<img src= >

like this:

<img src=http://i242.photobucket.com/albums/ff274/calicard1/wolverines.jpg >

Posted on 07/28/2011 4:06:09 PM PDT by Jim Robinson

Edited on 07/28/2011 5:06:23 PM PDT by Jim Robinson. [history]

“But I agree with you about Laura Ingram. She had George Will on tonight, and his compromise-prone disease is sickening. Laura just agrees with him. GW is just a typical beltway estab. RINO.”

_____________________________________________________

I didn’t see this tonight, but on her show this morning she was tripping all over her tongue singing the praises of GW.

Laura’s done many good things and I do like her, but I really believe she spends too much time with establishment types in the beltway like GW, O’Reilly, etc. Mark Levin was slamming Ingraham and the other appeasers tonight (without naming her of course). If she keeps this establishment crap up, I’m done listening to her...others will do the same.

What is being witnessed, in the present, is only a beginning should Congress betray America again. There have been too many betrayals to count... imho.

Shouldn't Congress listen to Americans? Congress represents Americans don't they or do they not? Solutions can only be presented when the problems are no longer ignored. Ignoring the problems only creates more problems. Increasing the blank check and adding QE3 (heard six weeks away) is not going to solve a problem but will move America closer to default. My suggestion ... Hold The Line.

That’s my point money continues to flow to other than American Citizens yet illegals still get U.S Benes.

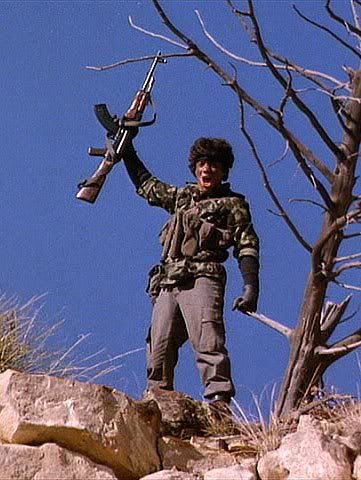

It will be interesting to see if the American people take this like sheep or stand up and fight back.

I add my agreement to your prayer! Amen.

Saw your thoughts on another thread. May I say, I also like Bob.

<img src= >

like this:

<img src=http://i242.photobucket.com/albums/ff274/calicard1/wolverines.jpg >

Amen, JR, and may God bless you! I’m praying right along with everyone that our Representatives hold the line against the Demon-rats and their leaders.

Actually, this is getting close to the last chances we will have as a nation to save ourselves and our children from a Socialist, government controlled existance.

Amen JR! HOLD THE LINE!

Thank you for your kind words. I fail so many times. The Line Has Been Held today. Tomorrow the outcome is in doubt. Please Pray, the Line will be Held.

“Sarah Palin: It’s the spending stupid! “

Well, I’m glad she made that wise pronouncement.

But she didn’t have to mention me personally like that.

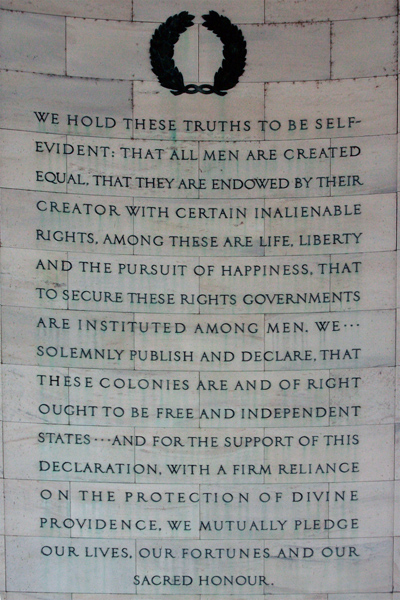

Smaller government = freedom which = capitalism and prosperity.

Bigger government = socialism = tyranny and poverty.

Democrats are for bigger government and socialism.

Smaller government = freedom which = capitalism and prosperity.

Bigger government = socialism = tyranny and poverty.

Democrats are for bigger government and socialism.

We need small, limited government with only a few laws including 2 laws that authorize the military and control illegal immigration and other things coming from other countries ( for example China).

This level is outrageously high. we need to go back to 2007 or thereabouts levels. We need to be talking about a DEBT CEILING DECREASE!

“HOLD THE LINE!!”

Amen.

And let them know they have our full support in the fight.

we are jim. God bless you!

i’m am carpet bombing the freshmen with faxes continuously.

keep it up. keep melting them down.

Sarah Palin Urges GOP Freshmen to ‘Remember Us Little People’

http://www.freerepublic.com/focus/f-news/2755547/posts

May 20 2011

The "One Percent Spending Reduction Act of 2011"

A Path to Balancing the Federal Budget

The Mack “One Percent Spending Reduction Act of 2011” (H.R. 1848) will achieve a balanced federal budget, beginning in 2019, by bringing federal spending down to average federal revenue over the past 30 years, which is 18% of gross domestic product (GDP).

KEY PROVISIONS:

One Percent Spending Reduction per Year: The Mack One Percent bill cuts total spending – mandatory and discretionary – by one percent each year for six consecutive fiscal years, beginning in fiscal year 2012.

•FY 2012 – $3.382 trillion*, less one percent => $3.348 trillion cap

•FY 2013 – $3.348 trillion, less one percent => $3.315 trillion cap

•FY 2014 – $3.315 trillion, less one percent => $3.282 trillion cap

•FY 2015 – $3.282 trillion, less one percent => $3.249 trillion cap

•FY 2016 – $3.249 trillion, less one percent => $3.216 trillion cap

•FY 2017 – $3.216 trillion, less one percent => $3.184 trillion cap

Overall Spending Cap in FY 2018: The bill sets an overall spending cap of 18 percent of GDP beginning in fiscal year 2018.

Enforcement of Spending Cuts: The one percent spending cuts would be achieved one of two ways: either 1) Congress and the President work together to enact program reforms and cut federal spending by one percent each year; or 2) If Congress and the President fail to do so, the bill triggers automatic, across-the-board spending cuts to ensure the one percent reduction is realized.

*Congressional Budget Office March 2011 Baseline for Total Outlays minus Net Interest

Presently the Mack Penny plan enjoys the support of over 40 co-sponsors in the U.S House. Click here to view the full list of co-sponsors.

Click here for more information on "The One Percent Spending Reduction Act"

http://mack.house.gov/index.cfm?p=Articles&ContentRecord_id=f18dea5d-c7db-400d-8eb5-bc0a5ee9d104&ContentType_id=a993f954-3acb-477f-b874-3661f9f6fb25&Group_id=2c61596a-fccc-47a0-8682-eeac569510d9

Gentlemen,

Please be careful not to confuse the FairTax (deliberate no space between r and T in FairTax) with the Flat Tax, as each is legislation in Congress and they are entirely different tax regimes.

Mr. Robinson is still correct in his point that the 16th repealed leads to an opportunity to revert to an excise tax and that such a tax to be Constitutional must necessarily be flat or uniformly applied.

The FairTax is brilliantly designed and uniformly applied to be a flat tax on consumer spending that taxes qualified Americans only after they have spent beyond ‘the bare essentials of living’, a euphemism for the poverty line. All other nonresidents on American soil are taxed uniformly on all purchases.

In other words under the FairTax there is for EVERY American not one penny of federal taxation applied below the poverty line.

And the above sentence corrects and repairs the longstanding ‘disproportionate burden’ argument of American tax history that has been used by those educated in communist and socialist philosophy to justify the graduated income tax and hence the foundational necessity for the 16th Amendment.

As we see a rapidly approaching historical opportunity to retool the apparatus used by our federal government in its power to spend and by association its power to tax, I point out to you that many will make their move, a move to implement a tax reform. I beg you to not be deceived or deluded to think of the ‘Flat Tax’ as a solution any more than you should allow youself to be persuaded that a FairTax can coexist with the 16th Amendment.

The Flat Tax is an income tax and by necessity requires the 16th Amendment to withstand challenges to its Constitutionality. We have had it in our history at times between our Civil War in 1861 until the establishment of the 16th Amendment in 1913. Every time our nation enacted a flat tax on income it began a process of bifurcation into a multi-tiered tax structure leading to a graduated income tax.

In other words the Flat Tax under the 16th Amendment never stays ‘flat’ because the 16th Amendment grants a de facto license to Congress to change the meaning and tax applicability of the word ‘income’.

This morphing of a Flat Tax into a tax code of monstrous complexity within a decade or two after its passage is due to power granted to Congress by the 16th Amendment.

I also beg you not to be persuaded to allow a consumption tax such as the FairTax to coexist with the 16th Amendment for then it will become a Value Added Tax or VAT.

A sharp student of American tax history would ask the question of why if the FairTax is so brilliant and solves a vexing problem of the original Constitutional tax provisions, why was it not applied before 1913, the year when the 16th Amendment was established?

And the answer is simple: “Inadequate Technology”.

But today we have the technology and we should use it to implement a means of taxation that will restore many of our lost freedoms and will cause the repatriation of more than 20 trillion US dollars of offshore holdings, as well as revive American competitiveness in global markets for products and services, and importantly comform with the Founder’s Original Intent.

So I beg you to support the FairTax over the Flat Tax when those in the know will make their move for tax reform after the current crisis erupts into a Constitutional facedown.

Please take the time to study this easy-worded FAQ:

http://www.fairtax.org/site/PageServer?pagename=about_faq

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.