Posted on 12/28/2010 7:33:55 AM PST by econjack

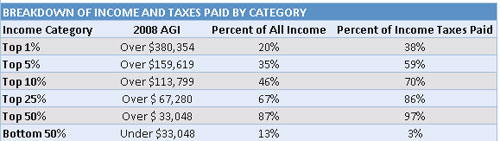

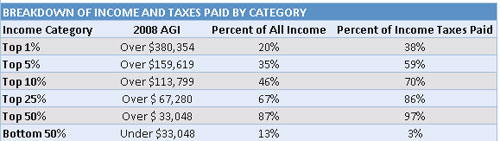

Compared with that 38% of taxes paid by the top 1% of earners, the bottom 50% pay just 2.7% of the taxes collected.

(Excerpt) Read more at finance.yahoo.com ...

What happens if you subtract unemployment/welfare/food stamps etc. from the bottom 50%?

86% paid by middle class Americans!

I'm not absolutely sure, but transfer payments are normally excluded from taxable income statistics. In other words, the bottom half actually has higher real income than is reported.

Correction...86% paid by everyone making up the top 25% of wage earners.

>>> I’m not absolutely sure, but transfer payments are normally excluded from taxable income statistics.

There’s a reason for that I think.

We need to see a chart showing all Americans....

because there is a second half to that chart.

Even if someone works, and files taxes, they may still actually fall into the negative tax category.

What percentage of our taxes paid goes to transfer payments?

If the dollars paid INTO transfer payments is represented in the chart, then 3% for the bottom 50% sounds awfully high. What percentage of Americans don’t even pay income tax? I would sure like to see a chart that represents ALL Americans (or benefit recipients) so we can see how we are REALLY getting screwed.

Milton Friedman once suggested that a flat 17% income tax with no deductions would raise more income tax revenue than the then-prevailing tax rates. You could fill out your tax return on a postcard.

It does grate on one, does it not??

However, perhaps we could define a term that is thrown around but does not have an agreed upon definition...

In income terms....how is "rich" defined?

In the 60’s and 70’s, we heard alot about leftists who wouldn’t pay taxes for “moral” reasons - not supporting the war in Vietnam, etc...

Now I have moral reasons for not wanting to pay taxes. Gov’t waste, immoral transfer of the fruits of my labor to others, funding abortions, funding the diminishment of my rights through Gov’t agency fiat, etc....

I am morally justified in not paying taxes???

A just tax system would require all citizens to contribute at least some minimal tax every year to help pay for government expenditures.

Until everyone “has some skin in the game” (to quote Obama) we will always have moochers and those in the lower income brackets clamoring for more government spending and more free stuff paid for by higher taxes on those who earn more.

And we will always have politicians more than willing to foment and capitalize on envy and class warfare.

That chart is very deceptive.

The ‘average’ American would read it as the ‘poor’ paying 3%, but they would also read it as the ‘rich’ only paying 38%.

The percentages on the left wouldn’t mean anything because they would only look at the ‘percent of all income’ and the ‘income’ bracket which shows the ‘middle class’ paying the most taxes.

Even then the threat of a penalty was right at the top of the form.

Neil Boortz goes one step further: He feels you either pay income taxes or you don't vote. Think how that would change the political landscape. Even more, he would "sell" votes. That is, if you pay $0-$10,000 dollars, one vote. $10,001-$20,000, 2 votes. He capped it at 5 votes and $50,000 in taxes. After that, no more votes. Not sure I buy the vote selling idea, but I'm in big favor of no-tax-no-vote and would even advocate a current events test to be able to vote.

Notice that its only the bottom 50% that have a % of the income tax burden that is less than their % of the national taxable income; while each of the income increments above 50% are paying an income tax burden that, on a % basis, is greater than their % of the national taxable income.

Even if that conditioned was equalized, the resulting tax rates would still be “progressive”.

I used to be a top 5 percenter until 2008.

Now I’m retired and **surprise** not paying much tax at all.

Sorry Baraq, heh heh heh

It would be a lot better if the % of income paid from the top 50% to the top 1% were reversed. People making between 33K and 67K, shouldn’t be paying the highest percentage.

I imagine you’re just as morally justified, as those liberals were.

The libs contend that if the current tax rates were effective, we wouldn’t have “this problem”.

Under this tax rate the 2007 Federal Tax receipts set a new record.

This means the libs refuse to acknowledge that SPENDING is the problem.

The Federal government is spending money to buy votes, irrespective the Constitutional limits placed on the Federal Government.

Lets do a flat tax. x% of ALL income, no breaks, no loopholes. If you get caught hiding income home or abroad you have 1 month to pay up or its off to the pokey until you pay up. How many of the wealthy would sign up for that?......none.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.