Skip to comments.

Coming Soon: A 300 Percent Increase in Foreclosures

Reason ^

| 02/04/2011

| Tim Cavanaugh

Posted on 02/04/2011 7:33:28 AM PST by SeekAndFind

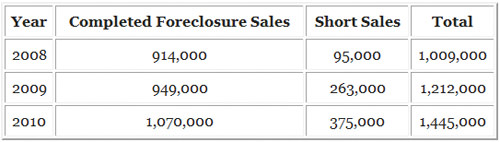

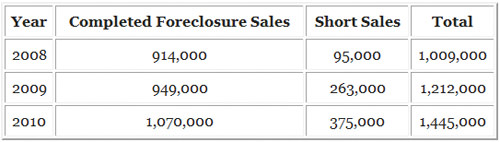

At Calculated Risk, Tom Lawler, a real estate economist and former risk policy veep at Fannie Mae, tries to figure out how many people have actually lost their homes to foreclosure, short sales or deed-in-lieu desertions. The answer: Not enough. Lawler (who is now living the life of Riley on a Virginia farm) says the number of foreclosures that have been completed so far is a drop in the bucket compared to the number of loans that have gone bad:

On the other hand, the above numbers could well OVERSTATE significantly the number of homeowners who lost their primary home either to foreclosure or to a short sale. A “significant” % of completed foreclosure sales has been completed foreclosures on non-owner-occupied homes, though estimates vary as to what that % has been. In addition, not all short sales have involved homeowners “involuntarily” leaving their home, but who instead wanted to (for economic or other reasons) move and who were able to negotiate a short sale with their lender.

So what is the right number for folks who lost their residence to foreclosure, a short sales, or a DIL? I don’t rightly know.

It is pretty clear, however, that overall foreclosure moratoria, foreclosure delays, modifications, and other workout activity continued to keep the number of homeowners who “lost” their homes to foreclosure massively lower than one would have expected given the delinquency/in foreclosure numbers.

So what will this mean when the last moratorium is lifted, the last show-me-the-note lawsuit gets thrown out of court, and the last loan modification has failed? Well by that time you’ll probably be able to buy property on a planet orbiting some nice warm star in Constellation Cygnus. But there could be roughly three times as many homes on the market as there are now. Lawler points to 1,445,000 completed foreclosures and short sales at the end of 2010, compared with 4,296,01 mortgages that are past due by 90 days or more.

Getting a handle on the shadow inventory is more than just a way to fill up the time between Sunday afternoon looky-loos. You should feel for these foreclosed people because they’ve lost their jobs – even though in most cases they haven’t lost their jobs. You should be worried about how foreclosure drives up neighborhood crime – even though it doesn’t. And be afraid, be very afraid of the failure of the Home Affordable Mortgage Program to keep hardworking American working families who work hard in America from losing their homes – even though the HAMP is actually designed to buy time for the banks. And if you really want to drop tears as fast as the Arabian trees their medicinal gum, read up on HAMP's underwhelming numbers, ineffectiveness, and costly efforts to limit redefaults.

Speaking of redefaults, the OCC/OTC Mortgage Metrics report [pdf] is out for the third quarter of 2010, and the results are barely less horrific than they were in the previous report. Just under half (47.6 percent) of modified loans are 30 days or more overdue (strong likelihood of permanent default) within a year; more than a third (36.7 percent) are 60 days overdue (near certainty of permanent default) and nearly a third (29.8 percent) are 90 days overdue (for God’s sake, get out of the house). Just to be clear: These are mortgages that the bank – frequently with backstopping from the taxpayers – has already fixed up once.

Redefault rates are showing gradual improvement, but the numbers are still pathetic. A quarter of all modified loans go bad after six months. To get even B-minus performances you have to make serious reductions in the borrower’s monthly payment. A third of bad borrowers who have had their payments reduced by up to 10 percent still default again; more than a quarter default after having their payment reduced between 10 percent and 20 percent. And 14.6 percent who have had their mortgage payments cut by more than 20 percent still manage to default within half a year. That goes beyond bad personal finance and becomes an achievement you have to respect.

Loans modified under HAMP actually have much better performance than other modifications. But the numbers are so poor all around that you shouldn’t hold your breath waiting to hear arguments for the success of the program. At this point the consensus that HAMP has failed seems pretty much unassailable. Which is just as well: If HAMP actually worked as promised, it would cost us almost a trillion dollars.

TOPICS: Business/Economy; Culture/Society; News/Current Events

KEYWORDS: foreclosures; housing; housingbubble; unexpected

Navigation: use the links below to view more comments.

first 1-20, 21-28 next last

To: SeekAndFind

Trillions will be lost because they were never there on the equity side.

2

posted on

02/04/2011 7:42:29 AM PST

by

MrEdd

(Heck? Geewhiz Cripes, thats the place where people who don't believe in Gosh think they aint going.8)

To: SeekAndFind

The mortgage problem has never been adequately addressed. It will take more than good cheerleading and wishful thinking. These losses have to be declared sooner or later.

3

posted on

02/04/2011 7:46:44 AM PST

by

Brownie63

To: SeekAndFind

Which will impact the economy in a more negative way: people losing their homes, or banks going under?

4

posted on

02/04/2011 8:04:10 AM PST

by

snowrip

(Liberal? You are a socialist idiot with no rational argument.)

To: MrEdd

I know a young couple, bought a home in the 250,000’s (seemed like a good price at the time...back in 2006), put 70,000 down, but the home has lost more than half it’s value since they bought, so now there is no equity. They sold on a short sale (not necessarily because of the mortgage payment but because of the taxes/insurance hit they were taking on the property.) The bank came back and placed some sort of a lien on them for the difference of what they owed and what the short sale was. They were current on their payments, but like I said, insurance and taxes unfortunately weren’t adjusted down as fast as the prices fell, and the bank absolutely refused to change or lower their interest rate, so they chose short sale.

Here’s an interesting story from our morning paper which seems to me is going to lead us right back into the same sort of mess we’ve come out of:

http://www.tampabay.com/news/business/realestate/article1149420.ece

5

posted on

02/04/2011 8:05:21 AM PST

by

dawn53

To: SeekAndFind

prices just don’t seem to have dropped here in Eastern Washington...they still want a ton of money for a smallish house in town......and land seems very high

6

posted on

02/04/2011 8:05:27 AM PST

by

cherry

To: SeekAndFind

Obama’s Debt Reduction Commission has recommended elimination of the mortgage deduction on our taxes. I doubt it will happen but if it does, real estate prices still would fall further. Because mortgage interest is the largest tax shelter the average person has, many buy more house than they need.

To: BealNoortz

RE: Obama’s Debt Reduction Commission has recommended elimination of the mortgage deduction on our taxes

Well if true, this will all but ensure that real estate values will fall FASTER. Why? Because the tax incentive to own, buy or invest in real estate will be GONE.

To: SeekAndFind

Why is it that in earlier decades we didnt have all this mass conundrum with mortgage foreclosures and sky high real estate prices? The artificially overpriced homes plus the big taxes to maintain them are putting a kabosh on the economy for so many.

9

posted on

02/04/2011 8:27:15 AM PST

by

tflabo

To: tflabo

I suspect if unemployment was in the pre obama levels, 5-6%, there would be quite a few houses quickly snapped up from the pool of foreclosures.

There are currently some very good deals out there, with once in a lifetime low rates for 30 year mortgages, but no one has, or wishes to spend, what bucks they have saved up, because the entire system is teetering, with the US govt f rom top down having no effin idea of how to stimulate growth.

Their answer to everything is MORE TAXES.

10

posted on

02/04/2011 8:34:41 AM PST

by

going hot

(Happiness is a Momma Deuce)

To: cherry

Eastern Washington?....great fishing all over the place! Outdoorsman's paradise and conservative also!

To: SeekAndFind

One has to wonder what will happen to the second mortgages on these foreclosures. I am betting over 40% of all foreclosures on first mortgages also have seconds behind them.

12

posted on

02/04/2011 8:38:02 AM PST

by

Toespi

To: Brownie63

13

posted on

02/04/2011 8:39:34 AM PST

by

FromLori

(FromLori">)

To: SeekAndFind

14

posted on

02/04/2011 8:40:54 AM PST

by

ex-Texan

(Ecclesiastes 5:10 - 20)

To: FromLori

Obama is dumping on us alright!.....

To: cherry

prices just don’t seem to have dropped here in Eastern Washington...they still want a ton of money for a smallish house in town......and land seems very high It really is all about location. Where I live property may have decreased a little but not near what I read about in other parts of the country.

To: snowrip

17

posted on

02/04/2011 8:48:05 AM PST

by

FromLori

(FromLori">)

To: Graybeard58

Location, location location....It’s all going to be about location when all the boomers retire. I don’t think they will be looking for homes next to major metro areas.....

To: Bullish; CJ Wolf; houeto; Quix; B4Ranch; Whenifhow; Silentgypsy; blam; FromLori; Lurker; ...

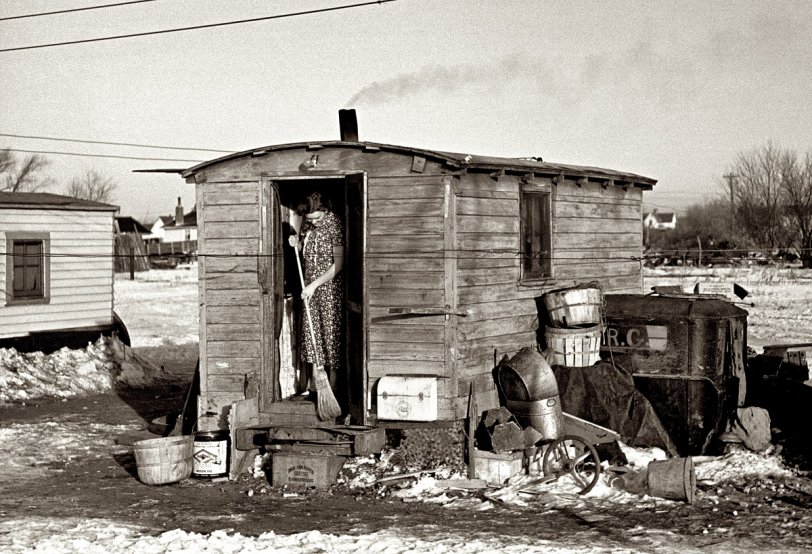

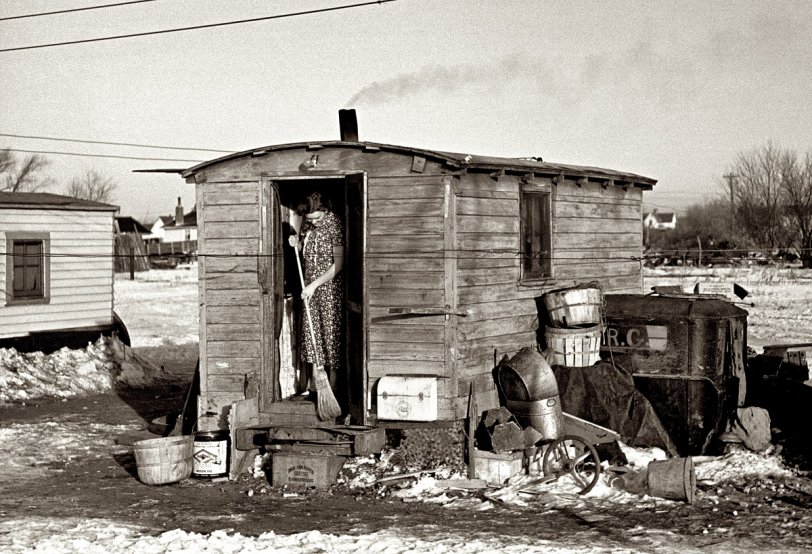

Just-think-of-it-as-extreme-camping ping.

"Economic Holocaust" ping.

Increasing volume ping list watching the slow motion Economic Holocaust.

FReepmail me if you want on or off

The Comedian's "Economic Holocaust" ping list...

Today is a good day to die.

I didn't say for whom.

19

posted on

02/04/2011 9:14:47 AM PST

by

The Comedian

(It's 3am all over the planet, and nobody's been answering the phone since 2008.)

To: SeekAndFind

huge waves of foreclosures will just feed the media narrative they need to get a third-party economic populist on the ballot in 2012. Obama is counting on that.

Navigation: use the links below to view more comments.

first 1-20, 21-28 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson