Posted on 07/06/2010 1:34:14 PM PDT by SeekAndFind

My past indiscrections are largely forgotten due to the poor record keeping of the federal government. < /snark >

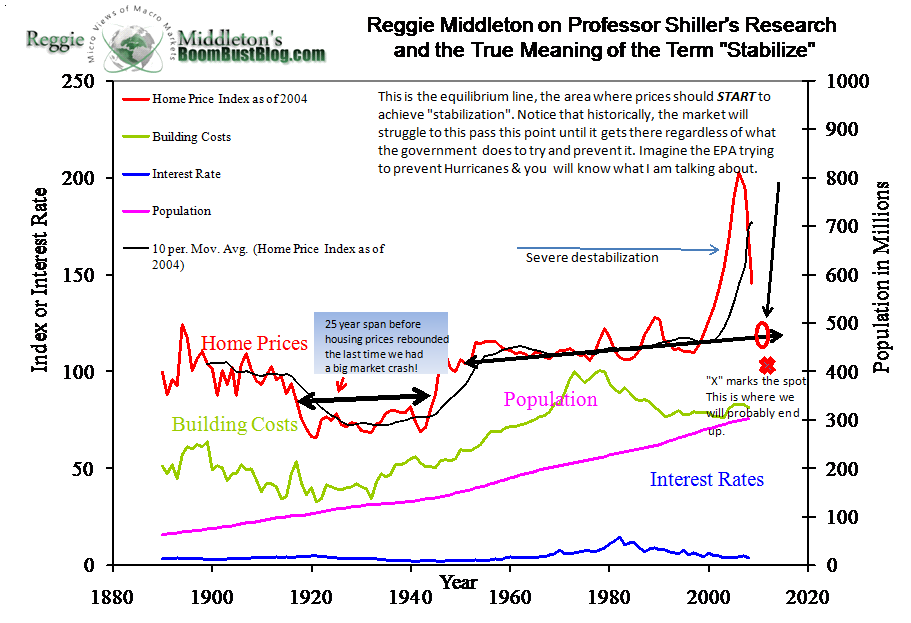

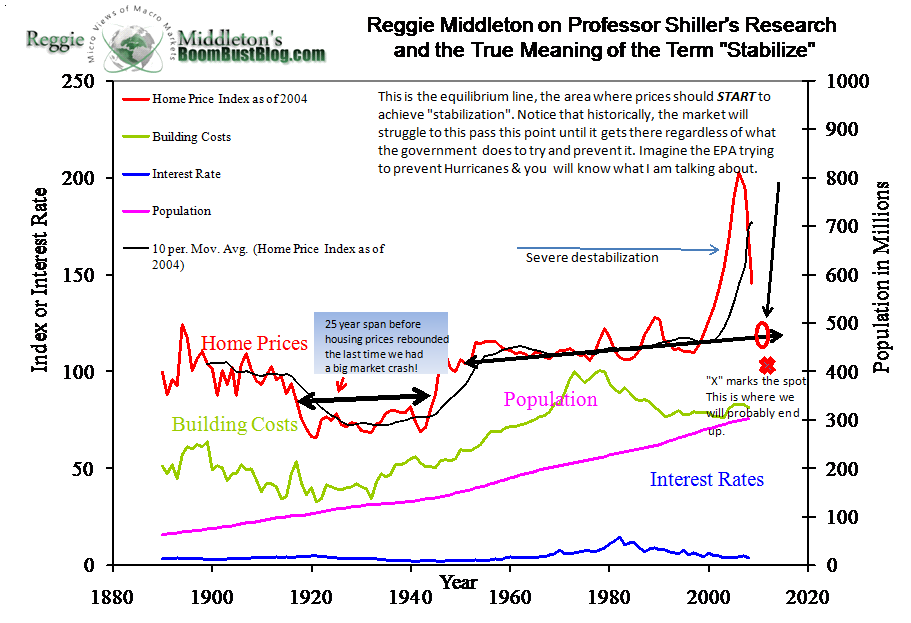

Spot on - and thanks for posting that chart.

I agree again. And I believe those lending standards are absolutely necessary to prevent a recurrence of defaults.

Today’s news on flip side of the issue you mention:

This trend is why the bankers are now conducting full body cavity search procedures on loan applicants.

I’m in the market to buy but haven’t found the right

one yet, hope the FTHBTC will get put back in, that

would help me a lot.

Funny, all my life I was told I was not a good credit risk

as I was self employed, now that I’m retired on SS and VA

it’s all OK.

Gee 64 and buying my first house, still have never bought

a new car but I own three.

One must have a job in order to have money to buy a house?

That plot showing housing prices in the US doubling between 2000 and 2006 is completely bogus. Housing prices with no adjustment increased at a rate from 3% to 4% per year from 1955 on.

How about from 1945 to 1970?

Sorry, not sure I understand why you think it is bogus? The chart shows both adjusted and unadjusted values between 2000 and 2006.

Just remember when they start giving you the “full body cavity search” (to use NVDaves’s terminology) that it is to be expected and you have to get past the irritation of day after day, right up to the closing, that they are going to need another ten different items.

Thank you. Interesting. Appreciate you looking that up for me.

From my last post: "Housing prices with no adjustment increased at a rate from 3% to 4% per year from 1955 on." That includes the time between 2000 and 2006. In that time some areas may have had ~6% gains, while others had none to 2% increases. At no time did US housing prices ~double in 6 years. That's an increase of ~11%/yr during those 6 years, which never occurred.

We can probably both agree that prices we appreciating at a much higher rate than the historical 4-5%, that it was unsustainable, and that there is more drop ahead to get bring things back into line.

Giddy up Jim...let me add...

The median home price (adjusted for inflation) is $100k, right now it is north of $180k...it will continue to fall and go below $100k (who knows how low with deflation coming and continued rapid monetary contraction) and then will settle back around $100k.

When are we going to learn...whenever the government claims it is putting something in place to fix something...the fix they are talking about is their hidden scam.

It's a specialty plot that doesn't represent gross US home sale prices.

"We can probably both agree that prices we appreciating at a much higher rate than the historical 4-5%, that it was unsustainable, and that there is more drop ahead to get bring things back into line.

The historical is less than that 4.5% avg. I think the correction point is near that ~3% historical line, which represents the true value of the housing being priced. Unsustainable yes. There's not much demand for exorbitantly priced housing and those holding the notes for it are in for some losses. Of course the losses will and are being passed on.

The trend lines converge in 2012. The actual prices, given the predicted drop before recovering, should then converge with those trend lines in 2012 also--which means I will buy in 2011. SF Bay Area prices are still obscenely high. They may not bottom out until much later.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.