Ponch made me do it!

Posted on 10/07/2010 6:34:38 PM PDT by tlb

The Securities and Exchange Commission just charged Wilcox and more than a dozen others with allegedly manipulating the volume and price of penny stocks to illegally generate stock sales.

Translation: Wilcox and the others allegedly set up a phony company to generate bogus stock sales.

This is not a criminal charge. The SEC is asking for an injunction against Wilcox and some of the others, as well as financial penalties.

Damn! John???

One of my childhood heroes. What were they thinkin’?

(snip)

The U.S. Attorney today announced criminal charges against some of the same individuals facing SEC civil charges.

According to the SEC's complaints filed in U.S. District Court for the Southern District of Florida, the schemes generally involved the payment of kickbacks to purportedly corrupt pension fund managers or stockbrokers, who would use their clients' accounts to purchase the publicly traded stock of microcap issuers controlled or promoted by the individuals and companies charged today. What the promoters and insiders did not know was that the people with whom they arranged these illegal transactions were actually undercover FBI agents or confidential sources participating in undercover operations.

"These corrupt promoters meticulously planned their schemes down to the last detail, except for the possibility that they were walking into an undercover operation," said Robert Khuzami, Director of the SEC's Division of Enforcement. "This joint law enforcement effort is a stark warning to those who embark on securities fraud schemes that we may be listening and we may be watching."

Eric I. Bustillo, Director of the SEC's Miami Regional Office, added, "These penny stock promoters paid illicit kickbacks to people who they thought would help them profit at the expense of unsuspecting investors by manipulating the price of their stock or fraudulently selling their shares."

The SEC's complaints allege the following individuals and companies perpetrated various kickback schemes:

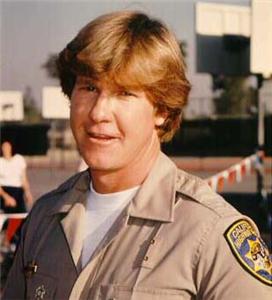

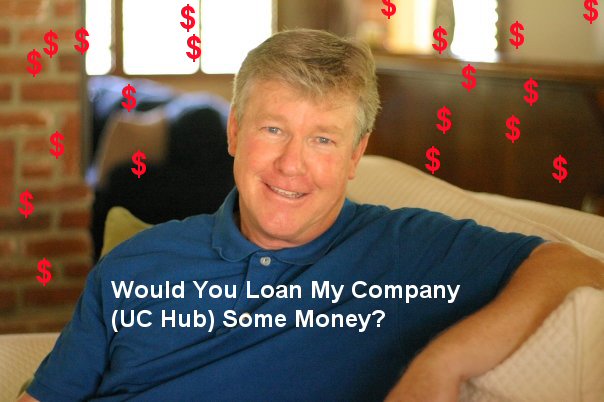

* Larry Wilcox, who lives in West Hills, Calif., and played Officer Jonathan "Jon" Baker on CHiPs, perpetrated interrelated kickback schemes with two other penny stock company executives. Anthony Mellone, who lives in Fort Lauderdale and was CEO of Tri-Star Holdings Inc., began the process by paying an illegal kickback to a purported employee pension fund trustee who was to purchase 40 million restricted shares of Tri-Star stock. Days later, Mellone paid another kickback for a purchase of 50 million restricted shares of stock. Unbeknownst to Mellone, the corrupt trustee and the trustee's business associate were undercover FBI agents, and another middleman was an FBI cooperating witness. Mellone, satisfied how the deal worked for his own company, sought to implement the same fraud with others. He informed Wilcox and Alex Parsinia of Calabasas, Calif., about the purportedly corrupt trustee, and both agreed to replicate the scheme for their own companies. Mellone demanded and received a $1,000 kickback from the witness for each completed restricted stock transaction he initiated. In each instance, the three attempted to conceal the kickback by entering into a consulting agreement with a phony company the trustee purportedly created to receive the kickback. Parsinia's company is Zcom Networks Inc. and Wilcox's company is The UC Hub Group.

(snip)

Corrected:

What, Ponch didn’t back him up?

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.