Whatever else he may have been, Roland Arnall was a holocaust survivor and co-founder of the Simon Wiesenthal Center, and from 2006 until shortly before his death he was, as you know, the United States Ambassador to the Netherlands.

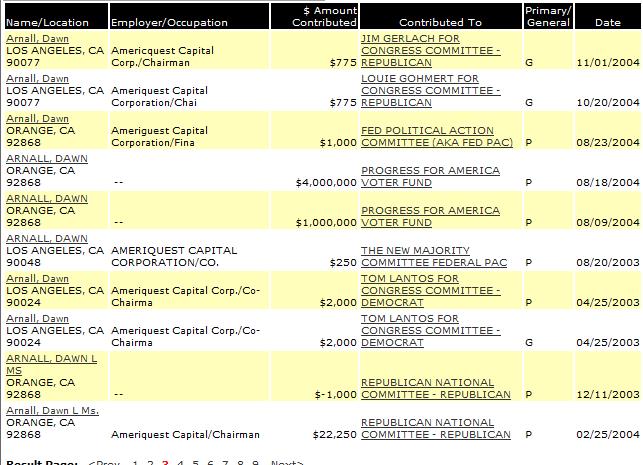

Arnall was once quoted as saying his support for Bush stemmed from Bush's stance on Israel. In 2004 Arnall was one of the top 10 donors to the Republican Party.

http://en.wikipedia.org/wiki/Roland_Arnall

See also......

http://www.washingtonpost.com/wp-dyn/content/article/2008/03/19/AR2008031903402.html

But apart from Arnall's association with Bush, Arnall's alleged "predatory lending practices" do not appear to have begun on Bush's watch. Moreover, he had his own issues with ACORN....which may have been a contributing factor in the so-called "predatory lending practices" of other lending institutions besides Ameriquest.

AMERIQUEST

Predatory Lending Allegation

......In 1996, the company agreed to pay $3 million into an "educational fund" to settle a Justice Department lawsuit accusing it of gouging and predatory lending practices against older, female, and minority borrowers. Prosecutors accused it of allowing mortgage brokers and its employees to charge these customers an additional fee of as much as 12% of the loan amount. As part of the settlement, Ameriquest (then still known as Long Beach Mortgage) agreed to use the educational fund to train its employees in proper mortgage techniques (training which most observers agree never actually occurred to any substantial degree), and to refrain from utilizing predatory lending techniques (such as "bicycling"), but only within the State of California. Shortly after entering into this settlement agreement, the company "switched" names with its subsidiary and began aggressively seeking refinance-mortgage business throughout the United States. In 2001, after being investigated by the Federal Trade Commission, the company settled a dispute with ACORN, a national organization of community groups, promising to offer $360 million in low-cost loans. In February 2005, reporters Michael Hudson (reporter) and Scott Reckard broke a story in the Los Angeles Times about “boiler room” sales tactics at Ameriquest. Their investigation found evidence that the lender had in various questionable practices, including “deceiving borrowers about the terms of their loans, forging documents, falsifying appraisals and fabricating borrowers' income to qualify them for loans they couldn't afford.” On 1 August 2005, Ameriquest announced that it would set aside $325 million to settle attorney-general investigations in 30 states to settle allegations that it had preyed on borrowers with hidden fees and balloon payments. In at least five of those states—California, Connecticut, Georgia, Massachusetts, and Florida—Ameriquest had already settled multimillion-dollar suits. Brian Montgomery, the Federal Housing Administration commissioner said that the Ameriquest settlement reinforced his concern that the industry was exploiting borrowers, and that he "was shocked to find those customers had been lured away by the “fool’s gold” of subprime loans". In May 2006, Ameriquest Mortgage announced it was closing all of its retail offices and in the future would make its loans through mortgage brokers, a channel that is not covered by the predatory-lending settlement with the Attorneys General. On June 13, 2007, lawyers for borrowers, who are seeking to combine 20 suits into one class-action suit, asserted in a filing in Illinois Northern District Court that "Assets of the Ameriquest entities were transferred to (the owner of Ameriquest) Arnall with the actual intent to hinder, delay, or defraud the plaintiffs in this action." The issues confronted by companies like Ameriquest could be a major contributing factor to the rapid rise of Certified Mortgage Planners, certified industry experts that work in concert with Certified Financial Planners in harmonizing the home-finance products utilized by consumers with their larger financial portfolios. Former employees from Ameriquest, which was United States's leading wholesale lender, described a system in which they were pushed to falsify documents on bad mortgages and then sell them to Wall Street banks eager to make fast profits. There is growing evidence that such mortgage fraud may be at the heart of the Financial crisis of 2007–2010.[1]

http://en.wikipedia.org/wiki/Ameriquest_Mortgage

ACORN Pressures Crack Ameriquest July 27, 2000

http://realtytimes.com/rtpages/20000727_safeguards.htm

From what we now know about ACORN, I wouldn't be surprised to learn that those lenders defined as "predators" by groups like ACORN were more the victims of ACORN looters than the looters were victims of the lenders who were sometimes almost forced to lend money to unqualified borrowers.