Posted on 01/27/2011 8:56:08 AM PST by NormsRevenge

WASHINGTON – The government-appointed panel investigating the roots of the financial crisis says the meltdown occurred because government officials and Wall Street executives ignored warning signs and failed to manage risks.

The crisis could have been avoided, the Financial Crisis Inquiry Commission determined in a final report released Thursday that was only supported by Democrats on the panel. Instead the country fell into the deepest recession since the 1930s and millions of people lost their jobs, the congressionally appointed panel concluded.

The Bush and Clinton administrations, the current and previous Federal Reserve chairmen, and Treasury Secretary Timothy Geithner all bear some responsibility for allowing the crisis to happen, the panel said.

(Excerpt) Read more at news.yahoo.com ...

even if it’s in the “report”.

Seriously, I think Bush should have smacked down Fannie Mae & Freddie Mac, so yes, he is somewhat culpable, but there are a pack of Democrats who deserve more blame. And some banksters, too.

With the right information anything is avoidable.

for starters

Carter, CRA, Greenspan, Fannie Mae, Freddy Mac, Clinton, Cuomo, Bush, Paulson, Geithner,

to some degree, all played a role..

Oh, Did I forget CONgre$$, the SEC, HUD, uhhh. ;-)

How can you forget to include Dodd, Frank, and El Reno?

I don’t suppose Barney Frank’s name shows up anywhere in this sham?

One of the dissenters to the official report weighs in:

http://keithhennessey.com/2011/01/26/fcic-dissent-2/

Related thread:

Financial Crisis Was Avoidable, Inquiry Finds

http://www.freerepublic.com/focus/f-news/2663466/posts

Thanks and Thanks!

I just hope we got a good deal on the the money we had to borrow to pay the people to write this report, which is nothing more than a misdirection exercise. The gutting of America is almost complete; the statute of limitations has almost tolled on most of the crimes that went on during this crisis, and the perps have indeed been incentivized to repeat their work, next time they can. Meanwhile, the regulators who failed to regulate and the enforcers who never saw any prosecutions brought before them (with only a scant few exceptions, eg; Madoff-—who was NOT connected to the subprime hoohah) all remain in office and all vow to do better next time.

“Mistakes were made....we’ll do better next time”. Yeah...what do you mean by “better”? Why will/would the regulators do better next time? If anything, they learned that there are never any consequences for failure. Literally, nobody went down for their thievery in this sordid era.

But the US will be facing a decade of stagflation and there will be plenty of pockets of serious misery scattered all over the landscape.

Washington Prowler

Democrat Leaders Played to Lose

By The Prowler Published 9/30/2008 12:50:21 AM

http://www.spectator.org/dsp_article.asp?art_id=13967

Everything from the global warming “CRISIS” - to every other crisis that the left promotes - is specifically designed to manipulate people into acting out of FEAR. When you act out of fear, you will make huge mistates.

Here’s background on what they’re up to:

James Simpson is the former White House economist has just published “Barack Obama & the Strategy of Manufactured Crisis” on AmericanThinker.com.

http://www.americanthinker.com/2008/09/barack_obama_and_the_strategy.html

In the meantime, just remember that it is total BS to say that “BOTH SIDES ARE AT FAULT”.

The live C-Span camera doesn’t lie.

This video shows who is responsible for the FNMA/FreddieMac BS in the first place; connect the dots straight to Obama and his economics advisor, Franklin Raines Youtube Video to send out in all your emails (regardless of the topic): http://www.youtube.com/watch?v=_MGT_cSi7Rs

Sunday, September 21, 2008

Bush Called For Reform of Fannie Mae & Freddie Mac 17 Times in 2008 Alone... Dems Ignored Warnings

http://gatewaypundit.blogspot.com/2008/09/bush-called-for-reform-of-fannie-mae.html

Commentary: Bankruptcy, not bailout, is the right answer

http://edition.cnn.com/2008/POLITICS/09/29/miron.bailout/index.html

By Jeffrey A. Miron

Special to CNN

Editor’s note: Jeffrey A. Miron is senior lecturer in economics at Harvard University. A Libertarian, he was one of 166 academic economists who signed a letter to congressional leaders last week opposing the government bailout plan.

CAMBRIDGE, Massachusetts (CNN) — Congress has balked at the Bush administration’s proposed $700 billion bailout of Wall Street. Under this plan, the Treasury would have bought the “troubled assets” of financial institutions in an attempt to avoid economic meltdown.

This bailout was a terrible idea. Here’s why.

The current mess would never have occurred in the absence of ill-conceived federal policies. The federal government chartered Fannie Mae in 1938 and Freddie Mac in 1970; these two mortgage lending institutions are at the center of the crisis. The government implicitly promised these institutions that it would make good on their debts, so Fannie and Freddie took on huge amounts of excessive risk.

Worse, beginning in 1977 and even more in the 1990s and the early part of this century, Congress pushed mortgage lenders and Fannie/Freddie to expand subprime lending. The industry was happy to oblige, given the implicit promise of federal backing, and subprime lending soared.

This subprime lending was more than a minor relaxation of existing credit guidelines. This lending was a wholesale abandonment of reasonable lending practices in which borrowers with poor credit characteristics got mortgages they were ill-equipped to handle.

Once housing prices declined and economic conditions worsened, defaults and delinquencies soared, leaving the industry holding large amounts of severely depreciated mortgage assets.

The fact that government bears such a huge responsibility for the current mess means any response should eliminate the conditions that created this situation in the first place, not attempt to fix bad government with more government.

The obvious alternative to a bailout is letting troubled financial institutions declare bankruptcy. Bankruptcy means that shareholders typically get wiped out and the creditors own the company.

Bankruptcy does not mean the company disappears; it is just owned by someone new (as has occurred with several airlines). Bankruptcy punishes those who took excessive risks while preserving those aspects of a businesses that remain profitable.

In contrast, a bailout transfers enormous wealth from taxpayers to those who knowingly engaged in risky subprime lending. Thus, the bailout encourages companies to take large, imprudent risks and count on getting bailed out by government. This “moral hazard” generates enormous distortions in an economy’s allocation of its financial resources.

Thoughtful advocates of the bailout might concede this perspective, but they argue that a bailout is necessary to prevent economic collapse. According to this view, lenders are not making loans, even for worthy projects, because they cannot get capital. This view has a grain of truth; if the bailout does not occur, more bankruptcies are possible and credit conditions may worsen for a time.

Talk of Armageddon, however, is ridiculous scare-mongering. If financial institutions cannot make productive loans, a profit opportunity exists for someone else. This might not happen instantly, but it will happen.

Further, the current credit freeze is likely due to Wall Street’s hope of a bailout; bankers will not sell their lousy assets for 20 cents on the dollar if the government might pay 30, 50, or 80 cents.

The costs of the bailout, moreover, are almost certainly being understated. The administration’s claim is that many mortgage assets are merely illiquid, not truly worthless, implying taxpayers will recoup much of their $700 billion.

If these assets are worth something, however, private parties should want to buy them, and they would do so if the owners would accept fair market value. Far more likely is that current owners have brushed under the rug how little their assets are worth.

The bailout has more problems. The final legislation will probably include numerous side conditions and special dealings that reward Washington lobbyists and their clients.

Anticipation of the bailout will engender strategic behavior by Wall Street institutions as they shuffle their assets and position their balance sheets to maximize their take. The bailout will open the door to further federal meddling in financial markets.

So what should the government do? Eliminate those policies that generated the current mess. This means, at a general level, abandoning the goal of home ownership independent of ability to pay. This means, in particular, getting rid of Fannie Mae and Freddie Mac, along with policies like the Community Reinvestment Act that pressure banks into subprime lending.

The right view of the financial mess is that an enormous fraction of subprime lending should never have occurred in the first place. Someone has to pay for that. That someone should not be, and does not need to be, the U.S. taxpayer.

The opinions expressed in this commentary are solely those of the writer

WE understand how this happened.

Clinton and his Citibank-owned cronies created the conditions for massive mortgage frauds, pocketing literally HUNDREDS OF MILLIONS OF DOLLARS off of it by cooking the books at Fannie Mae, and directing billions of dollars to Democrat Orgs like ACORN HOUSING that used the money for campaigning, while calling anyone who dared to point out the truth a racist.

More:

How the Democrats Created the Financial Crisis Commentary by Kevin A. Hassett

Posted: Monday, September 22, 2008

Bloomberg.com http://www.bloomberg.com/apps/news?pid=newsarchive&sid=aSKSoiNbnQY0

Sept. 22 (Bloomberg) — The financial crisis of the past year has provided a number of surprising twists and turns, and from Bear Stearns Cos. to American International Group Inc., ambiguity has been a big part of the story.

Why did Bear Stearns fail, and how does that relate to AIG? It all seems so complex.

But really, it isn’t. Enough cards on this table have been turned over that the story is now clear. The economic history books will describe this episode in simple and understandable terms: Fannie Mae and Freddie Mac exploded, and many bystanders were injured in the blast, some fatally.

Fannie and Freddie did this by becoming a key enabler of the mortgage crisis. They fueled Wall Street’s efforts to securitize subprime loans by becoming the primary customer of all AAA-rated subprime-mortgage pools. In addition, they held an enormous portfolio of mortgages themselves.

In the times that Fannie and Freddie couldn’t make the market, they became the market. Over the years, it added up to an enormous obligation. As of last June, Fannie alone owned or guaranteed more than $388 billion in high-risk mortgage investments. Their large presence created an environment within which even mortgage-backed securities assembled by others could find a ready home.

The problem was that the trillions of dollars in play were only low-risk investments if real estate prices continued to rise. Once they began to fall, the entire house of cards came down with them.

Turning Point

Take away Fannie and Freddie, or regulate them more wisely, and it’s hard to imagine how these highly liquid markets would ever have emerged. This whole mess would never have happened.

It is easy to identify the historical turning point that marked the beginning of the end.

Back in 2005, Fannie and Freddie were, after years of dominating Washington, on the ropes. They were enmeshed in accounting scandals that led to turnover at the top. At one telling moment in late 2004, captured in an article by my American Enterprise Institute colleague Peter Wallison, the Securities and Exchange Comiission’s chief accountant told disgraced Fannie Mae chief Franklin Raines that Fannie’s position on the relevant accounting issue was not even ``on the page’’ of allowable interpretations.

Then legislative momentum emerged for an attempt to create a ``world-class regulator’’ that would oversee the pair more like banks, imposing strict requirements on their ability to take excessive risks. Politicians who previously had associated themselves proudly with the two accounting miscreants were less eager to be associated with them. The time was ripe.

Greenspan’s Warning

The clear gravity of the situation pushed the legislation forward. Some might say the current mess couldn’t be foreseen, yet in 2005 Alan Greenspan told Congress how urgent it was for it to act in the clearest possible terms: If Fannie and Freddie ``continue to grow, continue to have the low capital that they have, continue to engage in the dynamic hedging of their portfolios, which they need to do for interest rate risk aversion, they potentially create ever-growing potential systemic risk down the road,’’ he said. ``We are placing the total financial system of the future at a substantial risk.’’

What happened next was extraordinary. For the first time in history, a serious Fannie and Freddie reform bill was passed by the Senate Banking Committee. The bill gave a regulator power to crack down, and would have required the companies to eliminate their investments in risky assets.

Different World

If that bill had become law, then the world today would be different. In 2005, 2006 and 2007, a blizzard of terrible mortgage paper fluttered out of the Fannie and Freddie clouds, burying many of our oldest and most venerable institutions. Without their checkbooks keeping the market liquid and buying up excess supply, the market would likely have not existed.

But the bill didn’t become law, for a simple reason: Democrats opposed it on a party-line vote in the committee, signaling that this would be a partisan issue. Republicans, tied in knots by the tight Democratic opposition, couldn’t even get the Senate to vote on the matter.

That such a reckless political stand could have been taken by the Democrats was obscene even then. Wallison wrote at the time: ``It is a classic case of socializing the risk while privatizing the profit. The Democrats and the few Republicans who oppose portfolio limitations could not possibly do so if their constituents understood what they were doing.’’

Mounds of Materials

Now that the collapse has occurred, the roadblock built by Senate Democrats in 2005 is unforgivable. Many who opposed the bill doubtlessly did so for honorable reasons. Fannie and Freddie provided mounds of materials defending their practices. Perhaps some found their propaganda convincing.

But we now know that many of the senators who protected Fannie and Freddie, including Barack Obama, Hillary Clinton and Christopher Dodd, have received mind-boggling levels of financial support from them over the years.

Throughout his political career, Obama has gotten more than $125,000 in campaign contributions from employees and political action committees of Fannie Mae and Freddie Mac, second only to Dodd, the Senate Banking Committee chairman, who received more than $165,000.

Clinton, the 12th-ranked recipient of Fannie and Freddie PAC and employee contributions, has received more than $75,000 from the two enterprises and their employees. The private profit found its way back to the senators who killed the fix.

There has been a lot of talk about who is to blame for this crisis. A look back at the story of 2005 makes the answer pretty clear.

Oh, and there is one little footnote to the story that’s worth keeping in mind while Democrats point fingers between now and Nov. 4: Senator John McCain was one of the three cosponsors of S.190, the bill that would have averted this mess.

( Kevin Hassett, director of economic-policy studies at the American Enterprise Institute, is a Bloomberg News columnist. He is an adviser to Republican Senator John McCain of Arizona in the 2008 presidential election. The opinions expressed are his own.)

To contact the writer of this column: Kevin Hassett at khassett@aei.org

Last Updated: September 22, 2008 00:04 EDT

More:

[1] Watch (or listen) to this C-Span video:

http://www.c-spanarchives.org/library/index.php?main_page=product_video_info&products_id=281010-1

Peter Wallison talked about the history and background of Fannie Mae and Freddie Mac. His books include Serving Two Masters, Yet Out of Control: Fannie Mae and Freddie Mac and Privatizing Fannie Mae, Freddie Mac and the Federal Home Loan Banks: Why and How, both by AEI Press. He explained a video clip of Treasury Secretary Paulson from Sunday, September 7, 2008, announcing the federal takeover of Fannie Mae and Freddie Mac.

From the video

Wallison: Congress is part of the problem. They created Fannie and Freddie, keep them alive, protect them from attack, they get benefits from them. Through Fannie Mae Congress can direct money to their friends without appropriating it. Barney Frank was anxious to get a slush fund into his bill, which would give money to community groups to “support housing.” Money would go to the community groups which support particular congressmen. .....

Mr. Wallison is a fellow at the American Enterprise Institute. His previous positions include counsel to President Reagan, general counsel to the Treasury Department, and an aide to Nelson Rockefeller both his time as governor of New York and counsel during his vice presidency, 1972-1976.

*

[2] Serving Two Masters, Yet out of Control: Fannie Mae and Freddie Mac Edited by Peter J. Wallison

Because two disparate, almost diametrically opposite clients demand loyalty from Fannie Mae and Freddie Mac, these government-sponsored entities must fulfill two ultimately irreconcilable roles.

As publicly owned corporations, they must maximize profitability for their shareholders; yet, as quasi-government agencies, they should use their huge, implicit government subsidies in support of their public missions. In reality, they split the difference as they transfer a large portion of their subsidy to their shareholders.

At the same time, Congress does not routinely scrutinize Fannie and Freddie, despite their enormous size and importance. The two are clearly too large and powerful for the small agency charged by Congress as their watchdog. Thus, while attempting to serve two masters, Fannie and Freddie are literally out of control.

Would privatization solve the dilemma of the dual public and private form? If not, what other options exist? In eleven essays, public figures, economists, and government officials probe the favored positions that have allowed the two agencies to grow to unprecedented size, realize extraordinary profitability, and achieve unparalleled influence over the political process.

*

[3] How Paulson Would Save Fannie Mae, By Peter J. Wallison

Posted: Friday, September 12, 2008

[excerpt] This after 20 years, during which Fannie and Freddie used government backing to enrich their shareholders, managements, lobbyists, former government officials and Washington insiders; after they rigged the political process with campaign contributions; and after their Congressional supporters resisted every effort at reform until the two companies were on the verge of collapse.

This is what I sent out to my email lists on 09/30/2008 when they asked me why Bush agreed to back the bailout:

I wrote:

Bush is conservative, but he isn’t a partisan (movement conservative like us) - as “President”, he refuses to fight for our side (because he thinks it diminishes the office), and he’s naive as hell !!!!!!

Trying to be “fair” and “bi-partisan” - he was dumb enough to pick a ‘RAT (Paulson who used to be a big CEO at Goldman Sachs) to be his Treasury Secretary and is getting rolled by him. Goldman Sachs held a 20% stake in AIG. Paulson conveniently saved their butts with Bush’s blessing. GRRRRRRRRRRRRRRR!!!!!!! See my NYTimes link below.

You cannot “play nice” with street fighters like the ‘RATS, that’s been my biggest problem with Bush!!! He won’t fight for us, and instead has kept, and not fired, all the Clinton hold-overs. Clinton was at least smart enough to get rid of all the people who didn’t agree with him politically the minute he took office. Bush left his enemies in their positions and they repaid him by trying to undermine everything he tries to do. SPIT!!!

Here’s another thing that reeeeeeally pisses me off:

VP Debate Mod. to release book Jan. 20: The Breakthrough: Politics and Race in the Age of Obama

Amazon ^ | September 29, 2008 | amazon.com

Posted on Monday, September 29, 2008 11:45:33 AM by cdga5for4

http://www.freerepublic.com/focus/f-news/2093127/posts

I apologize for the vanity post (and I posted this several weeks ago but it wasn’t debate week) but this needs to be brought to the fore. Thursday night’s debate moderator, Gwen Ifill, has a book coming out inauguration day titled: The Breakthrough: Politics and Race in the Age of Obama.

How can she moderate this debate with such an obvious conflict of interest. She has a vested interest in Obama’s ultimate success and, with the timing of the release, obviously has picked her winner.

This is just crazy. “

*

NY TIMES Link below this:

Paulson led bailout of AIG; saved $20 billion for Goldman Sachs

Sunday, September 28, 2008, 10:47 pm, by cmartenson

http://www.chrismartenson.com/blog/paulson-led-bailout-aig-saved-20-billion-goldman-sachs/5632

This is another astounding article by the very respectable Gretchen Morgenson of the NY Times.

It is astounding because of all that is revealed in the opening paragraphs.

Quote:

Two weeks ago, the nation’s most powerful regulators and bankers huddled in the Lower Manhattan fortress that is the Federal Reserve Bank of New York, desperately trying to stave off disaster.

As the group, led by Treasury Secretary Henry M. Paulson Jr., pondered the collapse of one of America’s oldest investment banks, Lehman Brothers, a more dangerous threat emerged: American International Group, the world’s largest insurer, was teetering. A.I.G. needed billions of dollars to right itself and had suddenly begged for help.

The only Wall Street chief executive participating in the meeting was Lloyd C. Blankfein of Goldman Sachs, Mr. Paulson’s former firm. Mr. Blankfein had particular reason for concern.

Although it was not widely known, Goldman, a Wall Street stalwart that had seemed immune to its rivals’ woes, was A.I.G.’s largest trading partner, according to six people close to the insurer who requested anonymity because of confidentiality agreements. A collapse of the insurer threatened to leave a hole of as much as $20 billion in Goldman’s side, several of these people said.

Days later, federal officials, who had let Lehman die and initially balked at tossing a lifeline to A.I.G., ended up bailing out the insurer for $85 billion.

Link (NYT) (copied and pasted in full below)

To recap:

Only one Wall Street executive was in the war room, and he was from Goldman Sachs (GS), the firm Paulson headed up before becoming Treasury Secretary.

Lehman, with whom GS did not have an overly large trading position, was allowed to go under.

AIG, with whom GS did have a large position, was handed an $85 billion handout.

Even if you don’t ascribe to all of this as a looting operation (which I do), hopefully you can allow that perhaps this doesn’t look too good from an appearances standpoint.

At this point I think we’re going to have to admit that, at times like these, the revolving door between Wall Street and the Treasury Department is too laden with conflicts of interest to be considered a good idea.

NY Times

September 28, 2008

Behind Insurer’s Crisis, Blind Eye to a Web of Risk

By GRETCHEN MORGENSON

http://www.nytimes.com/2008/09/28/business/28melt.html?_r=2&hp&o&oref=slogin

Correction Appended

“It is hard for us, without being flippant, to even see a scenario within any kind of realm of reason that would see us losing one dollar in any of those transactions.”

Joseph J. Cassano, a former A.I.G. executive, August 2007

Two weeks ago, the nation’s most powerful regulators and bankers huddled in the Lower Manhattan fortress that is the Federal Reserve Bank of New York, desperately trying to stave off disaster.

As the group, led by Treasury Secretary Henry M. Paulson Jr., pondered the collapse of one of America’s oldest investment banks, Lehman Brothers, a more dangerous threat emerged: American International Group, the world’s largest insurer, was teetering. A.I.G. needed billions of dollars to right itself and had suddenly begged for help.

In a separate meeting on Sept. 15 to discuss financial aid for A.I.G., the only participating Wall Street chief executive was Lloyd C. Blankfein of Goldman Sachs, Mr. Paulson’s former firm. Mr. Blankfein had particular reason for concern.

Although it was not widely known, Goldman, a Wall Street stalwart that had seemed immune to its rivals’ woes, was A.I.G.’s largest trading partner, according to six people close to the insurer who requested anonymity because of confidentiality agreements. A collapse of the insurer threatened to leave a hole of as much as $20 billion in Goldman’s side, several of these people said.

Days later, federal officials, who had let Lehman die and initially balked at tossing a lifeline to A.I.G., ended up bailing out the insurer for $85 billion.

Their message was simple: Lehman was expendable. But if A.I.G. unspooled, so could some of the mightiest enterprises in the world.

A Goldman spokesman said in an interview that the firm was never imperiled by A.I.G.’s troubles and that Mr. Blankfein participated in the Fed discussions to safeguard the entire financial system, not his firm’s own interests.

Yet an exploration of A.I.G.’s demise and its relationships with firms like Goldman offers important insights into the mystifying, virally connected and astonishingly fragile financial world that began to implode in recent weeks.

Although America’s housing collapse is often cited as having caused the crisis, the system was vulnerable because of intricate financial contracts known as credit derivatives, which insure debt holders against default. They are fashioned privately and beyond the ken of regulators sometimes even beyond the understanding of executives peddling them.

Originally intended to diminish risk and spread prosperity, these inventions instead magnified the impact of bad mortgages like the ones that felled Bear Stearns and Lehman and now threaten the entire economy.

In the case of A.I.G., the virus exploded from a freewheeling little 377-person unit in London, and flourished in a climate of opulent pay, lax oversight and blind faith in financial risk models. It nearly decimated one of the world’s most admired companies, a seemingly sturdy insurer with a trillion-dollar balance sheet, 116,000 employees and operations in 130 countries.

“It is beyond shocking that this small operation could blow up the holding company,” said Robert Arvanitis, chief executive of Risk Finance Advisors in Westport, Conn. “They found a quick way to make a fast buck on derivatives based on A.I.G.’s solid credit rating and strong balance sheet. But it all got out of control.”

The London Office

The insurance giant’s London unit was known as A.I.G. Financial Products, or A.I.G.F.P. It was run with almost complete autonomy, and with an iron hand, by Joseph J. Cassano, according to current and former A.I.G. employees.

A onetime executive with Drexel Burnham Lambert the investment bank made famous in the 1980s by the junk bond king Michael R. Milken, who later pleaded guilty to six felony charges Mr. Cassano helped start the London unit in 1987.

The unit became profitable enough that analysts considered Mr. Cassano a dark horse candidate to succeed Maurice R. Greenberg, the longtime chief executive who shaped A.I.G. in his own image until he was ousted amid an accounting scandal three years ago.

But last February, Mr. Cassano resigned after the London unit began bleeding money and auditors raised questions about how the unit valued its holdings. By Sept. 15, the unit’s troubles forced a major downgrade in A.I.G.’s debt rating, requiring the company to post roughly $15 billion in additional collateral which then prompted the federal rescue.

Mr. Cassano, 53, lives in a handsome, three-story town house in the Knightsbridge neighborhood of London, just around the corner from Harrods department store on a quiet square with a private garden.

He did not respond to interview requests left at his home and with his lawyer. An A.I.G. spokesman also declined to comment.

At A.I.G., Mr. Cassano found himself ensconced in a behemoth that had a long and storied history of deftly juggling risks. It insured people and properties against natural disasters and death, offered sophisticated asset management services and did so reliably and with bravado on many continents. Even now, its insurance subsidiaries are financially strong.

When Mr. Cassano first waded into the derivatives market, his biggest business was selling so-called plain vanilla products like interest rate swaps. Such swaps allow participants to bet on the direction of interest rates and, in theory, insulate themselves from unforeseen financial events.

Ten years ago, a “watershed” moment changed the profile of the derivatives that Mr. Cassano traded, according to a transcript of comments he made at an industry event last year. Derivatives specialists from J. P. Morgan, a leading bank that had many dealings with Mr. Cassano’s unit, came calling with a novel idea.

Morgan proposed the following: A.I.G. should try writing insurance on packages of debt known as “collateralized debt obligations.” C.D.O.’s. were pools of loans sliced into tranches and sold to investors based on the credit quality of the underlying securities.

The proposal meant that the London unit was essentially agreeing to provide insurance to financial institutions holding C.D.O.’s and other debts in case they defaulted in much the same way some homeowners are required to buy mortgage insurance to protect lenders in case the borrowers cannot pay back their loans.

Under the terms of the insurance derivatives that the London unit underwrote, customers paid a premium to insure their debt for a period of time, usually four or five years, according to the company. Many European banks, for instance, paid A.I.G. to insure bonds that they held in their portfolios.

Because the underlying debt securities mostly corporate issues and a smattering of mortgage securities carried blue-chip ratings, A.I.G. Financial Products was happy to book income in exchange for providing insurance. After all, Mr. Cassano and his colleagues apparently assumed, they would never have to pay any claims.

Since A.I.G. itself was a highly rated company, it did not have to post collateral on the insurance it wrote, analysts said. That made the contracts all the more profitable.

These insurance products were known as “credit default swaps,” or C.D.S.’s in Wall Street argot, and the London unit used them to turn itself into a cash register.

The unit’s revenue rose to $3.26 billion in 2005 from $737 million in 1999. Operating income at the unit also grew, rising to 17.5 percent of A.I.G.’s overall operating income in 2005, compared with 4.2 percent in 1999.

Profit margins on the business were enormous. In 2002, operating income was 44 percent of revenue; in 2005, it reached 83 percent.

Mr. Cassano and his colleagues minted tidy fortunes during these high-cotton years. Since 2001, compensation at the small unit ranged from $423 million to $616 million each year, according to corporate filings. That meant that on average each person in the unit made more than $1 million a year.

In fact, compensation expenses took a large percentage of the unit’s revenue. In lean years it was 33 percent; in fatter ones 46 percent. Over all, A.I.G. Financial Products paid its employees $3.56 billion during the last seven years.

The London unit’s reach was also vast. While clients and counterparties remain closely guarded secrets in the derivatives trade, Mr. Cassano talked publicly about how proud he was of his customer list.

At the 2007 conference he noted that his company worked with a “global swath” of top-notch entities that included “banks and investment banks, pension funds, endowments, foundations, insurance companies, hedge funds, money managers, high-net-worth individuals, municipalities and sovereigns and supranationals.”

Of course, as this intricate skein expanded over the years, it meant that the participants were linked to one another by contracts that existed for the most part inside the financial world’s version of a black box.

Goldman Sachs was a member of A.I.G.’s derivatives club, according to people familiar with the operation. It was a customer of A.I.G.’s credit insurance and also acted as an intermediary for trades between A.I.G. and its other clients.

Few knew of Goldman’s exposure to A.I.G. When the insurer’s flameout became public, David A. Viniar, Goldman’s chief financial officer, assured analysts on Sept. 16 that his firm’s exposure was “immaterial,” a view that the company reiterated in an interview.

Later that same day, the government announced its two-year, $85 billion loan to A.I.G., offering it a chance to sell its assets in an orderly fashion and theoretically repay taxpayers for their trouble. The plan saved the insurer’s trading partners but decimated its shareholders.

Lucas van Praag, a Goldman spokesman, declined to detail how badly hurt his firm might have been had A.I.G. collapsed two weeks ago. He disputed the calculation that Goldman had $20 billion worth of risk tied to A.I.G., saying the figure failed to account for collateral and hedges that Goldman deployed to reduce its risk.

Regarding Mr. Blankfein’s presence at the Fed during talks about an A.I.G. bailout, he said: “I think it would be a mistake to read into it that he was there because of our own interests. We were engaged because of the implications to the entire system.”

Mr. van Praag declined to comment on what communications, if any, took place between Mr. Blankfein and the Treasury secretary, Mr. Paulson, during the bailout discussions.

A Treasury spokeswoman declined to comment about the A.I.G. rescue and Goldman’s role. The government recently allowed Goldman to change its regulatory status to help bolster its finances amid the market turmoil.

An Executive’s Optimism

Regardless of Goldman’s exposure, by last year, A.I.G. Financial Products’ portfolio of credit default swaps stood at roughly $500 billion. It was generating as much as $250 million a year in income on insurance premiums, Mr. Cassano told investors.

Because it was not an insurance company, A.I.G. Financial Products did not have to report to state insurance regulators. But for the last four years, the London-based unit’s operations, whose trades were routed through Banque A.I.G., a French institution, were reviewed routinely by an American regulator, the Office of Thrift Supervision.

A handful of the agency’s officials were always on the scene at an A.I.G. Financial Products branch office in Connecticut, but it is unclear whether they raised any red flags. Their reports are not made public and a spokeswoman would not provide details.

For his part, Mr. Cassano apparently was not worried that his unit had taken on more than it could handle. In an August 2007 conference call with analysts, he described the credit default swaps as almost a sure thing.

“It is hard to get this message across, but these are very much handpicked,” he assured those on the phone.

Just a few months later, however, the credit crisis deepened. A.I.G. Financial Products began to choke on losses though they were only on paper.

In the quarter that ended Sept. 30, 2007, A.I.G. recognized a $352 million unrealized loss on the credit default swap portfolio.

Because the London unit was set up as a bank and not an insurer, and because of the way its derivatives contracts were written, it had to put up collateral to its trading partners when the value of the underlying securities they had insured declined. Any obligations that the unit could not pay had to be met by its corporate parent.

So began A.I.G.’s downward spiral as it, its clients, its trading partners and other companies were swept into the drowning pool set in motion by the housing downturn.

Mortgage foreclosures set off questions about the quality of debts across the entire credit spectrum. When the value of other debts sagged, calls for collateral on the securities issued by the credit default swaps sideswiped A.I.G. Financial Products and its legendary, sprawling parent.

Yet throughout much of 2007, the unit maintained that its risk assessments were reliable and its portfolios conservative. Last fall, however, the methods that A.I.G. used to value its derivatives portfolio began to come under fire from trading partners.

In February, A.I.G.’s auditors identified problems in the firm’s swaps accounting. Then, three months ago, regulators and federal prosecutors said they were investigating the insurer’s accounting.

This was not the first time A.I.G. Financial Products had run afoul of authorities. In 2004, without admitting or denying accusations that it helped clients improperly burnish their financial statements, A.I.G. paid $126 million and entered into a deferred prosecution agreement to settle federal civil and criminal investigations.

The settlement was a black mark on A.I.G.’s reputation and, according to analysts, distressed Mr. Greenberg, who still ran the company at the time. Still, as Mr. Cassano later told investors, the case caused A.I.G. to improve its risk management and establish a committee to maintain quality control.

“That’s a committee that I sit on, along with many of the senior managers at A.I.G., and we look at a whole variety of transactions that come in to make sure that they are maintaining the quality that we need to,” Mr. Cassano told them. “And so I think the things that have been put in at our level and the things that have been put in at the parent level will ensure that there won’t be any of those kinds of mistakes again.”

At the end of A.I.G.’s most recent quarter, the London unit’s losses reached $25 billion.

As those losses mounted, and A.I.G.’s once formidable stock price plunged, it became harder for the insurer to survive imperiling other companies that did business with it and leading it to stun the Federal Reserve gathering two weeks ago with a plea for help.

Mr. Greenberg, who has seen the value of his personal A.I.G. holdings decline by more than $5 billion this year, dumped five million shares late last week. A lawyer for Mr. Greenberg did not return a phone call seeking comment.

For his part, Mr. Cassano has departed from a company that is a far cry from what it was a year ago when he spoke confidently at the analyst conference.

“We’re sitting on a great balance sheet, a strong investment portfolio and a global trading platform where we can take advantage of the market in any variety of places,” he said then. “The question for us is, where in the capital markets can we gain the best opportunity, the best execution for the business acumen that sits in our shop?”

This article has been revised to reflect the following correction:

Correction: September 30, 2008

Because of an editing error, an article on Sunday about the financial problems of American International Group referred incorrectly to the timing and participants at meetings at the New York Federal Reserve between Saturday, Sept. 13, and Monday, Sept. 15. Although there were indeed meetings that weekend, there was also a separate meeting on Monday to discuss financial aid for A.I.G. Lloyd C. Blankfein, the chief executive of Goldman Sachs, was the only Wall Street chief executive who attended the Monday meeting, not the only chief executive who attended weekend meetings. Also, Henry M. Paulson Jr., the Treasury secretary, did not lead or attend the Monday meeting. (Both Mr. Blankfein and Mr. Paulson did attend the weekend meetings.)

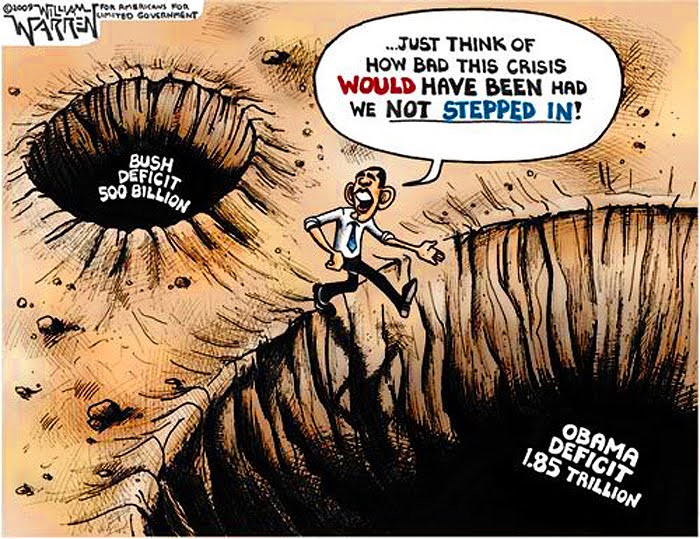

Obama’s Deficit Avalanche isn’t Bush’s Fault / scottuystarnes.com / 2/9/2010

SOURCE http://scottystarnes.files.wordpress.com/2010/02/obama-deficit.jpg?w=400&h=308

Washington Times reports: Even more staggering than the mountains of snow in the capital are the deficits the Obama administration plans for the next decade. Huge spending increases will add about $12 trillion to the national debt for budget years 2009 to 2020.

The scariest part is that these deficits are based on unrealistic budgeting assumptions; the real fiscal outlook is much bleaker. In the proposed 2011 budget, the White House defensively attacks the “irresponsibility of past” deficits.

For example, the 2009 budget deficit of $1.4 trillion is blamed on the George W. Bush administration as if President Obama’s $862 billion stimulus package and more than $400 billion supplemental spending bill had nothing to do with it. Mr. Obama’s planned 2010 budget deficit rises to an even higher record level of $1.6 trillion.

By comparison, all of Mr. Bush’s deficits from 2002 to 2008 – the seven years during which his team had the most control over the budget – produced a combined deficit of $2.1 trillion.

Obama has spent more in 2 years than Bush did in 7 years. Obama’s BIOB (Blame it on Bush) defense just won’t work anymore.

bttt

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.