by: Calafia Beach Pundit

February 10, 2011

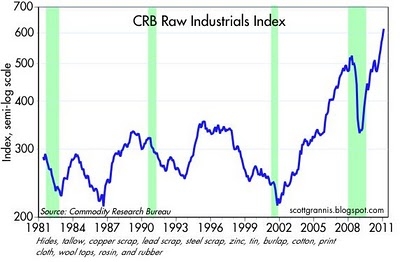

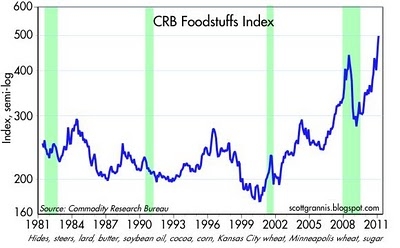

The above charts represent the two major components of the CRB Spot Commodity Index. Commodity prices continue to head skyward across the board, with most commodities hitting new all-time highs.

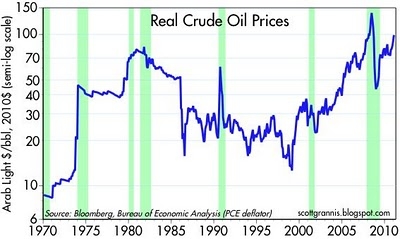

Arab Light Crude, flirting with $100/bbl, is now clearly higher in real terms than it was in the early 1980s. At this level, further price increases should begin to curtail demand, while also stimulating new sources of supply. But we are still well below the levels that might provoke a significant slowdown in economic activity, thanks to technological advances and energy conservation efforts.

Rising commodity prices continue to attest to a) strong global demand, and b) speculative activity fueled by easy/cheap money. Commodities are becoming increasingly vulnerable to any sign that monetary policy may begin to reverse course and seek to push short-term interest rates higher. I don't think this is imminent, but it is the clearest source of risk for commodity investors.