Posted on 05/17/2010 7:44:09 AM PDT by blam

Will There Be Blood In The Streets?

by: Cam Hui

May 17, 2010

Baron Rothchild was quoted as saying to buy when there was blood in the street. I wrote back on May 6 to watch the progress of market psychology for an indication of near term market direction.

Well the answer is in. We have widespread panic. Consider the following:

Mark Hulbert notes that his survey of market timers is showing a fearful reading, which is contrarian bullish.

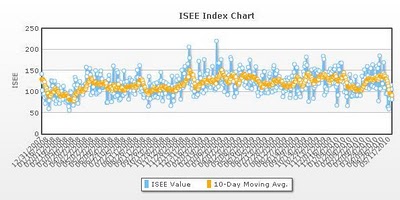

ISEE option sentiment, which is a call-put ratio, is showing that market players have suddenly tilted to a bearish extreme, which is also contrarian bullish.

Not quite the magazine cover effect, but the media is highlighting stories about the loss of confidence in Wall Street and the markets. For instance,Barry Ritholz has pointed out that the market cheerleaders at CNBC are talking about the total loss of confidence in Wall Street. Has even CNBC thrown in the towel?

Here's another story from the LA Times about how the equity allocation of some financial planners and advisors have fallen to 10-15%. 10-15%??? I believe what's significant isn't the planner's views, but that the markets columnist for the LA Times chose to focus on the story.

Meanwhile, the free-falling euro is trading at a long-term support zone. This looks an awful lot like blood in the street to me. While we may accept the premise that the bears have taken control of the market, these sentiment readings are setting the markets up for, at the very least, a bear market rally.

Bears need to tactically prepare for volatility. The market is poised for a short and sharp rally which could happen at any time.

Off with their heads!

There two other truisms to consider.

1) never catch a falling knife.

2) the market’s ability remain irrational is FAR beyond your ability to remain solvent.

With all due respect: The editorial choice of a single columnist, who may have been under a deadline and may have needed some filler, is not more significant than the actual investment decisions of investment planners, especially when they are investing their own money.

Regards,

2 is the prime truth.

GREAT comment. I think you've found yourself a tagline, taxcontrol....

As long as people are getting their entitlements and being entertained it won’t happen.

FMCDH(BITS)

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.