Posted on 06/27/2010 8:20:46 PM PDT by blam

the only way gold will crash to $400/oz is if a whole lot of people are suddenly willing to take a $600/oz loss. I don’t see that happening. I think gold is right about where it should be actually. I can maybe see it falling back to $1,000/oz briefly but that will just fuel a buying opportunity and it will continue to appreciate. The 2008 oil prices were, IMO, largely a result of rampant speculation. I think current prices are more reflective of what a barrel of oil is worth when speculation is taken out of the equation. I’m not sure it’s deflation, I think it could be decreased demand due to a sluggish economy. Long term interest rates are primarily a result of Ben Bernanke/federal reserve policy, no?

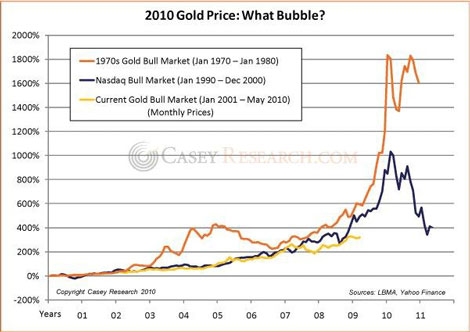

For the Last Time, Is Gold in a Bubble?..Yes

BTW I've been a gold and silver bug since the 70’s

Those are good, but I'd slash the size of the Federal Government as well, and have all departments cut their budgets.

The borders would be better enforced and a lot of foreign aid would dry up, too.

Ping

He ran on spending. Its as simple as that. The idea of cutting back is not something he can grasp. Next year he will propose cutting the deficit but try to make it a plan that cannot pass so that he can point fingers which is what hes best at.

I agree 100% and have been saying as much for the past year or so.

Gold is not the inflation hedge it once was..today its merely a risk management tool by wall street.

again, I agree; however, I think it's more than just that. You and I can trade gold for federal reserve notes and back to gold without the government being any the wiser. We can, therefore, make a profit that they can't get a piece of... same thing with guns and ammo and there's something to be said for that. Aside from that, it's just comwec currency to me. I own enough that I would be sitting OK for a disaster of that kind but not so much that I have to worry about the price collapsing. I like it and I'm not interested in trading it for paper dollars right now, not even $1,200 of them for an ounce. There's just something about sovereigns and krugerands that makes someone want to keep them imo.

BTW I've been a gold and silver bug since the 70’s

yeah? I was playing with bugs back in the 70s. :)

I agree 100% and have been saying as much for the past year or so.

Gold is not the inflation hedge it once was..today its merely a risk management tool by wall street.

again, I agree; however, I think it's more than just that. You and I can trade gold for federal reserve notes and back to gold without the government being any the wiser. We can, therefore, make a profit that they can't get a piece of... same thing with guns and ammo and there's something to be said for that. Aside from that, it's just comwec currency to me. I own enough that I would be sitting OK for a disaster of that kind but not so much that I have to worry about the price collapsing. I like it and I'm not interested in trading it for paper dollars right now, not even $1,200 of them for an ounce. There's just something about sovereigns and krugerands that makes someone want to keep them imo.

BTW I've been a gold and silver bug since the 70’s

yeah? I was playing with bugs back in the 70s. :)

I’d start with the IRS budget.

Next year he will propose cutting the deficit but try to make it a plan that cannot pass so that he can point fingers which is what hes best at.

::::::::::::::

This man is nuts. He raises the debt for generations to pay. Then he wants to cut spending? Anyone with an IQ over 65 will say “more lies” and be screaming “incompetence and malfeasance” — even moreso than now. I would bet the number of Congressional Dims that want him gone is way more than anyone realizes -— but they are still afraid of him. How many Dims want to walk off the political cliff with him in November? Not many I would guess. Where does this madness end? If the Dims want to survive, they will have to turn on his radicalism and incompetence.

There are plenty of dems in ‘safe seats’ that can do whatever they please. The battleground is elsewhere.

Well, let's see. Under deflation the value of the bank accounts of Obama's cronies increases, while under inflation I eventually get to pay off my mortgage with cheaper dollars.

Guess which Obama and his cronies favor?

“I get the feeling we are one “Black Swan “ be it war, natural disaster, etc, away from total catastrophe....”

I feel that you are correct. And in many ways I believe that people the world over want it to occur. Just tear it down and start all over again. Scary times we live in.

Put the money into a domestically produced energy equity, or buy into an oil/gas well project. Oil is priced in “world money units”, so that no matter the price of oil on the world market, you’ll get paid in dollars.

And one mo’ tang: we converted out of our 401K’s into Roth IRAs this year; don’t trust the cash grabbing Feds not to ‘save’ us by confiscation. My $.02

Thanks. Can I convert my active 401K into a Roth, even though I’m still working and contributing into it every paycheck?

Yes. All of these tax deferred plans require an ‘administrator’, keeping your grubby little paws away from your $$$. Many employers’ administrators are clueless about transferring out of their plans, and are not helpful. We used Entrust Administration Inc.; very professional. They did 99% of the paperwork for us, and within a week, it was done. For technical reasons, the 401K transfers into a Traditional IRA, then to a Roth. There is a tax impact, but you can pay it over 3 years. And this year only (so I’m told)there are no income restrictions on making the change.

BTW, I should add that Entrust specializes in setting up tax deferred retirement plans to hold non-traditional investments therein. Real estate, gold bullion, or in our case, a share position in a US based oil well joint venture.(onshore, not out in the GOM!)

Well, blam when you start posting something good; I may take you up on it.

I'm talking about you getting off your butt and posting something rather than whine to us that do. You're like a low-rent, drive by shooter....you add nothing. Just a whining parasite...sucking.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.