Linked to MSCI Eafe 0% Due 07/03/2013 Structured Note $500,001 - $1,000,000

GS Local Emerging Mkts Debt Fd Mutual Fund - CL 1 $500,001 - $1,000,000

Eksportfinans ASA Linked to Asian FX Bask vs USD 0% Coupon Due Jan 2012 Structured Note $500,001 - $1,000,000

The Goldman Sachs Group, Inc. Linked to DJIA 0% Coupon Due 07/29/2013 Structured Note $500,001 - $1,000,000

The Goldman Sachs Group, Inc. Linked to DJIA 0% Coupon Due 07/29/2013 Structured Note $500,001 - $1,000,000

CCG Investments (BVI) LP $500,001 - $1,000,000

Whitehall Street Global Real Estate Limited Partnership 2007 $500,001 - $1,000,000

Bain Capital Fund X $500,001 - $1,000,000

Bain Capital Fund IX $500,001 - $1,000,000

Golden Gate Capital Opportunity Fund, LP $500,001 - $1,000,000

Bain Capital Fund VII-E $500,001 - $1,000,000

Bain Capital Fund VIII-E $500,001 - $1,000,000

GS Capital Partners Fund 2000, LP $500,001 - $1,000,000

Bain Capital Fund VII $500,001 - $1,000,000

FHLB 3.625% 05/29/2013 MN $500,001 - $1,000,000

FHLB 1.0% 12/28/2011 JD $500,001 - $1,000,000

The Goldman Sachs Group, Inc. Linked to SP GSCI Agriculture 0% Due 09/07/2012 Structured Note $500,001 - $1,000,000

FHLB 1.875% 06/21/2013 JD $500,001 - $1,000,000

TVA 6.79% 05/23/2012 MN $500,001 - $1,000,000

Goldman Sachs Small Cap Value Class 1 $500,001 - $1,000,000

FHLB 5.375% 05/18/2016 MN $500,001 - $1,000,000

FHLB 4.500000% 09/16/2013 MS $500,001 - $1,000,000

FHLB 1.5% 01/16/2013 JJ $500,001 - $1,000,000

FHLB 1.625% 03/20/2013 $500,001 - $1,000,000

FHLB 1.625% 09/26/2012 MS $500,001 - $1,000,000

FHLB 5.375% 08/19/2011 FA $500,001 - $1,000,000

FHLB 5.375% 05/18/2016 MN $500,001 - $1,000,000

FHLB 5.250000% 06/18/2014 JD $500,001 - $1,000,000

FHLB 4.875% 11/18/2011 MN $500,001 - $1,000,000

FHLB 4.875% 05/17/2017 MN $500,001 - $1,000,000

FHLB 3.625% 10/18/2013 AO SR LIEN $500,001 - $1,000,000

FHLB 3.625% 07/01/2011 JJ $500,001 - $1,000,000

CCG Investment Fund, LP $250,001 - $500,000

GGC Investment Fund II-A, LP $250,001 - $500,000

Absolute Return Capital Partners $250,001 - $500,000

BNP Paribas Lnkd to Eurostoxx 50 Div PTS 0% Coupon Due 12/29/2014 Structured Note $250,001 - $500,000

Federated Government Obligation Fund $250,001 - $500,000

GGC Investment Annex Fund II, LP $250,001 - $500,000

Ford Motor Company $250,001 - $500,000

Bain Capital VIII Co-Investment Fund $250,001 - $500,000

Gold $250,001 - $500,000

Rob Rom, LLC, Moorpark, CA (Owns Horses) $250,001 - $500,000

Bain Capital Venture Fund 2001 $250,001 - $500,000

GS Strategic Income Fund Class I $250,001 - $500,000

Rabobank Nederland, Utrecht Linked to MSCI Taiwan Index 0% Due 07/11/2013 Structured Note $250,001 - $500,000

The Goldman Sachs Group, Inc. Lnkd To The Russell 2000 Index 0% Coupon Due 07/19/2013 Structured Note $250,001 - $500,000

Sankaty Credit Opportunities II $250,001 - $500,000

Goldman Sachs Trust GS Inflation Protected Securities Fund - INSTAL SHS $250,001 - $500,000

B of A Cash Accounts $250,001 - $500,000

Sankaty Special Situations I $100,001 - $250,000

Marriott International, Inc. Cmn Class A $100,001 - $250,000

Prospect Harbor Credit Partners $100,001 - $250,000

BCIP Associates II $100,001 - $250,000

Bain Capital Asia Fund $100,001 - $250,000

FNMA 3.25% 04/09/2013 AO $100,001 - $250,000

GGC Investment Fund II, LP $100,001 - $250,000

GGC Investments II-A Adjunct (BVI), LP $100,001 - $250,000

Cash - GS Account $100,001 - $250,000

GGC Investments II (BVI), LP $100,001 - $250,000

FHLMC 4.625% 10/25/2012 AO $100,001 - $250,000

Rabobank Nederland, Utrecht Lnkd to IShares FTSE/China 0% Coupon Due 5/7/2012 Structured Note $100,001 - $250,000

Whitehall Street Real Estate LP XIII/XIV $100,001 - $250,000

BNP Paribas Lnk to BRIC + IT vs JPY (FX) 0% Coupon Due 9/22/2011 Structured Note $50,001 - $100,000

Cash - GS Account $50,001 - $100,000

Sankaty Credit Opportunities IV $50,001 - $100,000

GS Emerging Markets Opportunities Fund LLC $50,001 - $100,000

Sankaty Credit Opportunities $50,001 - $100,000

Sankaty High Yield Asset Grantor Trust $50,001 - $100,000

Bain Capital Venture Fund 2005 $50,001 - $100,000

Bain Capital VII Coinvestment Fund $50,001 - $100,000

Bain Capital V Mezzanine Partners $50,001 - $100,000

Bain Capital Venture Fund 2007 $50,001 - $100,000

Bain Capital Fund VI $15,001 - $50,000

Abbott Laboratories $15,001 - $50,000

BCIP Associates III-B $15,001 - $50,000

GS Capital Partners III LP $15,001 - $50,000

BCIP Associates I $15,001 - $50,000

BCIP Associates $15,001 - $50,000

BCIP Trust Associates II $15,001 - $50,000

III Capital $15,001 - $50,000

Loan Secured by Real Property in Missouri City, TX $15,001 - $50,000

Whitehall Street Real Estate Fund IX/X $15,001 - $50,000

Abry Broadcast Partners II, LP $15,001 - $50,000

Whitehall Street Real Estate Fund XI/XII $15,001 - $50,000

Bain Capital Europe Fund III $15,001 - $50,000

Sankaty High Yield Partners III $15,001 - $50,000

CCG Investments LLC $15,001 - $50,000

Sankaty Credit Opportunities $1,001 - $15,000

Sankaty High Yield Partners II $1,001 - $15,000

GS Financial Square Federal Fund - FST Shares $1,001 - $15,000

Goldman Sachs Core Fixed-Inc Mutual Fund $1,001 - $15,000

Argo Digital Solutions, Inc. $1,001 - $15,000

Lynuxworks, Inc. $1,001 - $15,000

Sun Venture Capital Partners I, L.P. $1,001 - $15,000

Sankaty Special Situations I $1,001 - $15,000

III Capital $1,001 - $15,000

Bain Capital Fund IX Co-Investment Fund $1,001 - $15,000

GGC Investments II, LLC $1,001 - $15,000

Bain Capital Partners IV $1,001 - $15,000

Bain Capital Partners V $1,001 - $15,000

Eksportfinans ASA LNK to KRW vs EUR 0% Coupon Due 02/28/2011 Less Than $1,001

BNP Paribas Linked to Eurostoxx 50 Div PTS 0% Coupon Less Than $1,001

Cash - GS Account Less Than $1,001

FHLB 3.875000% 01/15/2010 JJ Less Than $1,001

GS Global Equity Partners I, LLC Less Than $1,001

Goldman Sachs Investment Grade Credit Fund - INST Less Than $1,001

Goldman Sachs Group, Inc. CMN Less Than $1,001

Goldman Sachs Ultra-Short Duration Government FD Less Than $1,001

Goldman Sachs Short Duration Government Fund Less Than $1,001

FHLB 4.375% 10/22/2010 AO Less Than $1,001

FHLB 4.375000% 09/17/2010 MS Less Than $1,001

FHLB 4.375000% 03/17/2010 MS Less Than $1,001

FHLB 4.625000% 02/18/2011 FA Less Than $1,001

Income

BCIP Trust Associates III $1,000,001 - $5,000,000

BCIP Associates III Over $1,000,000*

CCG Investments (BVI) LP Over $1,000,000*

Brookside Capital Partners Fund Over $1,000,000*

Bain Capital Fund VIII Over $1,000,000*

Absolute Return Capital Partners $100,001 - $1,000,000

SPDR S&P 500 ETF Trust SPDR $100,001 - $1,000,000

Goldman Sachs Trust GS Inflation Protected Securities Fund - Instl Shs $100,001 - $1,000,000

BCIP Venture Associates $100,001 - $1,000,000

Brookside Capital Partners Fund $100,001 - $1,000,000

Bain Capital Fund VIII-E $100,001 - $1,000,000

Thornburg Investment Management $100,001 - $1,000,000

GS Global Equity Partners I, LLC $100,001 - $1,000,000

Select Commodities Strategies, LLC $100,001 - $1,000,000

Goldman Sachs Investment Grade Credit Fund - INST $100,001 - $1,000,000

Goldman Sachs Group, Inc. CMN $100,001 - $1,000,000

Bain Capital Venture Fund 2005 $100,001 - $1,000,000

Sankaty Credit Opportunities IV $100,001 - $1,000,000

Brookside Capital Partners Fund II $100,001 - $1,000,000

Bain Capital Venture Fund 2001 $100,001 - $1,000,000

GS 2002 Exchange Place Fund LP $100,001 - $1,000,000

GS Capital Partners Fund 2000, LP $100,001 - $1,000,000

CCG Investment Fund, LP $100,001 - $1,000,000

GGC Investment Fund II-A, LP $100,001 - $1,000,000

GGC Investment Annex Fund II, LP $100,001 - $1,000,000

GGC Investment Fund II, LP $100,001 - $1,000,000

Solamere Founders Fund 1-B, LP $100,001 - $1,000,000

Bain Capital VII Coinvestment Fund $100,001 - $1,000,000

Bain Capital Fund VII $100,001 - $1,000,000

Marriott International (Board Service) $113,881

No Apology: The Case for American Greatness (Profits Donated to Charity) $100,001 - $1,000,000

Bain Capital Fund VII-E $100,001 - $1,000,000

Bain Capital VIII Co-Investment Fund $100,001 - $1,000,000

Sankaty Credit Opportunities IV $100,001 - $1,000,000

Goldman Sachs Global Opportunities Fund, LLC $100,001 - $1,000,000

Goldman Sachs Hedge Fund Partners, LLC $100,001 - $1,000,000

Goldman Sachs Hedge Fund Partners II, LLC $100,001 - $1,000,000

FHLB 4.625% 10/10/2012 AO $50,001 - $100,000

GS Local Emerging Mkts Debt Fd Mutual Fund - CL 1 $50,001 - $100,000

FHLB 5.375% 08/19/2011 FA $50,001 - $100,000

FHLB 5.375% 05/18/2016 MN $50,001 - $100,000

GGC Investments II (BVI), LP $50,001 - $100,000

Goldentree Asset Mgt., New York, NY $68,000

Elliott Associates, LP $50,001 - $100,000

FHLB 4.500000% 11/15/2012 $50,001 - $100,000

Sankaty Credit Opportunities II $50,001 - $100,000

GS Private Client Portfolio $50,001 - $100,000

International Franchise Assoc., Las Vegas, NV $68,000

Clark Consulting, Half Moon Bay, CA $66,000

Prospect Harbor Credit Partners $50,001 - $100,000

Federated Government Obligation Fund $15,001 - $50,000

Whitehall Street Real Estate LP XIII/XIV $15,001 - $50,000

FHLB 3.625% 05/29/2013 MN $15,001 - $50,000

Sankaty Special Situations I $15,001 - $50,000

FFCB 4.875000% 12/16/2015 JD $15,001 - $50,000

Quest Educational Foundation, Naples, FL $35,771

D5 Family Bulldog Fund, LP $15,001 - $50,000

Barclay’s Bank, Washington, DC $42,500

Absolute Return Capital Partners $15,001 - $50,000

Riverside Theatre, Vero Beach, FL $20,000

FFCB 4.875000% 12/16/2015 JD $15,001 - $50,000

HP Healthcare Services, Dallas, TX $32,831

GGC Investments II-A Adjunct (BVI), LP $15,001 - $50,000

Get Motivated Seminars, via Sat Link, Boston, MA $29,750

Sankaty Credit Opportunities $15,001 - $50,000

FHLB 5.250000% 06/18/2014 JD $15,001 - $50,000

Prospect Harbor Credit Partners $15,001 - $50,000

Sankaty Credit Opportunities $15,001 - $50,000

FHLB 1.625% 03/20/2013 $15,001 - $50,000

FHLB 3.625% 05/29/2013 MN $15,001 - $50,000

FHLB 3.625% 07/01/2011 JJ $15,001 - $50,000

FHLB 3.625% 10/18/2013 AO SR LIEN $15,001 - $50,000

Bain Capital Venture Fund 2007 $15,001 - $50,000

FHLB 4.625000% 02/18/2011 FA $15,001 - $50,000

FHLB 4.875% 05/17/2017 MN $15,001 - $50,000

FHLB 4.875% 11/18/2011 MN $15,001 - $50,000

FHLB 5.250000% 06/18/2014 JD $15,001 - $50,000

FHLB 3.625% 10/18/2013 AO SR LIEN $15,001 - $50,000

Goldman Sachs Short Duration Government Fund $15,001 - $50,000

FHLB SER: 312 5.750000% 05/15/2012 MN $15,001 - $50,000

GS Strategic Income Fund Class I $15,001 - $50,000

III Capital $5,001 - $15,000

FNMA 3.25% 04/09/2013 AO $5,001 - $15,000

FHLMC 4.625% 10/25/2012 AO $5,001 - $15,000

FHLB 1.625% 03/20/2013 MS $5,001 - $15,000

Bain Capital Fund VI $5,001 - $15,000

FHLB 5.5% 08/13/2014 FA $5,001 - $15,000

FHLB 4.625% 10/10/2012 AO $5,001 - $15,000

FHLB 4.500000% 09/16/2013 MS $5,001 - $15,000

FHLB 3.625% 09/16/2011 MS $5,001 - $15,000

TVA 6.79% 05/23/2012 MN $5,001 - $15,000

FHLB SER: 421 3.875000% 06/14/2013 JD $5,001 - $15,000

Whitehall Street Global Real Estate Limited Partnership 2007 $5,001 - $15,000

Whitehall Street Real Estate Fund IX/X $5,001 - $15,000

FHLB 1.75% 08/22/2012 FA $5,001 - $15,000

Claremont McKenna College, Claremont, CA $11,475

FHLB 4.75% 12/16/2016 JD $2,501 - $5,000

FHLB 5.375% 05/18/2016 MN $2,501 - $5,000

GS Strategic Income Fund Class 1 $2,501 - $5,000

Bain Capital V Mezzanine Partners $2,501 - $5,000

Marriott International, Inc. Cmn Class A $2,501 - $5,000

IShares TR-IShares MSCI Eafe Index Fund ETF $2,501 - $5,000

SPDR S&P 500 ETF Trust SPDR $2,501 - $5,000

FHLB 1.0% 12/28/2011 JD $2,501 - $5,000

Eksportfinans ASA LNK to KRW vs EUR 0% Coupon Due 02/28/2011 $2,501 - $5,000

FHLB 4.375000% 03/17/2010 MS $2,501 - $5,000

FHLB 4.375000% 09/17/2010 MS $2,501 - $5,000

BNP Paribas Linked to Eurostoxx 50 Div PTS 0% Coupon $2,501 - $5,000

FHLB 1.625% 09/26/2012 MS $2,501 - $5,000

FHLB 1.5% 01/16/2013 JJ $1,001 - $2,500

Goldman Sachs Small Cap Value Class 1 $1,001 - $2,500

Loan Secured by Real Property in Missouri City, TX $1,001 - $2,500

GS Financial Square Federal Fund - FST Shares $1,001 - $2,500

FHLB 3.875000% 01/15/2010 JJ $1,001 - $2,500

Sankaty Special Situations I $1,001 - $2,500

BCIP Associates $1,001 - $2,500

GS Financial Square Federal Fund - FST Shares $1,001 - $2,500

B of A Cash Accounts $1,001 - $2,500

FHLB 1.0% 12/28/2011 JD $1,001 - $2,500

Goldman Sachs Trust GS Inflation Protected Securities Fund - INSTAL SHS $1,001 - $2,500

FHLB 1.0% 12/28/2011 JD $201 - $1,000

Bain Capital Fund IX Co-Investment Fund $201 - $1,000

Goldman Sachs Core Fixed-Inc Mutual Fund $201 - $1,000

Liabilities

Solamere Founders Fund 1B, LP Over $1,000,000

Golden Gate Capital Opportunity Fund LP $250,001 - $500,000

Sankaty Credit Opportunities IV, LP $250,001 - $500,000

GGC Investments Annex Fund II LP $100,001 - $250,000

Whitehall Street Global Real Estate LP 2007 $100,001 - $250,000

Whitehall Street Real Estate Fund XI/XII $100,001 - $250,000

GGC Investments II (BVI) $15,001 - $50,000

GS Capital Partners III LP $15,001 - $50,000

Whitehall Street Real Estate Fund IX/X $15,001 - $50,000

GGC Investments II-A LP $10,001 - $15,000

Positions Held Outside U.S. Government

Irrevocable Trust Trust established to hold extended family vacation property Trustee 12/91-PRESENT

Marriott International Hotel Company Director 1/09-1/11

Notes:

-a large portion of Mitt and Ann Romney’s assets are held in blind trusts (Ann Romney Blind Trust and W. Mitt Romney Blind Trust)

-here is what Romney’s filing says about his liabilities: “Some investments in private equity and similar funds disclosed on Schedule A are made pursuant to agreements of limited partnership, subscription agreements and/or other similar documentation that could be characterized as creating liabilities for capital calls or other payments to be made by investors... in the case of Funds for which there is expected to be a capital call for future investments, the following table lists the Funds and the maximum expected future liability for such capital calls.”

Source: FEC.gov

*Average Net Worth = (Max Net Worth + Min Net Worth) / 2

**Average Income = (Max Net Worth + Min Net Worth) / 2

Includes Salary, Doesn’t Include Deductions

Note: Assets and Income are given in ranges, which is why there is a minimum and maximum net worth and income figure.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

http://www.investopedia.com/terms/l/limited-partner.asp

Limited Partner

http://www.sec.state.ma.us/cor/corpweb/corlp/lpinf.htm

Commonwealth of Massachusetts

Limited Partnership Information

LOL. They were in the tank for Romney last time around and they are this time around. He is essentially their boss so they work to balance retaining their listeners and retaining their jobs.

Wouldn’t Obama be the “bailout king” after giving away trillions of OPM?

Bain Capital joined with private-equity firm Thomas H. Lee Partners to buy Clear Channel in 2008, with the announcement made shortly before Romney’s 2008 run for the GOP nomination. The $25-billion deal included around 1,000 AM and FM stations, as well as dozens of televisions stations that were later sold off.

Clear Channel subsidiary Premiere Radio Networks — the largest radio syndication service in America with talk-show hosts including Rush Limbaugh, Glenn Beck, and Sean Hannity — was also part of the package. According to the company’s website, its radio programs reach nearly two-thirds of the American people each week through some 5,000 radio affiliations.

The economic disaster has apparently left a lot of formerly wealthy Rinos like fraux conservative radio hosts very susceptible to Romney's 30 pieces of silver. So they are cashing in for their 30 pieces of Romney’s silver and selling out to trash Newt!:

Mitt is the poster boy for Crony Capitalism!

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.