When?

Posted on 01/28/2011 6:55:23 AM PST by SeekAndFind

The reason the economy tanked is related to oil price shock which our country did nothing to avoid even though we went through this in the 70's. That plus the credit card rate hikes which also took money out of consumer's pockets. Yes the banks did it to themselves when they got greedy.

I disagree with your view of history.

Mortgages are not part of the problem? They are a multi-trillion dollar problem for the US. Their losses have not been recognized on the corrupt bankster balance sheets yet.

Holding interest rates too low causes inflation in everything. The next to come will be colleges, where the interest rates have been held down and created a college education bubble.

Oil price shock? Give me a break. Our economy has absorbed higher oil prices.

When?

as the US currency at the time was backed by gold, there was some link for the legitimacy for the POTUS to do this. some. as that link was severed, the government has zero claims on any gold in the US.

if your statement is trying to imply they could demand forfeiture of private property, then anything is up for grabs, not just gold.

they could demand all bullets and guns be turned in. cars. sneakers. bacon. anything. why do you think they would care about gold?

and of course, there would be a revolt as mass confiscation of private property will make the majority of Americans freak out (at least those that ever intended on or currently owning the items being seized)

keep in mind, long before they would try to confiscate private property, they would go after the ‘low hanging fruit’... the money in bank accounts and retirement accounts. they’ve even discussed how they could confiscate 401ks in the last few months, and have been over the last 2 yrs.

Gold is down $100/oz since December. Everyone who invested back then is under water now.

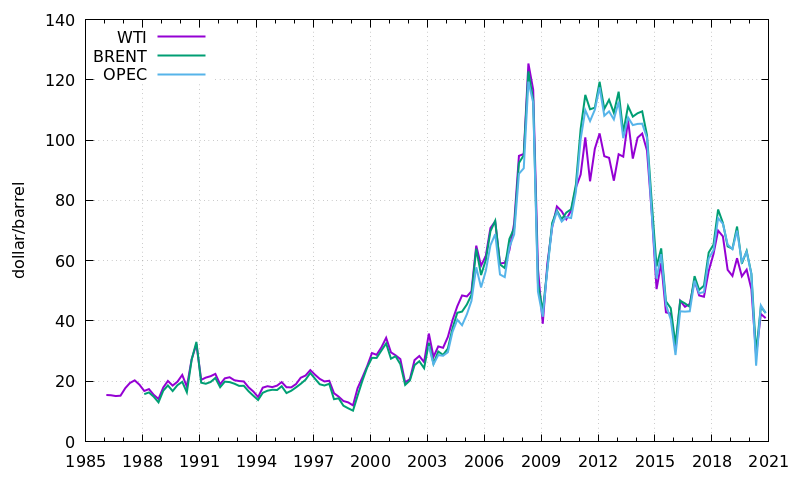

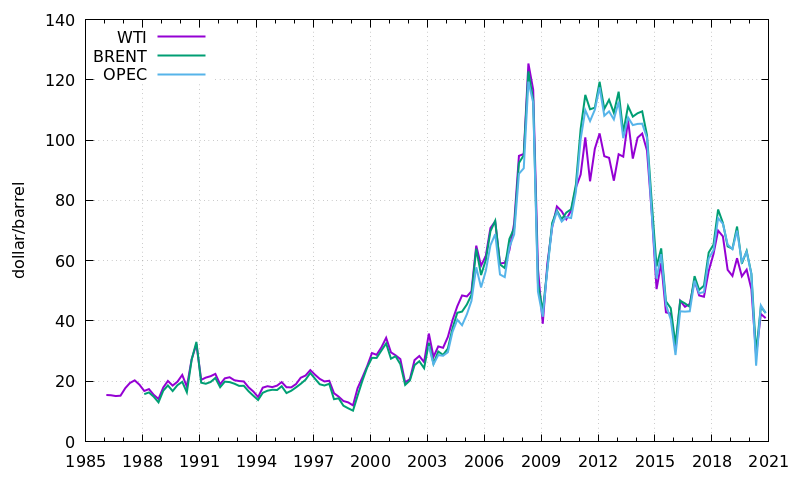

Your chart is not adjusted for inflation

http://www.fintrend.com/inflation/Inflation_Rate/Historical_Oil_Prices_Chart.asp

Second, if you think oil is the cause of our current economic woes then we are just going to have to disagree

And what happened in 1981, the only time that even on the inflation adjusted chart that it was close? A severe recession.

We’ll just have to agree. It’s not that Mortgages aren’t a problem. They just weren’t the root problem. They are more of a symptom. There wasn’t much fraud in overvaluing houses or in overstating people’s incomes. It’s that the incomes fell. And every, every, every time that happens in mass since this country was founded, mortgages go into default.

261 Million oz * $1300 = $338 Billion. So no, clearly there is not enough gold to cover the dollars printed. But then they never claimed there was. And it's of no consequence, because the Fed has kept the dollar significantly more stable than it was on the gold standard.

By the way, there are only about 5 billion oz of gold in the world. So even if the US had it all, it would cap the money supply at $6.5 trillion. With 6 billion people in the world, going to a gold standard is a really stupid, stupid idea.

The assumption that the number of dollars in existence follows from the current price of gold leads to what might be an invalid conclusion. It might be more correct to assume that the price of gold follows from the number of dollars in existence, which I believe from earlier articles and calculations leads to a gold price upwards of $50K per ounce.

Excuse me, Can you break a $50k piece?

Excuse me, Can you break a $50k piece?

re: Gold is down $100/oz since December. Everyone who invested back then is under water now

I bought Gold when it was $880/oz just a few years ago. Sybsequently, it dropped to less than $800 if my memory served me right. Still I held on.

Had I said to myself -— “I have to sell because I am now under water” when it happened, I would not be in the profitable position I am in.

I held on because I saw the financial fundamentals were debasing the US dollar and there was no other place to turn to... the stock market was tanking, so was housing, so was the bond market... where else to turn to than the safe haven that gold is?

I was right.

You may think that this system cannot work, but it worked perfectly well from 1717 (When Isaac Newton put Britain on the gold standard) until World War One, when inflation and a refusal to pursue monetary policies to deflate money back down to its proper value reduced the gold standard to a hollow sham....

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.