Posted on 07/09/2011 12:46:33 PM PDT by Hojczyk

She ain’t got no steenking problems what with all those tax-payer funded vacations....what a pair of losers!

AMEN! And, I would add, anyone, ANYONE, who remains a Democrat is not a true American. Any party that would openly support such blatant Marxism needs to be crushed and eliminated.

F you, Zero

The DUmmies reaction.

http://www.democraticunderground.com/discuss/duboard.php?az=view_all&address=102x4912219

Even the left isn’t buying this anymore. And as much as the media will try to spin it, few are going to credit him for reigning in the debt. Obama has no message.

I knew we were in for a rough socialist ride a few years back when I realized it had become fashionable to hate George Bush, and blame him for everything that was not good. That fashion started when Gore tried to steal the election in 2000.

"Yup. Uh-huh. He's right. Bush's fault. That's right."

Telling the truth to a liberal is like holding up a crucifix to a vampire.

Congress is mostly to blame, and both political parties ran the debt up. With the way politicians behave for their most coveted constituents, the default is essentially inevitable.

The left is buying it because Bush raised the debt limit numerous times and the left thinks they are the good hearted people who care and don’t hate while we republicans hate gays etc and are only for big coroporations. They are still blaming Bush and it has not let up much among the believers and lets not forget the cheerleaders too, the msm is spinning 0bama’s way at every chance.

"Let me be clear..."

"It's my predecessor's fault...

Etc, etc.

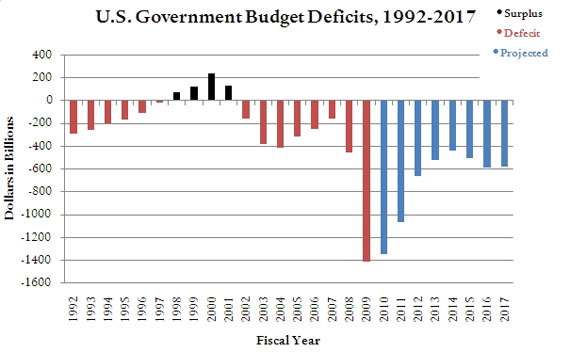

In a fair accounting, President Obama is responsible (along with the then-Democratic Congress) for the $1.3 trillion in deficit spending in 2010 and the estimated $1.6 trillion in deficit spending in 2011. He [Obama] should not get credit, moreover, for the $149 billion in TARP (Troubled Asset Relief Program) repayments made in 2010 and 2011 to cover most of the $154 billion in bank loans that remained unpaid at the end of the 2009 fiscal year—loans that count against President Bush’s 2009 deficit tally.

The Treasury Department says that all but $5 billion of the TARP bank loans has now been repaid. The portion of repayments that was for loans issued in 2009 should be deducted from Bush’s deficit tally, not credited to Obama as deficit savings. There is some astounding number crunching in this article, and a chart of modern day president’s “average annual deficit spending” ........a frightening conclusion of what happens if Obama has an 8 year term.

O’s SOTU speech was deliberately contrived to gull the citizenry. Obama wants Americans to believe he “just happened to drop by” the WH for a spell....and doesn’t have anything to do with the dismal state of the US economy.

Candidate Barack Obama told us on the campaign trail: “ The problem is, that the way Bush has done it over the last eight years is to take out a credit card from the Bank of China in the name of our children, driving up our national debt from $5 trillion for the first 42 presidents, # 43 added $4 trillion by his lonesome so that now we have over $9 trillion of debt that we are going to have to pay back, $30,000 for every man woman and child. That’s irresponsible. It’s unpatriotic.”

REALITY CHECK Obama presided over the biggest political heist in US history. The Obamanations (insiders and politicians) sucked up trillions under the guise of inheriting the “Bush financial crisis.”

THIS MADE ME LAUGH OUT LOUD Obama COS Rahm Emanuel “suddenly” discovered he wanted to be Chicago’s mayor-—the little turn went before the mics and announced his campaign “raised $10 million in just a few weeks.” Rahm also controlled the US Treasury as COS.

What the so-called “collapse” of the banking system wrought under Obama:

FOURTEEN TRILLION DOLLARS Behind The Real Size of the Bailout; A guide to the abbreviations, acronyms, and obscure programs that make up the $14 trillion federal bailout of Wall Street

SOURCE motherjones.com

Mon Dec. 21, 2009 12:23 PM PST

The price tag for the Wall Street bailout is often put at $700 billion—the size of the Troubled Assets Relief Program. But TARP is just the best known program in an array of more than 30 overseen by Treasury Department and Federal Reserve that have paid out or put aside money to bail out financial firms and inject money into the markets.

To get a sense of the size of the real $14 trillion bailout, see our chart at web site. Below, a guide to the pieces of the puzzle:

Treasury Department bailout programs

(Remember that Obama’s Treasury Dept was controlled by his then-COS Rahm Emanuel-—a G/S lobbyist in the WH)

Money Market Mutual Fund: In September 2008, the Treasury announced that it would insure the holdings of publicly offered money market mutual funds. According to the Special Inspector General for the Troubled Asset Relief Program (SIGTARP), these guarantees could have potentially cost the federal government more than $3 trillion [PDF].

Public-Private Investment Fund: This joint Treasury-Federal Reserve program bought toxic assets from banks and brokerages—as much as $5 billion of assets per firm. According to SIGTARP, the government’s potential exposure from the PPIF is between $500 million and $1 trillion [PDF].

TARP: As part of the Troubled Asset Relief Program, the Treasury has made loans to or investments more than 750 banks and financial institutions. $650 billion has been paid out (not including HAMP; see below). As of December 21, 2009, $117.5 billion of that has been repaid.

Government-sponsored enterprise (GSE) stock purchase: The Treasury has bought $200 million in preferred stock from Fannie Mae and another $200 million from Freddie Mac [PDF] to show that they “will remain viable entities critical to the functioning of the housing and mortgage markets.”

GSE mortgage-backed securities purchase: Under the Housing and Economic Recovery Act of 2008, the Treasury may buy mortgage-backed securities from Fannie Mae and Freddie Mac. According to SIGTARP, these purchases could cost as much as $314 billion -—SNIP-—.

LONG READ-—go to web site to read more and checkout the shocking financial charts.

SOURCE http://motherjones.com/politics/2009/12/behind-real-size-bailout

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.